Form 8865 Instructions

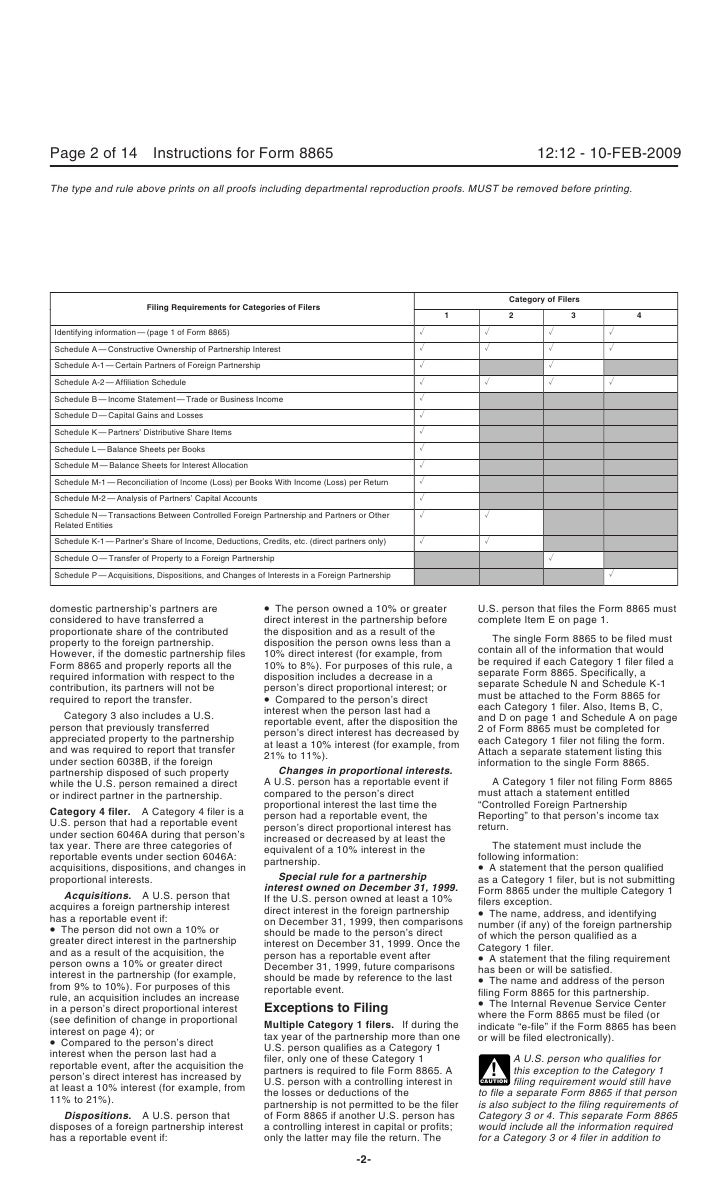

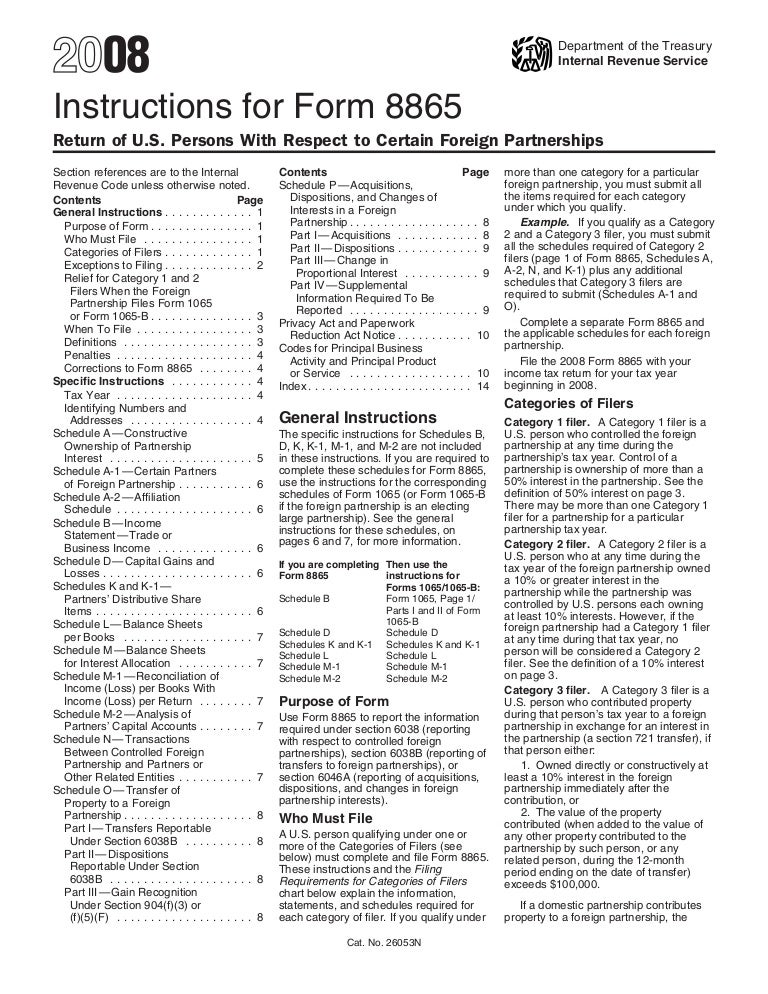

Form 8865 Instructions - Persons with respect to certain foreign partnerships, including recent updates, related forms, and instructions on how to file. Similar to the more common form 5471, it. Web 5 things you should know about irs form 8865. Use form 8865 to report the information required under section 6038 (reporting with respect to controlled foreign partnerships), section 6038b (reporting of transfers to foreign partnerships), or section 6046a (reporting of acquisitions, dispositions, and changes in foreign partnership interests). If you own at least 10% of a controlled foreign partnership, you may be required to file form 8865. Persons with respect to certain foreign partnerships. Even though it’s purely informational in nature, it’s still a necessary part of your tax return if you meet the requirements. The reason form 8865 exists is to help the irs track u.s. Department of the treasury internal revenue service. Persons with respect to certain foreign partnerships.

