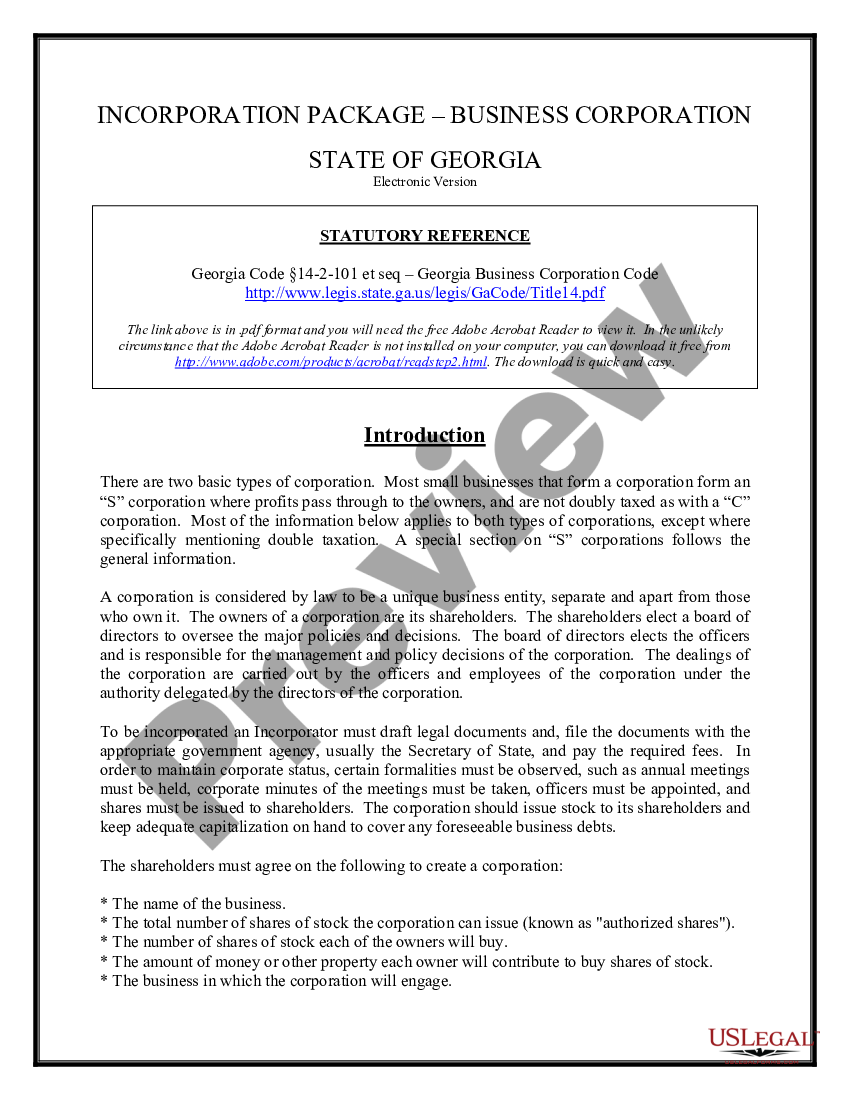

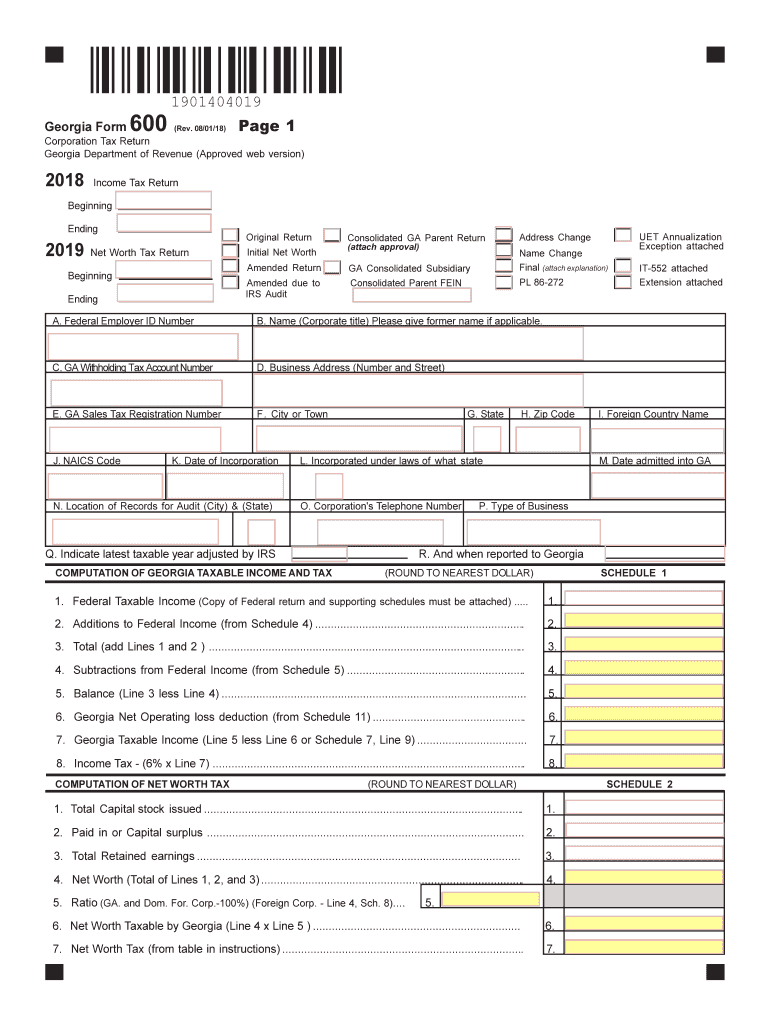

Georgia Form 600 Instructions

Georgia Form 600 Instructions - Corporation income tax general instructions booklet. Web department of revenue 2022 corporation income tax general instructions file form 600 and pay the tax electronically. Georgia taxable income (line 5 less line 6 or schedule 7, line 9). Complete, save and print the form online using your browser. Due dates for partnership returns partnership returns are due on or before the 15th day of the 3rd month following the close of the taxable year. Kemp governor electronic filing the georgia department of revenue accepts visa, american Web georgia form 600 (rev. 2022 it611 corporate income tax instruction booklet (871.18 kb) 2021 it611 corporate income tax instruction booklet (587.11 kb) 2020 it611 corporate income tax instruction booklet (2.63 mb) 2019 it611 corporate income tax instruction booklet. If direct deposit is not selected, a paper check will be issued. Visit our website dor.georgia.gov for more information.

Web georgia form 600 (rev. To successfully complete the form, you must download and use the current version of adobe acrobat reader. Web georgia individual income tax returns must be received or postmarked by the april 18, 2023 due date. Accounts only) see booklet for further instructions. It also provides for the imposition of a net worth tax. Visit our website dor.georgia.gov for more information. Georgia ratio (divide line 3a by 3b). 