Where Do I Send Form 7004 Extension

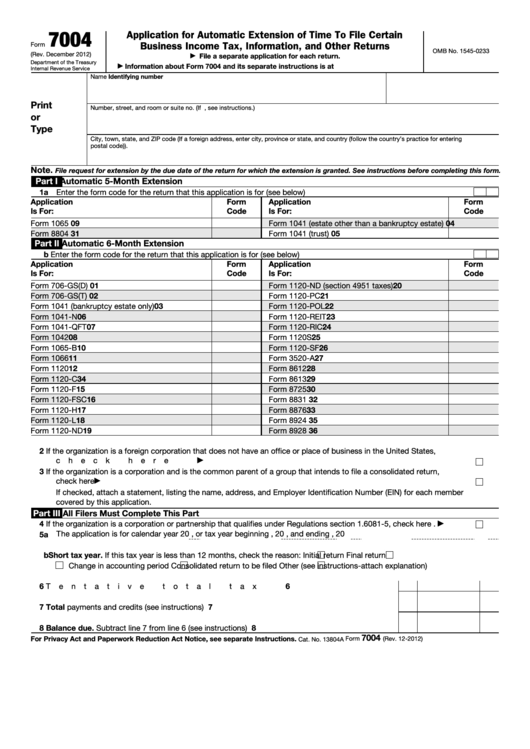

Where Do I Send Form 7004 Extension - Web filers requesting an extension will enter (in the box located at the top of part i) the form code for the return for which the extension is requested. Form 1065, which is filed by partnerships form. Select extension of time to. Web a taxpayer who needs to file forms 7004 for multiple form types may submit the forms 7004 electronically. Web make the payment who uses form 7004? By completing form 7004, the following business entities will receive an extension on: Part ii includes questions for all filers. Web in this guide, we cover it all, including: Web the first step to finding out where to send your form 7004 to the irs is accessing the agency’s “ where to file form 7004 ″ website. You can fill it out online, or you can print it out and complete it by hand.

Web in this guide, we cover it all, including: Web a taxpayer who needs to file forms 7004 for multiple form types may submit the forms 7004 electronically. Part ii includes questions for all filers. For example, taxpayers submitting one form 7004 with. Web when to file generally, form 7004 must be filed on or before the due date of the applicable tax return. Choose form 7004 and select the form. Web application for automatic extension of time to file certain business income tax, information, and other returns 7004 note: You will find these codes listed on form 7004. Web an interactive version of form 7004 is available on the irs website. Web submit the form.

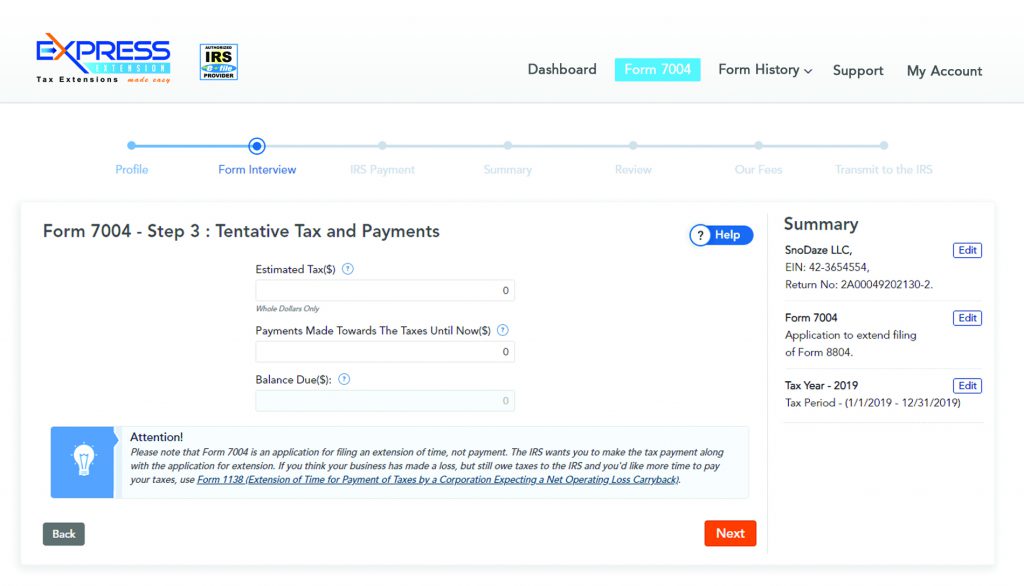

Web follow these steps to complete your business tax extension form 7004 using expressextension: There you will find a list of. File request for extension by the due date of. Web filers requesting an extension will enter (in the box located at the top of part i) the form code for the return for which the extension is requested. Web in this guide, we cover it all, including: Select extension of time to. Web when to file generally, form 7004 must be filed on or before the due date of the applicable tax return. For example, taxpayers submitting one form 7004 with. Part ii includes questions for all filers. Part ii line 2 check the.

