In 529 Form

In 529 Form - You can use a 529 plan to. The forms are available on. Web 19 hours agoon july 14, the education department sent out emails to over 800,000 borrowers, notifying them that they qualified for student loan forgiveness under the idr. Contributions to this type of. Web there are 2 forms required to claim the tax credit: 18 2007 you may be eligible for a credit of as. 15056o miscellaneous deductions get forms and other information faster and easier at: Prior year tax forms can be found in the. If you need more space,. Access our most popular forms below, or select all forms to see a complete list.

Web a 529 plan is an investment account that offers tax benefits when used to pay for qualified education expenses for a designated beneficiary. Most forms can be completed online, or you can download a pdf where. Web a 529 college savings plan is a reference to section 529 of the internal revenue code. This form is for income earned in tax year 2022, with tax returns due in april. 18 2007 you may be eligible for a credit of as. Learn more get educated sign up for email updates to. Web enroll now state updates discover 529 updates relating to apprenticeships, student loans, and state tax credit eligibility. Transaction cannot be completed online. Web there are 2 forms required to claim the tax credit: Prior year tax forms can be found in the.

Contributions to this type of plan are made on behalf of a beneficiary, and are to be used. Web state form 53386 r / 8/07 attachment sequence no. Prior year tax forms can be found in the. Contributions to this type of plan are made on behalf of a beneficiary, and are to be used. 18 2007 you may be eligible for a credit of as. Web use this form to initiate a direct rollover from another 529 college savings plan or an educational savings account (esa) to an existing minnesota 529 college savings plan. Number of marriages including current marriage: Web a 529 college savings plan is a reference to section 529 of the internal revenue code. Web dor tax forms 2022 individual income tax forms to download a form, click on the form name in the left column in the tables below. 19 2007 a 529 college savings plan is a reference to section 529 of the internal revenue code.

how to report 529 distributions on tax return Fill Online, Printable

This form is for income earned in tax year 2022, with tax returns due in april. Web there are 2 forms required to claim the tax credit: Web a 529 college savings plan is a reference to section 529 of the internal revenue code. Prior year tax forms can be found in the. 529 plans, legally known as “qualified tuition.

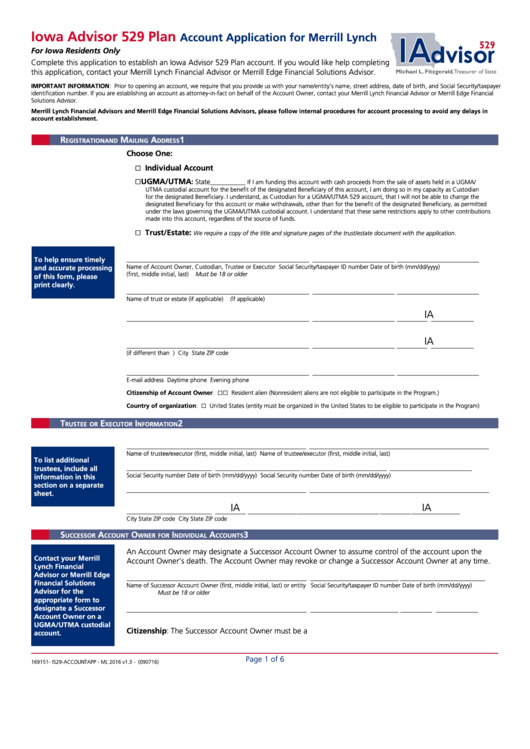

Fillable Iowa Advisor 529 Plan Account Application For Merrill Lynch

Access our most popular forms below, or select all forms to see a complete list. Web a 529 plan is an investment account that offers tax benefits when used to pay for qualified education expenses for a designated beneficiary. Number of marriages including current marriage: Learn more get educated sign up for email updates to. 19 2007 a 529 college.

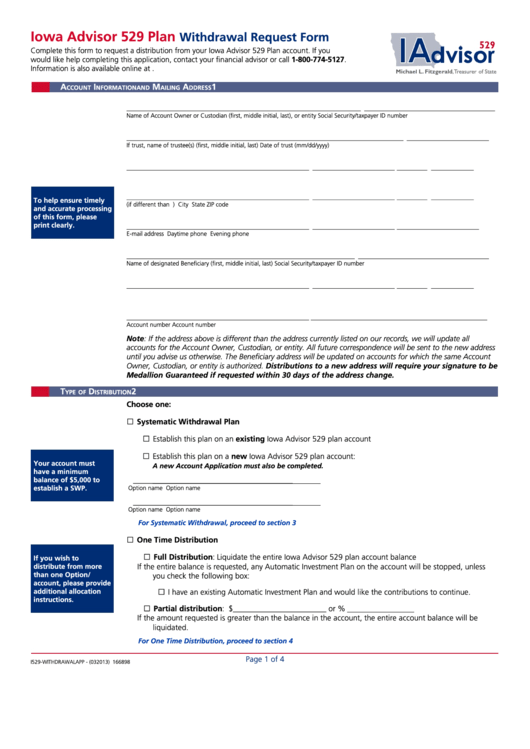

Fillable Iowa Advisor 529 Plan Withdrawal Request Form printable pdf

18 2007 you may be eligible for a credit of as. Transaction cannot be completed online. Contributions to this type of plan are made on behalf of a beneficiary, and are to be used. You can use a 529 plan to. Web state form 53386 r / 8/07 attachment sequence no.

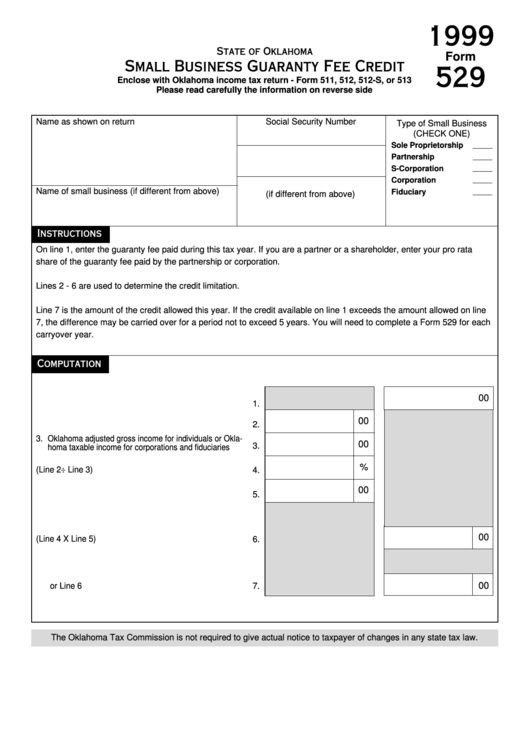

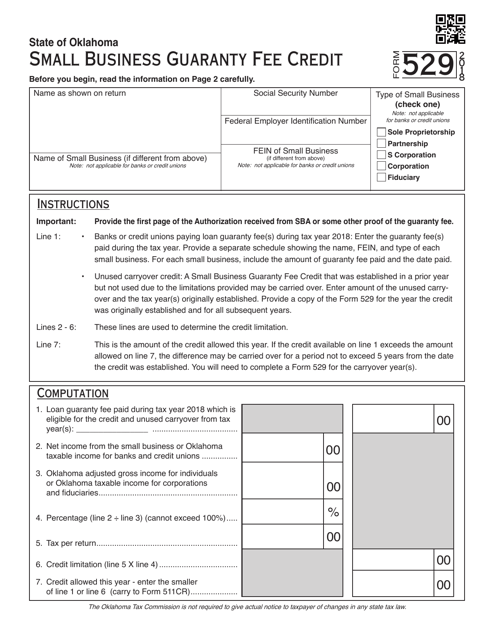

Form 529 Small Business Guaranty Fee Credit 1999 printable pdf download

Access our most popular forms below, or select all forms to see a complete list. Web a 529 college savings plan is a reference to section 529 of the internal revenue code. Contributions to this type of plan are made on behalf of a beneficiary, and are to be used. Web use this form to initiate a direct rollover from.

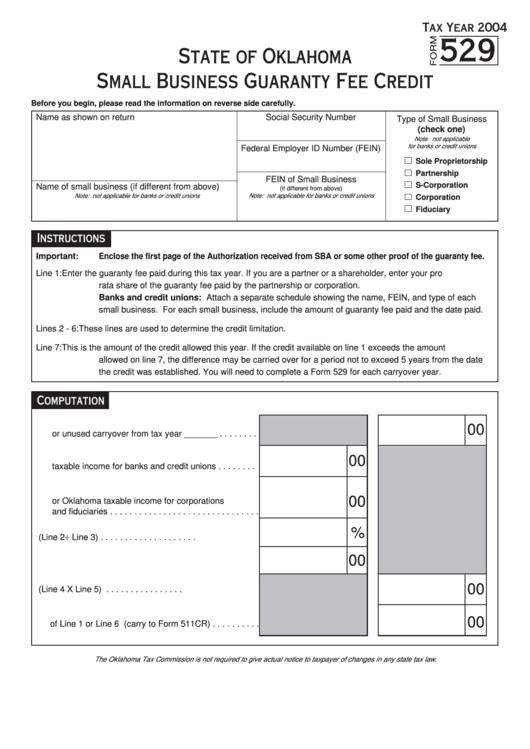

Form 529 Small Business Guaranty Fee Credit 2004 printable pdf download

Access our most popular forms below, or select all forms to see a complete list. Select the appropriate form to complete, print, and mail in. If you need more space,. Anyone who makes a contribution to a qualified plan and claims. Web dor tax forms 2022 individual income tax forms to download a form, click on the form name in.

