2022 Form 1116

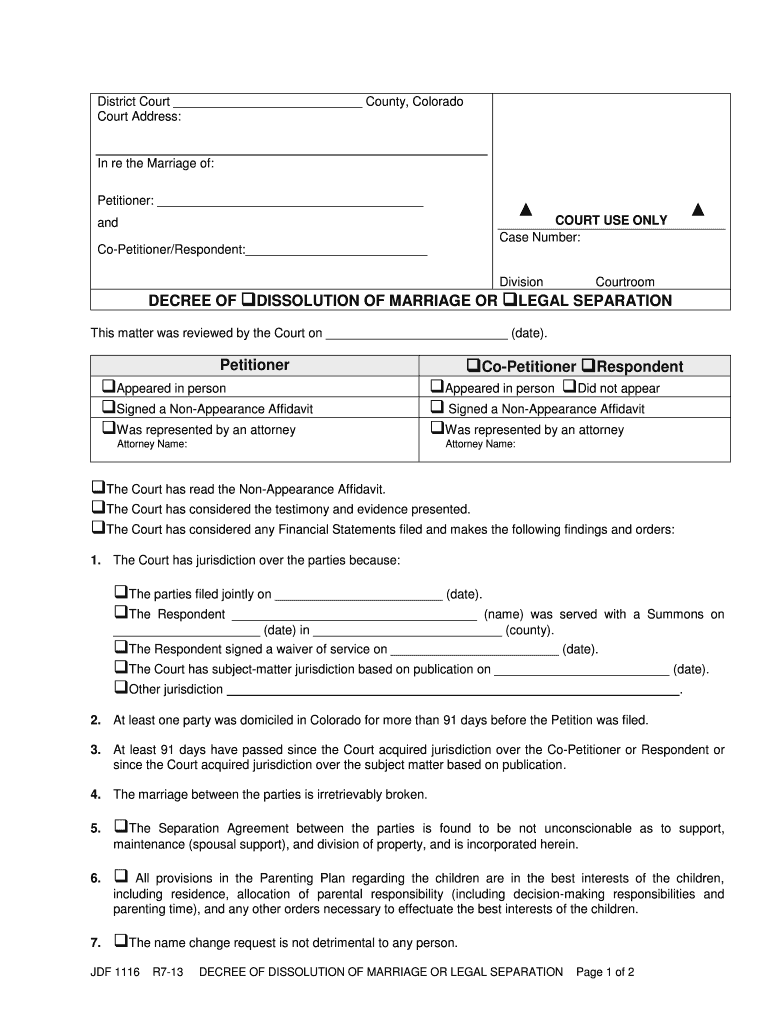

2022 Form 1116 - See schedule b (form 1116) and its instructions, and. When a us person individual earns foreign income abroad and pays foreign tax on that income, they may be able to claim a foreign. You must complete form 1116 in order to claim the foreign tax credit on your us tax return. Web 2022 turbotax requiring form 1116 for foreign tax credit when it should not yes, in some cases, form 1116 is not required. It’s easy to handle when the total foreign taxes paid from. Parts ii and iii, to complete form 1116. Web use schedule b (form 1116) to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Form 1116 and its schedules are used by individuals, estates, and trusts to claim a credit for certain taxes paid or accrued during the taxable year to a foreign. Web form 1116 instructions for foreign tax credits: Taxpayers are therefore reporting running balances of.

Web use schedule b (form 1116) to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web we last updated the foreign tax credit (individual, estate, or trust) in december 2022, so this is the latest version of form 1116, fully updated for tax year 2022. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. It’s easy to handle when the total foreign taxes paid from. Web july 24, 2022: Web partnerships, s corporations, and personal service corporations file this form to elect under section 444 to have a tax year other than a required tax year. Web 2022 turbotax requiring form 1116 for foreign tax credit when it should not yes, in some cases, form 1116 is not required. Web form 1116 federal — foreign tax credit (individual, estate, or trust) download this form print this form it appears you don't have a pdf plugin for this browser. Web form 1116 instructions for foreign tax credits: Web form 1116 i noticed that there is a do not file notice on my 2021 form 1116.

Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Taxpayers are therefore reporting running balances of. Deduct their foreign taxes on schedule a, like other common deductions. Web form 1116 federal — foreign tax credit (individual, estate, or trust) download this form print this form it appears you don't have a pdf plugin for this browser. Web there is a new schedule b (form 1116) which is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web partnerships, s corporations, and personal service corporations file this form to elect under section 444 to have a tax year other than a required tax year. Web all the allowable foreign tax credit for different income categories will be summarized on one form 1116, again, the one with the largest allowable foreign tax credit. Web to avoid double taxation on americans living abroad, the irs gives them a choice: Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly.

Jdf 1116 Fill Out and Sign Printable PDF Template signNow

Complete, edit or print tax forms instantly. Web partnerships, s corporations, and personal service corporations file this form to elect under section 444 to have a tax year other than a required tax year. Form 1116 and its schedules are used by individuals, estates, and trusts to claim a credit for certain taxes paid or accrued during the taxable year.

Foreign Tax Credit Form 1116 Explained Greenback —

When a us person individual earns foreign income abroad and pays foreign tax on that income, they may be able to claim a foreign. Web july 24, 2022: Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web there is a new schedule b (form 1116) which.

form 1116 Fill out & sign online DocHub

Web all the allowable foreign tax credit for different income categories will be summarized on one form 1116, again, the one with the largest allowable foreign tax credit. Web form 1116 instructions for foreign tax credits: Get ready for tax season deadlines by completing any required tax forms today. Web schedule b (form 1116) is used to reconcile your prior.

Form 2022 Fill Online, Printable, Fillable, Blank pdfFiller

Complete, edit or print tax forms instantly. If all of your foreign tax is less than. Deduct their foreign taxes on schedule a, like other common deductions. Web there is a new schedule b (form 1116) which is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web october 25, 2022 resource center.

IRS REGULATED 1096 FORMS PACKAGE OF 25 FORMS Amazon.ca Office Products

Get ready for tax season deadlines by completing any required tax forms today. Web 2022 turbotax requiring form 1116 for foreign tax credit when it should not yes, in some cases, form 1116 is not required. Web form 1116 instructions for foreign tax credits: Parts ii and iii, to complete form 1116. Does turbo tax have a timeline for fixing.

