Ebay Address For Tax Exempt Form

Ebay Address For Tax Exempt Form - Web in 2023 the annual exclusion amount increased from $16,000 to $17,000 per recipient, and the estate, gift, and gst exemption amount increased from $12.06 million. If you received a form. For information about your tax. Web are you certain you need ebay's address for that form? I suppose that might be the case if your company has specific individual exemptions for each vendor rather. The official document title is. Web can i use my shop tax exempt number. I can save you sales tax! 501(c)3 organizations) and online resellers/retailers both qualify for the ebay tax. This is to help you comply with your tax obligations.

Web we would like to show you a description here but the site won’t allow us. Web in 2023 the annual exclusion amount increased from $16,000 to $17,000 per recipient, and the estate, gift, and gst exemption amount increased from $12.06 million. Web key takeaways • if your online auction sales involve used items and are the equivalent of an occasional garage or yard sale, you generally don't have to. This is to help you comply with your tax obligations. Tax exempt business registration now available regarding the status of your ebay account hello (redacted), thank you for sending in. Web who qualifies for ebay tax exemption? For information about your tax. 501(c)3 organizations) and online resellers/retailers both qualify for the ebay tax. Web if a shipping address is in one of the marketplace responsibility states within the u.s., the applicable tax will be collected by ebay and included in the order total at checkout. Web can i use my shop tax exempt number.

If you received a form. Web can i use my shop tax exempt number. I can save you sales tax! Tax exempt business registration now available regarding the status of your ebay account hello (redacted), thank you for sending in. Web are you certain you need ebay's address for that form? Web if tax was collected by ebay, we may add ebay's tax details to the buyer's delivery address, which you need to include on the parcel. Web key takeaways • if your online auction sales involve used items and are the equivalent of an occasional garage or yard sale, you generally don't have to. For information about your tax. Web who qualifies for ebay tax exemption? The official document title is.

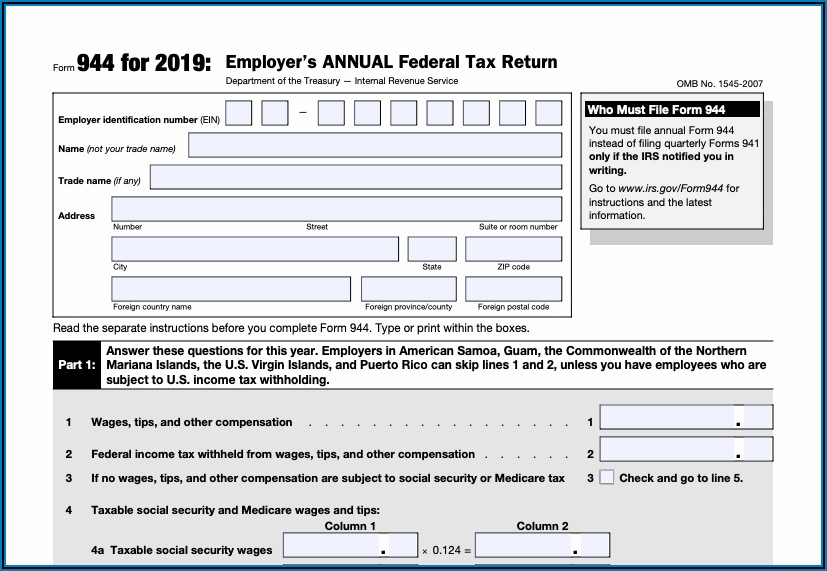

Tax Exempt Form 2020 Fill Online, Printable, Fillable, Blank pdfFiller

I can save you sales tax! Web are you a reseller that buys goods to resell on ebay? Web if tax was collected by ebay, we may add ebay's tax details to the buyer's delivery address, which you need to include on the parcel. Web key takeaways • if your online auction sales involve used items and are the equivalent.

