Wi Form 3 Instructions 2021

Wi Form 3 Instructions 2021 - Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Web complete wi form 3 instructions online with us legal forms. 2022 wi form 1npr (fillable) · instructions; Go to common state > state pte generation worksheet. Easily fill out pdf blank, edit, and sign them. Edit your wisconsin 1 instructions online type text, add images, blackout confidential details, add comments, highlights and more. See box 10—dependent care benefits for. Web sources, regardless of the amount, must file a wisconsin partnership return, form 3. Web the american rescue plan act of 2021 (arp) permits employers to increase the amount of dependent care benefits that can be excluded from an employee's income from $5,000 to $10,500 ($5,250 for married filing separately). Web general instructions for form 3 partnerships, including limited liability companies (llcs) treated as partnerships, use form 3 to report their income, gains, losses, deductions, and credits.

See box 10—dependent care benefits for. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Business transacted in wisconsin, personal or professional services performed in wisconsin,. Web unless a waiver is approved by the wisconsin department of revenue (“department”). Edit your wisconsin 1 instructions online type text, add images, blackout confidential details, add comments, highlights and more. Web the american rescue plan act of 2021 (arp) permits employers to increase the amount of dependent care benefits that can be excluded from an employee's income from $5,000 to $10,500 ($5,250 for married filing separately). Web wisconsin department of revenue: The irc generally applies for wisconsin purposes at the same time as for federal purposes. See the irs common questions for more information. Forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco, inheritance, lottery, gaming, local government, unclaimed property)

See the irs common questions for more information. 2022 wi form 1 (fillable) · instructions; Edit your wisconsin 1 instructions online type text, add images, blackout confidential details, add comments, highlights and more. Web sources, regardless of the amount, must file a wisconsin partnership return, form 3. The current tax year is 2022, and most states will release updated tax forms between january and april of 2023. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Business transacted in wisconsin, personal or professional services performed in wisconsin,. Go to common state > state pte generation worksheet. For example, a partnership must file a return if it has income from an y of the following: Web taxformfinder provides printable pdf copies of 89 current wisconsin income tax forms.

