3Rd Party Authorization Form Pdf

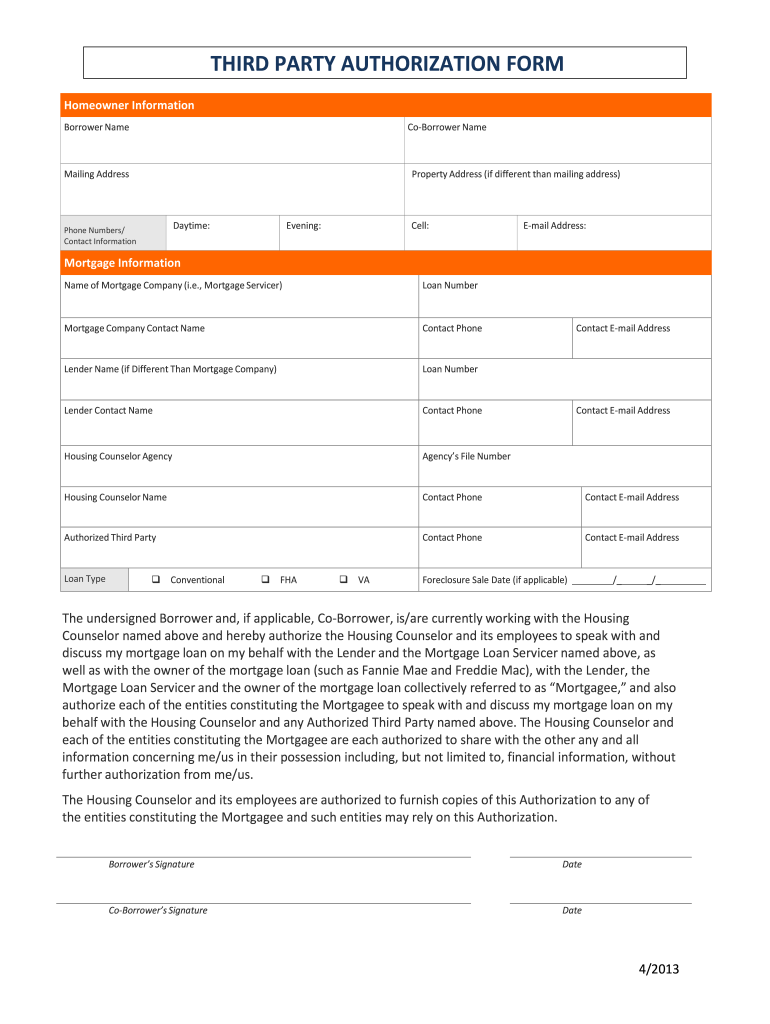

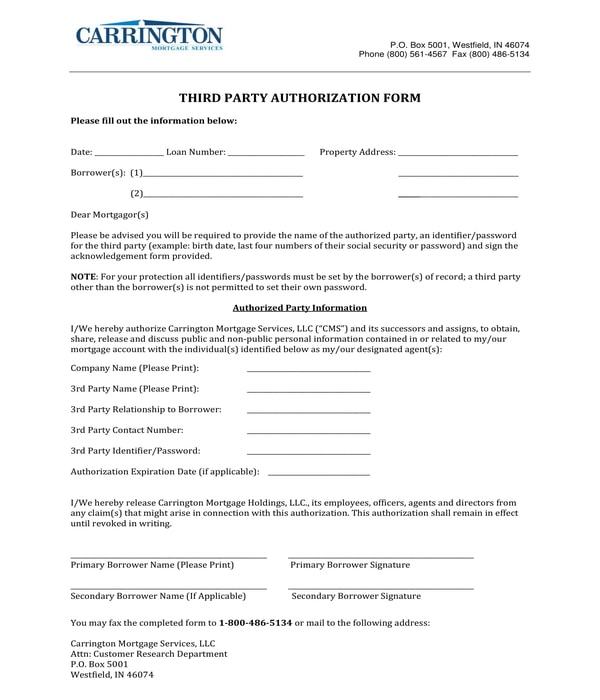

3Rd Party Authorization Form Pdf - Web completed forms may be sent to the division at: Taxpayer identification number(s) daytime telephone number. Web borrower authorization of third party mortgage servicer name customer service/loss mitigation phone number borrower(s) name(s) property address mortgage loan account number(s) third party information (all applicable fields must be completed) name of entity, agency, firm name(s) of authorized person(s) mailing address office address email Web taxpayer must sign and date this form on line 6. Burials and memorials, careers and employment, disability, education and training, health care, housing assistance, life insurance, pension, records form last updated: Check here if a list of additional designees is attached. If you wish to name more than two designees, attach a list to this form. Use this form to authorize individuals or companies (such as employers or credential services) to contact the department on your behalf regarding your application. The third party can be a family member or friend, a tax professional, attorney or business, depending on the authorization. Name(s) shown on return your social security number you must use this form to authorize the irs to contact a third party on your behalf or to revoke that authorization.

Use this form to authorize individuals or companies (such as employers or credential services) to contact the department on your behalf regarding your application. Web if authorized party listed on this form is the result of power of attorney, administrator or executor of an estate, proper documentation establishing the authority must accompany this form when submitted authorized party or organization: There are different types of third party authorizations: Web borrower authorization of third party mortgage servicer name customer service/loss mitigation phone number borrower(s) name(s) property address mortgage loan account number(s) third party information (all applicable fields must be completed) name of entity, agency, firm name(s) of authorized person(s) mailing address office address email Web completed forms may be sent to