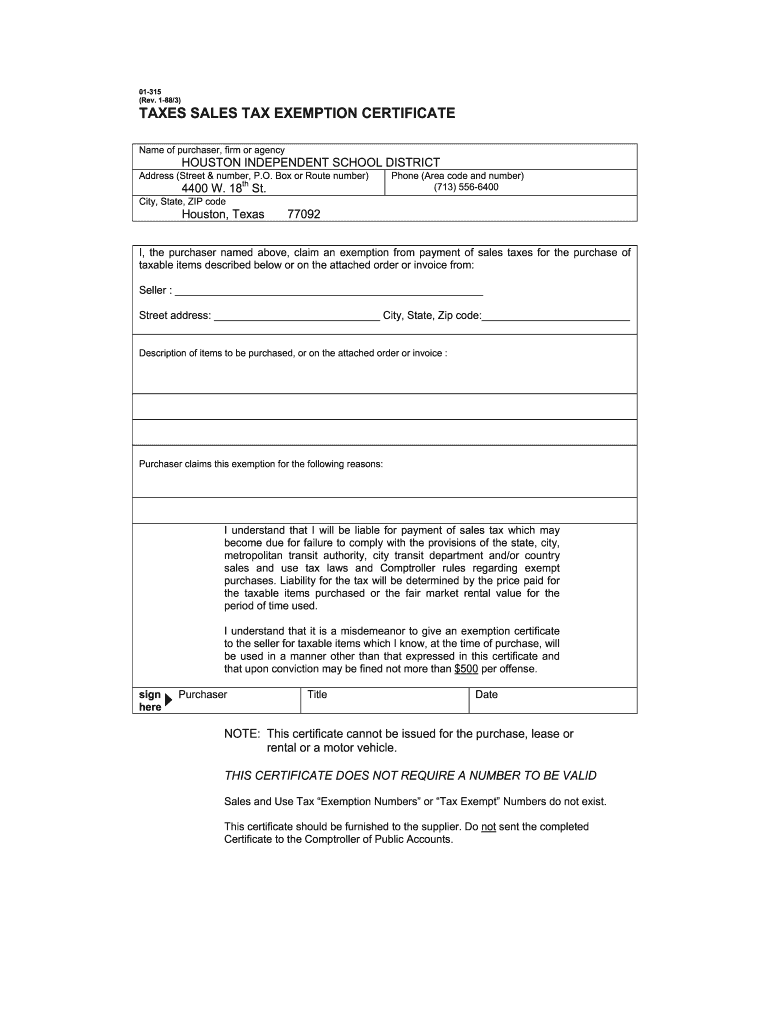

Texas Tax Exempt Form Fill Out and Sign Printable PDF Template signNow

For information about your tax. Web when you buy an item, taxes may be applicable to your purchase and may vary depending on a variety of factors, such as: Web in 2023 the annual exclusion amount increased from $16,000 to $17,000 per recipient, and the estate, gift, and gst exemption amount increased from $12.06 million. Tax exempt business registration now.

Missouri Tax Exempt form Great How to Title A Vehicle In Missouri

Web if tax was collected by ebay, we may add ebay's tax details to the buyer's delivery address, which you need to include on the parcel. Web we would like to show you a description here but the site won’t allow us. In today's video i show how to submit your application for sales tax exemptio. Web in 2023 the.

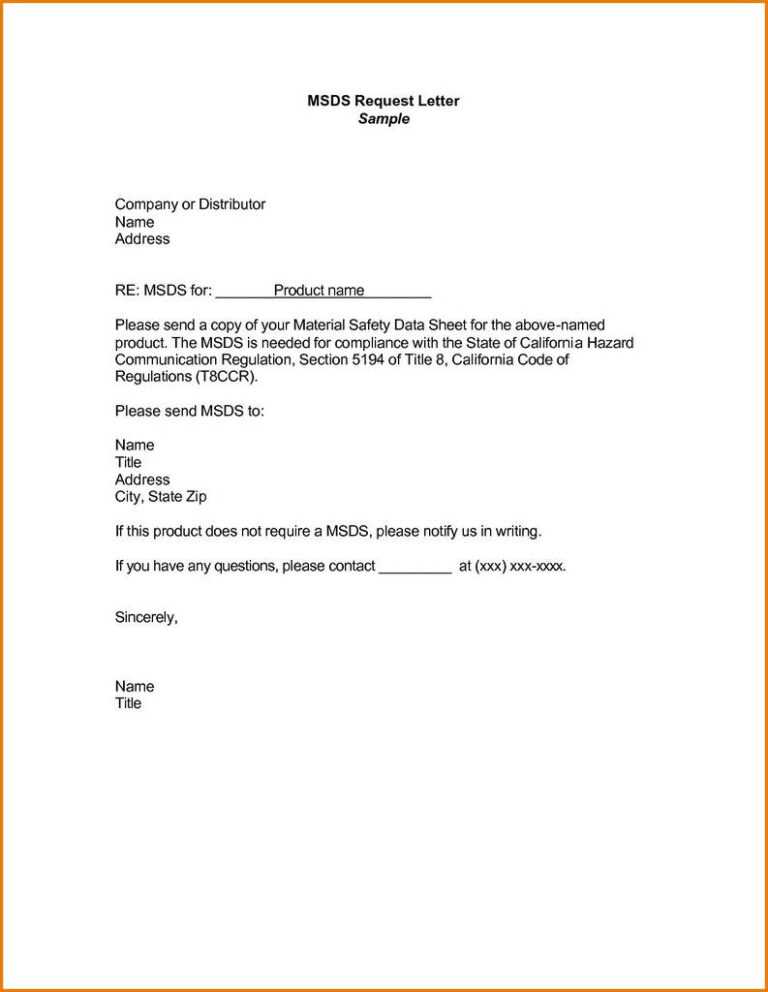

Tax Exempt Form Request Letter Awesome 25 Inspirational In Resale

This is to help you comply with your tax obligations. Web who qualifies for ebay tax exemption? Web if tax was collected by ebay, we may add ebay's tax details to the buyer's delivery address, which you need to include on the parcel. Web key takeaways • if your online auction sales involve used items and are the equivalent of.

Tax Exempt Forms San Patricio Electric Cooperative

For information about your tax. This is to help you comply with your tax obligations. Web if tax was collected by ebay, we may add ebay's tax details to the buyer's delivery address, which you need to include on the parcel. Web are you certain you need ebay's address for that form? Web who qualifies for ebay tax exemption?

Toll Tax Exemption Certificate Format Master of Documents

Web can i use my shop tax exempt number. I suppose that might be the case if your company has specific individual exemptions for each vendor rather. Tax exempt business registration now available regarding the status of your ebay account hello (redacted), thank you for sending in. If you received a form. Web are you certain you need ebay's address.

