Nolo How To Form A Nonprofit Corporation

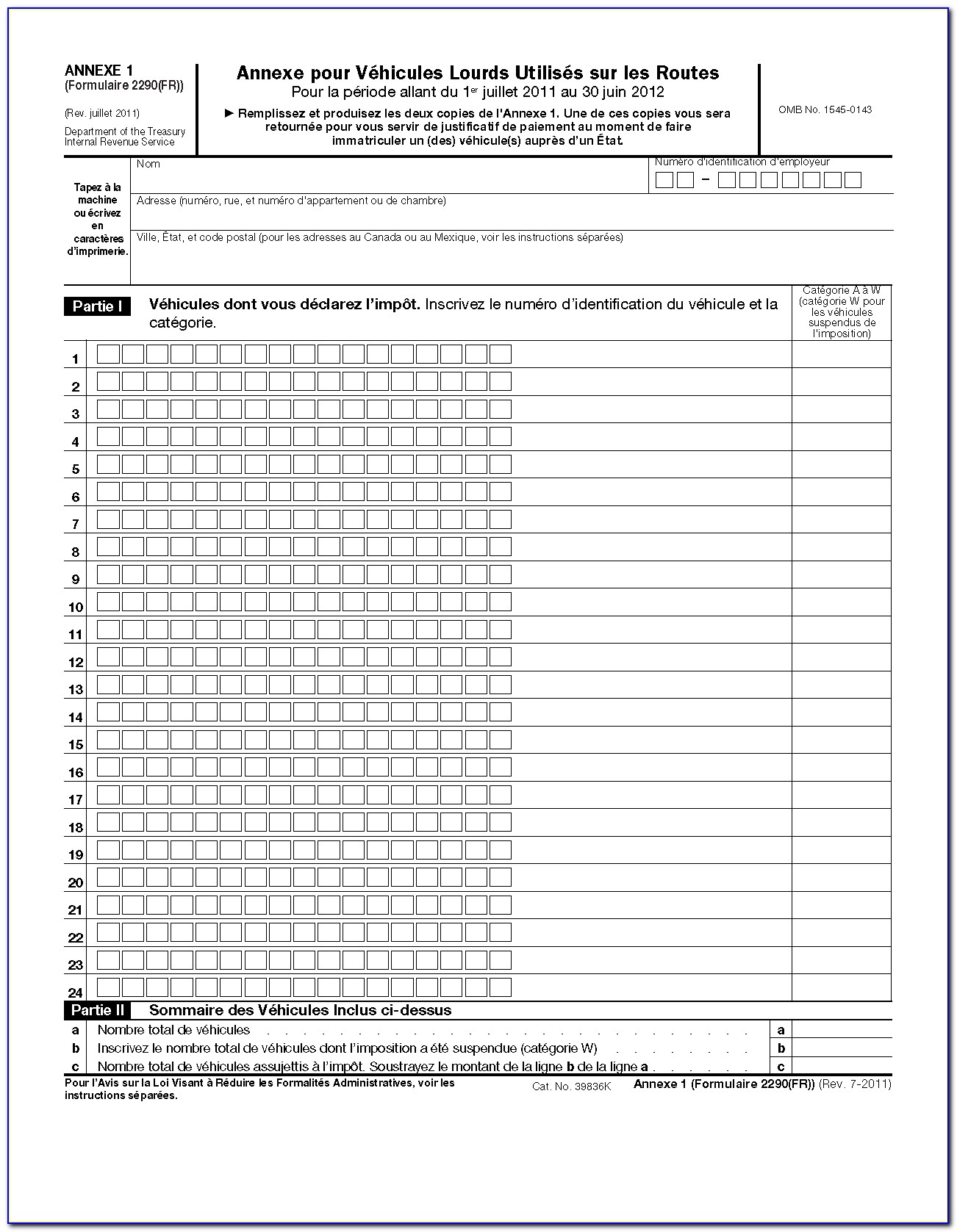

Nolo How To Form A Nonprofit Corporation - Web up to 25% cash back nonprofit formation documents: Ad our business specialists help you incorporate your business. Learn the basics about your nonprofit's important. Web up to 25% cash back nolo’s legal forms and books are here to help. The next step is to let the irs know that the organization is officially dissolved in its state of incorporation. The first necessary step is the formation of a corporate entity in one of the united states. Web up to 25% cash back diy products. Choose initial directors for your nonprofit corporation in colorado, your nonprofit corporation must have one or more directors. Web up to 25% cash back for detailed guidance on all aspects of the state fundraising registration process, including links to all the forms you need to register and renew, see nonprofit. Web up to 25% cash back starting at $50.00 online form bylaws for nonprofit starting at $20.99 $29.99 book & ebook effective fundraising for nonprofits starting at $24.49 $34.99 book &.

