Arkansas Franchise Tax Form

Arkansas Franchise Tax Form - Web how do i pay the franchise tax for my business? Web arkansas limited liability company franchise tax report make checks payable to arkansas secretary of state mail to: Enter your file number and federal tax id. Make a check or money order out to the arkansas secretary of state and mail along with your paperwork. Web $45 to form your arkansas llc (to file your llc articles of organization). If you do not have a federal. Web to pay by mail, download the annual franchise tax pdf form. Skip the overview and jump to the filing link ↓ 2021 confusion: The following instructions will guide you through the. Do i need to file an.

Web if you have not received a franchise tax report by march 20th, please contact us via email at [email protected], online at. Web how do i pay the franchise tax for my business? Web department of finance and administration franchise tax section p.o. Web northwest will form your llc for $39 (60% discount). The file number is located above your company name on your tax report. Make a check or money order out to the arkansas secretary of state and mail along with your paperwork. Web arkansas limited liability company franchise tax report make checks payable to arkansas secretary of state mail to: Ar1023ct application for income tax exempt status. Web arkansas has a state income tax that ranges between 2% and 6.6%. Web $45 to form your arkansas llc (to file your llc articles of organization).

Web annual llc franchise tax report 2023 for the year ending 12/31/2022 reports and taxes are due on or before may 1, 2023. Do i need to file an. Web how do i pay the franchise tax for my business? Send your report and payment to the arkansas secretary of state. Skip the overview and jump to the filing link ↓ 2021 confusion: Web arkansas limited liability company franchise tax report make checks payable to arkansas secretary of state mail to: Enter your file number and federal tax id. Web northwest will form your llc for $39 (60% discount). Web enter your file number: Make a check or money order out to the arkansas secretary of state and mail along with your paperwork.

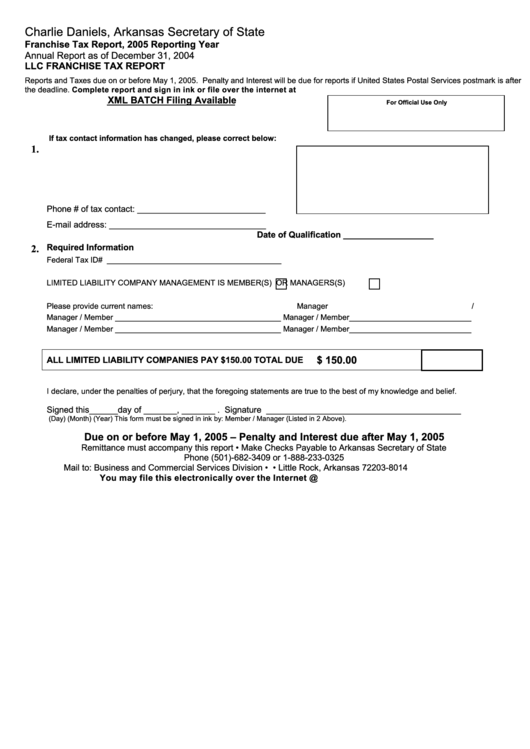

Llc Franchise Tax Report Form Arkansas Secretary Of State 2005

Web businesses may file and pay their annual franchise tax as early as january 1. Llcs (limited liability companies) and pllcs (professional limited. Web $45 to form your arkansas llc (to file your llc articles of organization). Send your report and payment to the arkansas secretary of state. Enter your file number and federal tax id.

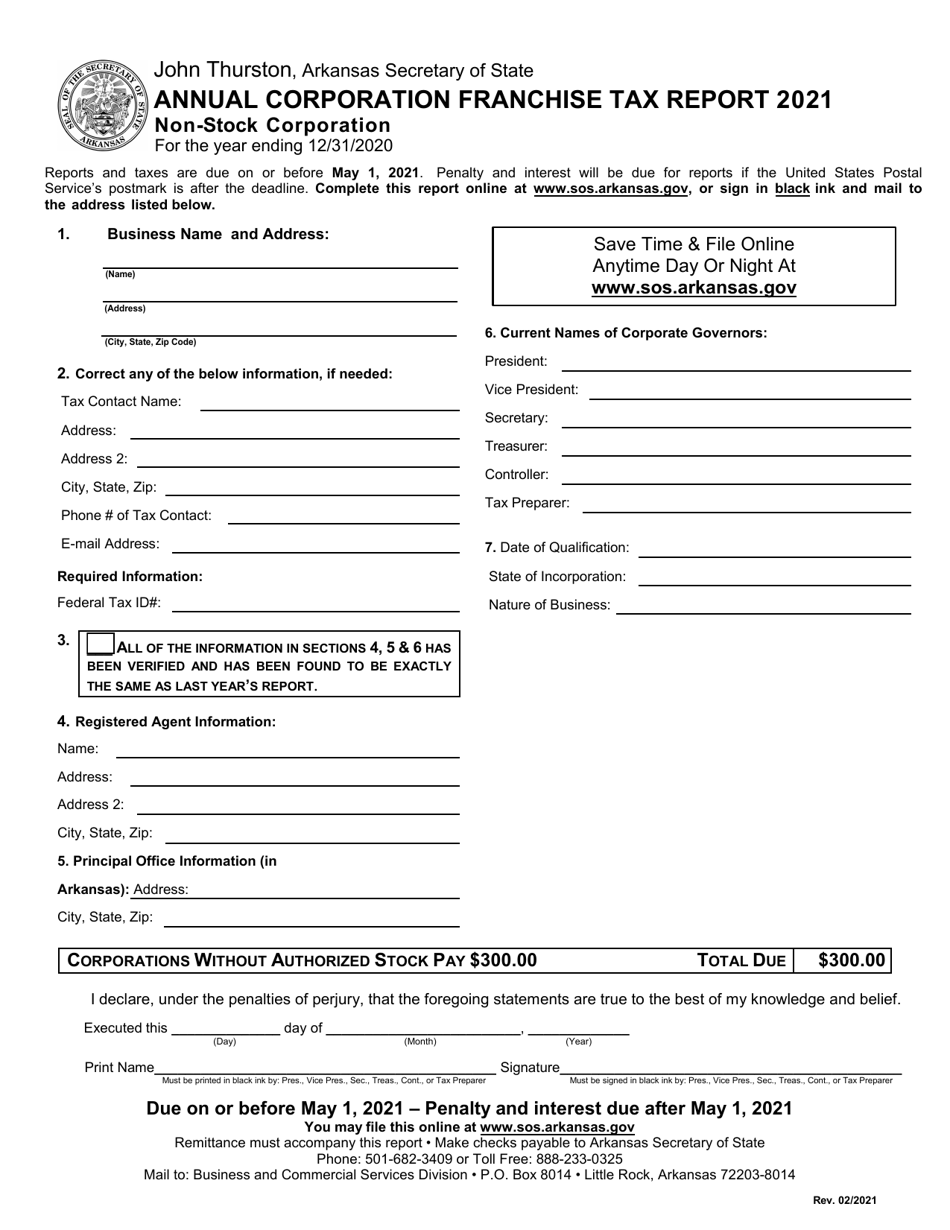

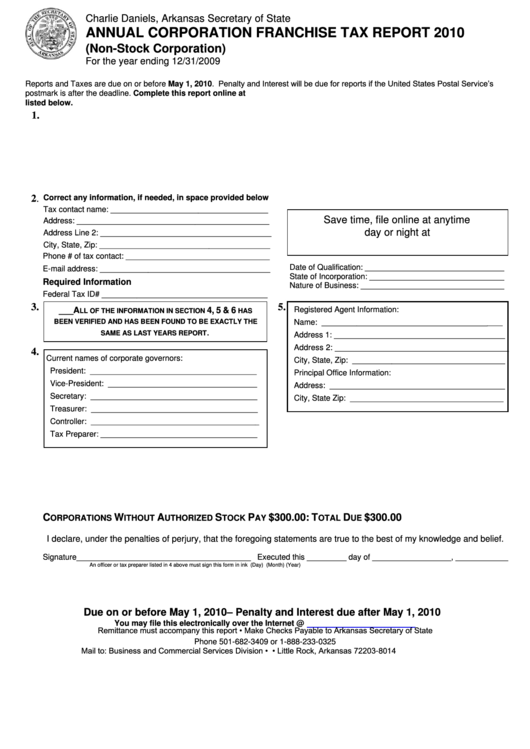

2021 Arkansas Annual Corporation Franchise Tax Report Nonstock

Skip the overview and jump to the filing link ↓ 2021 confusion: Make a check or money order out to the arkansas secretary of state and mail along with your paperwork. Send your report and payment to the arkansas secretary of state. Web department of finance and administration franchise tax section p.o. $150 in annual fees (your annual franchise tax).

Fillable Form Ar1055 Arkansas Request For Extension Of Time For

Web northwest will form your llc for $39 (60% discount). Skip the overview and jump to the filing link ↓ 2021 confusion: Web arkansas limited liability company franchise tax report make checks payable to arkansas secretary of state mail to: Web to pay by mail, download the annual franchise tax pdf form. Ar1100esct corporation estimated tax vouchers.