2022 it611 corporate income tax instruction booklet (871.18 kb) 2021 it611 corporate income tax instruction booklet (587.11 kb) 2020 it611 corporate income tax instruction booklet (2.63 mb) 2019 it611 corporate income tax instruction booklet. Georgia individual income tax is based on the taxpayer's federal adjusted gross income, adjustments that are required by georgia law, and the taxpayers filing requirements. Due dates for partnership returns partnership returns are due on or before the 15th day of the 3rd month following the close of the taxable year.

Due dates for partnership returns partnership returns are due on or before the 15th day of the 3rd month following the close of the taxable year. Direct deposit options (for u.s. Web georgia form 600 (rev. Visit our website dor.georgia.gov for more information. Checking number account number savings routing Georgia individual income tax is based on the taxpayer's federal adjusted gross income, adjustments that are required by georgia law, and the taxpayers filing requirements. Web department of revenue 2022 corporation income tax general instructions file form 600 and pay the tax electronically. 06/20/19) page 1 corporation tax return georgia department of revenue (approved web version) 2019 income tax return beginning ending original return consolidated ga parent return (attach approval). If direct deposit is not selected, a paper check will be issued. 2022 it611 corporate income tax instruction booklet (871.18 kb) 2021 it611 corporate income tax instruction booklet (587.11 kb) 2020 it611 corporate income tax instruction booklet (2.63 mb) 2019 it611 corporate income tax instruction booklet.

