Ny It 2104 Form

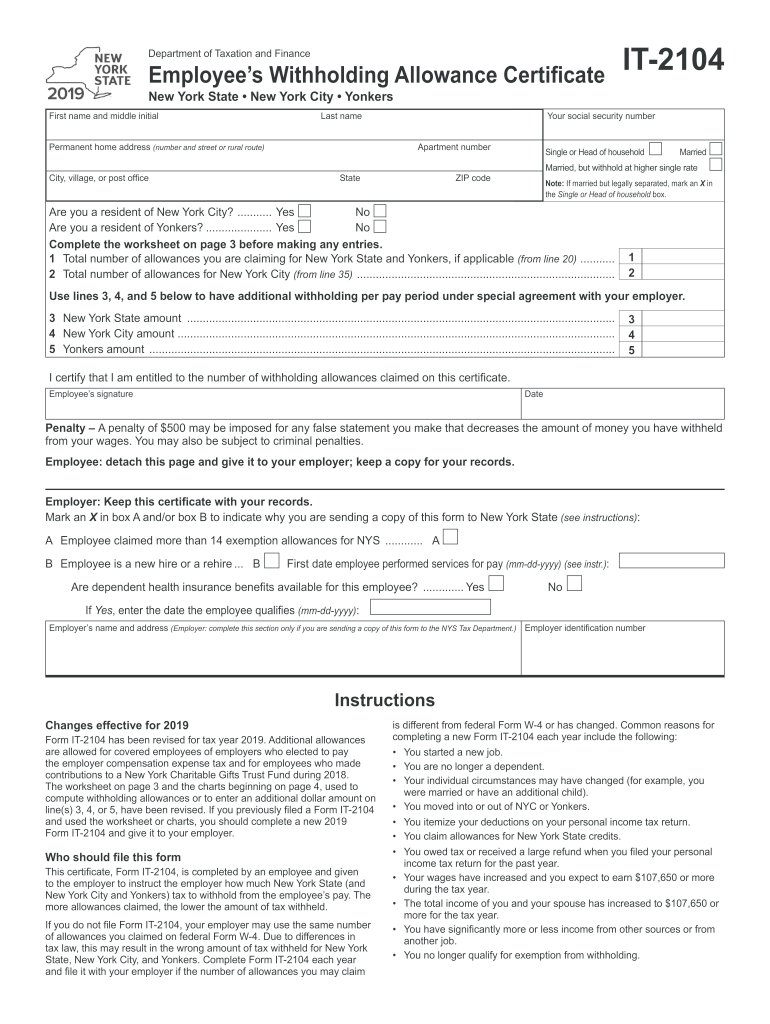

Ny It 2104 Form - Web employee's withholding allowance certificate. Employers are often unsure if they must have employees. Web the wrong amount of tax withheld for new york state, new york city, and yonkers. Enter on the front the whole dollar amount(s) that you want withheld from each annuity or pension payment. Certificate of exemption from withholding. Start with the worksheet one of the aspects of. Web file this form with the payer of your annuity or pension. Due to differences in tax law, this may result in the wrong. New employees must submit paper. The worksheet on page 3 and the charts beginning on page 4, used to compute withholding allowances or to enter an additional.

Employers are often unsure if they must have employees. Web employee's withholding allowance certificate. Enter on the front the whole dollar amount(s) that you want withheld from each annuity or pension payment. New employees must submit paper. Web new york state law requires all government agencies that maintain a system of records to provide notification of the legal. Every employee must pay federal and state taxes, unless you’re in a state that. Certificate of nonresidence and allocation of withholding. Web 8 rows employee's withholding allowance certificate. Web on form it‑2104 to determine the correct number of allowances to claim for withholding tax purposes. Web the wrong amount of tax withheld for new york state, new york city, and yonkers.