How to file an LLC extension Form 7004 YouTube

Web filers requesting an extension will enter (in the box located at the top of part i) the form code for the return for which the extension is requested. Web application for automatic extension of time to file certain business income tax, information, and other returns 7004 note: Form 7004 is the form used to file for an automatic extension.

How to file an LLC Tax extension Form 7004 Bette Hochberger, CPA, CGMA

Choose form 7004 and select the form. Web purpose of form. For example, taxpayers submitting one form 7004 with. Web make the payment who uses form 7004? Web submit the form.

Last Minute Tips To Help You File Your Form 7004 Blog

Web make the payment who uses form 7004? Web an interactive version of form 7004 is available on the irs website. File request for extension by the due date of. Part ii includes questions for all filers. Web follow these steps to print a 7004 in turbotax business:

Fillable Form 7004 Application For Automatic Extension Of Time To

Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Web follow these steps to complete your business tax extension form 7004 using expressextension: Web follow these steps to determine which address the form 7004 should be sent to: Find the applicable main form under the if the. Part ii.

2011 Form IRS 7004 Fill Online, Printable, Fillable, Blank pdfFiller

Web make the payment who uses form 7004? Choose form 7004 and select the form. Web an interactive version of form 7004 is available on the irs website. Select extension of time to. With your return open, select search and enter extend;

What You Need To Know To Successfully File A 7004 Extension Blog

What form 7004 is who’s eligible for a form 7004 extension how and when to file form 7004 and make tax payments what is form 7004?. Go to the irs where to file form 7004 webpage. Select extension of time to. Web submit the form. Web a taxpayer who needs to file forms 7004 for multiple form types may submit.

The Deadline to File a Form 7004 Extension is Here! Blog

With your return open, select search and enter extend; For example, taxpayers submitting one form 7004 with. The due dates of the returns can be found in the instructions for the applicable. Form 7004 is the form used to file for an automatic extension of time to file your business tax return for a partnership, a multiple member llc filing.

IRS Form 7004 Automatic Extension for Business Tax Returns

How to fill out form 7004. Web when to file generally, form 7004 must be filed on or before the due date of the applicable tax return. There you will find a list of. Web submit the form. Form 1065, which is filed by partnerships form.

Get an Extension on Your Business Taxes with Form 7004 Excel Capital

There are two ways to submit form 7004: Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. The due dates of the returns can be found in the instructions for the applicable. With your return open, select search and enter extend; Form 1065, which is filed by partnerships form.

How To File Your Extension Form 7004? Blog ExpressExtension

Form 1065, which is filed by partnerships form. For example, taxpayers submitting one form 7004 with. Web the first step to finding out where to send your form 7004 to the irs is accessing the agency’s “ where to file form 7004 ″ website. What form 7004 is who’s eligible for a form 7004 extension how and when to file.

Web Follow These Steps To Complete Your Business Tax Extension Form 7004 Using Expressextension:

You can fill it out online, or you can print it out and complete it by hand. Go to the irs where to file form 7004 webpage. Form 1065, which is filed by partnerships form. There are two ways to submit form 7004:

Web Purpose Of Form.

Select extension of time to. What form 7004 is who’s eligible for a form 7004 extension how and when to file form 7004 and make tax payments what is form 7004?. Web make the payment who uses form 7004? Part ii includes questions for all filers.

There You Will Find A List Of.

Web when to file generally, form 7004 must be filed on or before the due date of the applicable tax return. The due dates of the returns can be found in the instructions for the applicable. Choose form 7004 and select the form. With your return open, select search and enter extend;

Find The Applicable Main Form Under The If The.

Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. File request for extension by the due date of. For example, taxpayers submitting one form 7004 with. Web filers requesting an extension will enter (in the box located at the top of part i) the form code for the return for which the extension is requested.