the division at: Taxpayer identification number(s) daytime telephone number. Send your signed authorization in by utilizing the following methods: July 2023 when to use this form Web you can grant a third party authorization to help you with federal tax matters. Authorization to disclose personal information to a third party related to:

Name(s) shown on return your social security number you must use this form to authorize the irs to contact a third party on your behalf or to revoke that authorization. There are different types of third party authorizations: July 2023 when to use this form Web you can grant a third party authorization to help you with federal tax matters. Taxpayer identification number(s) daytime telephone number. Web use this form to authorize another person or entity, called a “third party,” to receive documents and information related to your individual annuity contract or certificate under a group annuity contract with john hancock life insurance company (u.s.a.) or john hancock life insurance company of new york (together, “john hancock”). Web if authorized party listed on this form is the result of power of attorney, administrator or executor of an estate, proper documentation establishing the authority must accompany this form when submitted authorized party or organization: Plan number (if applicable) 2. The third party can be a family member or friend, a tax professional, attorney or business, depending on the authorization. Web borrower authorization of third party mortgage servicer name customer service/loss mitigation phone number borrower(s) name(s) property address mortgage loan account number(s) third party information (all applicable fields must be completed) name of entity, agency, firm name(s) of authorized person(s) mailing address office address email

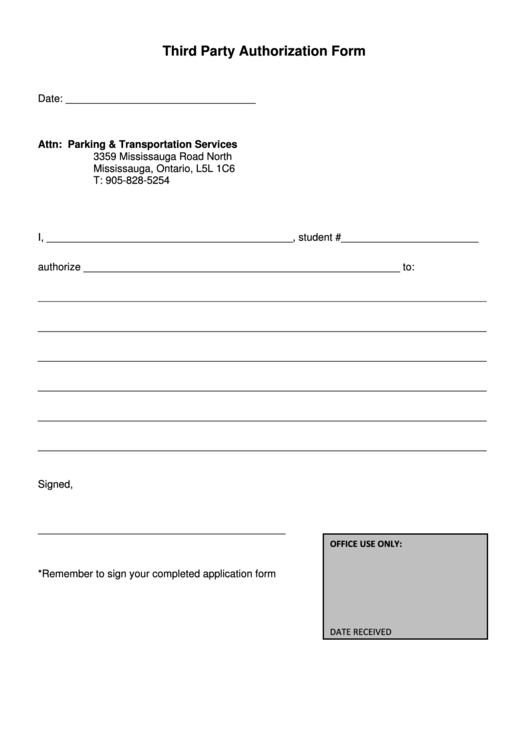

Third Party Auth Myloancare Fill Online, Printable, Fillable, Blank

Web taxpayer must sign and date this form on line 6. The third party can be a family member or friend, a tax professional, attorney or business, depending on the authorization. If you wish to name more than two designees, attach a list to this form. Name(s) shown on return your social security number you must use this form to.

