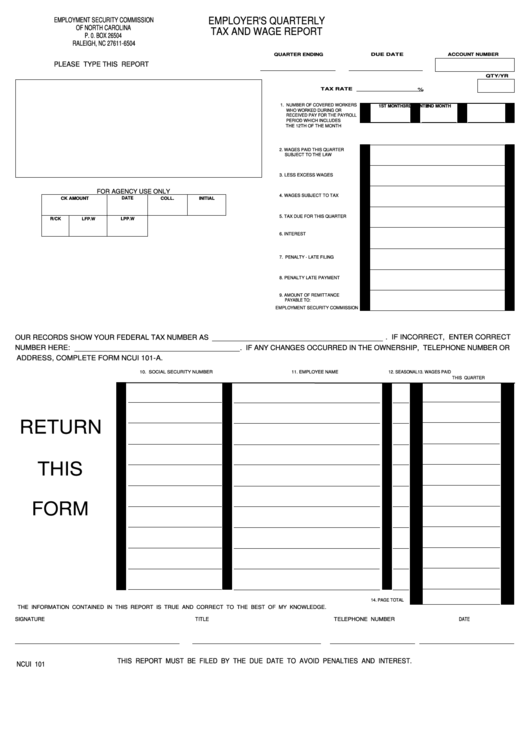

Form Ncui 101

Form Ncui 101 - Sold or otherwise transferred all or part of the business to: Tax computation data must be reported by using the appropriate n record contained in this guide. Web our records show your federal tax number as number here: If you report your wages under branch account numbers, enter the consolidated account number on the first line and enter the branch account number under which Enter the employer account number assigned by this agency. You can file this report online at des.nc.gov quarter ending due date account number qty/yr tax rate % number of covered workers who worked during or received pay for the. Web our records show your federal tax number as number here: Web form ncui 101, employer’s quarterly tax and wage report, must be submitted for each employer account number with payment (if any due). Submitting the n record along with employee wage details eliminates the need for filing a paper return. Enter the employer's name, mailing address and contact person's telephone number in space provided.

If you report your wages under branch account numbers, enter the consolidated account number on the first line and enter the branch account number under which Web (form ncui 685) 1. Quarter ending due date account number qtr/yr tax rate % number of covered workers who worked during or received pay for the payroll period which includes the 12th of the. You can file this report online at des.nc.gov quarter ending due date account number qty/yr tax rate % number of covered workers who worked during or received pay for the. Web form ncui 101, employer’s quarterly tax and wage report, must be submitted for each employer account number with payment (if any due). Tax computation data must be reported by using the appropriate n record contained in this guide. Enter the employer's name, mailing address and contact person's telephone number in space provided. Of commerce division of employment security p.o. Submitting the n record along with employee wage details eliminates the need for filing a paper return. Web our records show your federal tax number as number here:

You can file this report online at des.nc.gov quarter ending due date account number qty/yr tax rate % number of covered workers who worked during or received pay for the. 09/2013) change in status report account number employer name and address: Sold or otherwise transferred all or part of the business to: Web form ncui 101, employer’s quarterly tax and wage report, must be submitted for each employer account number with payment (if any due). See the online filing support menu in the form module. Web our records show your federal tax number as number here: Of commerce division of employment security p.o. Submitting the n record along with employee wage details eliminates the need for filing a paper return. Quarter ending due date account number qtr/yr tax rate % number of covered workers who worked during or received pay for the payroll period which includes the 12th of the. Enter the employer account number assigned by this agency.