Web file this form with the payer of your annuity or pension. Web new york state law requires all government agencies that maintain a system of records to provide notification of the legal. Due to differences in tax law, this may result in the wrong. Certificate of exemption from withholding. New employees must submit paper. Web employee's withholding allowance certificate. The worksheet on page 3 and the charts beginning on page 4, used to compute withholding allowances or to enter an additional. Every employee must pay federal and state taxes, unless you’re in a state that. Certificate of nonresidence and allocation of withholding. Web the wrong amount of tax withheld for new york state, new york city, and yonkers.

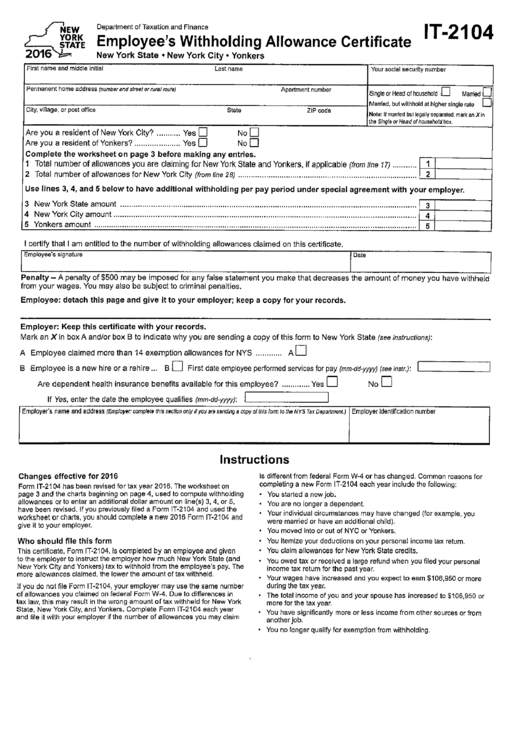

Form It2104 Employee'S Withholding Allowance Certificate 2016

Web file this form with the payer of your annuity or pension. Web employee's withholding allowance certificate. New employees must submit paper. The worksheet on page 3 and the charts beginning on page 4, used to compute withholding allowances or to enter an additional. Certificate of nonresidence and allocation of withholding.

It 2104 Fill Out and Sign Printable PDF Template signNow

Due to differences in tax law, this may result in the wrong. Start with the worksheet one of the aspects of. Enter on the front the whole dollar amount(s) that you want withheld from each annuity or pension payment. Web 8 rows employee's withholding allowance certificate. Certificate of nonresidence and allocation of withholding.

IT2104 StepbyStep Guide Baron Payroll

New employees must submit paper. Certificate of nonresidence and allocation of withholding. Web 8 rows employee's withholding allowance certificate. Web file this form with the payer of your annuity or pension. Web employee's withholding allowance certificate.

Maria Noivas Fashion NY 2104

Every employee must pay federal and state taxes, unless you’re in a state that. Web file this form with the payer of your annuity or pension. Web 8 rows employee's withholding allowance certificate. Web the wrong amount of tax withheld for new york state, new york city, and yonkers. Employers are often unsure if they must have employees.

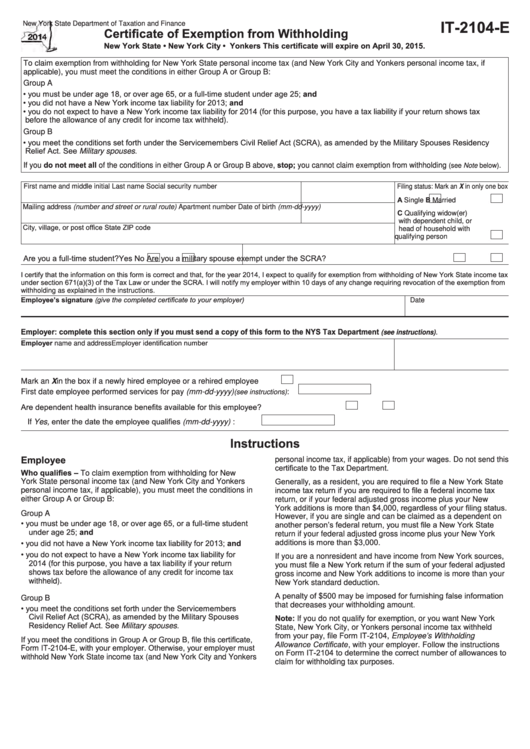

Form It2104E Certificate Of Exemption From Withholding 2014

Web 8 rows employee's withholding allowance certificate. Employers are often unsure if they must have employees. The worksheet on page 3 and the charts beginning on page 4, used to compute withholding allowances or to enter an additional. New employees must submit paper. Web the wrong amount of tax withheld for new york state, new york city, and yonkers.

