Virginia W2 Form

Virginia W2 Form - Web if the value of your basic group life insurance is more than $50,000, the cost of the amount over $50,000 is subject to income and fica taxes. The virginia department of revenue mandates the filing of w2 forms only if there is state tax withholding. Web home | virginia tax Employing agency and applicants must complete parts a, b, d, e, f on both sides of this application a. Total va tax withheld 6c. Available 24 hours a day, seven days a week. Total virginia state tax withheld: Web january 19, 2011 — want to get your tax refund sooner? Web w2 exemption form revised 5 04 note: Taxbandits supports the filing of.

Taxbandits supports the filing of. Available 24 hours a day, seven days a week. Total va tax withheld 6c. Employing agency and applicants must complete parts a, b, d, e, f on both sides of this application a. Web w2 exemption form revised 5 04 note: Total virginia state tax withheld: Web january 19, 2011 — want to get your tax refund sooner? Web home | virginia tax Web if the value of your basic group life insurance is more than $50,000, the cost of the amount over $50,000 is subject to income and fica taxes. The virginia department of revenue mandates the filing of w2 forms only if there is state tax withholding.

Web if the value of your basic group life insurance is more than $50,000, the cost of the amount over $50,000 is subject to income and fica taxes. The virginia department of revenue mandates the filing of w2 forms only if there is state tax withholding. Total va tax withheld 6c. Available 24 hours a day, seven days a week. Web january 19, 2011 — want to get your tax refund sooner? Total virginia state tax withheld: Web home | virginia tax Web w2 exemption form revised 5 04 note: Employing agency and applicants must complete parts a, b, d, e, f on both sides of this application a. Taxbandits supports the filing of.

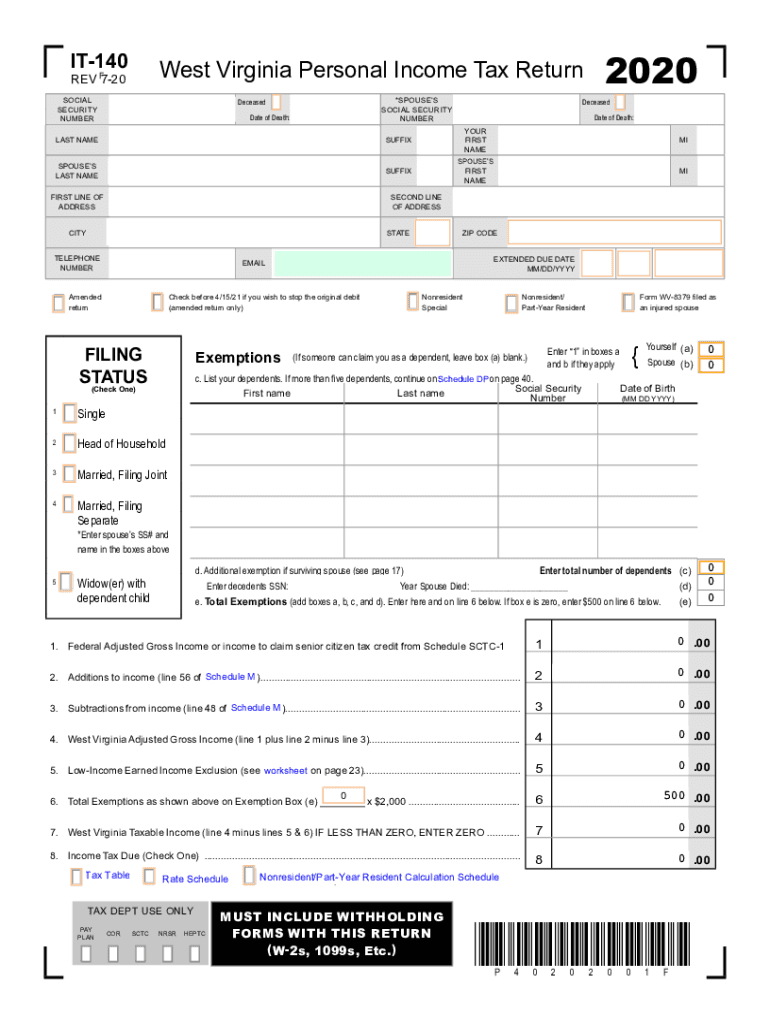

It140 Fill Out and Sign Printable PDF Template signNow

Web home | virginia tax Web january 19, 2011 — want to get your tax refund sooner? Total virginia state tax withheld: Employing agency and applicants must complete parts a, b, d, e, f on both sides of this application a. The virginia department of revenue mandates the filing of w2 forms only if there is state tax withholding.