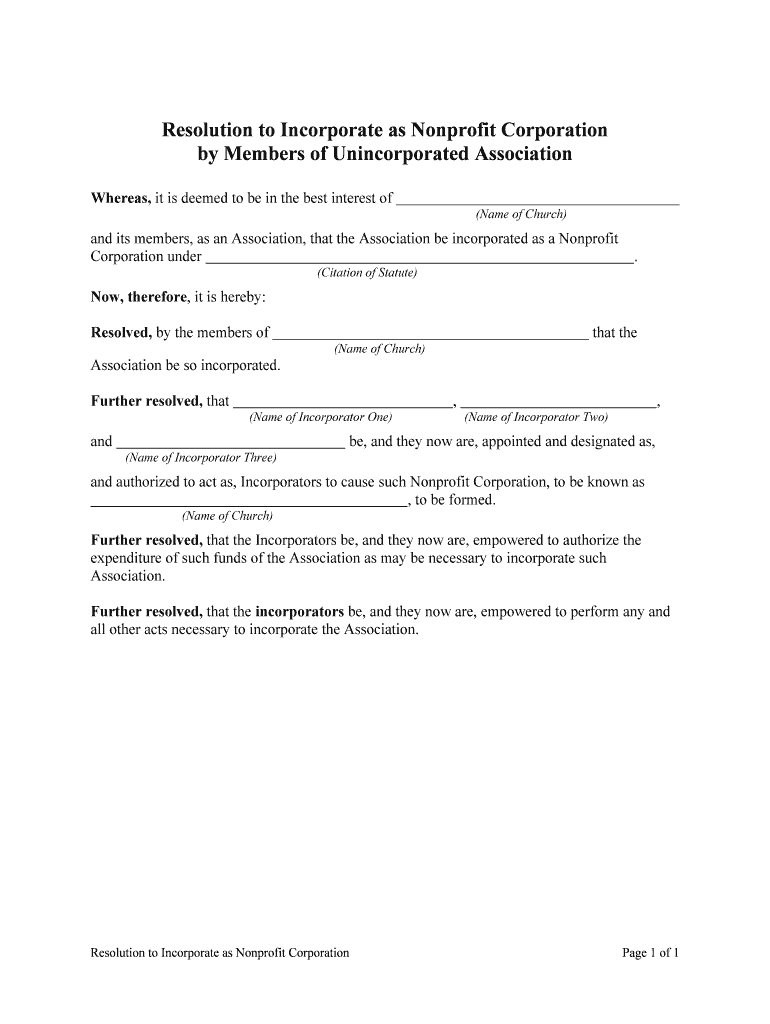

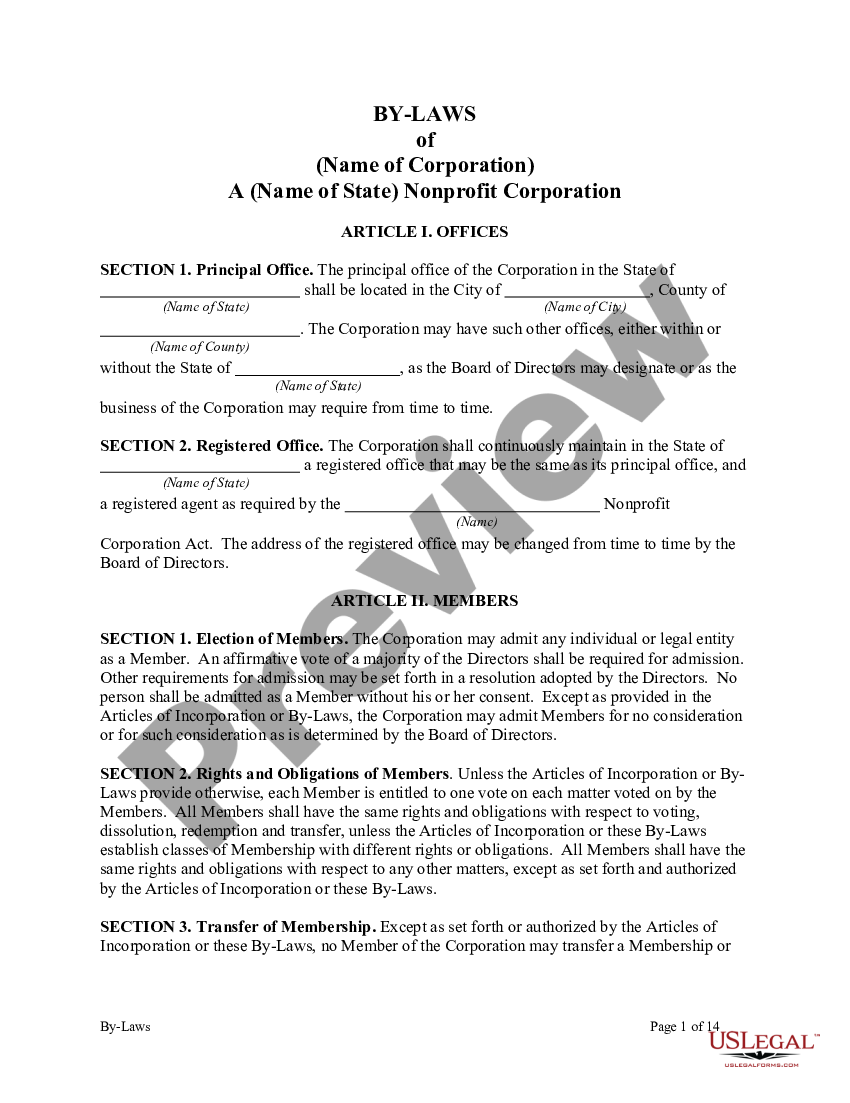

Web up to 25% cash back nonprofit formation documents: Choose the initial directors and officers for your nonprofit in new york, your nonprofit corporation must have at least three directors. Web up to 25% cash back diy products. Learn the basics about your nonprofit's important. Articles of incorporation, bylaws, and organizational minutes. Starting at $34.99 $49.99 book & ebook how to. Web up to 25% cash back it is not necessary for an unincorporated association to convert to a nonprofit corporation to obtain irs recognition of its section 510 (c) (3) status. Ad our business specialists help you incorporate your business. Web up to 25% cash back starting at $50.00 online form bylaws for nonprofit starting at $20.99 $29.99 book & ebook effective fundraising for nonprofits starting at $24.49 $34.99 book &. Web up to 25% cash back 1.

Choose initial directors for your nonprofit corporation in colorado, your nonprofit corporation must have one or more directors. Web up to 25% cash back for detailed guidance on all aspects of the state fundraising registration process, including links to all the forms you need to register and renew, see nonprofit. Articles of incorporation, bylaws, and organizational minutes. Protect your business from liabilities. Web up to 25% cash back 1. Web up to 25% cash back 1. The way to inform the irs of the organization’s. Ad our business specialists help you incorporate your business. Starting at $34.99 $49.99 book & ebook how to. The first necessary step is the formation of a corporate entity in one of the united states.

Online LLC Form an LLC Nolo Limited liability company, Llc

Articles of incorporation, bylaws, and organizational minutes. Web up to 25% cash back for detailed guidance on all aspects of the state fundraising registration process, including links to all the forms you need to register and renew, see nonprofit. The way to inform the irs of the organization’s. The first necessary step is the formation of a corporate entity in.

How to Form a Missouri Nonprofit Corporation Non profit

Learn the basics about your nonprofit's important. The next step is to let the irs know that the organization is officially dissolved in its state of incorporation. Web up to 25% cash back diy products. The way to inform the irs of the organization’s. Web up to 25% cash back 1.

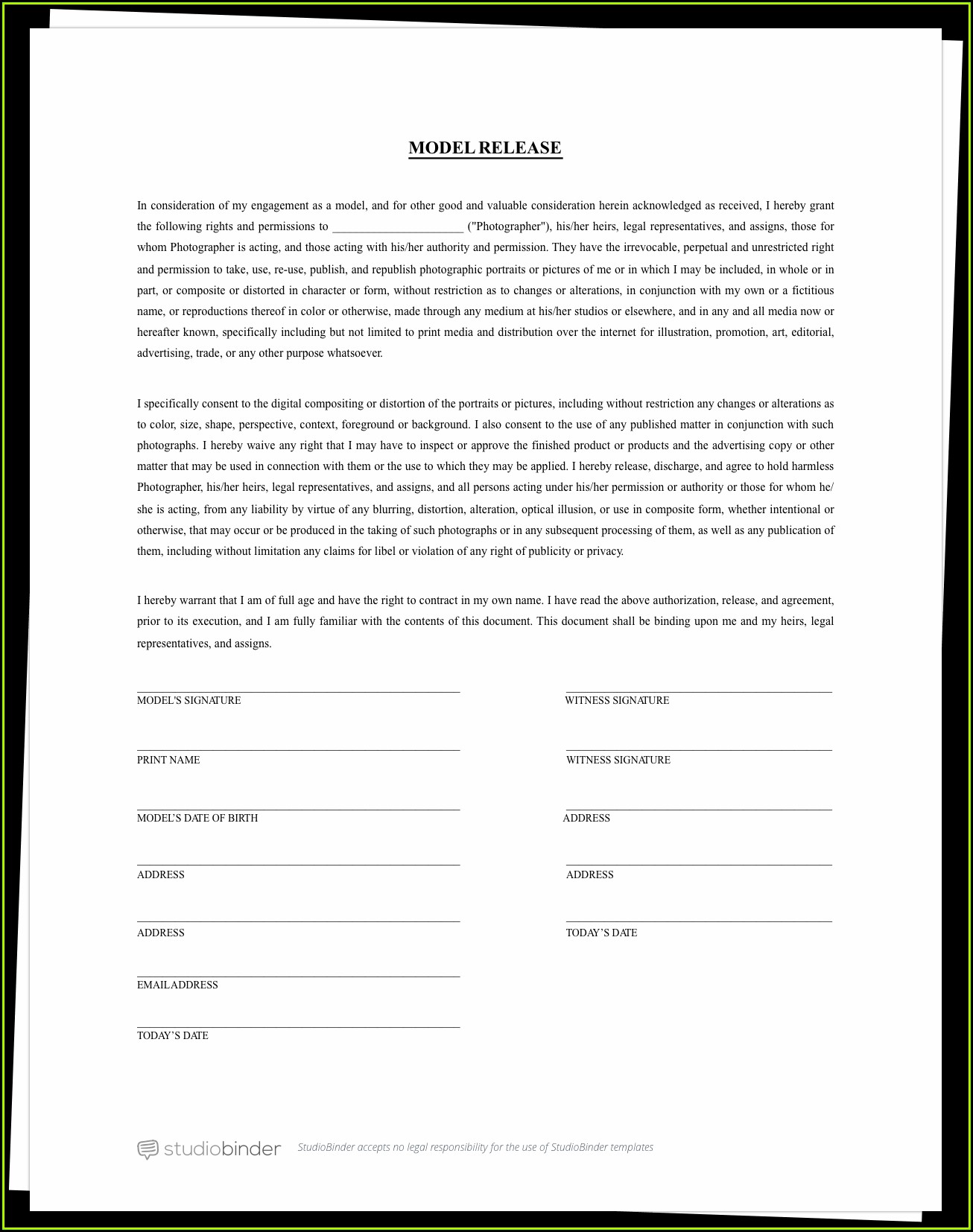

Nolo Legal Forms Free Form Resume Examples qeYzWdNV8X

Web up to 25% cash back diy products. Web up to 25% cash back nonprofit formation documents: Web up to 25% cash back it is not necessary for an unincorporated association to convert to a nonprofit corporation to obtain irs recognition of its section 510 (c) (3) status. Web up to 25% cash back starting at $50.00 online form bylaws.