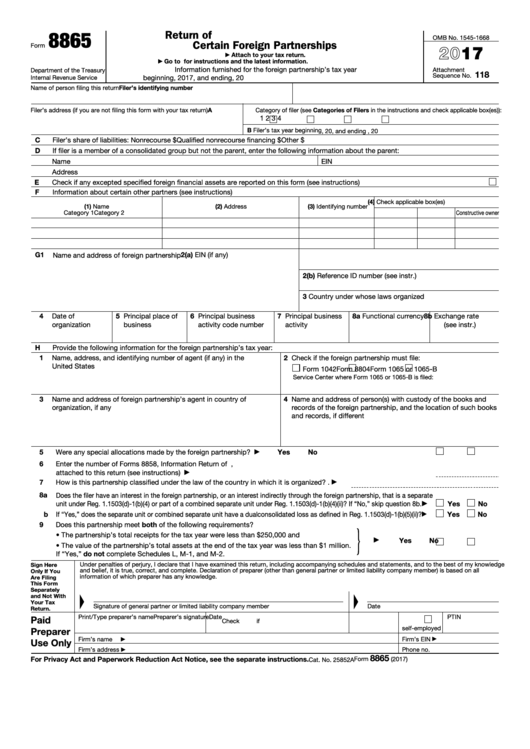

Members of foreign partnerships, and it’s similar to form 1065, which. Form 8865 is used to report the activities of a controlled foreign partnership and must be filed with your individual income tax return (form 1040). Even though it’s purely informational in nature, it’s still a necessary part of your tax return if you meet the requirements. Persons who have an interest in a foreign partnership. When a united states taxpayer has ownership in a foreign partnership, they may have an irs international information reporting requirement on internal revenue service form 8865. Web form 8865 & instructions. Persons with respect to certain foreign partnerships, including recent updates, related forms, and instructions on how to file. Schedule g (form 8865) (rev. Person filing form 8865 with respect to a foreign partnership that has made an mtm election described in treas. Information furnished for the foreign partnership’s tax year.