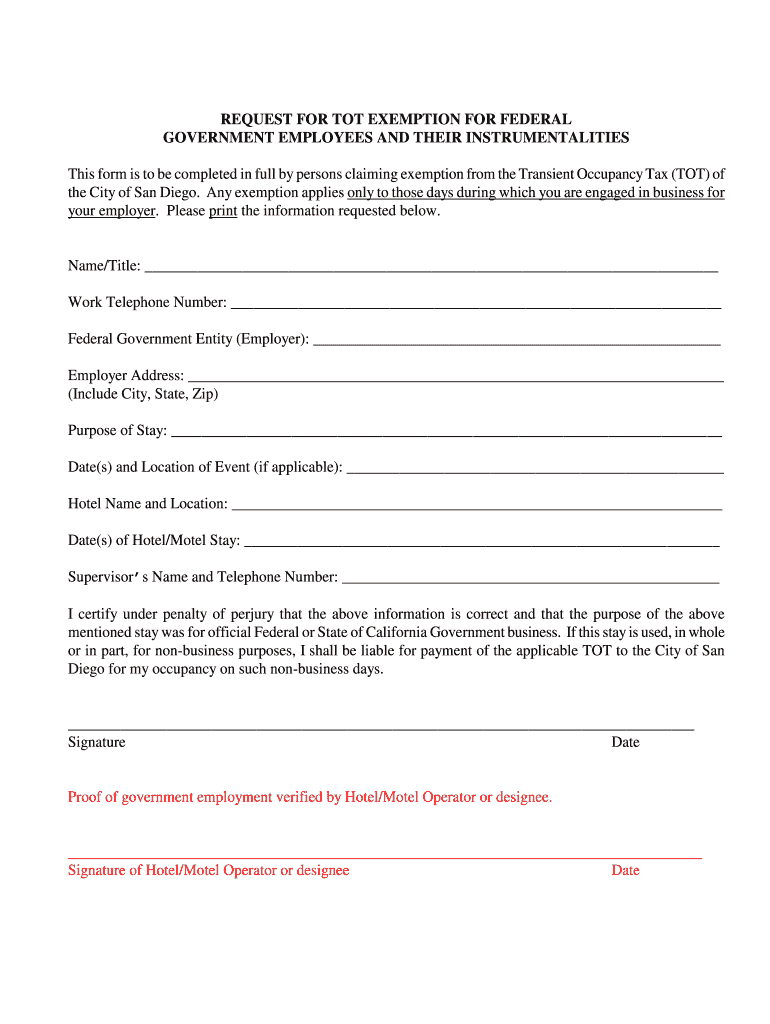

San Diego Tax Exempt Form Fill Out and Sign Printable PDF Template

In today's video i show how to submit your application for sales tax exemptio. The official document title is. Web we would like to show you a description here but the site won’t allow us. I suppose that might be the case if your company has specific individual exemptions for each vendor rather. Web key takeaways • if your online.

Irs 501 C 3 Change Of Address Form Form Resume Examples pv9wX1zeY7

The official document title is. Web we would like to show you a description here but the site won’t allow us. Tax exempt business registration now available regarding the status of your ebay account hello (redacted), thank you for sending in. Web are you certain you need ebay's address for that form? Where do i send tax exempt forms within.