What is an Unincorporated Nonprofit Association?Nolo Form Fill Out

Web up to 25% cash back $34.99 $49.99 30% off add to cart form a corporation in any state, quickly and easily ready to incorporate your business? Web up to 25% cash back nolo’s legal forms and books are here to help. Protect your business from liabilities. Choose a name for your. Web best seller how to form a nonprofit.

How to Form a Corporation in Nolo

Starting at $34.99 $49.99 book & ebook how to. Articles of incorporation, bylaws, and organizational minutes. Web best seller how to form a nonprofit corporation (national edition): The next step is to let the irs know that the organization is officially dissolved in its state of incorporation. Web up to 25% cash back 1.

(2009) How to Form a Nonprofit Corporation (PDF) by Anthony Mancuso

Web up to 25% cash back for detailed guidance on all aspects of the state fundraising registration process, including links to all the forms you need to register and renew, see nonprofit. The first necessary step is the formation of a corporate entity in one of the united states. Choose a name for your. Choose initial directors for your nonprofit.

Nolo Law Forms For Personal Use Form Resume Examples qlkmPEmOaj

The next step is to let the irs know that the organization is officially dissolved in its state of incorporation. Choose a name for your. Learn the basics about your nonprofit's important. Protect your business from liabilities. Choose initial directors for your nonprofit corporation in colorado, your nonprofit corporation must have one or more directors.

Nonprofits Law Books, Legal Forms & Software Nolo Law books

Choose initial directors for your nonprofit corporation in colorado, your nonprofit corporation must have one or more directors. Starting at $34.99 $49.99 book & ebook how to. Web up to 25% cash back $34.99 $49.99 30% off add to cart form a corporation in any state, quickly and easily ready to incorporate your business? Web up to 25% cash back.

Bylaws of Nonprofit Corporation US Legal Forms

Web up to 25% cash back 1. Choose the initial directors and officers for your nonprofit in new york, your nonprofit corporation must have at least three directors. The first necessary step is the formation of a corporate entity in one of the united states. Web up to 25% cash back it is not necessary for an unincorporated association to.

Nonprofit Meetings, Minutes & Records Legal Book Nolo Non profit

Web up to 25% cash back for detailed guidance on all aspects of the state fundraising registration process, including links to all the forms you need to register and renew, see nonprofit. Starting at $34.99 $49.99 book & ebook how to. Choose initial directors for your nonprofit corporation in colorado, your nonprofit corporation must have one or more directors. Web.

Web Up To 25% Cash Back Diy Products.

Web up to 25% cash back nolo’s legal forms and books are here to help. Web step #7 notify the irs. Ad our business specialists help you incorporate your business. Web up to 25% cash back nonprofit formation documents:

Choose The Initial Directors And Officers For Your Nonprofit In New York, Your Nonprofit Corporation Must Have At Least Three Directors.

Web up to 25% cash back it is not necessary for an unincorporated association to convert to a nonprofit corporation to obtain irs recognition of its section 510 (c) (3) status. Choose initial directors for your nonprofit corporation in colorado, your nonprofit corporation must have one or more directors. Web up to 25% cash back 1. Web up to 25% cash back for detailed guidance on all aspects of the state fundraising registration process, including links to all the forms you need to register and renew, see nonprofit.

Protect Your Business From Liabilities.

Web up to 25% cash back 1. Directors must be at least 18. Web up to 25% cash back starting at $50.00 online form bylaws for nonprofit starting at $20.99 $29.99 book & ebook effective fundraising for nonprofits starting at $24.49 $34.99 book &. Learn the basics about your nonprofit's important.

The First Necessary Step Is The Formation Of A Corporate Entity In One Of The United States.

The way to inform the irs of the organization’s. Choose a name for your. Web up to 25% cash back $34.99 $49.99 30% off add to cart form a corporation in any state, quickly and easily ready to incorporate your business? The next step is to let the irs know that the organization is officially dissolved in its state of incorporation.