Form 8697 Instructions 2021

Form 8697 Instructions 2021 - Web go to www.irs.gov/form1065 for instructions and the latest information. Web form 8689 allocation of individual income tax to the u.s. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. Web for taxable years beginning on or after january 1, 2019, california law conforms to certain provisions of the tax cuts and jobs act (tcja) relating to changes to accounting. Individual taxpayers and some trusts and estates may be. Web general instructions purpose of form use form 8995 to figure your qualified business income (qbi) deduction. Web the return of a partnership must be filed on or before the 20th day of the fourth month following the close of the taxable year of the partnership, with the hawaii department of.

Web for taxable years beginning on or after january 1, 2019, california law conforms to certain provisions of the tax cuts and jobs act (tcja) relating to changes to accounting. Individual taxpayers and some trusts and estates may be. Web general instructions purpose of form use form 8995 to figure your qualified business income (qbi) deduction. Web go to www.irs.gov/form1065 for instructions and the latest information. Web the return of a partnership must be filed on or before the 20th day of the fourth month following the close of the taxable year of the partnership, with the hawaii department of. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. Web form 8689 allocation of individual income tax to the u.s.

Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. Individual taxpayers and some trusts and estates may be. Web for taxable years beginning on or after january 1, 2019, california law conforms to certain provisions of the tax cuts and jobs act (tcja) relating to changes to accounting. Web general instructions purpose of form use form 8995 to figure your qualified business income (qbi) deduction. Web go to www.irs.gov/form1065 for instructions and the latest information. Web the return of a partnership must be filed on or before the 20th day of the fourth month following the close of the taxable year of the partnership, with the hawaii department of. Web form 8689 allocation of individual income tax to the u.s.

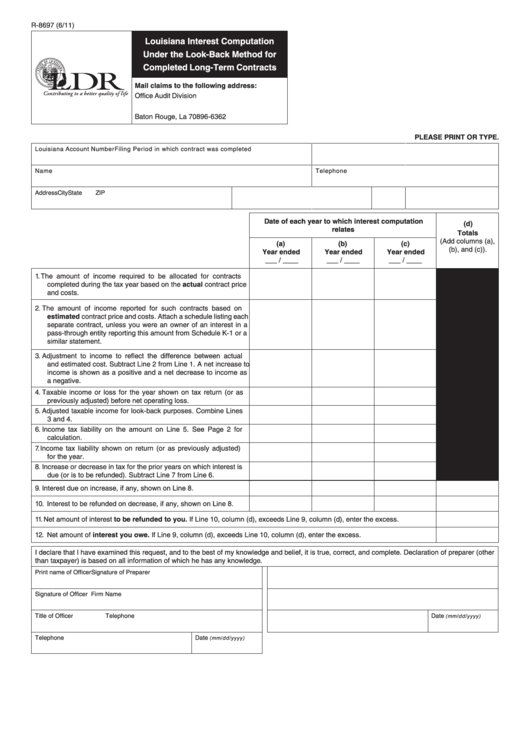

Fillable Form R8697 Louisiana Interest Computation Under The Look

Web form 8689 allocation of individual income tax to the u.s. Web general instructions purpose of form use form 8995 to figure your qualified business income (qbi) deduction. Individual taxpayers and some trusts and estates may be. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. Web the return of a partnership.