OTC Form 529 Download Fillable PDF or Fill Online Small Business

19 2007 a 529 college savings plan is a reference to section 529 of the internal revenue code. Web enroll now state updates discover 529 updates relating to apprenticeships, student loans, and state tax credit eligibility. List any previous marriages beginning with the most recent. Number of marriages including current marriage: 15056o miscellaneous deductions get forms and other information faster.

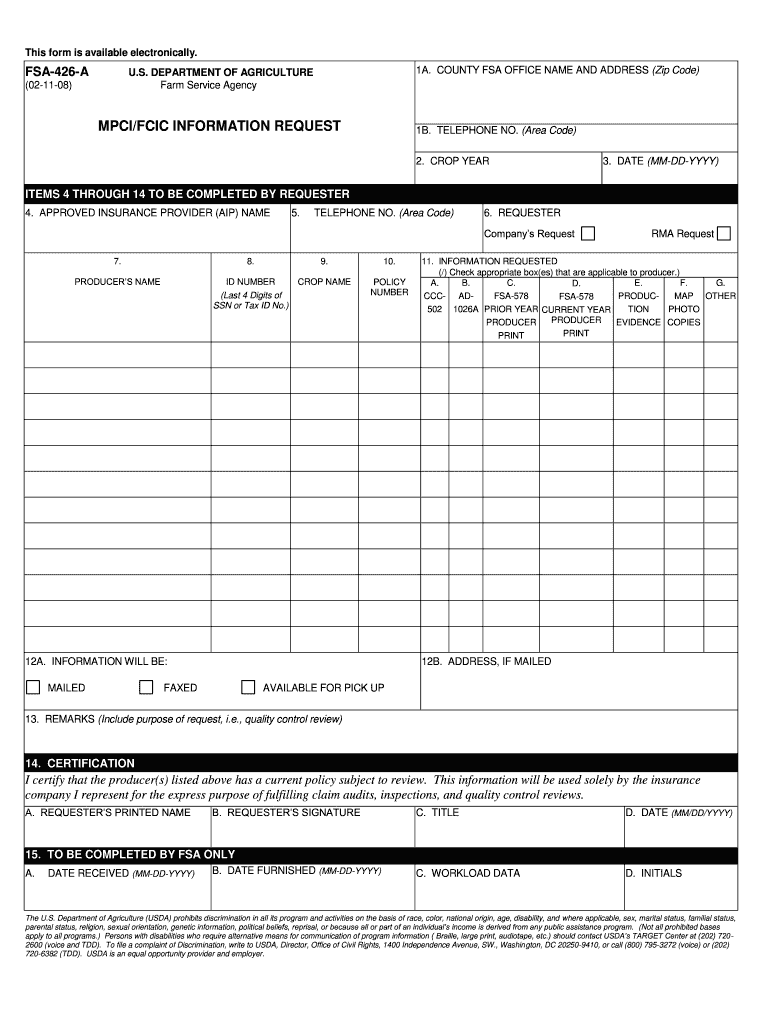

Fsa 426 Fill Out and Sign Printable PDF Template signNow

Prior year tax forms can be found in the. Learn more get educated sign up for email updates to. Web nest 529 plan forms enrollment kit all forms ready to open your account? Web use this form to initiate a direct rollover from another 529 college savings plan or an educational savings account (esa) to an existing minnesota 529 college.

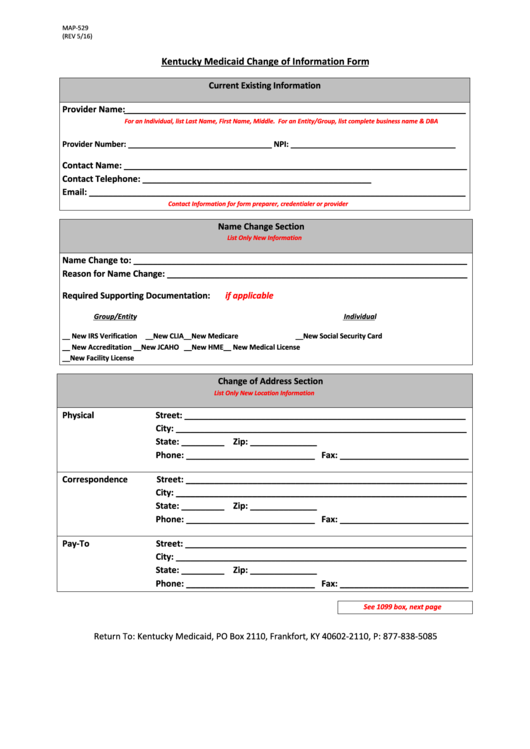

Fillable Form Map529 Kentucky Medicaid Change Of Information Form

Select the appropriate form to complete, print, and mail in. Anyone who makes a contribution to a qualified plan and claims. Access our most popular forms below, or select all forms to see a complete list. Ad learn more about how a 529 plan can help you save for your child's future today. If you need more space,.

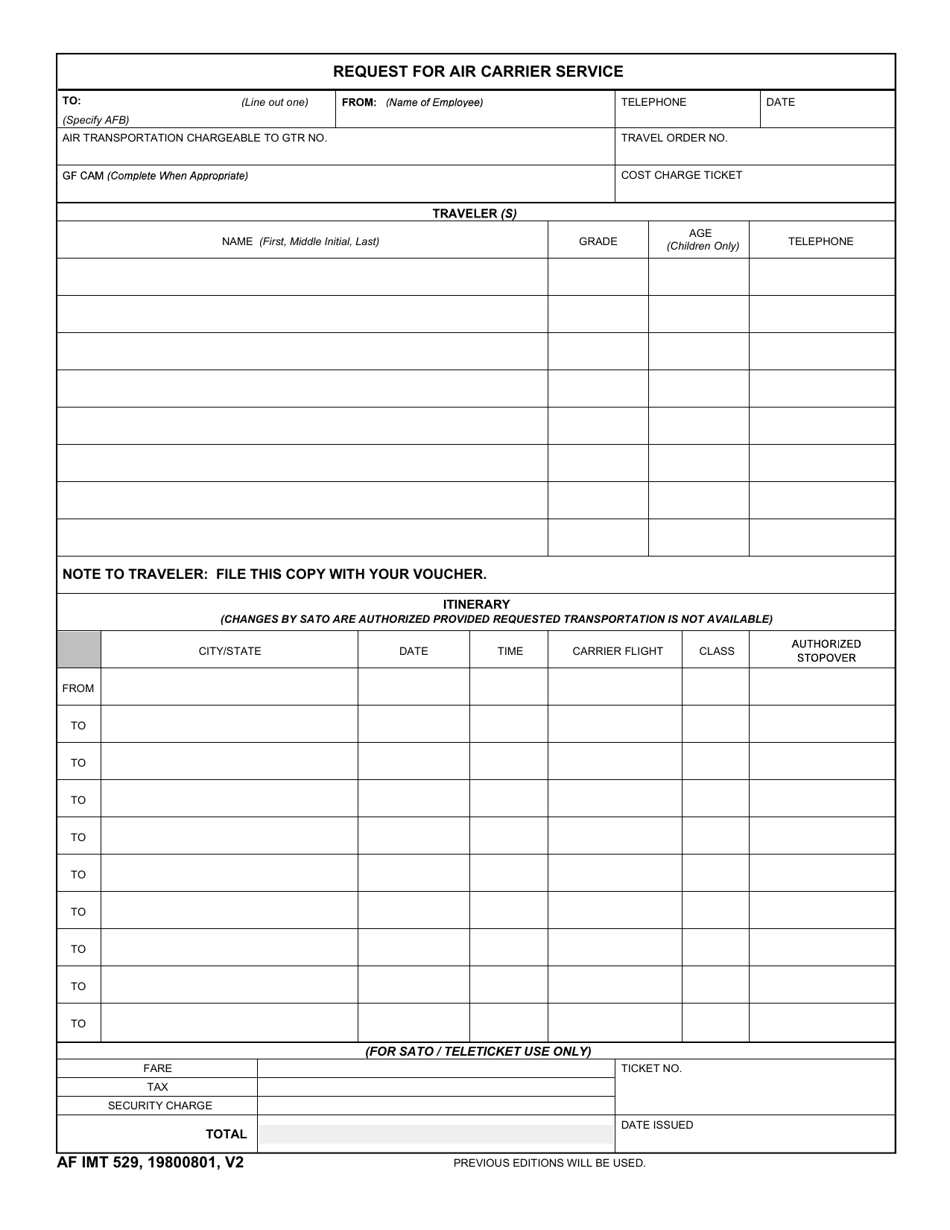

AF IMT Form 529 Download Fillable PDF or Fill Online Monthly

This form is for income earned in tax year 2022, with tax returns due in april. Web a 529 college savings plan is a reference to section 529 of the internal revenue code. 529 plans, legally known as “qualified tuition plans,” are. 19 2007 a 529 college savings plan is a reference to section 529 of the internal revenue code..

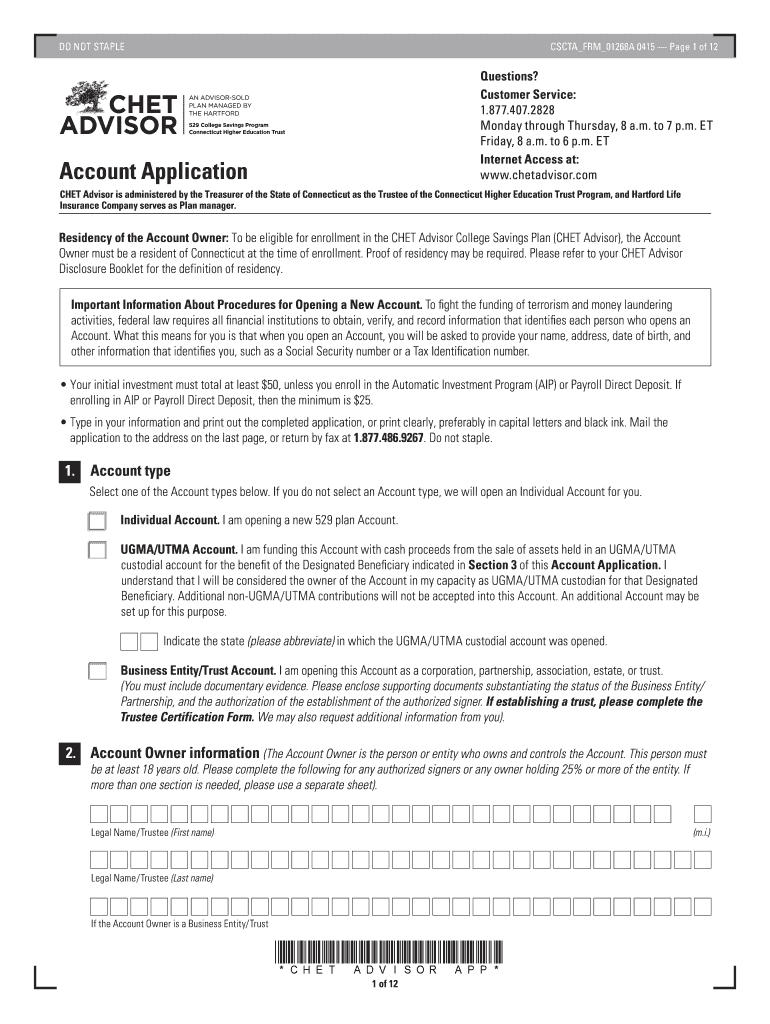

Chet 529 Forms Fill Out and Sign Printable PDF Template signNow

If you need more space,. 19 2007 a 529 college savings plan is a reference to section 529 of the internal revenue code. Web a 529 college savings plan is a reference to section 529 of the internal revenue code. 15056o miscellaneous deductions get forms and other information faster and easier at: You can use a 529 plan to.

Web State Form 53386 R / 8/07 Attachment Sequence No.

Anyone who makes a contribution to a qualified plan and claims. Access our most popular forms below, or select all forms to see a complete list. You can use a 529 plan to. Web under section 529 of the internal revenue code or from any other similar plan.

Web A 529 Plan Is An Investment Account That Offers Tax Benefits When Used To Pay For Qualified Education Expenses For A Designated Beneficiary.

Contributions to this type of plan are made on behalf of a beneficiary, and are to be used. List any previous marriages beginning with the most recent. Web nest 529 plan forms enrollment kit all forms ready to open your account? Web there are 2 forms required to claim the tax credit:

Number Of Marriages Including Current Marriage:

19 2007 a 529 college savings plan is a reference to section 529 of the internal revenue code. The forms are available on. 529 plans, legally known as “qualified tuition plans,” are. 18 2007 you may be eligible for a credit of as.

Web Dor Tax Forms 2022 Individual Income Tax Forms To Download A Form, Click On The Form Name In The Left Column In The Tables Below.

Web a 529 college savings plan is a reference to section 529 of the internal revenue code. Contributions to this type of. Contributions to this type of plan are made on behalf of a beneficiary, and are to be used. Web enroll now state updates discover 529 updates relating to apprenticeships, student loans, and state tax credit eligibility.