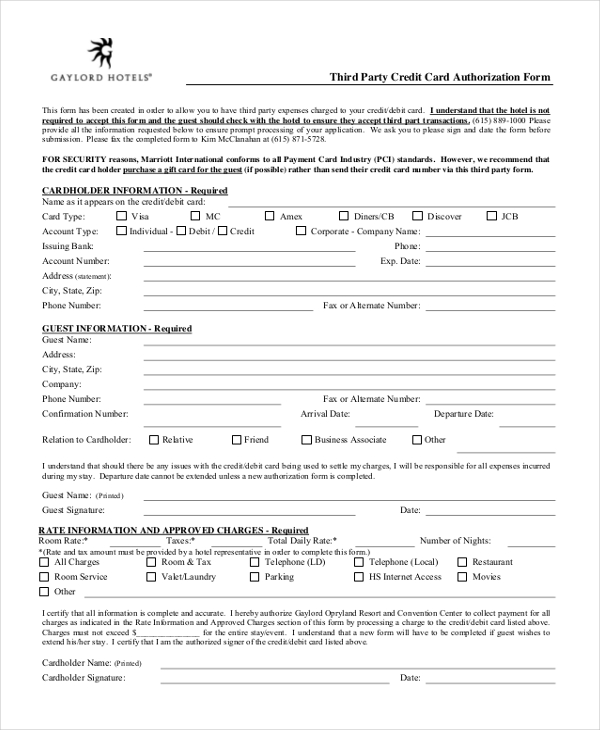

FREE 13+ Sample Credit Card Authorization Forms in PDF MS Word Excel

Web completed forms may be sent to the division at: The third party can be a family member or friend, a tax professional, attorney or business, depending on the authorization. Authorization to disclose personal information to a third party related to: Web taxpayer must sign and date this form on line 6. Burials and memorials, careers and employment, disability, education.

FREE 8+ Third Party Authorization Forms in PDF MS Word

Plan number (if applicable) 2. The third party can be a family member or friend, a tax professional, attorney or business, depending on the authorization. Web you can grant a third party authorization to help you with federal tax matters. Web if authorized party listed on this form is the result of power of attorney, administrator or executor of an.

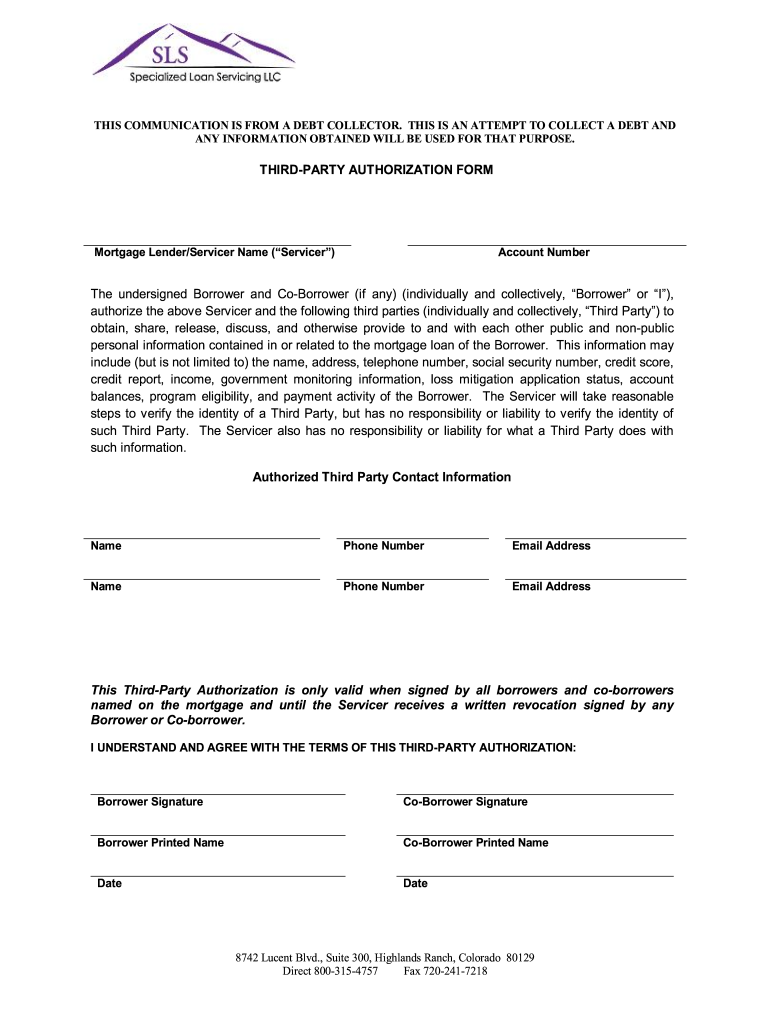

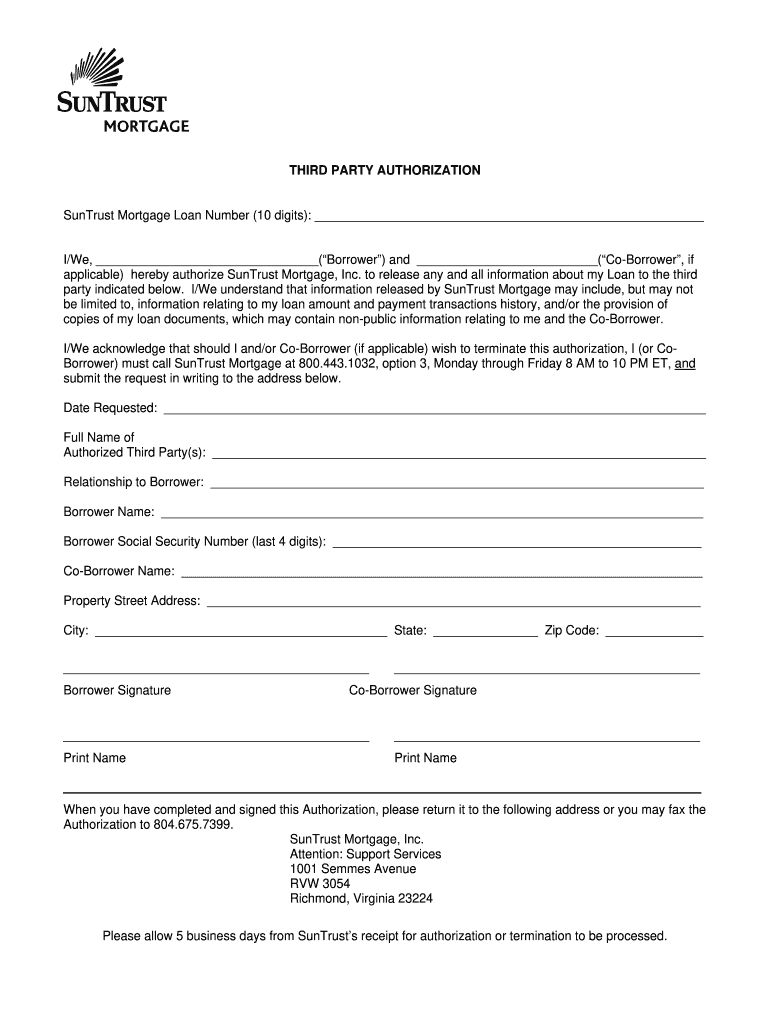

Sls Third Party Authorization Form Fill Online, Printable, Fillable

Authorization to disclose personal information to a third party related to: Plan number (if applicable) 2. Send your signed authorization in by utilizing the following methods: Web use this form to authorize another person or entity, called a “third party,” to receive documents and information related to your individual annuity contract or certificate under a group annuity contract with john.

Third Party Authorization Form Fill Out and Sign Printable PDF

Burials and memorials, careers and employment, disability, education and training, health care, housing assistance, life insurance, pension, records form last updated: Use this form to authorize individuals or companies (such as employers or credential services) to contact the department on your behalf regarding your application. Web completed forms may be sent to the division at: Web taxpayer must sign and.

Third Party Authorization Form Sample printable pdf download

Web taxpayer must sign and date this form on line 6. Web if authorized party listed on this form is the result of power of attorney, administrator or executor of an estate, proper documentation establishing the authority must accompany this form when submitted authorized party or organization: Name(s) shown on return your social security number you must use this form.

Generic 3rd party authorization Fill out & sign online DocHub

Name(s) shown on return your social security number you must use this form to authorize the irs to contact a third party on your behalf or to revoke that authorization. Send your signed authorization in by utilizing the following methods: Check here if a list of additional designees is attached. Plan number (if applicable) 2. If you wish to name.

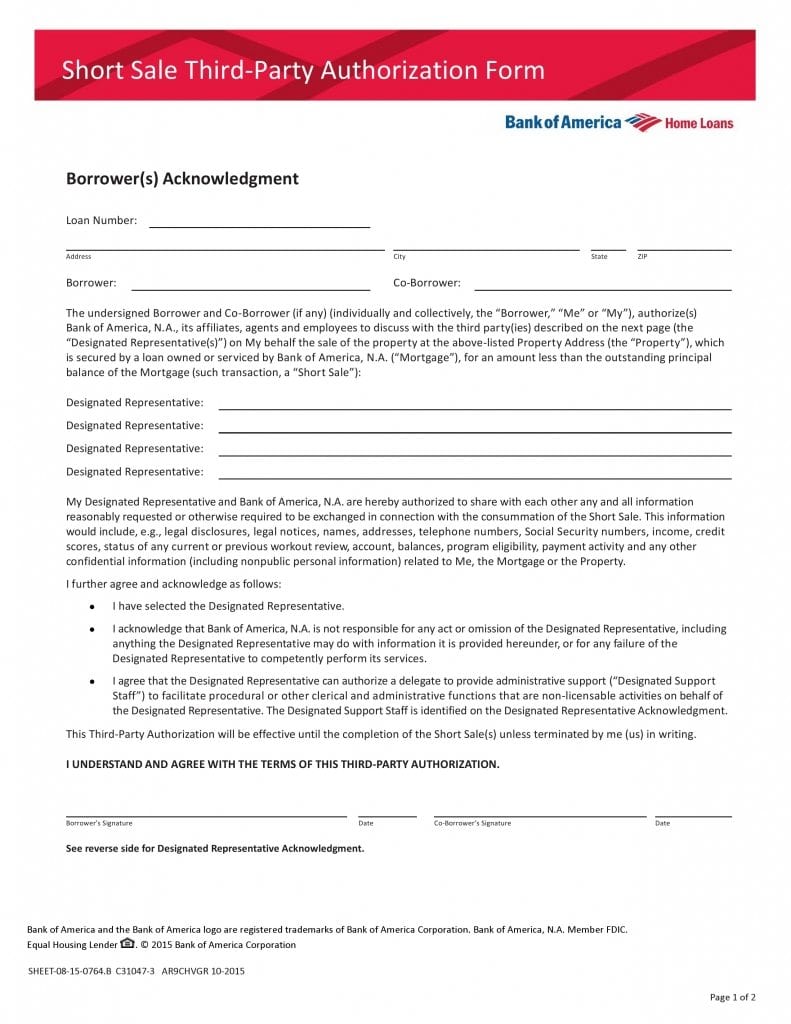

Free Bank of America Third Party Authorization Form PDF Template

Taxpayer identification number(s) daytime telephone number. Web if authorized party listed on this form is the result of power of attorney, administrator or executor of an estate, proper documentation establishing the authority must accompany this form when submitted authorized party or organization: Web you should make a copy of your signed authorization for your records before mailing it to va..

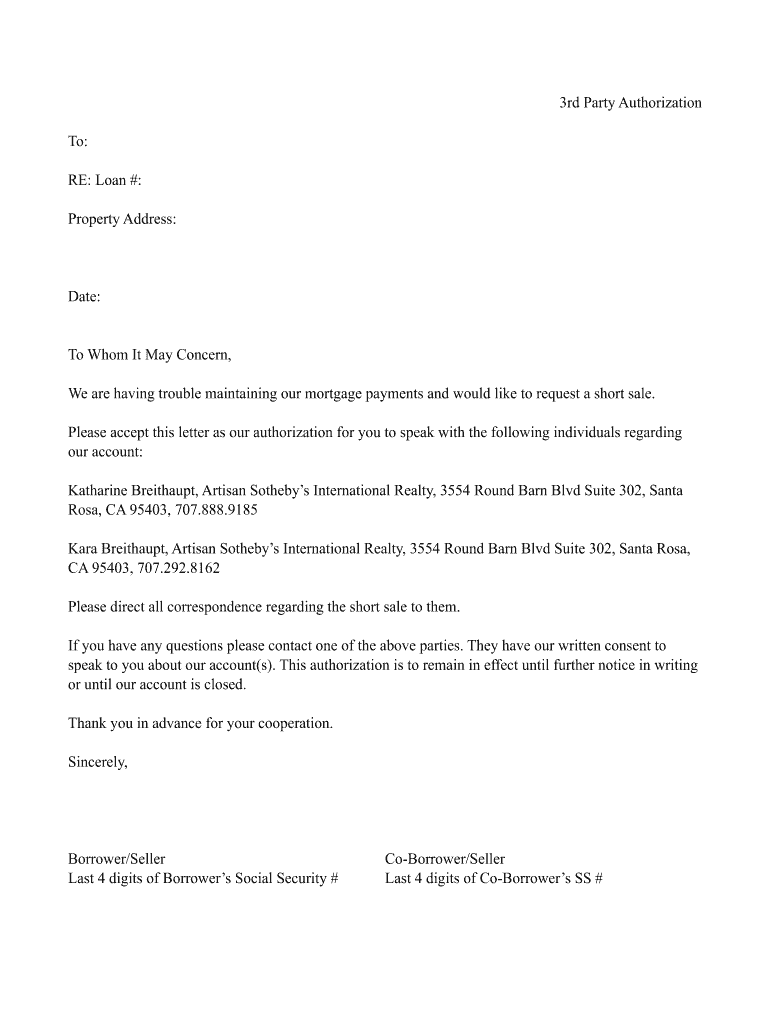

FREE 9+ Sample Third Party Authorization Letter Templates in PDF MS Word

Web you can grant a third party authorization to help you with federal tax matters. Plan number (if applicable) 2. If you wish to name more than two designees, attach a list to this form. Web if authorized party listed on this form is the result of power of attorney, administrator or executor of an estate, proper documentation establishing the.

Sample Third Party Authorization Letter 11+ Free , Examples , Format

Web you can grant a third party authorization to help you with federal tax matters. There are different types of third party authorizations: Web completed forms may be sent to the division at: The third party can be a family member or friend, a tax professional, attorney or business, depending on the authorization. Burials and memorials, careers and employment, disability,.

July 2023 When To Use This Form

Plan number (if applicable) 2. Authorization to disclose personal information to a third party related to: Web borrower authorization of third party mortgage servicer name customer service/loss mitigation phone number borrower(s) name(s) property address mortgage loan account number(s) third party information (all applicable fields must be completed) name of entity, agency, firm name(s) of authorized person(s) mailing address office address email Web you can grant a third party authorization to help you with federal tax matters.

Check Here If A List Of Additional Designees Is Attached.

Send your signed authorization in by utilizing the following methods: If you wish to name more than two designees, attach a list to this form. Web use this form to authorize another person or entity, called a “third party,” to receive documents and information related to your individual annuity contract or certificate under a group annuity contract with john hancock life insurance company (u.s.a.) or john hancock life insurance company of new york (together, “john hancock”). Use this form to authorize individuals or companies (such as employers or credential services) to contact the department on your behalf regarding your application.

Web Taxpayer Must Sign And Date This Form On Line 6.

Burials and memorials, careers and employment, disability, education and training, health care, housing assistance, life insurance, pension, records form last updated: Web you should make a copy of your signed authorization for your records before mailing it to va. Web if authorized party listed on this form is the result of power of attorney, administrator or executor of an estate, proper documentation establishing the authority must accompany this form when submitted authorized party or organization: Name(s) shown on return your social security number you must use this form to authorize the irs to contact a third party on your behalf or to revoke that authorization.

Web Completed Forms May Be Sent To The Division At:

Taxpayer identification number(s) daytime telephone number. There are different types of third party authorizations: The third party can be a family member or friend, a tax professional, attorney or business, depending on the authorization.