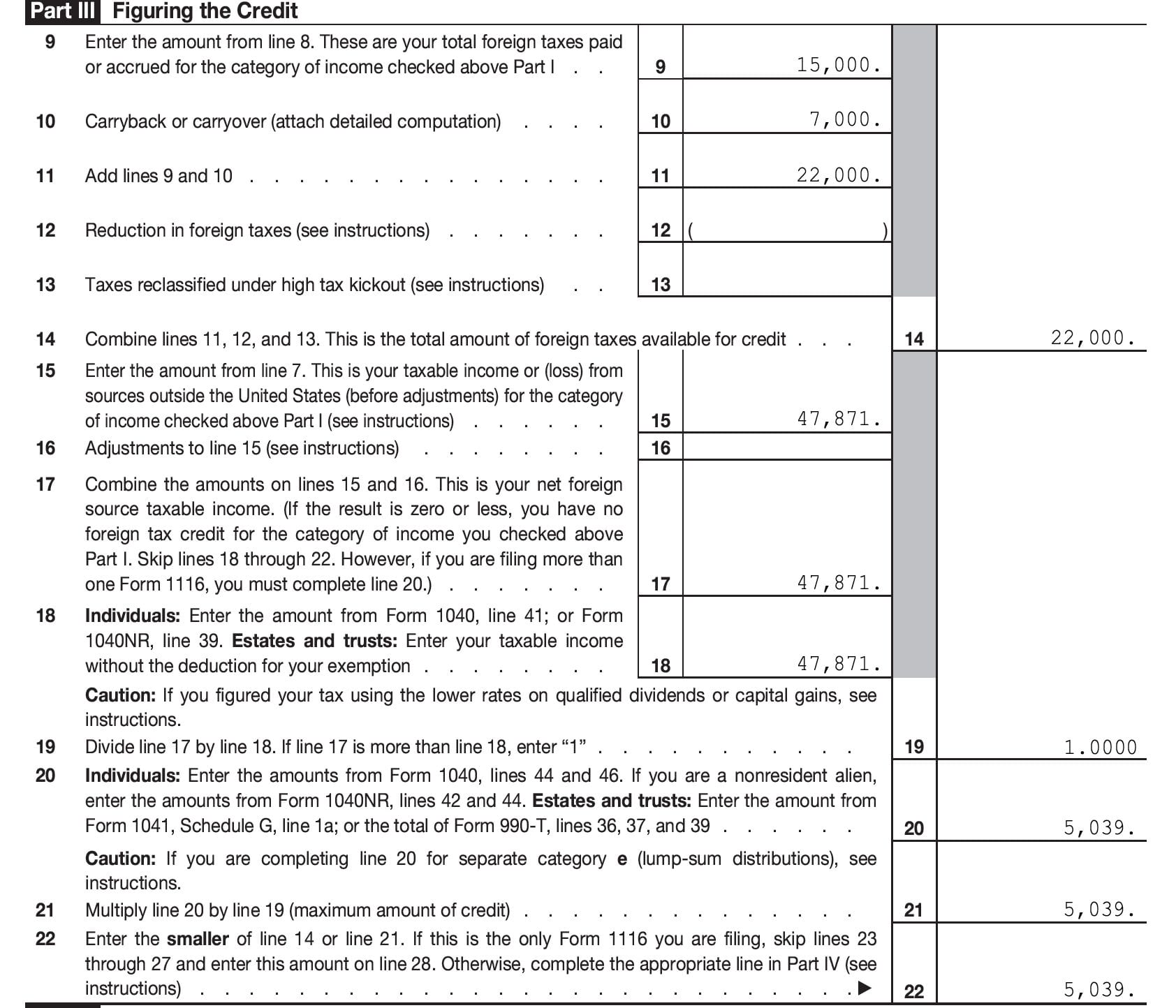

Eic Worksheet 2023 Fill online, Printable, Fillable Blank

Web july 24, 2022: Claiming the foreign tax credit at a glance find out what irs form 1116 is used for and how to file it to get. Web 2022 turbotax requiring form 1116 for foreign tax credit when it should not yes, in some cases, form 1116 is not required. Web to avoid double taxation on americans living abroad,.

Form 1116 Instructions 2022 2023 IRS Forms Zrivo

If all of your foreign tax is less than. Web form 1116 federal — foreign tax credit (individual, estate, or trust) download this form print this form it appears you don't have a pdf plugin for this browser. When a us person individual earns foreign income abroad and pays foreign tax on that income, they may be able to claim.

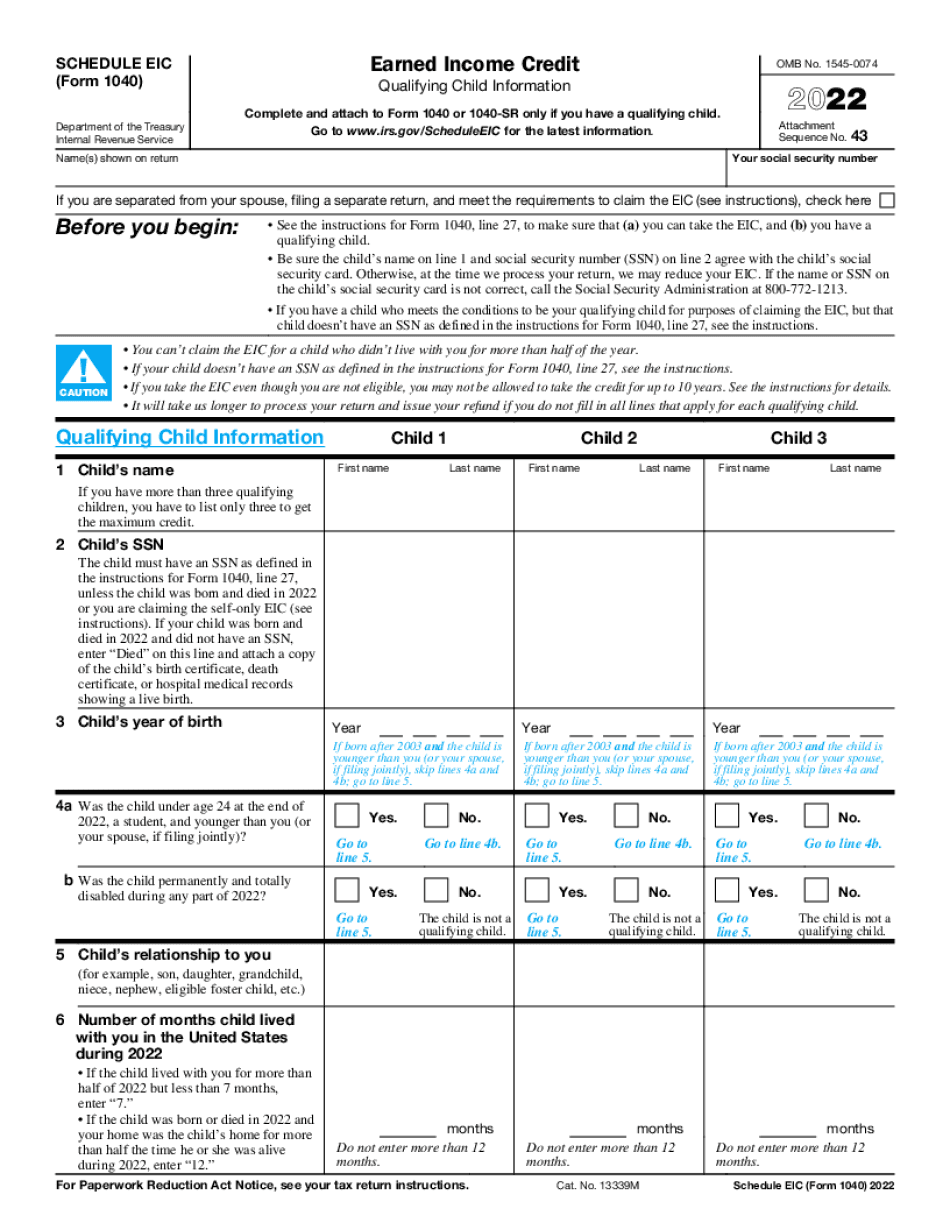

Puget Sound Solar LLC

Web form 1116 instructions for foreign tax credits: Web we last updated the foreign tax credit (individual, estate, or trust) in december 2022, so this is the latest version of form 1116, fully updated for tax year 2022. Complete, edit or print tax forms instantly. Parts ii and iii, to complete form 1116. Web to avoid double taxation on americans.

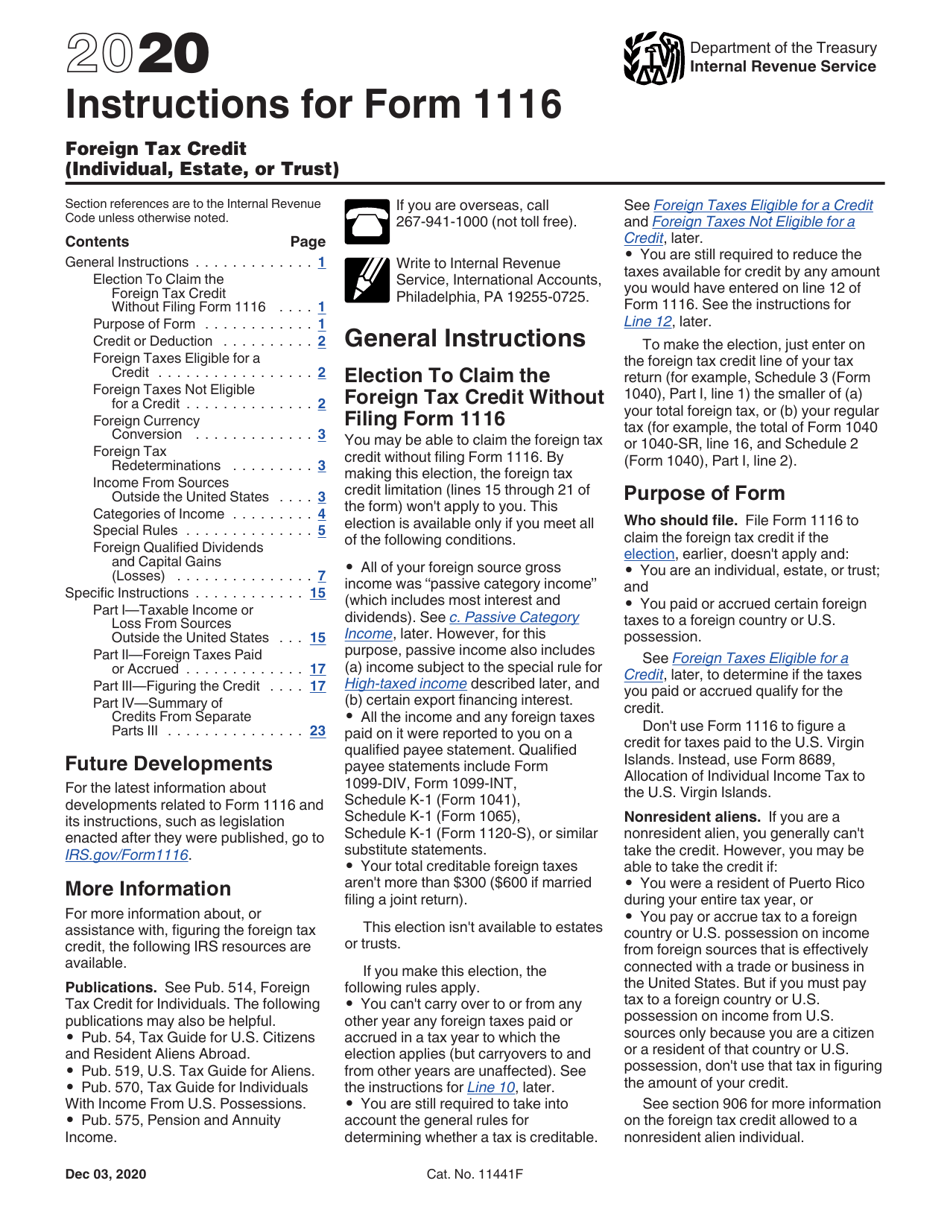

Download Instructions for IRS Form 1116 Foreign Tax Credit (Individual

Web form 1116 i noticed that there is a do not file notice on my 2021 form 1116. Parts ii and iii, to complete form 1116. Web form 1116 instructions for foreign tax credits: Web partnerships, s corporations, and personal service corporations file this form to elect under section 444 to have a tax year other than a required tax.

Form 1116 Instructions 2021 2022 IRS Forms Zrivo

Web use schedule b (form 1116) to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web october 25, 2022 resource center forms form 1116: Complete, edit or print tax forms instantly. When a us person individual earns foreign income abroad and pays foreign tax on that income, they may be able to claim a.

When A Us Person Individual Earns Foreign Income Abroad And Pays Foreign Tax On That Income, They May Be Able To Claim A Foreign.

Web partnerships, s corporations, and personal service corporations file this form to elect under section 444 to have a tax year other than a required tax year. Web form 1116 instructions for foreign tax credits: Parts ii and iii, to complete form 1116. Web form 1116 i noticed that there is a do not file notice on my 2021 form 1116.

Web To Avoid Double Taxation On Americans Living Abroad, The Irs Gives Them A Choice:

Web october 25, 2022 resource center forms form 1116: Web there is a new schedule b (form 1116) which is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. See schedule b (form 1116) and its instructions, and. Deduct their foreign taxes on schedule a, like other common deductions.

If All Of Your Foreign Tax Is Less Than.

Complete, edit or print tax forms instantly. Web form 1116 federal — foreign tax credit (individual, estate, or trust) download this form print this form it appears you don't have a pdf plugin for this browser. Get ready for tax season deadlines by completing any required tax forms today. Web all the allowable foreign tax credit for different income categories will be summarized on one form 1116, again, the one with the largest allowable foreign tax credit.

Web July 24, 2022:

Taxpayers are therefore reporting running balances of. This information should have been reported in prior years,. You must complete form 1116 in order to claim the foreign tax credit on your us tax return. Does turbo tax have a timeline for fixing this issue?