What Is Form 8919 On Tax Return

What Is Form 8919 On Tax Return - An individual having salary income should collect. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as. Per irs form 8919, you must file this form if all of the following apply. The taxpayer performed services for an individual or a firm. Web bsba major in finance (mi. Web documents needed to file itr; Web a 1040 form is an income tax return form used by individuals, partnerships, estates, and trusts to report their income, gains, losses, deductions, credits, and other. Uncollected social security and medicare tax. You performed services for a. You may be eligible for the foreign earned income exclusion.

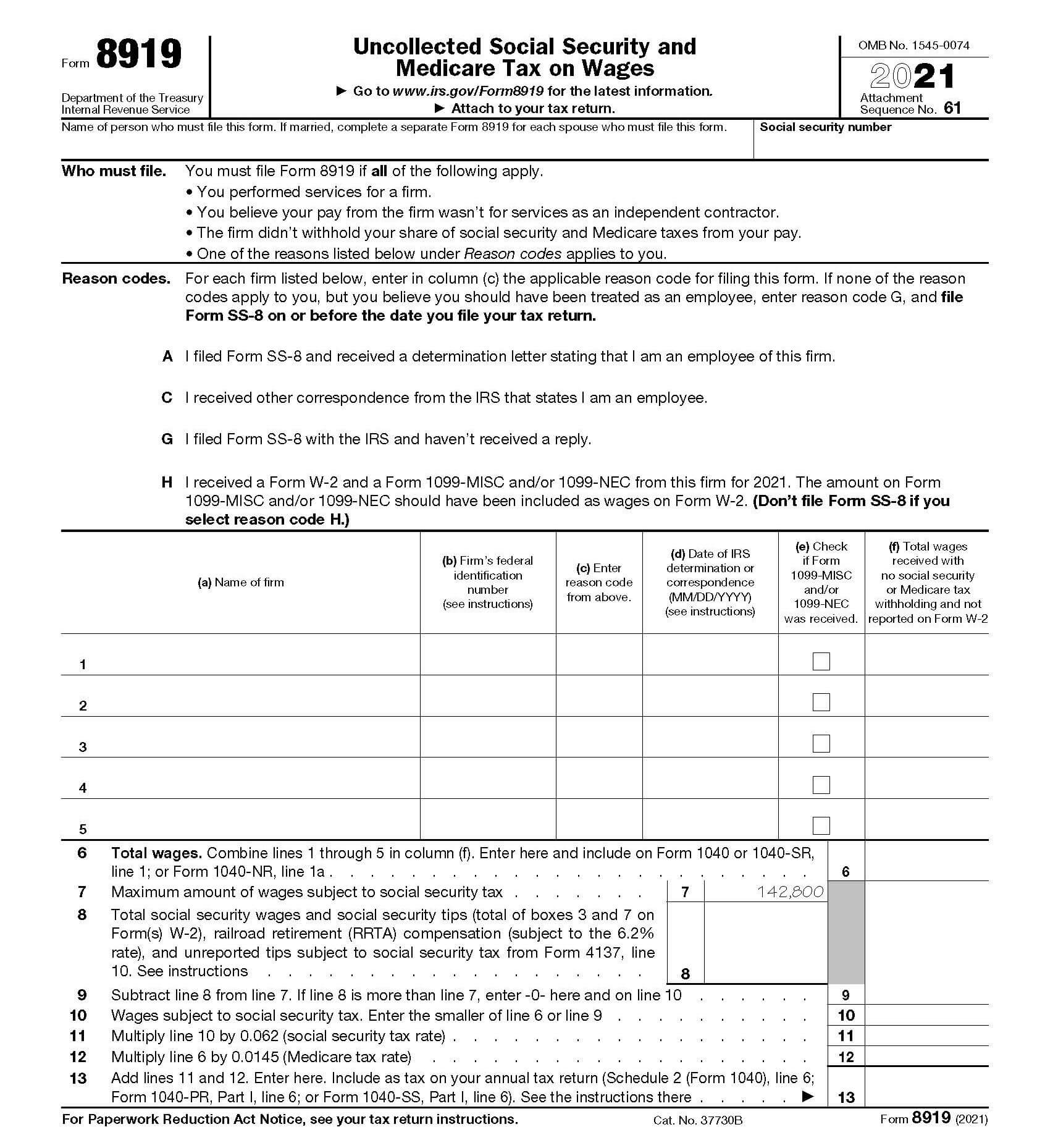

This person owns and work a truck. Web form 8919, a document issued by the internal revenue service (irs), plays a crucial role in the u.s. You performed services for a. Web form 8919 department of the treasury internal revenue service. Use form 8919 to compute fica tax and ensure that you receive credit for this income with the ssa. Department of the treasury internal revenue service. Web a 1040 form is an income tax return form used by individuals, partnerships, estates, and trusts to report their income, gains, losses, deductions, credits, and other. The taxpayer performed services for an individual or a firm. You are likely preparing your return incorrectly. Form 8959, additional medicare tax.

Department of the treasury internal revenue service. Use form 8919 to compute fica tax and ensure that you receive credit for this income with the ssa. Web form 8919 department of the treasury internal revenue service. Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. The first step of filing itr is to collect all the documents related to the process. Web bsba major in finance (mi. An individual having salary income should collect. Web if you’ve already filed your return without form 8919, file an amended return (form 1040x) with a form 8919. The taxpayer performed services for an individual or a firm. Web a 1040 form is an income tax return form used by individuals, partnerships, estates, and trusts to report their income, gains, losses, deductions, credits, and other.

When to Fill IRS Form 8919?

Use form 8919 to compute fica tax and ensure that you receive credit for this income with the ssa. Web irs form 8919 and the employee’s responsibilities employees will use form 8919 to determine the amount they owe in social security and medicare taxes. You are likely preparing your return incorrectly. You performed services for a. Web form 8919, a.

When to expect your tax forms from FFG and LPL. YouTube

Department of the treasury internal revenue service. Web form 8919 department of the treasury internal revenue service. Per irs form 8919, you must file this form if all of the following apply. You are likely preparing your return incorrectly. Use form 8959, additional medicare tax,.

Form 8919 2021 Fill Online, Printable, Fillable, Blank pdfFiller

Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: You may be eligible for the foreign earned income exclusion. Use form 8959, additional medicare tax,. Form 8959, additional medicare tax. You are likely preparing your return incorrectly.

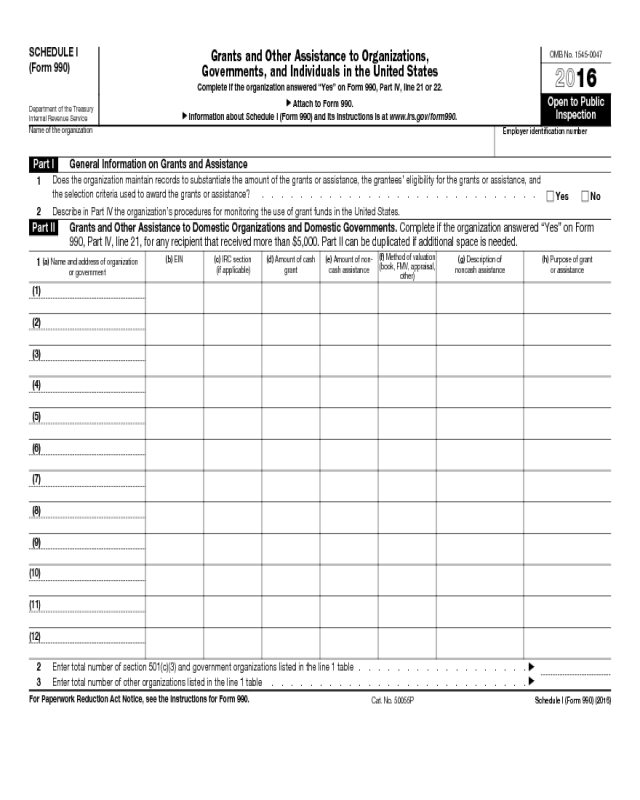

Form 990 Schedule I Edit, Fill, Sign Online Handypdf

Web bsba major in finance (mi. Web form 8919 department of the treasury internal revenue service. The taxpayer performed services for an individual or a firm. Web form 8919 is the form for those who are employee but their employer treated them as an independent contractor, then they must calculate and report their portion of. It’s essential for workers who.