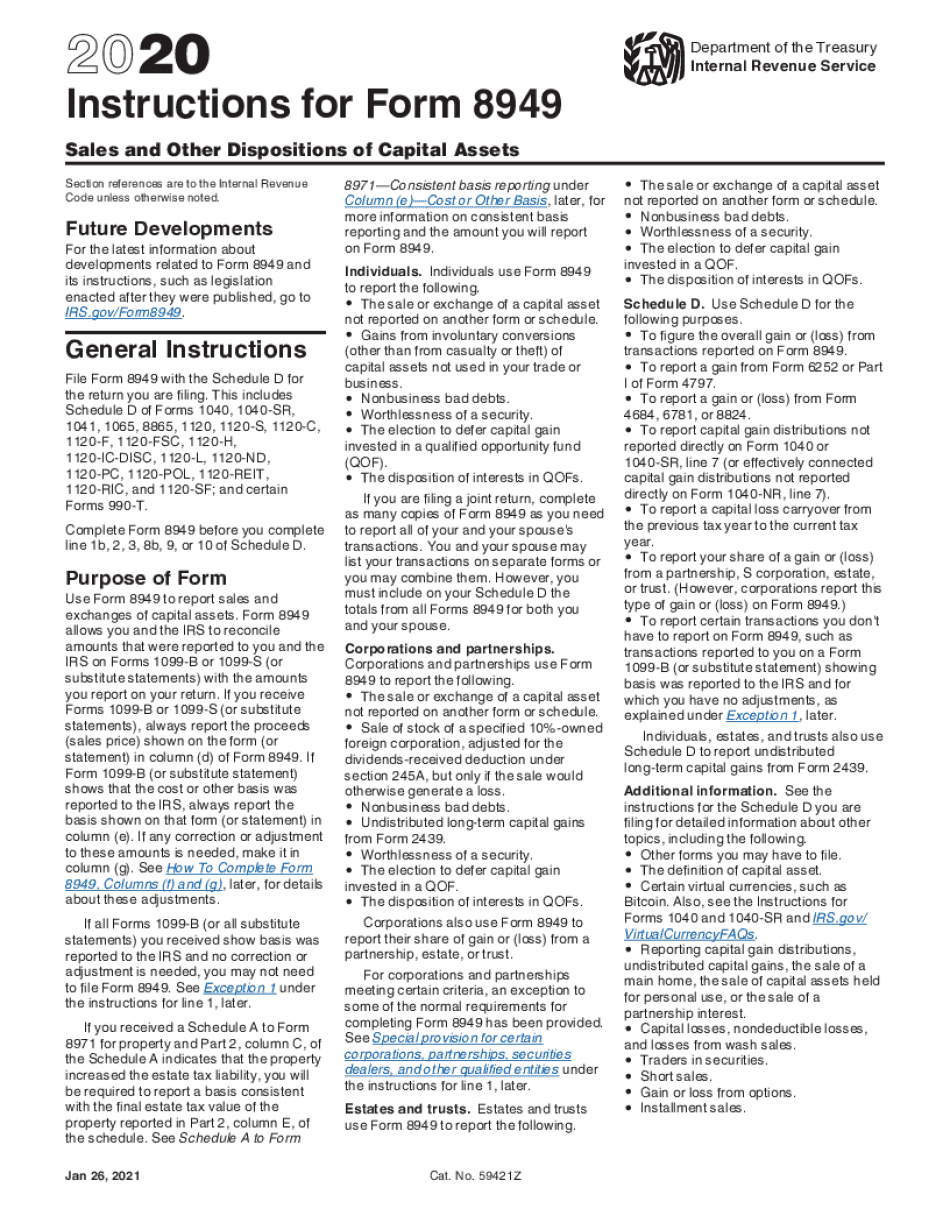

Form 8949 Instructions 2020 2021 Fillable and Editable PDF Template

Web the return of a partnership must be filed on or before the 20th day of the fourth month following the close of the taxable year of the partnership, with the hawaii department of. Web general instructions purpose of form use form 8995 to figure your qualified business income (qbi) deduction. Web form 8689 allocation of individual income tax to.