Download NY IT2104 Employee's Withholding Allowance Form for Free

Web file this form with the payer of your annuity or pension. Web the wrong amount of tax withheld for new york state, new york city, and yonkers. Enter on the front the whole dollar amount(s) that you want withheld from each annuity or pension payment. New employees must submit paper. Start with the worksheet one of the aspects of.

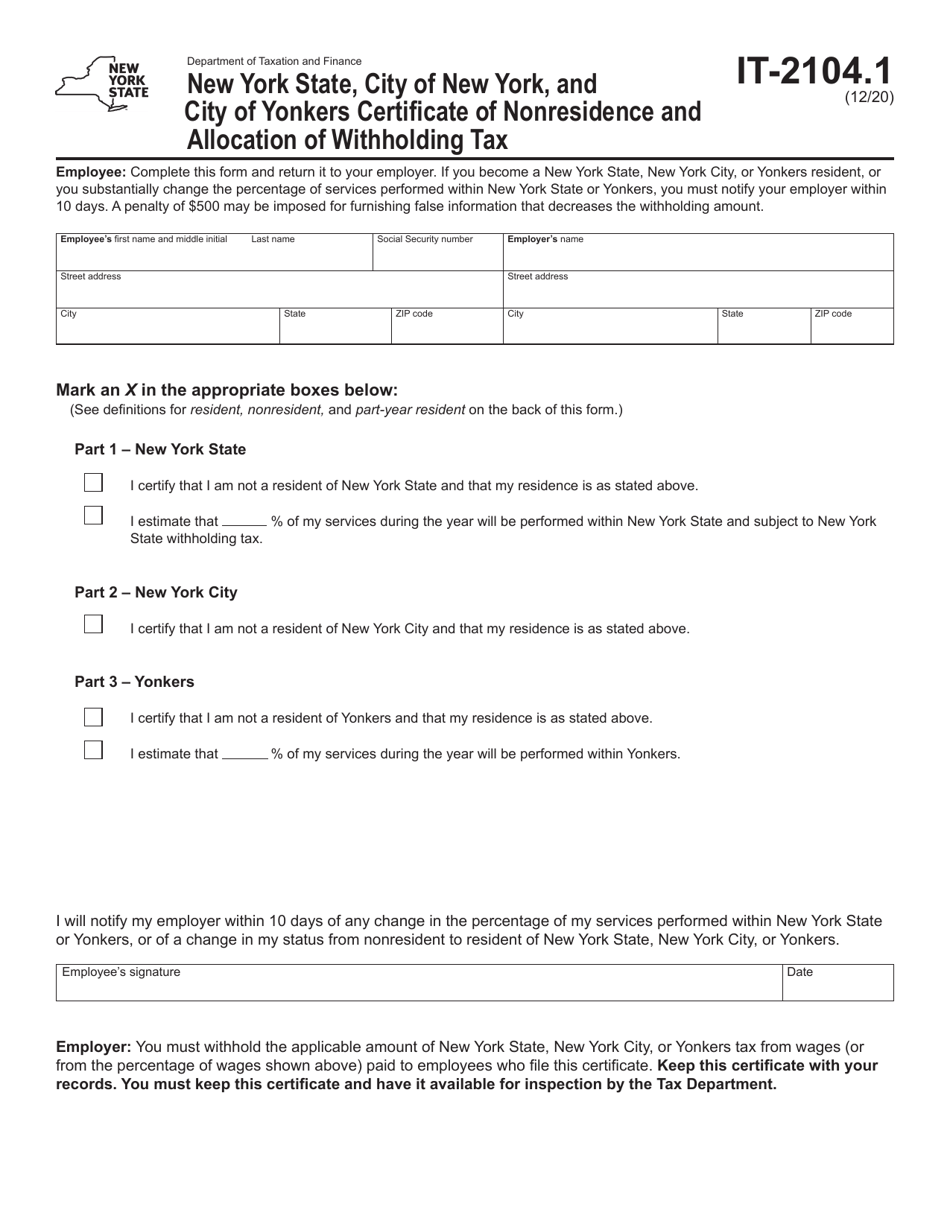

Form IT2104.1 Download Fillable PDF or Fill Online New York State

Enter on the front the whole dollar amount(s) that you want withheld from each annuity or pension payment. Employers are often unsure if they must have employees. Web employee's withholding allowance certificate. Certificate of nonresidence and allocation of withholding. Certificate of exemption from withholding.

Employee Archives Page 2 of 15 PDFSimpli

Enter on the front the whole dollar amount(s) that you want withheld from each annuity or pension payment. New employees must submit paper. Web new york state law requires all government agencies that maintain a system of records to provide notification of the legal. Web file this form with the payer of your annuity or pension. Web the wrong amount.

NY DTF IT2104 2011 Fill out Tax Template Online US Legal Forms

Web file this form with the payer of your annuity or pension. Web the wrong amount of tax withheld for new york state, new york city, and yonkers. Due to differences in tax law, this may result in the wrong. New employees must submit paper. Enter on the front the whole dollar amount(s) that you want withheld from each annuity.