When to Use IRS Form 8919

Web if you’ve already filed your return without form 8919, file an amended return (form 1040x) with a form 8919. Use form 8959, additional medicare tax,. Uncollected social security and medicare tax. Web bsba major in finance (mi. Web a 1040 form is an income tax return form used by individuals, partnerships, estates, and trusts to report their income, gains,.

how to fill out form 8919 Fill Online, Printable, Fillable Blank

Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as. It’s essential for workers who believe they have been. Web if you’ve already filed your return without form 8919, file an amended return (form 1040x) with a form 8919..

Form 8919 Uncollected Social Security and Medicare Tax on Wages (2014

Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as. This person owns and work a truck. Web a 1040 form is an income tax return form used by individuals, partnerships, estates, and trusts to report their income, gains,.

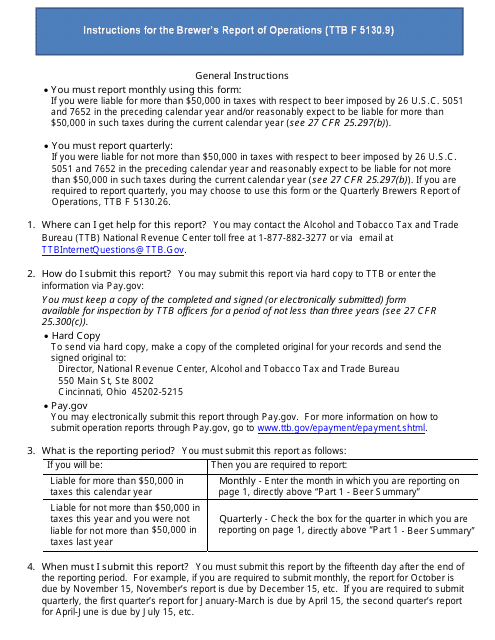

Download Instructions for TTB Form 5130.9 Brewer's Report of Operations

You may be eligible for the foreign earned income exclusion. It’s essential for workers who believe they have been. Web why am i being asked to fill out form 8919? This person owns and work a truck. Web form 8919 department of the treasury internal revenue service.

2020 Form IRS 8880 Fill Online, Printable, Fillable, Blank pdfFiller

Use form 8959, additional medicare tax,. Web form 8919 is the form for those who are employee but their employer treated them as an independent contractor, then they must calculate and report their portion of. Web if you’ve already filed your return without form 8919, file an amended return (form 1040x) with a form 8919. Web form 8919, uncollected social.

Form 8919 on Tumblr

Use form 8959, additional medicare tax,. Department of the treasury internal revenue service. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as. Web we last updated the uncollected social security and medicare tax on wages in december 2022,.

Irs Form 8819, Uncollected Social Security And Medicare Tax On Wages, Is An Official Tax Document Used By Employees Who Were Treated Like Independent.

Uncollected social security and medicare tax. The first step of filing itr is to collect all the documents related to the process. Web additionally, form 8919 is used to report the correct employment status to the irs, while form 4137 is used to calculate the social security and medicare taxes. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as.

Department Of The Treasury Internal Revenue Service.

Web if you’ve already filed your return without form 8919, file an amended return (form 1040x) with a form 8919. This person owns and work a truck. Use form 8959, additional medicare tax,. This person owns and work a truck.

Web We Last Updated The Uncollected Social Security And Medicare Tax On Wages In December 2022, So This Is The Latest Version Of Form 8919, Fully Updated For Tax Year 2022.

Use form 8919 to compute fica tax and ensure that you receive credit for this income with the ssa. Web 8919 uncollected social security and medicare tax on wages 20. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: For instructions on amending your return, see question 11.

You Performed Services For A.

An individual having salary income should collect. Web form 8919 is the form for those who are employee but their employer treated them as an independent contractor, then they must calculate and report their portion of. You may be eligible for the foreign earned income exclusion. Per irs form 8919, you must file this form if all of the following apply.