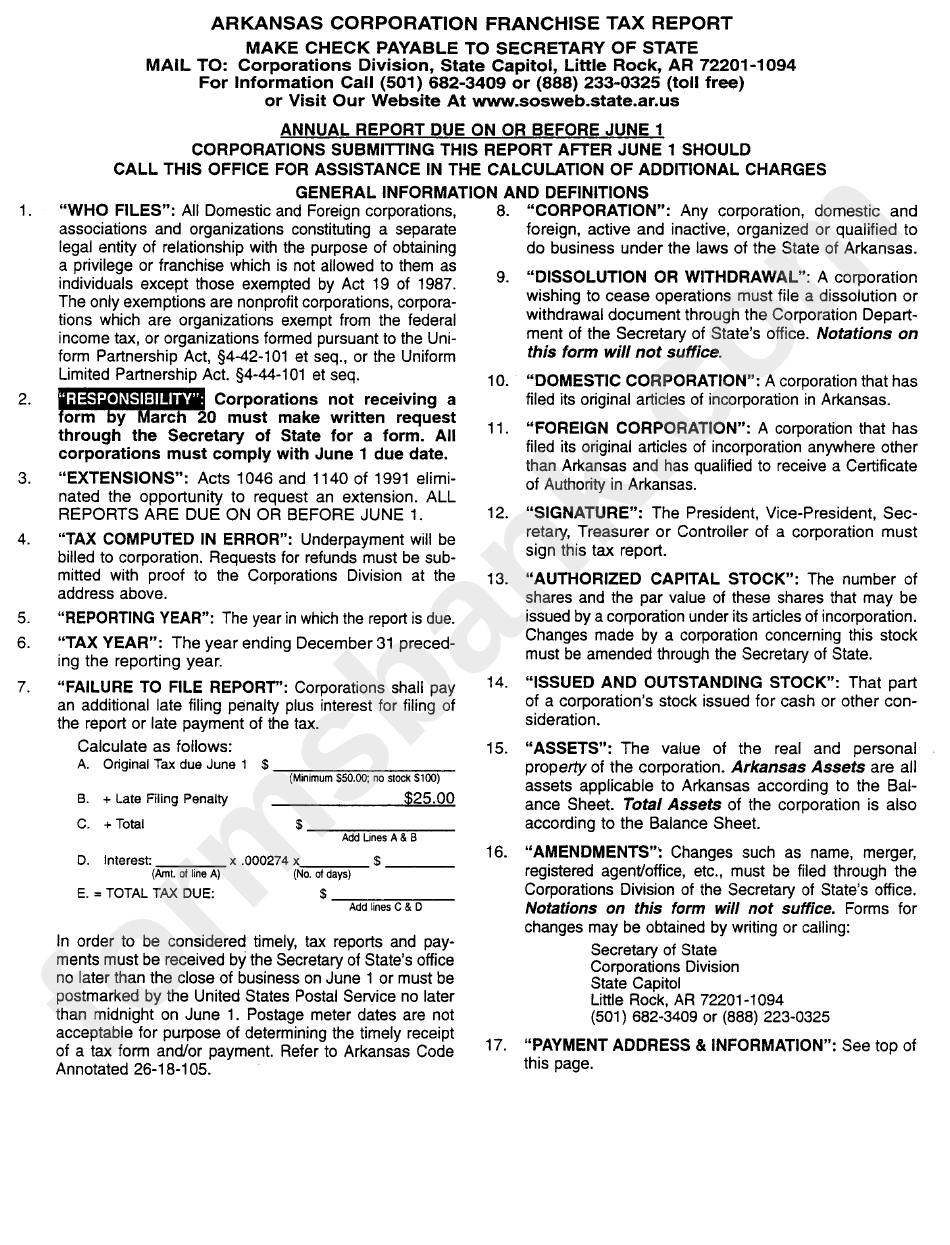

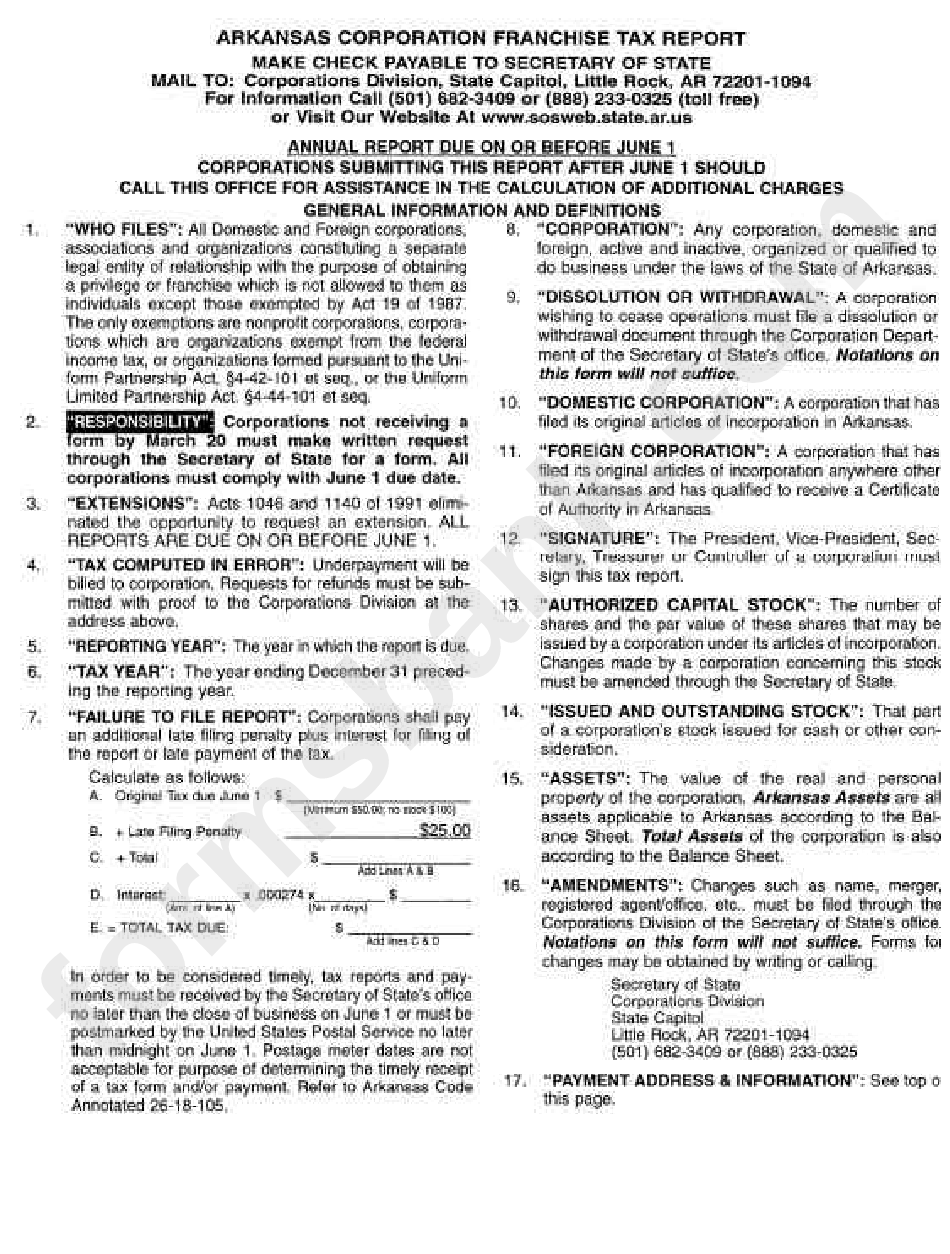

Arkansas Corporation Franchise Tax Report Form Instructions printable

Find your file number enter your federal tax id: Web to pay by mail, download the annual franchise tax pdf form. Make a check or money order out to the arkansas secretary of state and mail along with your paperwork. Enter your file number and federal tax id. Web arkansas limited liability company franchise tax report make checks payable to.

arkansas franchise tax 2022 LLC Bible

Skip the overview and jump to the filing link ↓ 2021 confusion: Enter your file number and federal tax id. Web arkansas has a state income tax that ranges between 2% and 6.6%. Ar1023ct application for income tax exempt status. Web arkansas limited liability company franchise tax report make checks payable to arkansas secretary of state mail to:

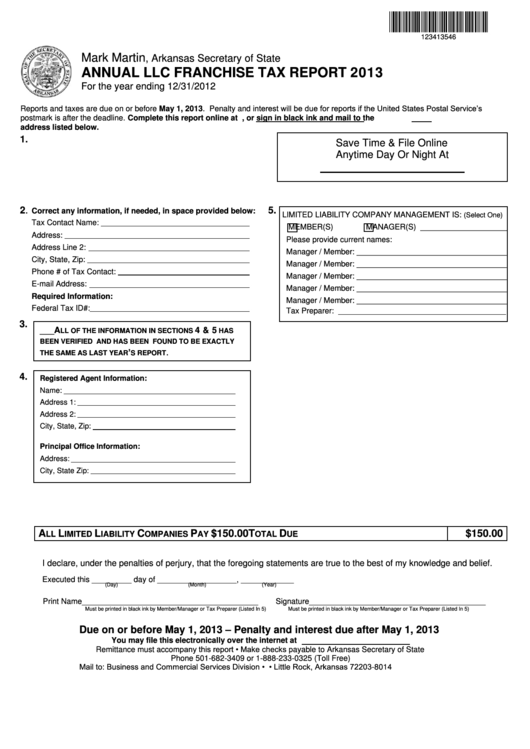

Annual Llc Franchise Tax Report Form Arkansas Secretary Of State

Do i need to file an. The following instructions will guide you through the. The file number is located above your company name on your tax report. Web complete your tax report online or download a paper form. Web arkansas has a state income tax that ranges between 2% and 6.6%.

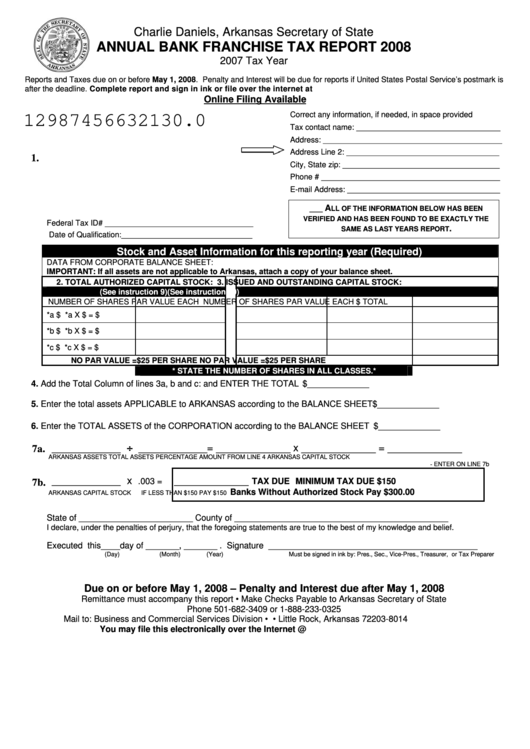

Annual Bank Franchise Tax Report Arkansas Secretary Of State 2008

Web complete your tax report online or download a paper form. Web to pay by mail, download the annual franchise tax pdf form. Skip the overview and jump to the filing link ↓ 2021 confusion: Web arkansas limited liability company franchise tax report make checks payable to arkansas secretary of state mail to: Find your file number enter your federal.

Arkansas Corporation Franchise Tax Report printable pdf download

Web complete your tax report online or download a paper form. If you do not have a federal. Web how do i pay the franchise tax for my business? Web enter your file number: Ar1023ct application for income tax exempt status.

Annual Corporation Franchise Tax Report (NonStock Corporation

Web department of finance and administration franchise tax section p.o. Web arkansas has a state income tax that ranges between 2% and 6.6%. Web to pay by mail, download the annual franchise tax pdf form. Send your report and payment to the arkansas secretary of state. Ar1023ct application for income tax exempt status.

The Following Instructions Will Guide You Through The.

Make a check or money order out to the arkansas secretary of state and mail along with your paperwork. Ar1100esct corporation estimated tax vouchers. Llcs (limited liability companies) and pllcs (professional limited. Do i need to file an.

Enter Your File Number And Federal Tax Id.

Web annual llc franchise tax report 2023 for the year ending 12/31/2022 reports and taxes are due on or before may 1, 2023. Web if you have not received a franchise tax report by march 20th, please contact us via email at [email protected], online at. Web businesses may file and pay their annual franchise tax as early as january 1. Find your file number enter your federal tax id:

If You Do Not Have A Federal.

Web enter your file number: Skip the overview and jump to the filing link ↓ 2021 confusion: Web northwest will form your llc for $39 (60% discount). Web arkansas limited liability company franchise tax report make checks payable to arkansas secretary of state mail to:

Web To Pay By Mail, Download The Annual Franchise Tax Pdf Form.

Send your report and payment to the arkansas secretary of state. Web complete your tax report online or download a paper form. Web department of finance and administration franchise tax section p.o. Web arkansas has a state income tax that ranges between 2% and 6.6%.