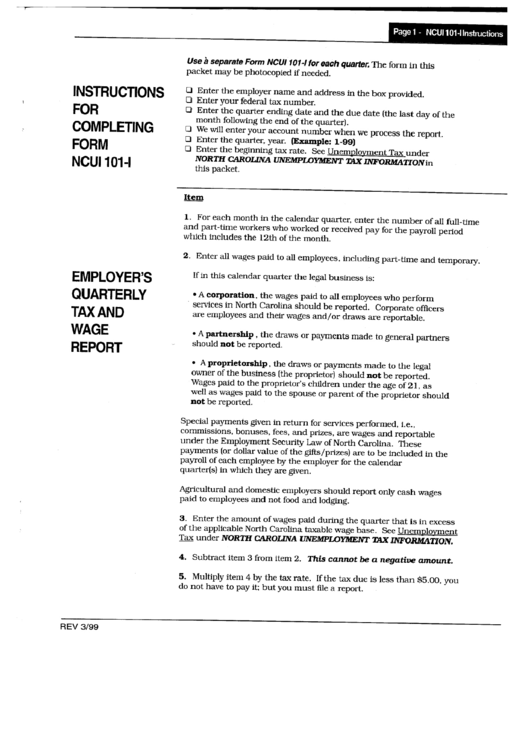

Instructions For Form Ncui 101I Employer'S Quarterly Tax And Wage

Web our records show your federal tax number as number here: Quarter ending due date account number qtr/yr tax rate % number of covered workers who worked during or received pay for the payroll period which includes the 12th of the. This option is only available to employers who have nine or less employee wage items. Web (form ncui 685).

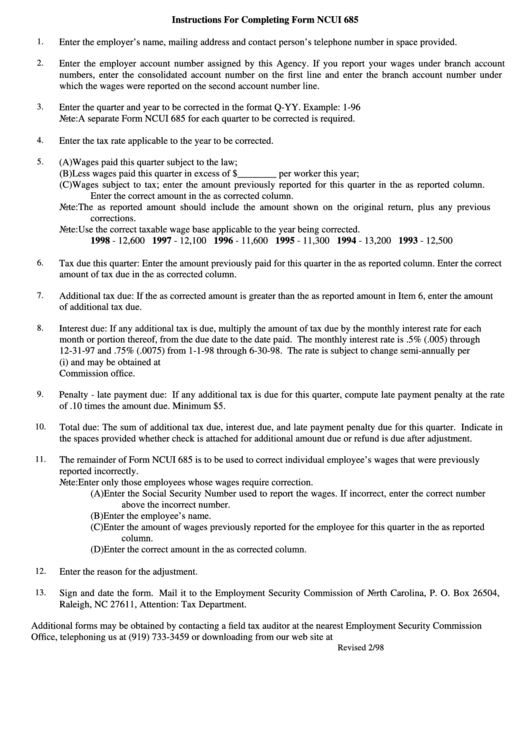

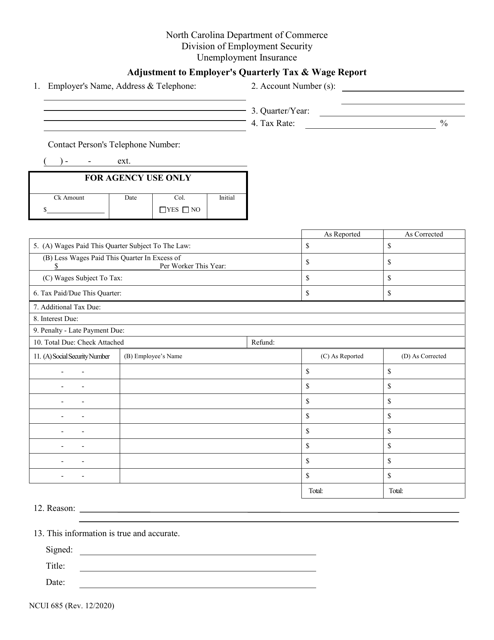

Instructions For Completing Form Ncui 685 printable pdf download

Submitting the n record along with employee wage details eliminates the need for filing a paper return. Web (form ncui 685) 1. Enter the employer account number assigned by this agency. Tax computation data must be reported by using the appropriate n record contained in this guide. See the online filing support menu in the form module.