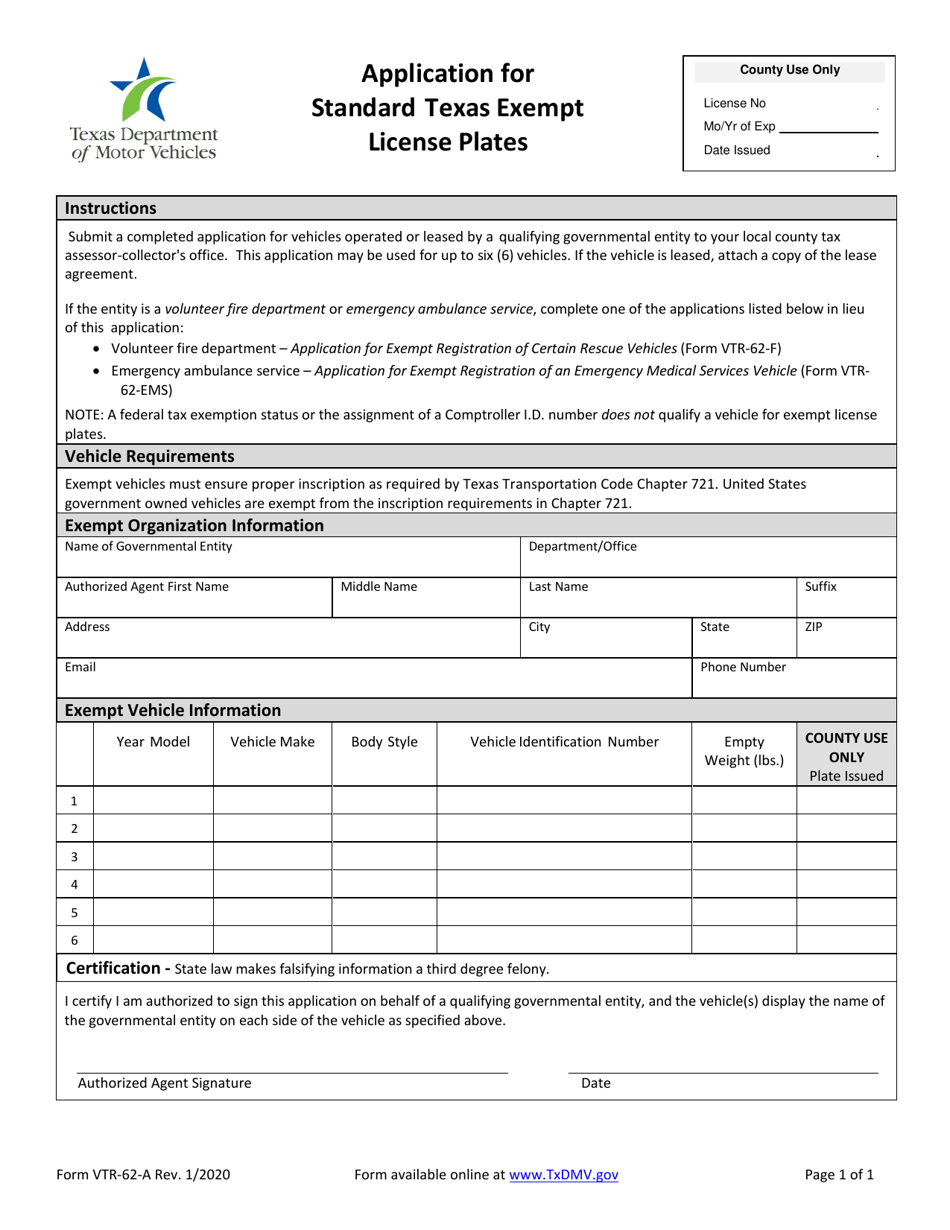

Form VTR62A Download Fillable PDF or Fill Online Application for

If you received a form. The official document title is. This is to help you comply with your tax obligations. Web are you a reseller that buys goods to resell on ebay? Web can i use my shop tax exempt number.

Sales tax exempt, how to fill out SST form? Ebay

Web are you a reseller that buys goods to resell on ebay? Web in 2023 the annual exclusion amount increased from $16,000 to $17,000 per recipient, and the estate, gift, and gst exemption amount increased from $12.06 million. If you received a form. Web when you buy an item, taxes may be applicable to your purchase and may vary depending.

Web When You Buy An Item, Taxes May Be Applicable To Your Purchase And May Vary Depending On A Variety Of Factors, Such As:

Web we would like to show you a description here but the site won’t allow us. I suppose that might be the case if your company has specific individual exemptions for each vendor rather. If you received a form. Web if tax was collected by ebay, we may add ebay's tax details to the buyer's delivery address, which you need to include on the parcel.

This Is To Help You Comply With Your Tax Obligations.

For information about your tax. Web are you certain you need ebay's address for that form? Where do i send tax exempt forms within ebay? Tax exempt business registration now available regarding the status of your ebay account hello (redacted), thank you for sending in.

In Today's Video I Show How To Submit Your Application For Sales Tax Exemptio.

501(c)3 organizations) and online resellers/retailers both qualify for the ebay tax. Web who qualifies for ebay tax exemption? Web can i use my shop tax exempt number. Web if a shipping address is in one of the marketplace responsibility states within the u.s., the applicable tax will be collected by ebay and included in the order total at checkout.

Web In 2023 The Annual Exclusion Amount Increased From $16,000 To $17,000 Per Recipient, And The Estate, Gift, And Gst Exemption Amount Increased From $12.06 Million.

I can save you sales tax! The official document title is. Web key takeaways • if your online auction sales involve used items and are the equivalent of an occasional garage or yard sale, you generally don't have to. Web are you a reseller that buys goods to resell on ebay?