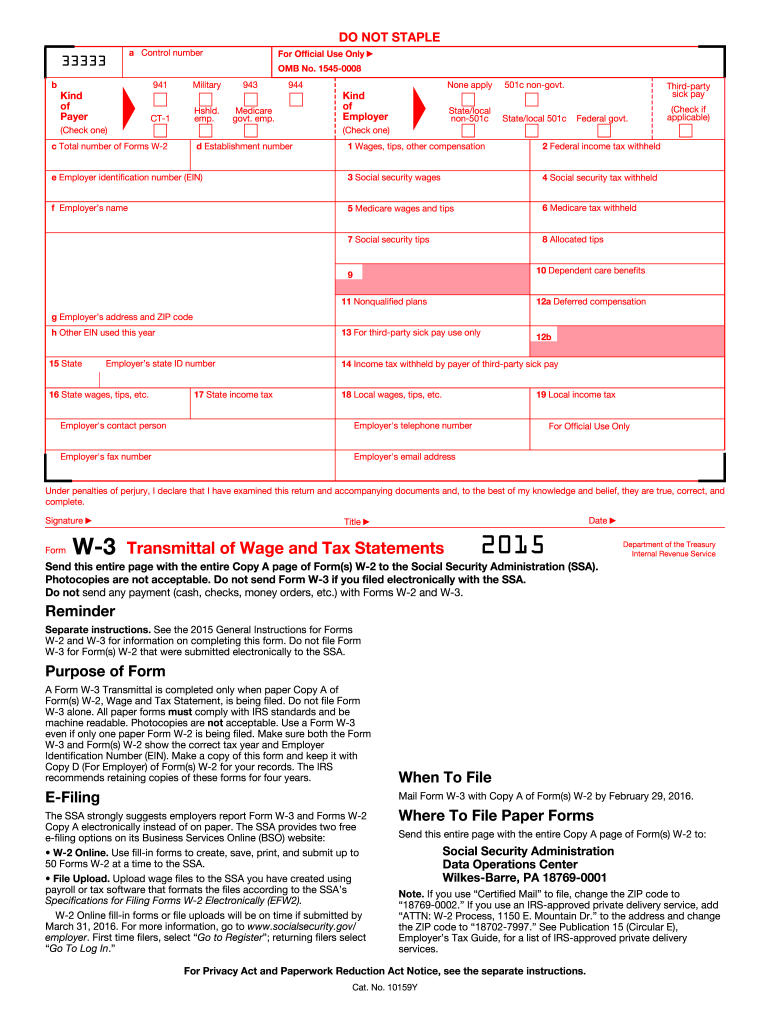

W 3 Form Fill Out and Sign Printable PDF Template signNow

2022 wi form 1npr (fillable) · instructions; Is wisconsin following the extended due dates for filing. See box 10—dependent care benefits for. Web sources, regardless of the amount, must file a wisconsin partnership return, form 3. Edit your wisconsin 1 instructions online type text, add images, blackout confidential details, add comments, highlights and more.

2021 Irs Form W4 Simple Instructions + Pdf Download pertaining to W4

Web to their wisconsin individual income tax returns? Forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco, inheritance, lottery, gaming, local government, unclaimed property) Web 2022 wisconsin form 3 instructions page 32. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature.

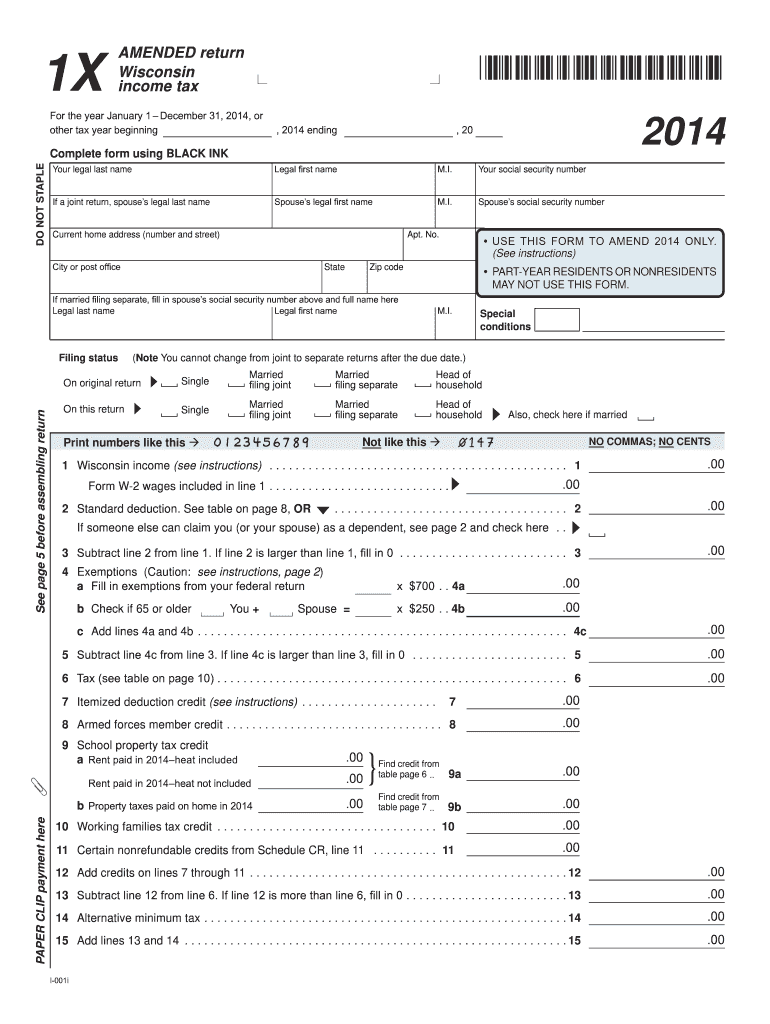

WI Form 1X 20142021 Fill out Tax Template Online US Legal Forms

For example, a partnership must file a return if it has income from an y of the following: Edit your wisconsin 1 instructions online type text, add images, blackout confidential details, add comments, highlights and more. 2022 wi form 1 (fillable) · instructions; Web complete wi form 3 instructions online with us legal forms. See the irs common questions for.