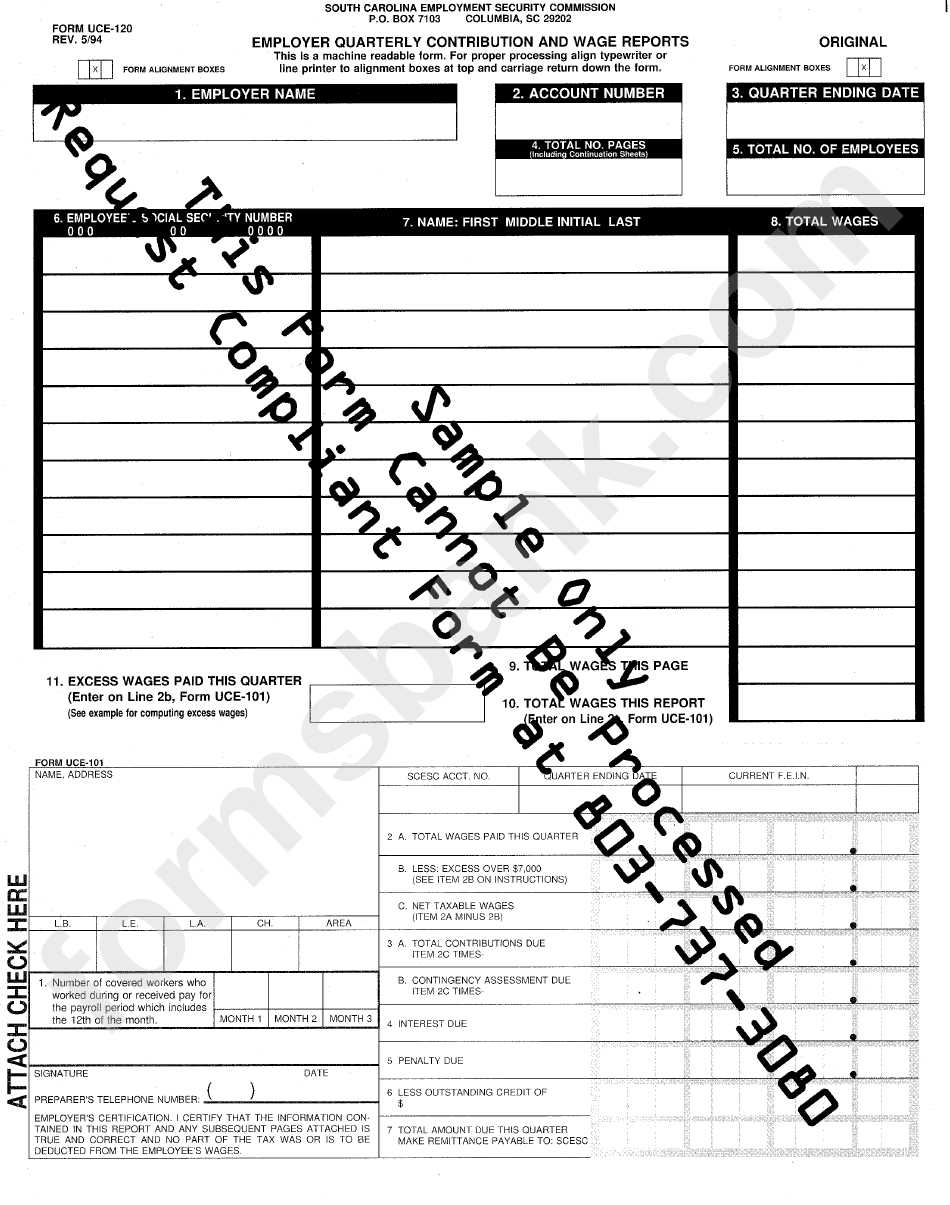

Form Uce120 Employer Quarterly Contribution And Wage Reports

This option is only available to employers who have nine or less employee wage items. You can file this report online at des.nc.gov quarter ending due date account number qty/yr tax rate % number of covered workers who worked during or received pay for the. See the online filing support menu in the form module. Enter the employer account number.

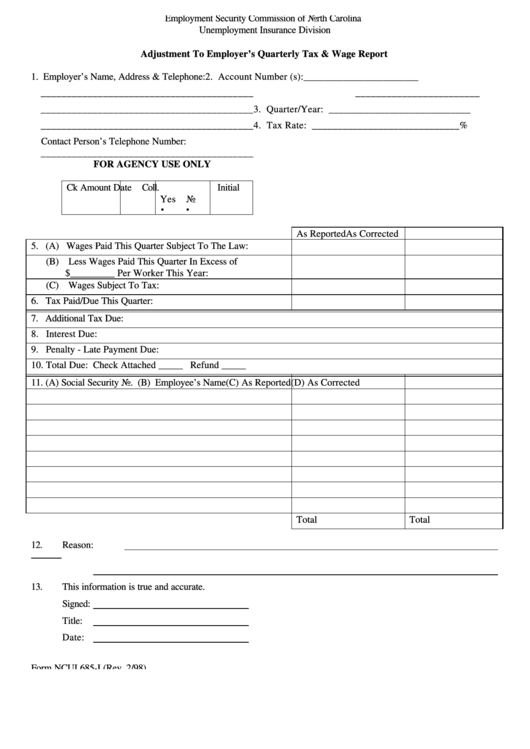

Form Ncui 685I Adjustment To Employer'S Quarterly Tax & Wage Report

Tax computation data must be reported by using the appropriate n record contained in this guide. Quarter ending due date account number qtr/yr tax rate % number of covered workers who worked during or received pay for the payroll period which includes the 12th of the. Sold or otherwise transferred all or part of the business to: Of commerce division.

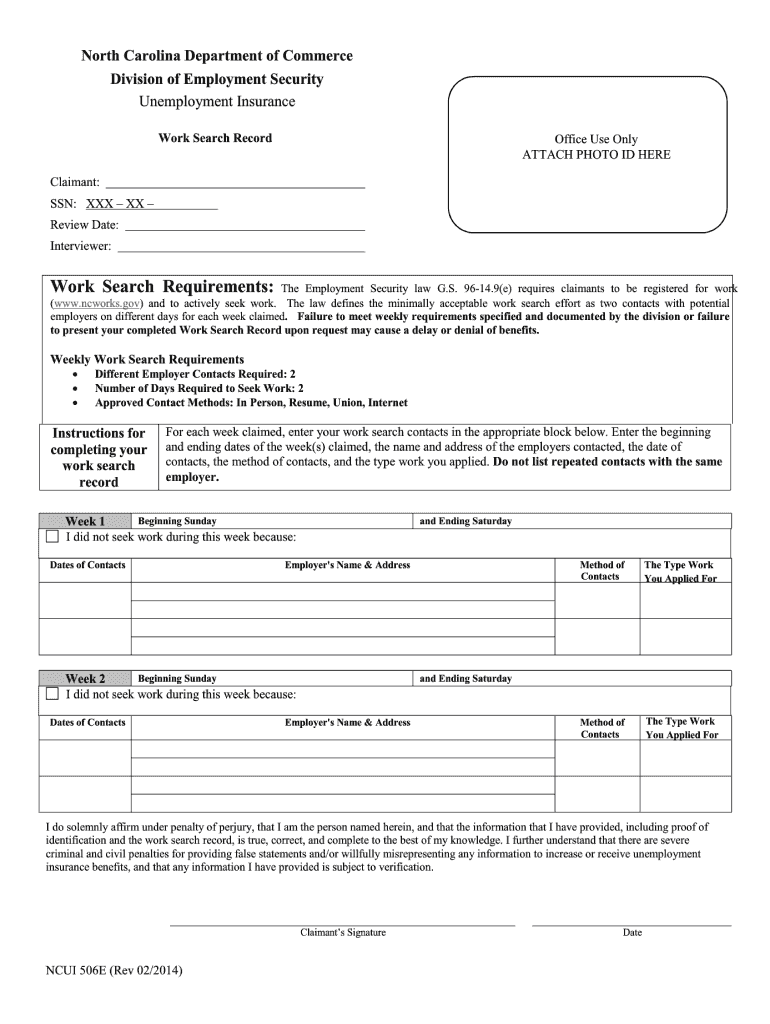

2014 Form NC NCUI 506E Fill Online, Printable, Fillable, Blank pdfFiller

Sold or otherwise transferred all or part of the business to: Web (form ncui 685) 1. Enter the employer account number assigned by this agency. This option is only available to employers who have nine or less employee wage items. Submitting the n record along with employee wage details eliminates the need for filing a paper return.