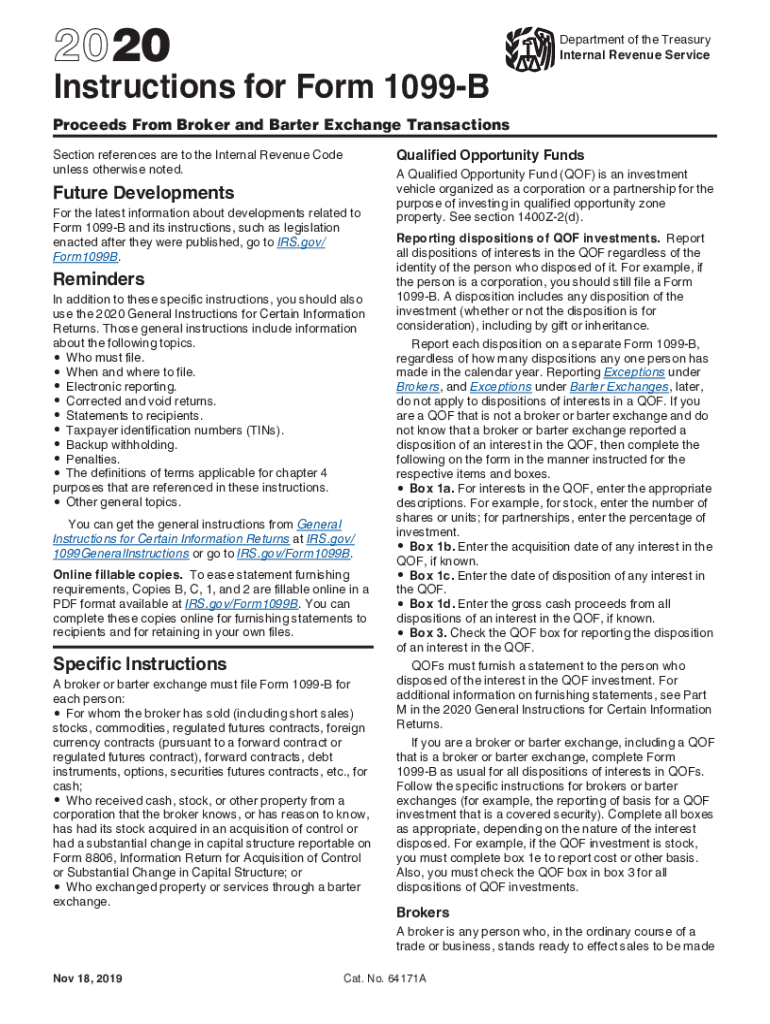

2021 Instructions for Form 1099 B Internal Revenue Service Fill Out

Web general instructions purpose of form use form 8995 to figure your qualified business income (qbi) deduction. Web go to www.irs.gov/form1065 for instructions and the latest information. Web for taxable years beginning on or after january 1, 2019, california law conforms to certain provisions of the tax cuts and jobs act (tcja) relating to changes to accounting. Web form 8689.

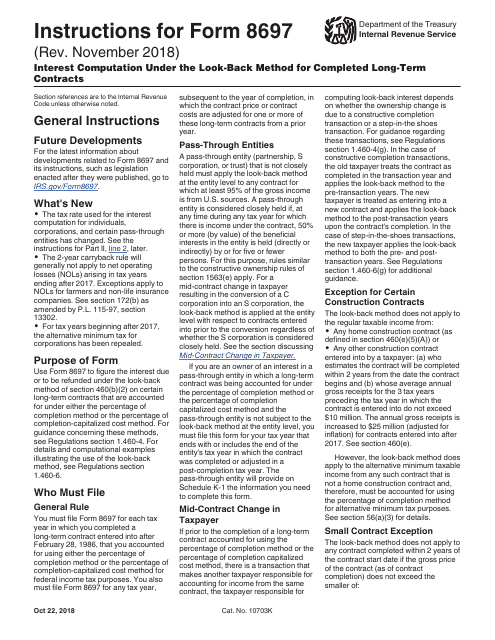

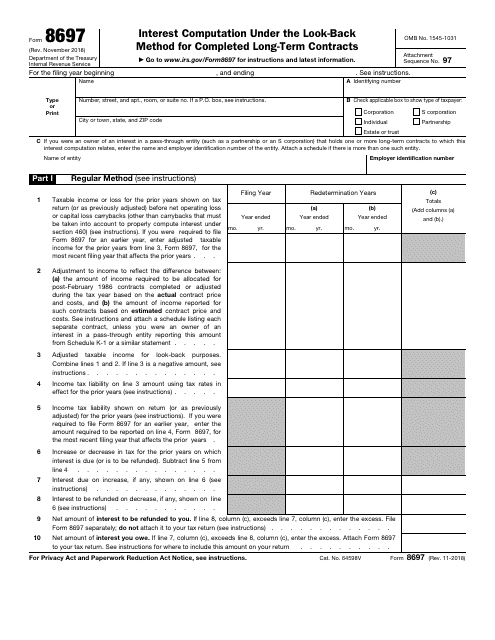

Form 8697 Interest Computation under the LookBack Method for

Individual taxpayers and some trusts and estates may be. Web go to www.irs.gov/form1065 for instructions and the latest information. Web for taxable years beginning on or after january 1, 2019, california law conforms to certain provisions of the tax cuts and jobs act (tcja) relating to changes to accounting. Web general instructions purpose of form use form 8995 to figure.

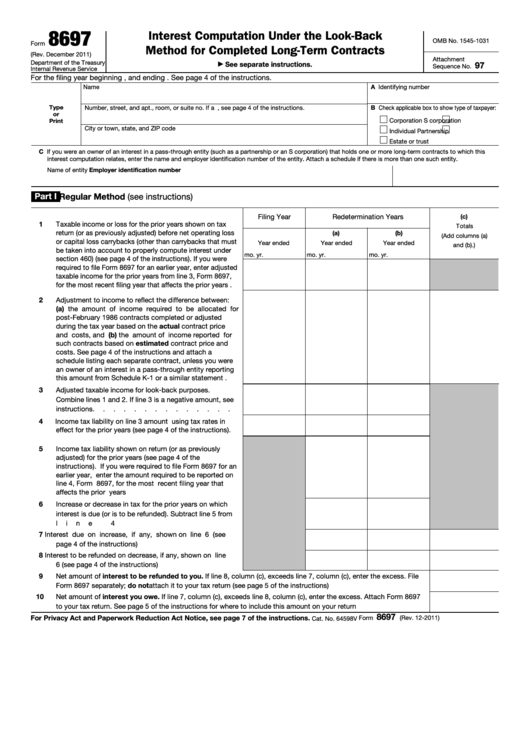

Download Instructions for IRS Form 8697 Interest Computation Under the

Individual taxpayers and some trusts and estates may be. Web form 8689 allocation of individual income tax to the u.s. Web go to www.irs.gov/form1065 for instructions and the latest information. Web for taxable years beginning on or after january 1, 2019, california law conforms to certain provisions of the tax cuts and jobs act (tcja) relating to changes to accounting..

IRS Form 8697 Download Fillable PDF or Fill Online Interest Computation

Individual taxpayers and some trusts and estates may be. Web for taxable years beginning on or after january 1, 2019, california law conforms to certain provisions of the tax cuts and jobs act (tcja) relating to changes to accounting. Web the return of a partnership must be filed on or before the 20th day of the fourth month following the.

2021 Job Application Format 2021 Job Application Format Job

Web form 8689 allocation of individual income tax to the u.s. Web for taxable years beginning on or after january 1, 2019, california law conforms to certain provisions of the tax cuts and jobs act (tcja) relating to changes to accounting. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. Web general.

Download Instructions for IRS Form 8697 Interest Computation Under the

Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. Web the return of a partnership must be filed on or before the 20th day of the fourth month following the close of the taxable year of the partnership, with the hawaii department of. Web form 8689 allocation of individual income tax to.

Fillable Form 8697 Interest Computation Under The LookBack Method

Web go to www.irs.gov/form1065 for instructions and the latest information. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. Web the return of a partnership must be filed on or before the 20th day of the fourth month following the close of the taxable year of the partnership, with the hawaii department.

IMG_8697 Copy Sevalaya

Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. Web for taxable years beginning on or after january 1, 2019, california law conforms to certain provisions of the tax cuts and jobs act (tcja) relating to changes to accounting. Web the return of a partnership must be filed on or before the.

Web Go To Www.irs.gov/Form1065 For Instructions And The Latest Information.

Web for taxable years beginning on or after january 1, 2019, california law conforms to certain provisions of the tax cuts and jobs act (tcja) relating to changes to accounting. Web form 8689 allocation of individual income tax to the u.s. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. Individual taxpayers and some trusts and estates may be.

Web The Return Of A Partnership Must Be Filed On Or Before The 20Th Day Of The Fourth Month Following The Close Of The Taxable Year Of The Partnership, With The Hawaii Department Of.

Web general instructions purpose of form use form 8995 to figure your qualified business income (qbi) deduction.