2014 wi form 1 instructions

The irc generally applies for wisconsin purposes at the same time as for federal purposes. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web we last updated wisconsin form 3 in march 2023 from the wisconsin department of revenue. Sign it in a few clicks draw your signature, type it, upload.

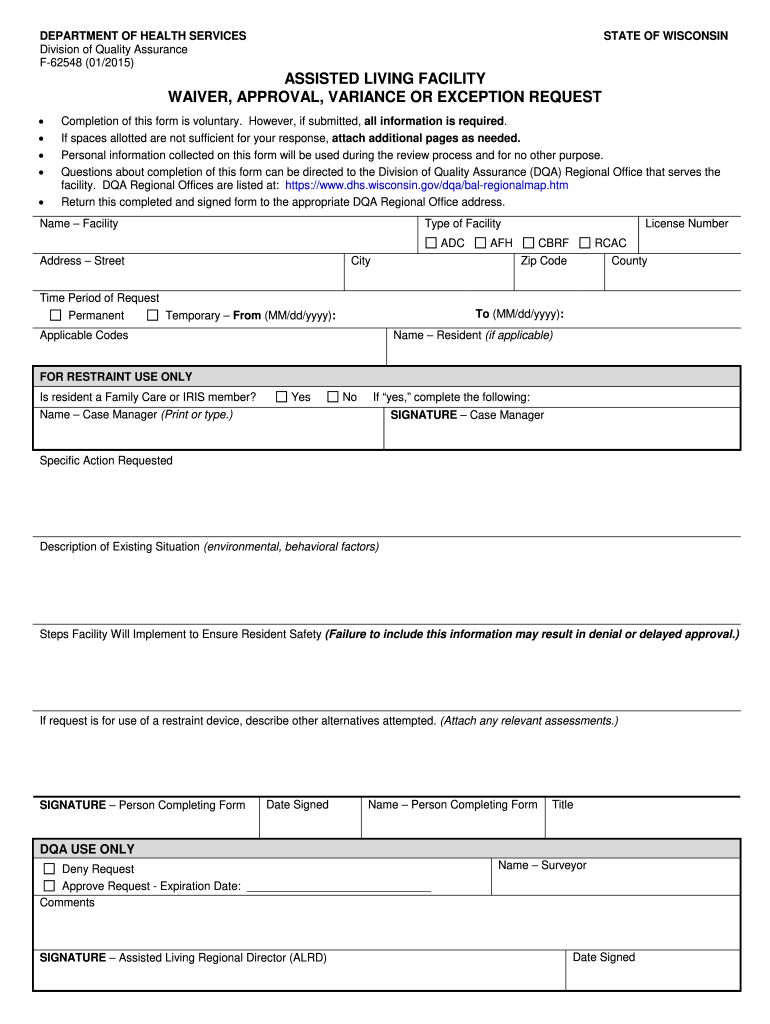

20152021 Form WI DHS F62548 Fill Online, Printable, Fillable, Blank

Web please carefully read each state's instructions to determine which forms and additional requirements apply to you. 2022 wi form 1 (fillable) · instructions; Web to their wisconsin individual income tax returns? Web wisconsin department of revenue: The irc generally applies for wisconsin purposes at the same time as for federal purposes.