Similar to the more common form 5471, it. The reason form 8865 exists is to help the irs track u.s. Persons with respect to certain foreign partnerships. Web 5 things you should know about irs form 8865. Information furnished for the foreign partnership’s tax year. Form 8865 is used to report the activities of a controlled foreign partnership and must be filed with your individual income tax return (form 1040). Persons with respect to certain foreign partnerships, including recent updates, related forms, and instructions on how to file. Person filing form 8865 with respect to a foreign partnership that has made an mtm election described in treas. Even though it’s purely informational in nature, it’s still a necessary part of your tax return if you meet the requirements. Web information about form 8865, return of u.s.

form 8865 instructions 2020 Fill Online, Printable, Fillable Blank

When a united states taxpayer has ownership in a foreign partnership, they may have an irs international information reporting requirement on internal revenue service form 8865. Web form 8865 & instructions. If you own at least 10% of a controlled foreign partnership, you may be required to file form 8865. Information furnished for the foreign partnership’s tax year. Form 8865.

Form 8865 (Schedule K1) Partner's Share of Deductions and

Web information about form 8865, return of u.s. Web for paperwork reduction act notice, see the instructions for form 8865. Web 5 things you should know about irs form 8865. Person filing form 8865 with respect to a foreign partnership that has made an mtm election described in treas. Form 8865 refers to the irs’ return of u.s.

Inst 8865Instructions for Form 8865, Return of U.S. Persons With Res…

Allocation percentages of partnership items with respect to section 721(c) property (see instructions) part i, line number: Form 8865 is used to report the activities of a controlled foreign partnership and must be filed with your individual income tax return (form 1040). Web tax form 8865 is used by u.s. Attach to your tax return. If you own at least.

Fillable Form 8865 Return Of U.s. Persons With Respect To Certain

Form 8865 refers to the irs’ return of u.s. For instructions and the latest information. Persons with respect to certain foreign partnerships. Persons with respect to certain foreign partnerships. Web form 8865 & instructions.

Inst 8865Instructions for Form 8865, Return of U.S. Persons With Res…

Persons with respect to certain foreign partnerships, including recent updates, related forms, and instructions on how to file. Form 8865 refers to the irs’ return of u.s. Information furnished for the foreign partnership’s tax year. Web tax form 8865 is used by u.s. Use form 8865 to report the information required under section 6038 (reporting with respect to controlled foreign.

Fill Free fillable Form 8865 Return of Persons With Respect to

The reason form 8865 exists is to help the irs track u.s. If you own at least 10% of a controlled foreign partnership, you may be required to file form 8865. Persons with respect to certain foreign partnerships. Use form 8865 to report the information required under section 6038 (reporting with respect to controlled foreign partnerships), section 6038b (reporting of.

Irs form 8865 instructions

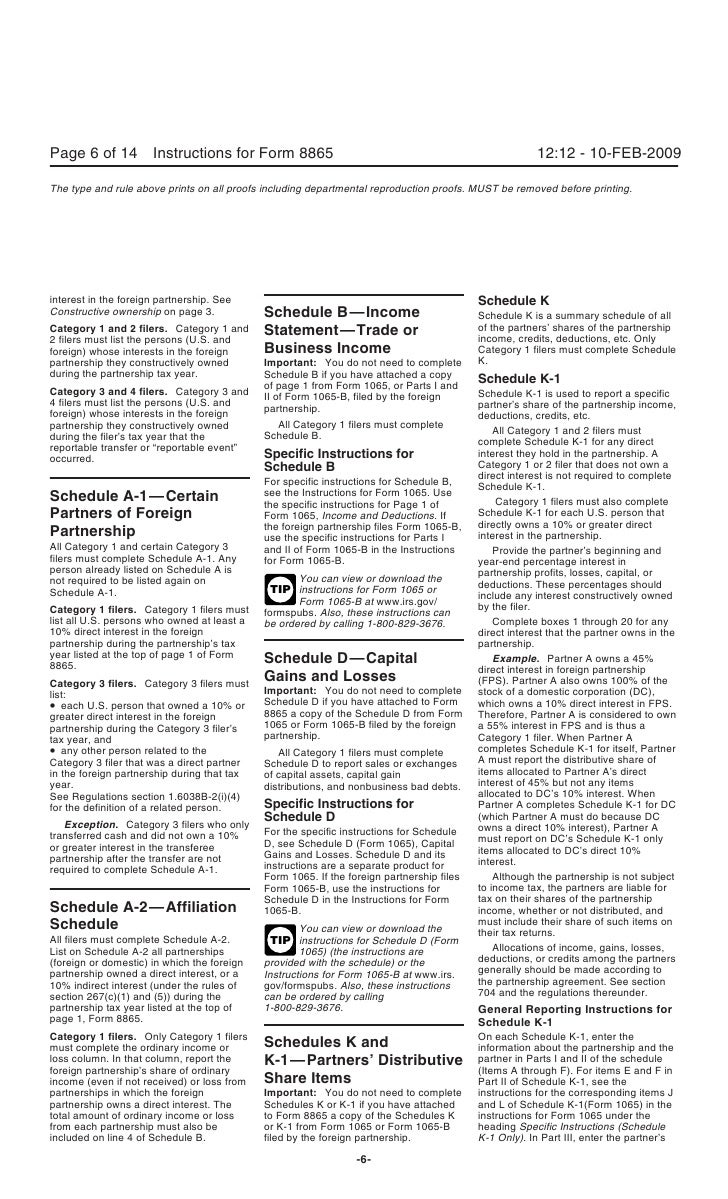

Persons with respect to certain foreign partnerships. Even though it’s purely informational in nature, it’s still a necessary part of your tax return if you meet the requirements. Department of the treasury internal revenue service. Web for specific instructions for form 8865, schedule b, use the instructions for form 1065, lines 1a through 21 (income and deductions). Persons who have.

Inst 8865Instructions for Form 8865, Return of U.S. Persons With Res…

Persons with respect to certain foreign partnerships. Similar to the more common form 5471, it. Form 8865 is used to report the information required under section 6038 (reporting with respect to controlled foreign partnerships), section 6038b (reporting of transfers to. Schedule g (form 8865) (rev. The reason form 8865 exists is to help the irs track u.s.

Form 8865 Return of U.S. Persons With Respect to Certain Foreign

You can view or download the instructions for form 1065 at irs.gov/scheduled(form1065). Form 8865 refers to the irs’ return of u.s. Even though it’s purely informational in nature, it’s still a necessary part of your tax return if you meet the requirements. Attach to your tax return. Schedule g (form 8865) (rev.

Inst 8865Instructions for Form 8865, Return of U.S. Persons With Res…

Persons with respect to certain foreign partnerships. Information furnished for the foreign partnership’s tax year. Web for paperwork reduction act notice, see the instructions for form 8865. Form 8865 is used to report the information required under section 6038 (reporting with respect to controlled foreign partnerships), section 6038b (reporting of transfers to. Person filing form 8865 with respect to a.

Persons Who Have An Interest In A Foreign Partnership.

Allocation percentages of partnership items with respect to section 721(c) property (see instructions) part i, line number: If you own at least 10% of a controlled foreign partnership, you may be required to file form 8865. Form 8865 is used to report the information required under section 6038 (reporting with respect to controlled foreign partnerships), section 6038b (reporting of transfers to. Even though it’s purely informational in nature, it’s still a necessary part of your tax return if you meet the requirements.

Department Of The Treasury Internal Revenue Service.

Persons with respect to certain foreign partnerships. Web for specific instructions for form 8865, schedule b, use the instructions for form 1065, lines 1a through 21 (income and deductions). Person filing form 8865 with respect to a foreign partnership that has made an mtm election described in treas. Schedule g (form 8865) (rev.

Web For Paperwork Reduction Act Notice, See The Instructions For Form 8865.

When a united states taxpayer has ownership in a foreign partnership, they may have an irs international information reporting requirement on internal revenue service form 8865. Use form 8865 to report the information required under section 6038 (reporting with respect to controlled foreign partnerships), section 6038b (reporting of transfers to foreign partnerships), or section 6046a (reporting of acquisitions, dispositions, and changes in foreign partnership interests). You can view or download the instructions for form 1065 at irs.gov/scheduled(form1065). Form 8865 is used to report the activities of a controlled foreign partnership and must be filed with your individual income tax return (form 1040).

Information Furnished For The Foreign Partnership’s Tax Year.

Web tax form 8865 is used by u.s. For instructions and the latest information. Web 5 things you should know about irs form 8865. Members of foreign partnerships, and it’s similar to form 1065, which.