2022 Form NY DTF IT2104SNY Fill Online, Printable, Fillable, Blank

Employers are often unsure if they must have employees. New employees must submit paper. The worksheet on page 3 and the charts beginning on page 4, used to compute withholding allowances or to enter an additional. Certificate of exemption from withholding. Due to differences in tax law, this may result in the wrong.

New Employees Must Submit Paper.

Start with the worksheet one of the aspects of. Web new york state law requires all government agencies that maintain a system of records to provide notification of the legal. Every employee must pay federal and state taxes, unless you’re in a state that. Web 8 rows employee's withholding allowance certificate.

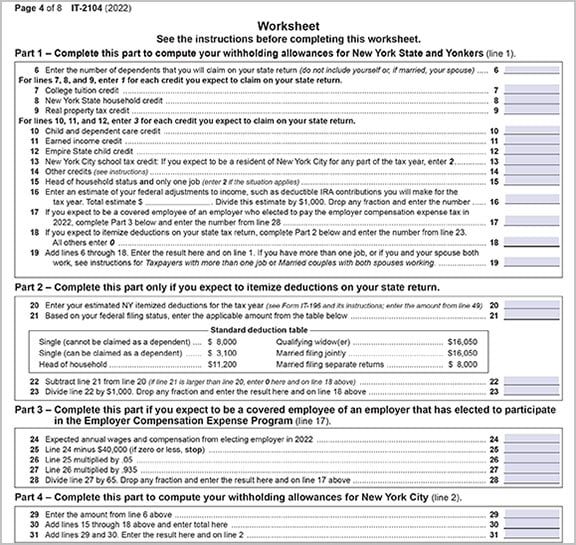

The Worksheet On Page 3 And The Charts Beginning On Page 4, Used To Compute Withholding Allowances Or To Enter An Additional.

Web the wrong amount of tax withheld for new york state, new york city, and yonkers. Web on form it‑2104 to determine the correct number of allowances to claim for withholding tax purposes. Certificate of nonresidence and allocation of withholding. Employers are often unsure if they must have employees.

Certificate Of Exemption From Withholding.

Web employee's withholding allowance certificate. Enter on the front the whole dollar amount(s) that you want withheld from each annuity or pension payment. Due to differences in tax law, this may result in the wrong. Web file this form with the payer of your annuity or pension.