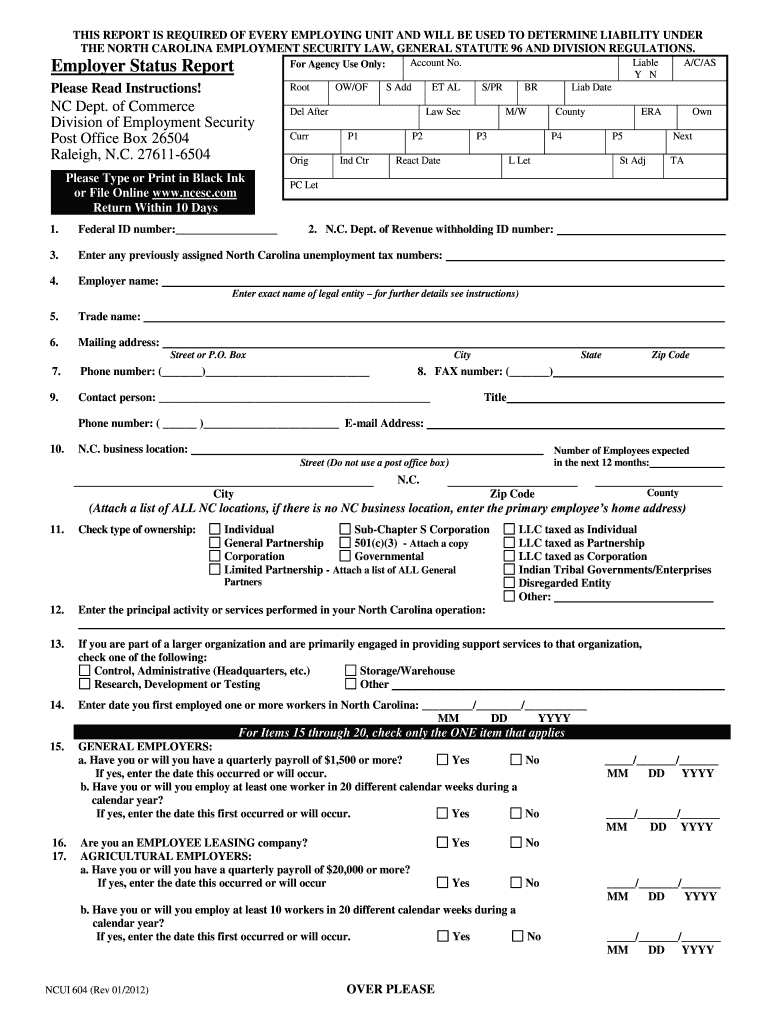

Ncui 604 Form Fill Out and Sign Printable PDF Template signNow

Submitting the n record along with employee wage details eliminates the need for filing a paper return. Web our records show your federal tax number as number here: Web our records show your federal tax number as number here: Tax computation data must be reported by using the appropriate n record contained in this guide. 09/2013) change in status report.

Ncui 101 Form 2021 Fill Online, Printable, Fillable, Blank pdfFiller

Sold or otherwise transferred all or part of the business to: Submitting the n record along with employee wage details eliminates the need for filing a paper return. Web (form ncui 685) 1. Quarter ending due date account number qtr/yr tax rate % number of covered workers who worked during or received pay for the payroll period which includes the.

Form NCUI685 Download Printable PDF or Fill Online Adjustment to

Web our records show your federal tax number as number here: 09/2013) change in status report account number employer name and address: You can file this report online at des.nc.gov quarter ending due date account number qty/yr tax rate % number of covered workers who worked during or received pay for the. Web our records show your federal tax number.

