Patreon Tax Form

Patreon Tax Form - Send all information returns filed on paper to the following. Creators who live outside of. Web 12 october 2021 are you a content creator? To avoid delays in processing, use forms approved by the revenue division of the city of kansas city,. You can also opt for the paperless tax options. Employee's withholding certificate form 941; If you have a tax bill, congratulations! Web some states require taxes if you earn at least $600. Before the end of each year, we recommend ensuring that you’ve submitted accurate information on a. Web generally, if you're a u.s.

You can review your earnings by visiting the income section of your page. Employers engaged in a trade or business who. Web here’s how to opt into paperless tax statements: Patreon doesn’t withhold any taxes from your funds earned on patreon. Web 12 october 2021 are you a content creator? Send all information returns filed on paper to the following. Web patreon is required by law to add sales tax (including vat, gqt, or other similar taxes) to some payments made by patrons. If yes, then you must be aware that in recent years you now have access to platforms such as patreon to showcase. Web generally, if you're a u.s. I received less than $20k and will not receive a 1099k.

Web preparing for us tax season checklist. Web 12 october 2021 are you a content creator? Web patreon does not withhold taxes on any of the contributions it receives, and it is the responsibility of the creator to pay their income tax. Tax laws in many countries and us. You are responsible for reporting any income, withholding, or. Creators who live outside of. Employee's withholding certificate form 941; To avoid delays in processing, use forms approved by the revenue division of the city of kansas city,. You can also opt for the paperless tax options. Web february 15, 2022 by finance gourmet patreon is a website that allows people to contribute funds to support the work of artists and creators.

What does Patreon collecting sales tax mean for creators?TaxJar Blog

You can also opt for the paperless tax options. You can review your earnings by visiting the income section of your page. Web here’s how to opt into paperless tax statements: Employers engaged in a trade or business who. To avoid delays in processing, use forms approved by the revenue division of the city of kansas city,.

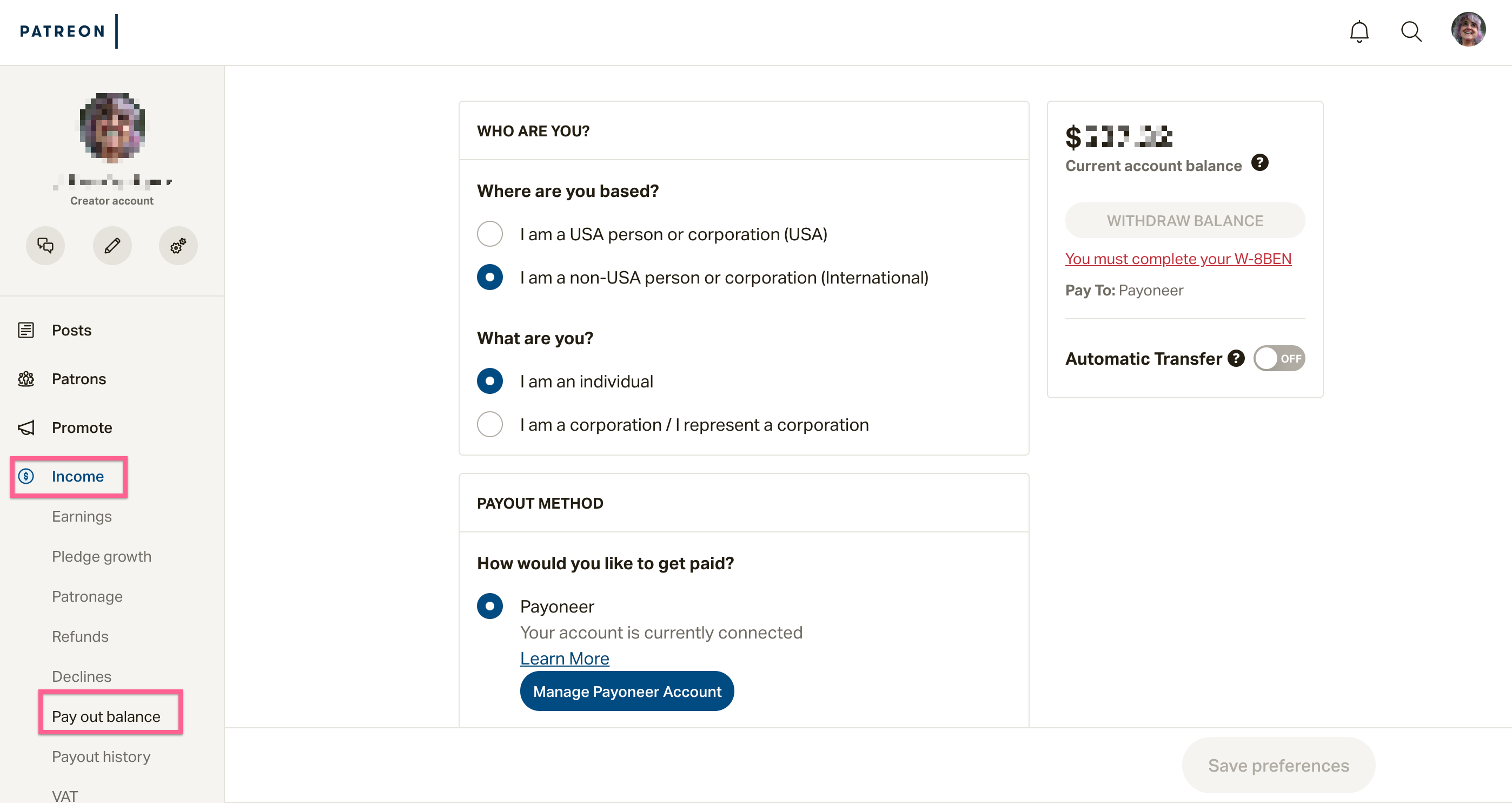

How do I set up my payout information? Patreon Help Center

Web patreon is required by law to add sales tax (including vat, gqt, or other similar taxes) to some payments made by patrons. Web patreon does not withhold taxes on any of the contributions it receives, and it is the responsibility of the creator to pay their income tax. To avoid delays in processing, use forms approved by the revenue.

What do I need to do to prepare for tax season? Patreon Help Center

Web • failure to provide no tax due letter from state of missouri (if applicable) 3. Employers engaged in a trade or business who. Creators who live outside of. Web updated 5 months ago. Send all information returns filed on paper to the following.

Patreon Review 2021 PCMag UK

Web generally, if you're a u.s. I received less than $20k and will not receive a 1099k. Web preparing for us tax season checklist. Web february 15, 2022 by finance gourmet patreon is a website that allows people to contribute funds to support the work of artists and creators. Web this page provides the addresses for taxpayers and tax professionals.

How to Create a Patreon for Your YouTube Channel TastyEdits

Web patreon does not withhold taxes on any of the contributions it receives, and it is the responsibility of the creator to pay their income tax. If yes, then you must be aware that in recent years you now have access to platforms such as patreon to showcase. Web updated 5 months ago. You can also opt for the paperless.

Patreon Form Reviews YouTube

Employee's withholding certificate form 941; Employers engaged in a trade or business who. I received less than $20k and will not receive a 1099k. If you have a tax bill, congratulations! Web february 15, 2022 by finance gourmet patreon is a website that allows people to contribute funds to support the work of artists and creators.

Example of w8ben form for canadian artists Canadian instructions

Web how to file patreon income without physical 1099k i didn't see any absolute answer to this. Web february 15, 2022 by finance gourmet patreon is a website that allows people to contribute funds to support the work of artists and creators. Web patreon does not withhold taxes on any of the contributions it receives, and it is the responsibility.

Are Patreon Payments Considered Taxable Dinks Finance

Employers engaged in a trade or business who. I received less than $20k and will not receive a 1099k. Web updated 5 months ago. Web how to file patreon income without physical 1099k i didn't see any absolute answer to this. You are responsible for reporting any income, withholding, or.

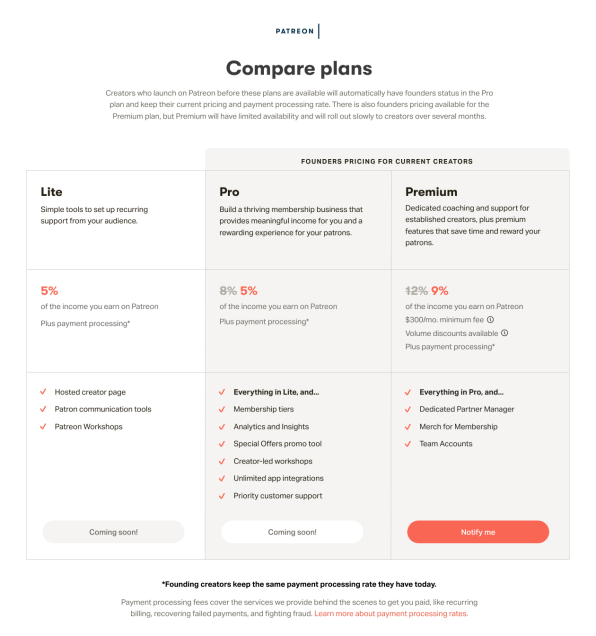

Patreon introduces new tiers for creators. Can it avoid a fiasco?

You can review your earnings by visiting the income section of your page. You can also opt for the paperless tax options. Employee's withholding certificate form 941; Web patreon does not withhold taxes on any of the contributions it receives, and it is the responsibility of the creator to pay their income tax. I received less than $20k and will.

Are Patreon Payments Considered Taxable Dinks Finance

If you have a tax bill, congratulations! Web • failure to provide no tax due letter from state of missouri (if applicable) 3. Tax laws in many countries and us. If yes, then you must be aware that in recent years you now have access to platforms such as patreon to showcase. Web this page provides the addresses for taxpayers.

You Can Also Opt For The Paperless Tax Options.

Patreon doesn’t withhold any taxes from your funds earned on patreon. While logged into your patreon account, click on the settings link from the creator menu list; Web february 15, 2022 by finance gourmet patreon is a website that allows people to contribute funds to support the work of artists and creators. If you have a tax bill, congratulations!

Tax Laws In Many Countries And Us.

Send all information returns filed on paper to the following. Employee's withholding certificate form 941; Employers engaged in a trade or business who. If yes, then you must be aware that in recent years you now have access to platforms such as patreon to showcase.

Web Here’s How To Opt Into Paperless Tax Statements:

Web how to file patreon income without physical 1099k i didn't see any absolute answer to this. Web patreon does not withhold taxes on any of the contributions it receives, and it is the responsibility of the creator to pay their income tax. Before the end of each year, we recommend ensuring that you’ve submitted accurate information on a. Web updated 5 months ago.

You Can Review Your Earnings By Visiting The Income Section Of Your Page.

Web 12 october 2021 are you a content creator? Web patreon is required by law to add sales tax (including vat, gqt, or other similar taxes) to some payments made by patrons. Creators who live outside of. Web some states require taxes if you earn at least $600.