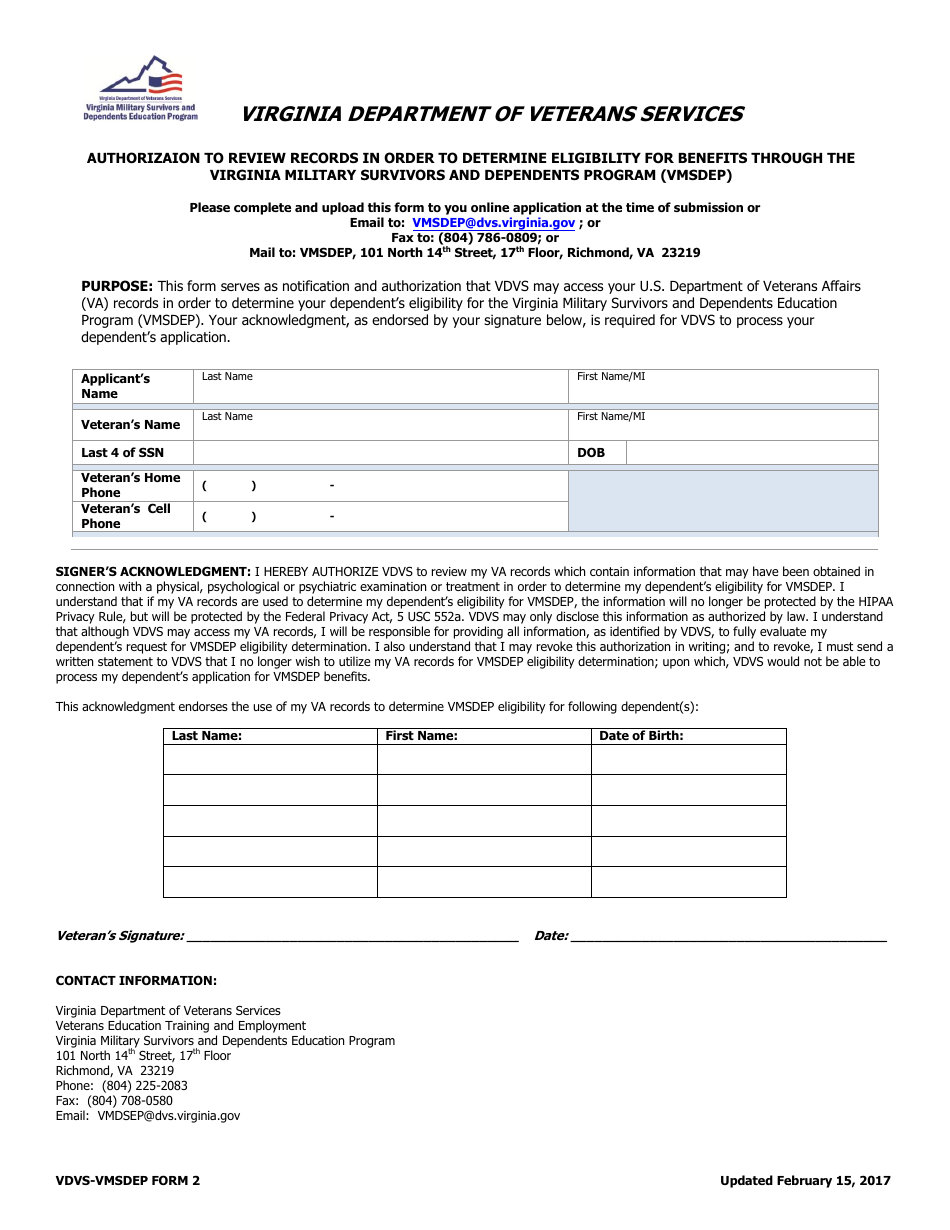

Form 2 Download Printable PDF or Fill Online Authorizaion to Review

Taxbandits supports the filing of. Web january 19, 2011 — want to get your tax refund sooner? Total virginia state tax withheld: Web if the value of your basic group life insurance is more than $50,000, the cost of the amount over $50,000 is subject to income and fica taxes. Total va tax withheld 6c.

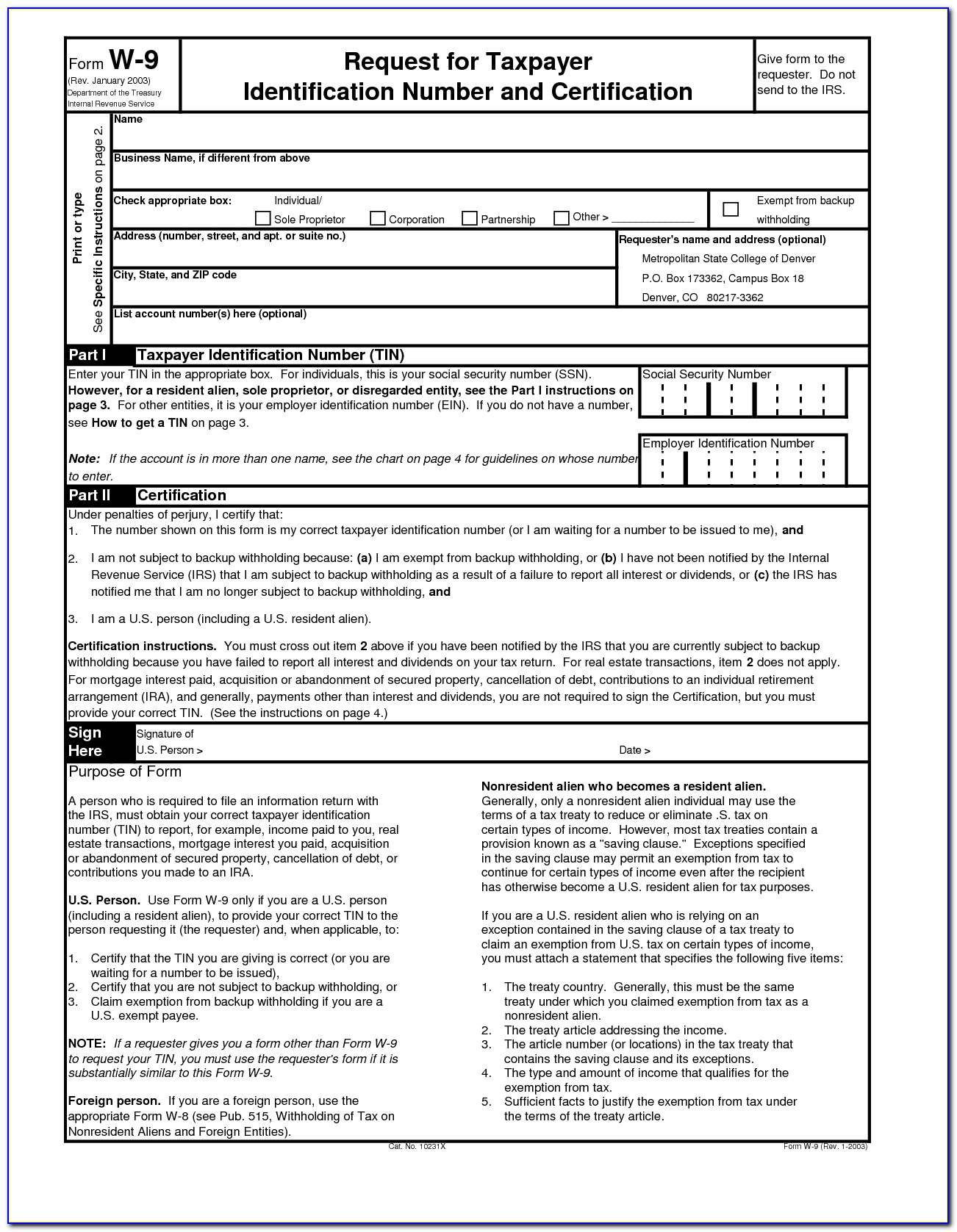

W9 Form Va Understanding The Background Of W9 Form Va AH STUDIO Blog

The virginia department of revenue mandates the filing of w2 forms only if there is state tax withholding. Available 24 hours a day, seven days a week. Web w2 exemption form revised 5 04 note: Web january 19, 2011 — want to get your tax refund sooner? Total va tax withheld 6c.

W7 Form Download 7 What Makes W7 Form Download 7 So Addictive That You

Web w2 exemption form revised 5 04 note: The virginia department of revenue mandates the filing of w2 forms only if there is state tax withholding. Web if the value of your basic group life insurance is more than $50,000, the cost of the amount over $50,000 is subject to income and fica taxes. Web january 19, 2011 — want.

W 9 Form For 2020 Printable Example Calendar Printable

The virginia department of revenue mandates the filing of w2 forms only if there is state tax withholding. Web home | virginia tax Employing agency and applicants must complete parts a, b, d, e, f on both sides of this application a. Total va tax withheld 6c. Web january 19, 2011 — want to get your tax refund sooner?

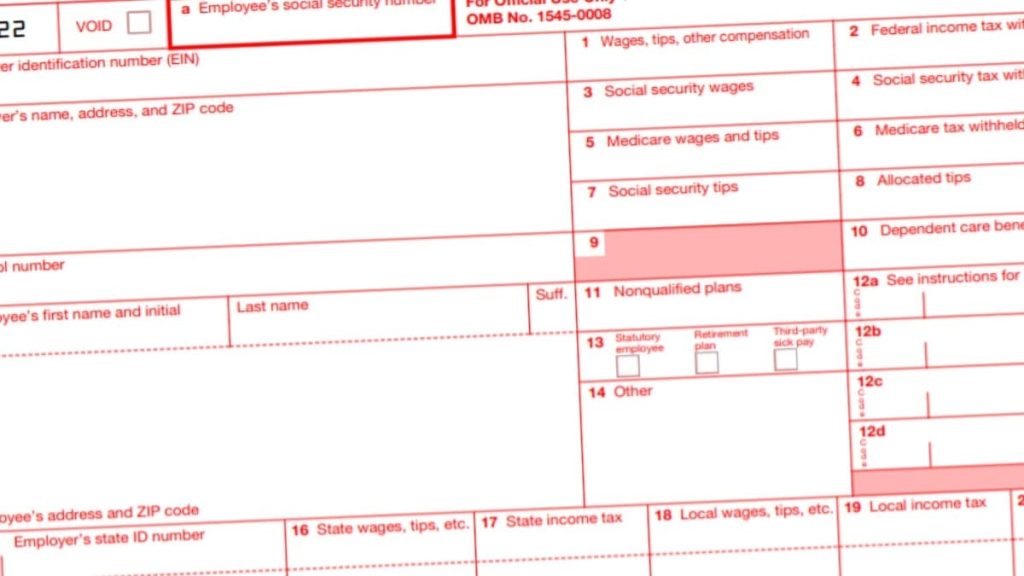

W2 State Withholding Universal Network

Web if the value of your basic group life insurance is more than $50,000, the cost of the amount over $50,000 is subject to income and fica taxes. The virginia department of revenue mandates the filing of w2 forms only if there is state tax withholding. Total va tax withheld 6c. Available 24 hours a day, seven days a week..

Exact W2 Form Printable Blank PDF Online

Total virginia state tax withheld: The virginia department of revenue mandates the filing of w2 forms only if there is state tax withholding. Web w2 exemption form revised 5 04 note: Employing agency and applicants must complete parts a, b, d, e, f on both sides of this application a. Total va tax withheld 6c.

W2 Form 2022 Fillable Form 2023

Taxbandits supports the filing of. Web january 19, 2011 — want to get your tax refund sooner? Employing agency and applicants must complete parts a, b, d, e, f on both sides of this application a. The virginia department of revenue mandates the filing of w2 forms only if there is state tax withholding. Web if the value of your.

Virginia Unemployment W2 Forms Universal Network

Employing agency and applicants must complete parts a, b, d, e, f on both sides of this application a. Web home | virginia tax Web w2 exemption form revised 5 04 note: Web january 19, 2011 — want to get your tax refund sooner? Total virginia state tax withheld:

W2 Form 2020 Online Print and Download Stubcheck

Employing agency and applicants must complete parts a, b, d, e, f on both sides of this application a. Total virginia state tax withheld: Web if the value of your basic group life insurance is more than $50,000, the cost of the amount over $50,000 is subject to income and fica taxes. Web w2 exemption form revised 5 04 note:.

Total Virginia State Tax Withheld:

Web w2 exemption form revised 5 04 note: Web january 19, 2011 — want to get your tax refund sooner? The virginia department of revenue mandates the filing of w2 forms only if there is state tax withholding. Available 24 hours a day, seven days a week.

Employing Agency And Applicants Must Complete Parts A, B, D, E, F On Both Sides Of This Application A.

Total va tax withheld 6c. Web home | virginia tax Taxbandits supports the filing of. Web if the value of your basic group life insurance is more than $50,000, the cost of the amount over $50,000 is subject to income and fica taxes.