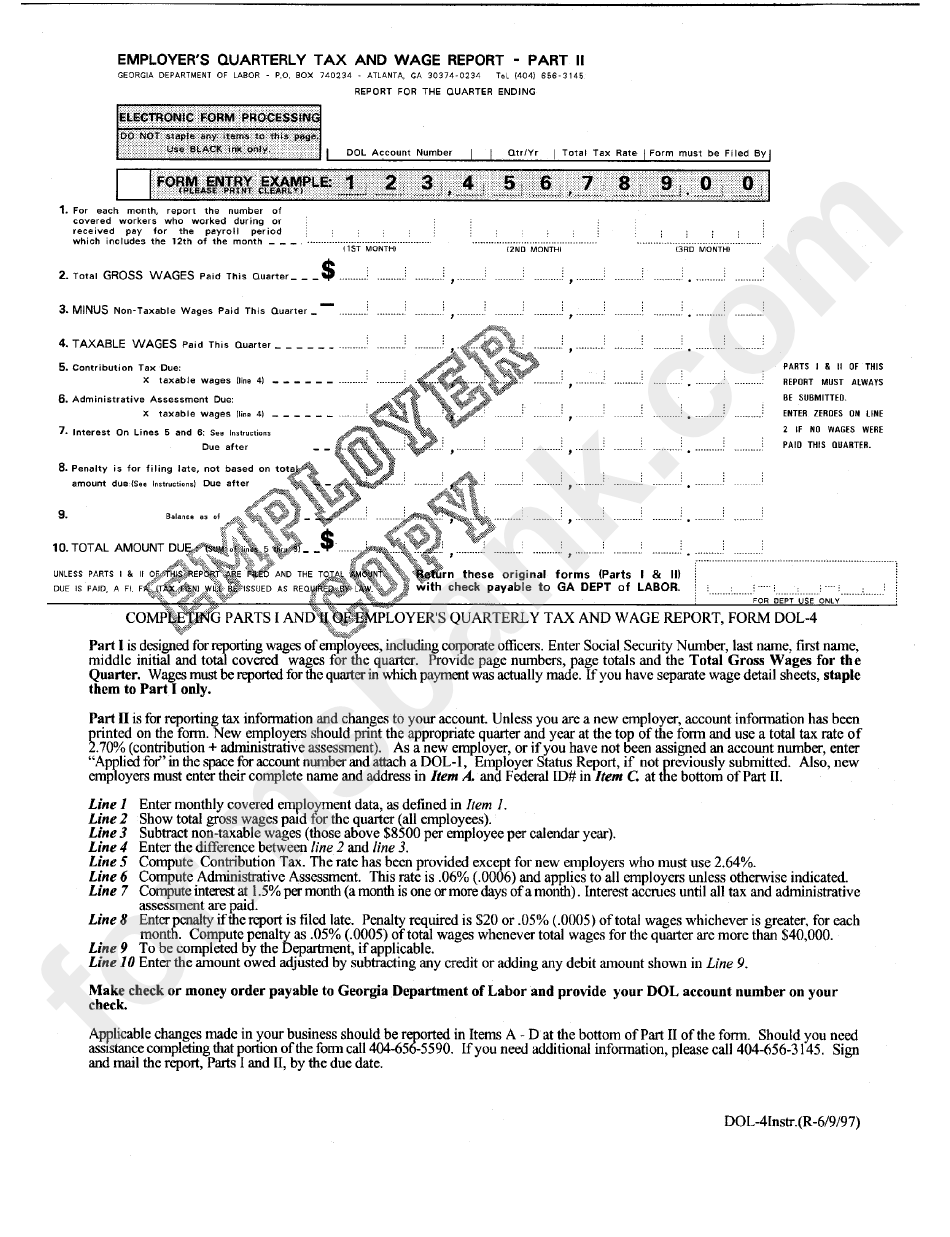

Form Dol4 Employer'S Quarterly Tax And Wage Report Part Ii

Web our records show your federal tax number as number here: Web our records show your federal tax number as number here: Sold or otherwise transferred all or part of the business to: This option is only available to employers who have nine or less employee wage items. See the online filing support menu in the form module.

Fillable Form Ncui 101 Employerr'S Quarterly Tax And Wage Report

Web our records show your federal tax number as number here: Quarter ending due date account number qtr/yr tax rate % number of covered workers who worked during or received pay for the payroll period which includes the 12th of the. Sold or otherwise transferred all or part of the business to: If you report your wages under branch account.

Web Our Records Show Your Federal Tax Number As Number Here:

09/2013) change in status report account number employer name and address: Enter the employer's name, mailing address and contact person's telephone number in space provided. Web (form ncui 685) 1. Tax computation data must be reported by using the appropriate n record contained in this guide.

Web Form Ncui 101, Employer’s Quarterly Tax And Wage Report, Must Be Submitted For Each Employer Account Number With Payment (If Any Due).

See the online filing support menu in the form module. This option is only available to employers who have nine or less employee wage items. Sold or otherwise transferred all or part of the business to: Submitting the n record along with employee wage details eliminates the need for filing a paper return.

Quarter Ending Due Date Account Number Qtr/Yr Tax Rate % Number Of Covered Workers Who Worked During Or Received Pay For The Payroll Period Which Includes The 12Th Of The.

Of commerce division of employment security p.o. If you report your wages under branch account numbers, enter the consolidated account number on the first line and enter the branch account number under which Enter the employer account number assigned by this agency. Web our records show your federal tax number as number here: