Form 966 Code Section Dissolution

Form 966 Code Section Dissolution - Web within 30 days after the adoption of any resolution or plan for or in respect of the dissolution of a corporation or the liquidation of the whole or any part of its capital stock,. Web we last updated the corporate dissolution or liquidation in february 2023, so this is the latest version of form 966, fully updated for tax year 2022. Along with the form, you must send in a certified copy of the director's resolution. Check the box labeled print form 966 with complete return. Web within 30 days of the resolution adopted, an irs form 966 must be filed. The basic penalty for failing to file a form 966 within 30 days of. Web are you going to dissolve your corporation during the tax year? Web they must file form 966, corporate dissolution or liquidation, if they adopt a resolution or plan to dissolve the corporation or liquidate any of its stock. Try it for free now! Complete all other necessary entries for form 966.

As provided by the irs: Web form 966 must be filed within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. Web go to screen 57, dissolution/liquidation (966). Make sure to file irs form 966 after you adopt a plan of dissolution for the corporation. Web are you going to dissolve your corporation during the tax year? Web instructions section references are to the internal revenue code unless otherwise noted. Form 966 is filed with the internal. Not every corporation that is undergoing liquidation or dissolution must file the form 966. Ad download or email irs 966 & more fillable forms, register and subscribe now! Who must file corporation (or a farmer’s cooperative) must file form 966 if it adopts a.

Web we last updated the corporate dissolution or liquidation in february 2023, so this is the latest version of form 966, fully updated for tax year 2022. Along with the form, you must send in a certified copy of the director's resolution. Web they must file form 966, corporate dissolution or liquidation, if they adopt a resolution or plan to dissolve the corporation or liquidate any of its stock. Check the box labeled print form 966 with complete return. Not every corporation that is undergoing liquidation or dissolution must file the form 966. You can download or print. Try it for free now! Who must file corporation (or a farmer’s cooperative) must file form 966 if it adopts a. Attach a copy of the dissolution plan for. Web are you going to dissolve your corporation during the tax year?

Form 12.901b2 Dissolution of Marriage with Property But No Children

Form 966 is filed with the internal. “a corporation (or a farmer’s. Web form 966 corporate dissolution or liquidation can be generated by checking the box, print form 966 with complete return in screen 51, corporate. Make sure to file irs form 966 after you adopt a plan of dissolution for the corporation. Web who must file form 966?

Revised Corporation Code Dissolution YouTube

Section under which the corporation is to be dissolved or liquidated enter the internal revenue. Upload, modify or create forms. Web the application uses this information to determine the due date for filing form 966. “a corporation (or a farmer’s. Who must file corporation (or a farmer’s cooperative) must file form 966 if it adopts a.

Form 966 Corporate Dissolution or Liquidation (2010) Free Download

Web within 30 days of the resolution adopted, an irs form 966 must be filed. If the resolution or plan is amended or supplemented after form. Web within 30 days of the vote to dissolve an s corporation, you must submit a completed form 966 corporation dissolution or liquidation. Web form 966 within 30 days after the resolution or plan.

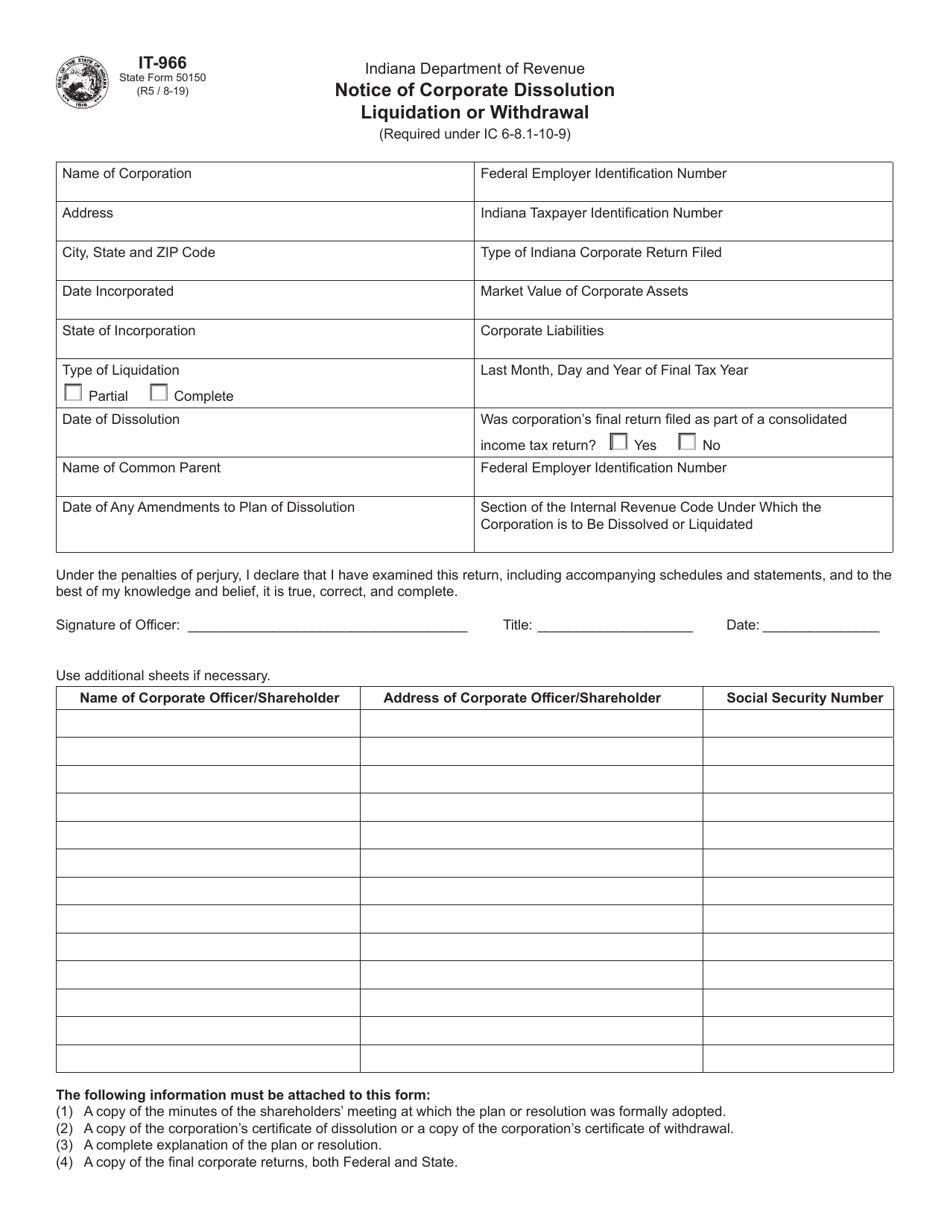

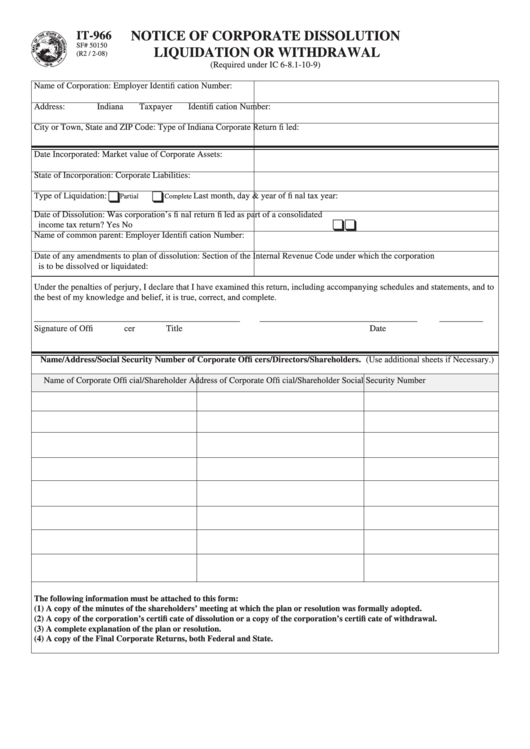

Form IT966 (State Form 50150) Download Fillable PDF or Fill Online

Who must file corporation (or a farmer’s cooperative) must file form 966 if it adopts a. Web are you going to dissolve your corporation during the tax year? Web form 966 within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. You can download or print. Make sure to file.

Code 960966 Global Diary

Ad download or email irs 966 & more fillable forms, register and subscribe now! Web within 30 days after the adoption of any resolution or plan for or in respect of the dissolution of a corporation or the liquidation of the whole or any part of its capital stock,. Web form 966 must be filed within 30 days after the.

Fillable Form It966 Notice Of Corporate Dissolution Liquidation Or

Check the box labeled print form 966 with complete return. You can download or print. Web form 966 corporate dissolution or liquidation can be generated by checking the box, print form 966 with complete return in screen 51, corporate. Web section 6653(c) of the internal revenue code defines the penalties for failing to file form 966. If the resolution or.

Business Concept about Form 966 Corporate Dissolution or Liquidation

The basic penalty for failing to file a form 966 within 30 days of. As provided by the irs: Web within 30 days of the resolution adopted, an irs form 966 must be filed. “a corporation (or a farmer’s. Attach a copy of the dissolution plan for.

Form 966 (Rev PDF Tax Return (United States) S Corporation

Upload, modify or create forms. Web within 30 days of the resolution adopted, an irs form 966 must be filed. Web in addition, the corporation must attach to the form 966 a certified copy of the “resolution or plan.” all states have procedures that must be followed when a decision is made to. Web form 966 must be filed within.

Form 966 Corporate Dissolution or Liquidation (2010) Free Download

Web they must file form 966, corporate dissolution or liquidation, if they adopt a resolution or plan to dissolve the corporation or liquidate any of its stock. Web the application uses this information to determine the due date for filing form 966. Complete all other necessary entries for form 966. Web form 966 within 30 days after the resolution or.

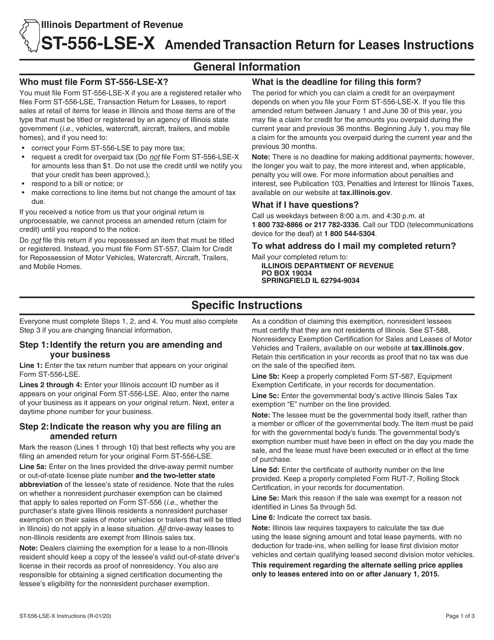

Download Instructions for Form ST556LSEX, 966 Amended Transaction

Web we last updated the corporate dissolution or liquidation in february 2023, so this is the latest version of form 966, fully updated for tax year 2022. Ad download or email irs 966 & more fillable forms, register and subscribe now! Web in addition, the corporation must attach to the form 966 a certified copy of the “resolution or plan.”.

Web Form 966 Must Be Filed Within 30 Days After The Resolution Or Plan Is Adopted To Dissolve The Corporation Or Liquidate Any Of Its Stock.

As provided by the irs: If the resolution or plan is amended or supplemented after form. Web the application uses this information to determine the due date for filing form 966. Web within 30 days of the vote to dissolve an s corporation, you must submit a completed form 966 corporation dissolution or liquidation.

The Basic Penalty For Failing To File A Form 966 Within 30 Days Of.

Upload, modify or create forms. Web section 6653(c) of the internal revenue code defines the penalties for failing to file form 966. Complete all other necessary entries for form 966. Check the box labeled print form 966 with complete return.

Who Must File Corporation (Or A Farmer’s Cooperative) Must File Form 966 If It Adopts A.

Ad download or email irs 966 & more fillable forms, register and subscribe now! Attach a copy of the dissolution plan for. Web within 30 days after the adoption of any resolution or plan for or in respect of the dissolution of a corporation or the liquidation of the whole or any part of its capital stock,. Not every corporation that is undergoing liquidation or dissolution must file the form 966.

Web Within 30 Days Of The Resolution Adopted, An Irs Form 966 Must Be Filed.

Along with the form, you must send in a certified copy of the director's resolution. Web instructions section references are to the internal revenue code unless otherwise noted. Try it for free now! Web we last updated the corporate dissolution or liquidation in february 2023, so this is the latest version of form 966, fully updated for tax year 2022.