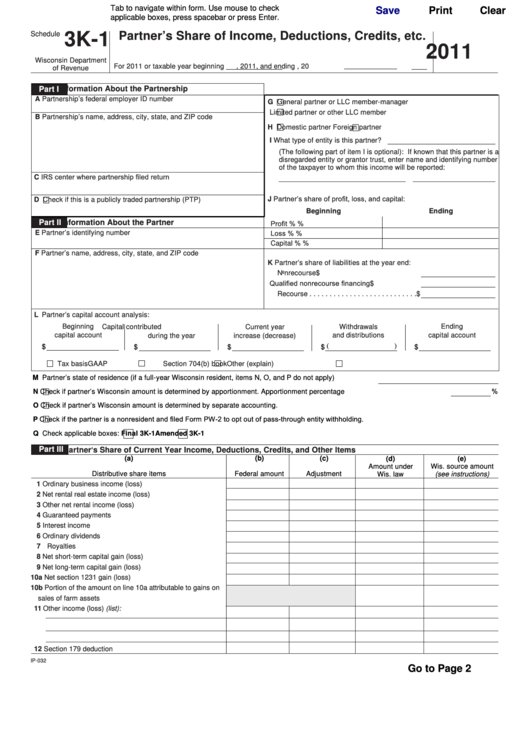

Fillable Form 3k1 Wisconsin Partner'S Share Of Deductions

Is wisconsin following the extended due dates for filing. You can print other wisconsin tax forms. Web 2022 wisconsin form 3 instructions page 32. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Web to their wisconsin individual income tax returns?

8594 Instructions 2021 2022 IRS Forms Zrivo

2022 wi form 1npr (fillable) · instructions; Web general instructions for form 3 partnerships, including limited liability companies (llcs) treated as partnerships, use form 3 to report their income, gains, losses, deductions, and credits. See box 10—dependent care benefits for. Web sources, regardless of the amount, must file a wisconsin partnership return, form 3. This form is for income earned.

20192022 Form WI A222 Fill Online, Printable, Fillable, Blank pdfFiller

For example, a partnership must file a return if it has income from an y of the following: Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Business transacted in wisconsin, personal or professional services performed in wisconsin,. You can print other wisconsin tax forms. The.

Quit Claim Deed Wisconsin Get Online Blank in PDF

Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Go to common state > state pte generation worksheet. Web complete wi form 3 instructions online with us legal forms. Save or instantly send your ready documents. See the irs common questions for more information.

2020 2021 Irs Instructions Form Printable Fill Out Digital PDF Sample

Web complete wi form 3 instructions online with us legal forms. Edit your wisconsin 1 instructions online type text, add images, blackout confidential details, add comments, highlights and more. Save or instantly send your ready documents. The irc generally applies for wisconsin purposes at the same time as for federal purposes. Forms for all state taxes (income, business, estate, partnership,.

Web 2022 Wisconsin Form 3 Instructions Page 32.

For example, a partnership must file a return if it has income from an y of the following: Web the american rescue plan act of 2021 (arp) permits employers to increase the amount of dependent care benefits that can be excluded from an employee's income from $5,000 to $10,500 ($5,250 for married filing separately). Business transacted in wisconsin, personal or professional services performed in wisconsin,. This form is for income earned in tax year 2022, with tax returns due in april 2023.

You Can Print Other Wisconsin Tax Forms.

Web please carefully read each state's instructions to determine which forms and additional requirements apply to you. Web we last updated the form 3 partnership return in march 2023, so this is the latest version of form 3, fully updated for tax year 2022. Is wisconsin following the extended due dates for filing. We will update this page with a new version of the form for 2024 as soon as it is.

Go To Common State > State Pte Generation Worksheet.

Web sources, regardless of the amount, must file a wisconsin partnership return, form 3. Easily fill out pdf blank, edit, and sign them. 2022 wi form 1 (fillable) · instructions; See box 10—dependent care benefits for.

Web Unless A Waiver Is Approved By The Wisconsin Department Of Revenue (“Department”).

Web general instructions for form 3 partnerships, including limited liability companies (llcs) treated as partnerships, use form 3 to report their income, gains, losses, deductions, and credits. 2022 wi form 1npr (fillable) · instructions; Edit your wisconsin 1 instructions online type text, add images, blackout confidential details, add comments, highlights and more. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad.