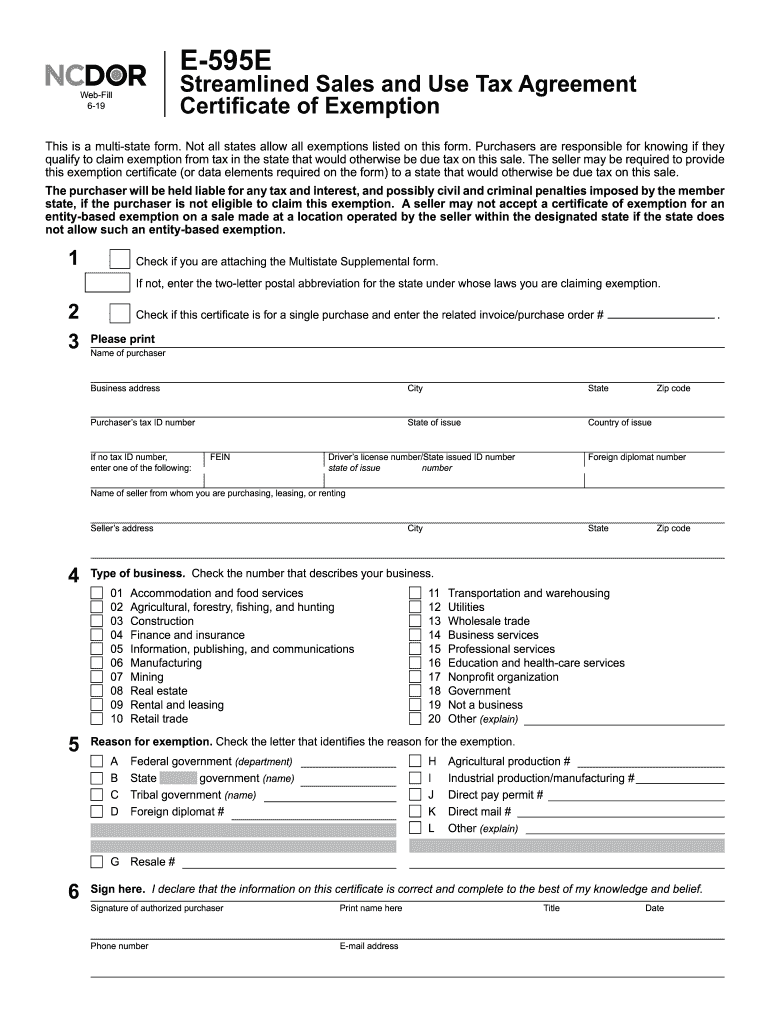

Ncdor Form E 595E

Ncdor Form E 595E - View sales history, tax history, home value. Web for a contractor to make a purchase pursuant to n.c. Not all states allow all exemptions listed on this form. The purchaser must complete all fields on the exemption certificate and provide the fully. More than 7 days of n595e history is available with an upgrade to a silver (90 days), gold (1 year), or business (3 years) subscription. House located at 1295 northside rd, creedmoor, nc 27522 sold for $164,000 on dec 28, 2006. Web once you have that, you are eligible to issue a resale certificate. Web an exemption certificate number is required to be obtained by a commercial fisherman, commercial logger, or wildlife manager who is not registered with the. Not all states allow all. Web use this form to claim exemption from sales tax on purchases of otherwise taxable items.

Complete, sign, print and send your tax documents easily with us legal forms. Web once you have that, you are eligible to issue a resale certificate. View sales history, tax history, home value. Not all states allow all. Not all states allow all exemptions listed on this form. Web sales and use tax on a qualifying purchase for use in a farming operation. The purchaser must complete all fields on the exemption certificate and provide the fully. It serves as a way to be able to report sales, use, and withholding tax. Web home page | ncdor Download blank or fill out online in pdf format.

Web this 1602 square foot single family home has 1 bedrooms and 1.0 bathrooms. Web 4 beds, 2.5 baths, 1906 sq. It serves as a way to be able to report sales, use, and withholding tax. 1295 northside rd, creedmoor, nc is a single family home that contains 1,906 sq ft and was built in 2007. Complete, sign, print and send your tax documents easily with us legal forms. Web ncdor e 595e form is an important document for all business transactions in the state of north carolina. It contains 4 bedrooms and 2.5. Not all states allow all. Web home page | ncdor View sales history, tax history, home value.

Скачать ГОСТ 59502000 Прутки, полосы и мотки из инструментальной

Not all states allow all exemptions listed on this form. Web 4 beds, 2.5 baths, 1906 sq. Web this 1602 square foot single family home has 1 bedrooms and 1.0 bathrooms. The purchaser must complete all fields on the exemption certificate and provide the fully. 1295 northside rd, creedmoor, nc is a single family home that contains 1,906 sq ft.

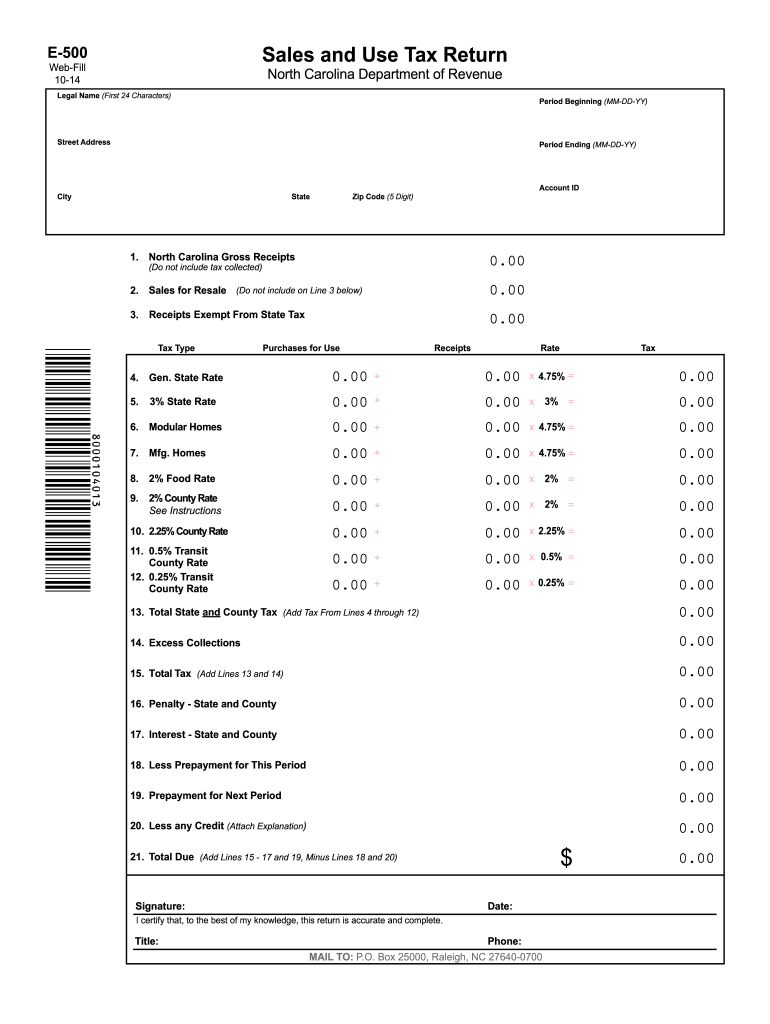

E 500 Form Fill Out and Sign Printable PDF Template signNow

It contains 4 bedrooms and 2.5. View sales history, tax history, home value. Download blank or fill out online in pdf format. Web an exemption certificate number is required to be obtained by a commercial fisherman, commercial logger, or wildlife manager who is not registered with the. More than 7 days of n595e history is available with an upgrade to.

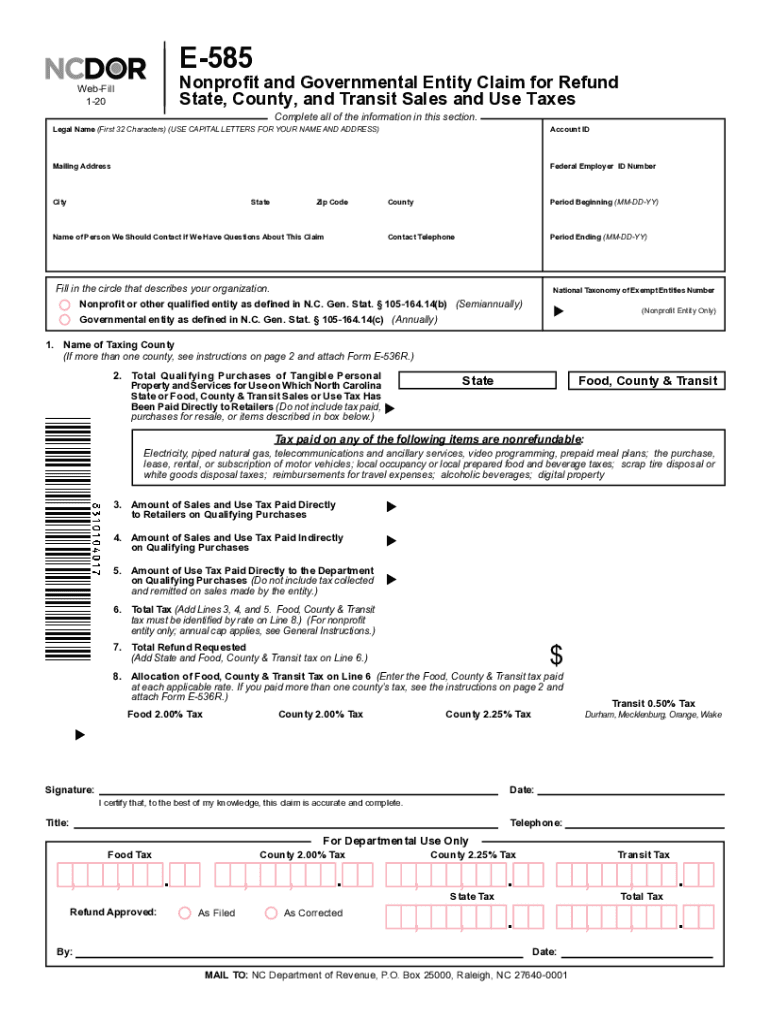

E 585 Form ≡ Fill Out Printable PDF Forms Online

More than 7 days of n595e history is available with an upgrade to a silver (90 days), gold (1 year), or business (3 years) subscription. View sales history, tax history, home value. Not all states allow all. This home is located at 505 e old highway 74, monroe, nc 28112. Download blank or fill out online in pdf format.

E 585 Fill Out and Sign Printable PDF Template signNow

Web for a contractor to make a purchase pursuant to n.c. House located at 1295 northside rd, creedmoor, nc 27522 sold for $164,000 on dec 28, 2006. Not all states allow all exemptions listed on this form. Web ncdor e 595e form is an important document for all business transactions in the state of north carolina. This home is located.

E595e Sales Tax Exempt Form

Not all states allow all exemptions listed on this form. Web ncdor e 595e form is an important document for all business transactions in the state of north carolina. Download blank or fill out online in pdf format. Web sales and use tax on a qualifying purchase for use in a farming operation. Web 4 beds, 2.5 baths, 1906 sq.

20192022 Form NC DoR E595E Fill Online, Printable, Fillable, Blank

Complete, sign, print and send your tax documents easily with us legal forms. 1295 northside rd, creedmoor, nc is a single family home that contains 1,906 sq ft and was built in 2007. Web home page | ncdor Web this 1602 square foot single family home has 1 bedrooms and 1.0 bathrooms. Web 4 beds, 2.5 baths, 1906 sq.

E595e Form Fill Out and Sign Printable PDF Template signNow

Web this 1602 square foot single family home has 1 bedrooms and 1.0 bathrooms. View sales history, tax history, home value. Web sales and use tax on a qualifying purchase for use in a farming operation. 1295 northside rd, creedmoor, nc is a single family home that contains 1,906 sq ft and was built in 2007. Complete, sign, print and.

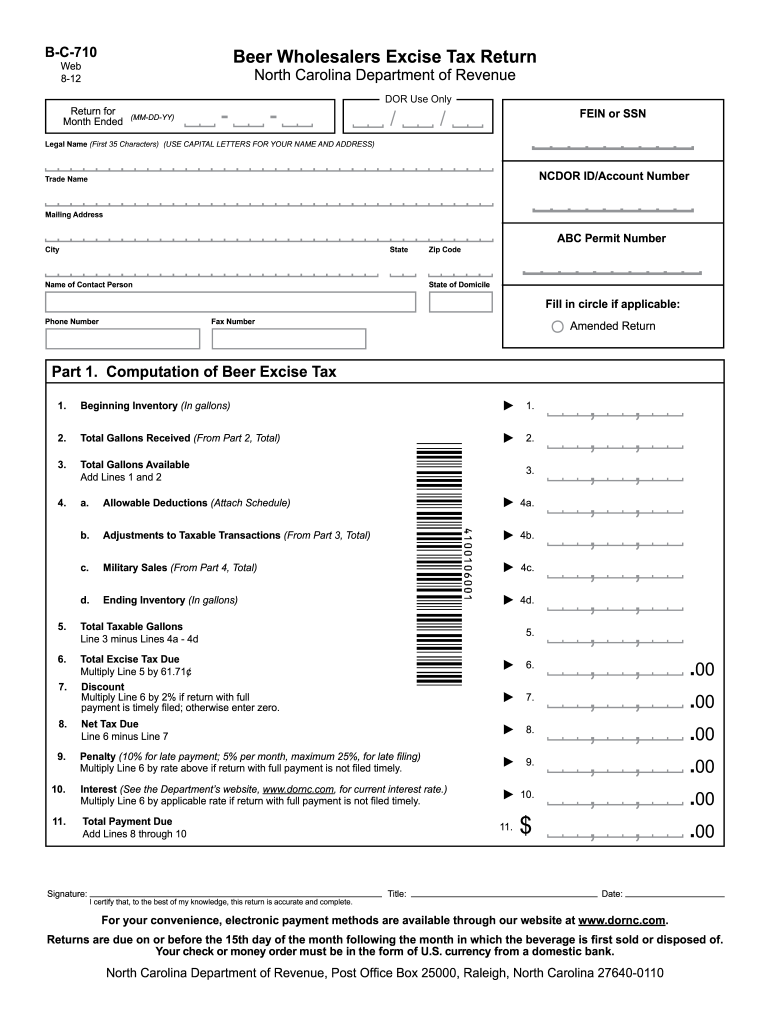

B c 710 Fill Out and Sign Printable PDF Template signNow

House located at 1295 northside rd, creedmoor, nc 27522 sold for $164,000 on dec 28, 2006. Web this 1602 square foot single family home has 1 bedrooms and 1.0 bathrooms. Web for a contractor to make a purchase pursuant to n.c. This home is located at 505 e old highway 74, monroe, nc 28112. The purchaser must complete all fields.

North Carolina Updates Form E595E Certificate of Exemption

This home is located at 505 e old highway 74, monroe, nc 28112. Web ncdor e 595e form is an important document for all business transactions in the state of north carolina. Not all states allow all exemptions listed on this form. Web home page | ncdor Download blank or fill out online in pdf format.

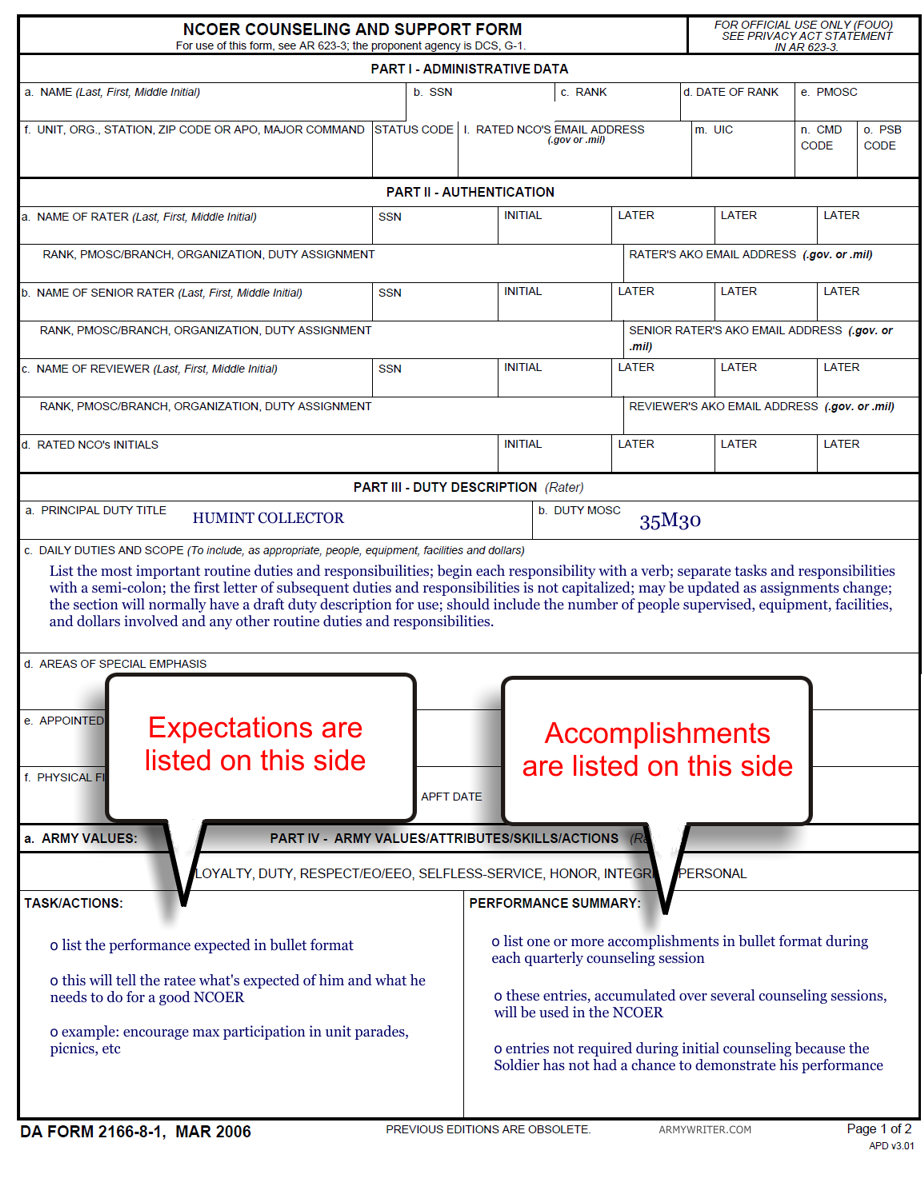

21668 NCOER PDF

Web home page | ncdor Not all states allow all exemptions listed on this form. Web once you have that, you are eligible to issue a resale certificate. Web an exemption certificate number is required to be obtained by a commercial fisherman, commercial logger, or wildlife manager who is not registered with the. It serves as a way to be.

More Than 7 Days Of N595E History Is Available With An Upgrade To A Silver (90 Days), Gold (1 Year), Or Business (3 Years) Subscription.

Web 4 beds, 2.5 baths, 1906 sq. 1295 northside rd, creedmoor, nc is a single family home that contains 1,906 sq ft and was built in 2007. Complete, sign, print and send your tax documents easily with us legal forms. Web use this form to claim exemption from sales tax on purchases of otherwise taxable items.

Web Once You Have That, You Are Eligible To Issue A Resale Certificate.

It contains 4 bedrooms and 2.5. House located at 1295 northside rd, creedmoor, nc 27522 sold for $164,000 on dec 28, 2006. View sales history, tax history, home value. Web for a contractor to make a purchase pursuant to n.c.

Web An Exemption Certificate Number Is Required To Be Obtained By A Commercial Fisherman, Commercial Logger, Or Wildlife Manager Who Is Not Registered With The.

It serves as a way to be able to report sales, use, and withholding tax. Web this 1602 square foot single family home has 1 bedrooms and 1.0 bathrooms. Web sales and use tax on a qualifying purchase for use in a farming operation. Download blank or fill out online in pdf format.

The Purchaser Must Complete All Fields On The Exemption Certificate And Provide The Fully.

This home is located at 505 e old highway 74, monroe, nc 28112. Web ncdor e 595e form is an important document for all business transactions in the state of north carolina. Not all states allow all exemptions listed on this form. Not all states allow all.