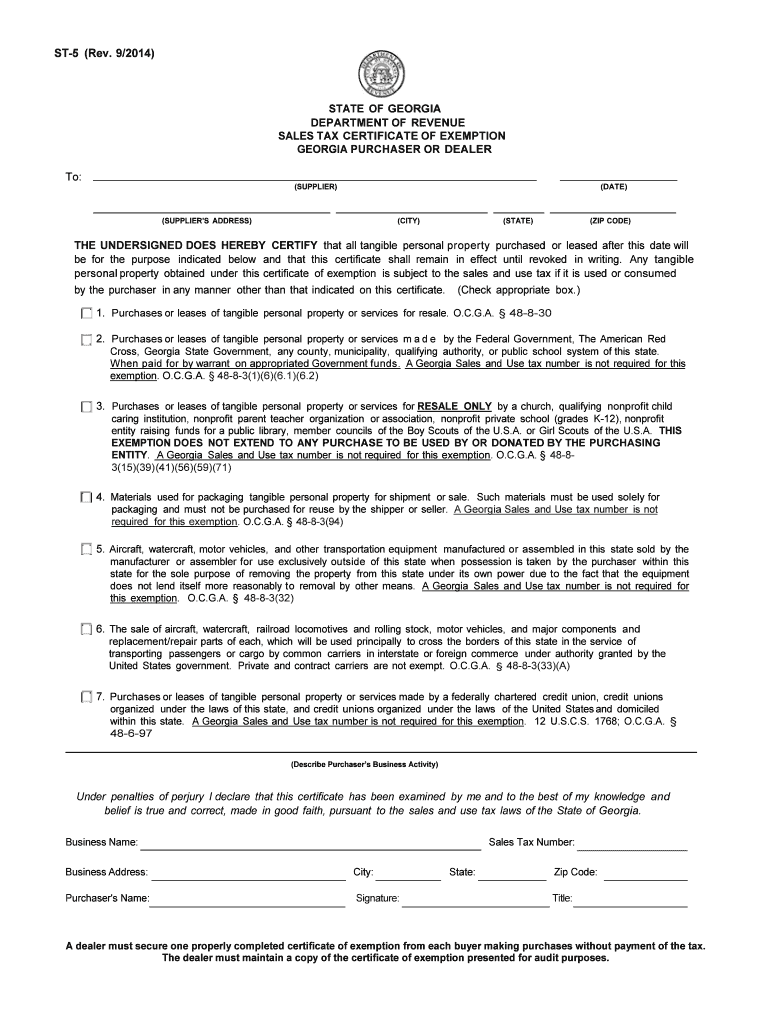

2014 Form GA DoR ST5 Fill Online, Printable, Fillable, Blank PDFfiller

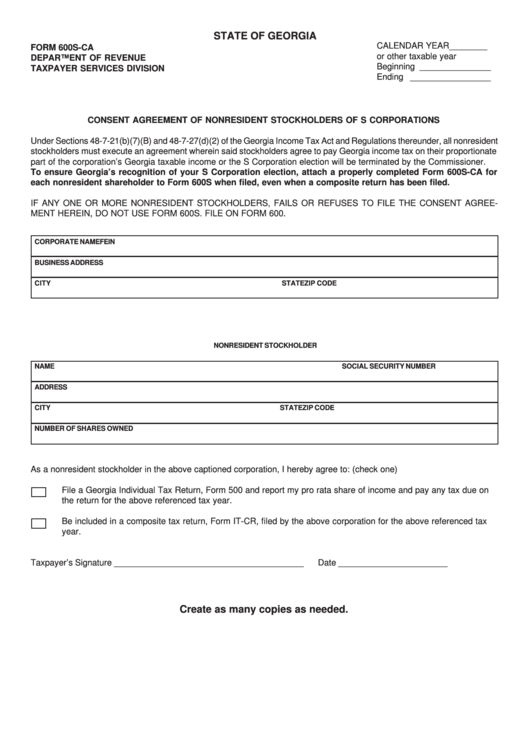

It also provides for the imposition of a net worth tax. Checking number account number savings routing Web georgia law recognizes an election to file as an s corporation under the provisions of the i.r.c. Visit our website dor.georgia.gov for more information. Kemp governor electronic filing the georgia department of revenue accepts visa, american

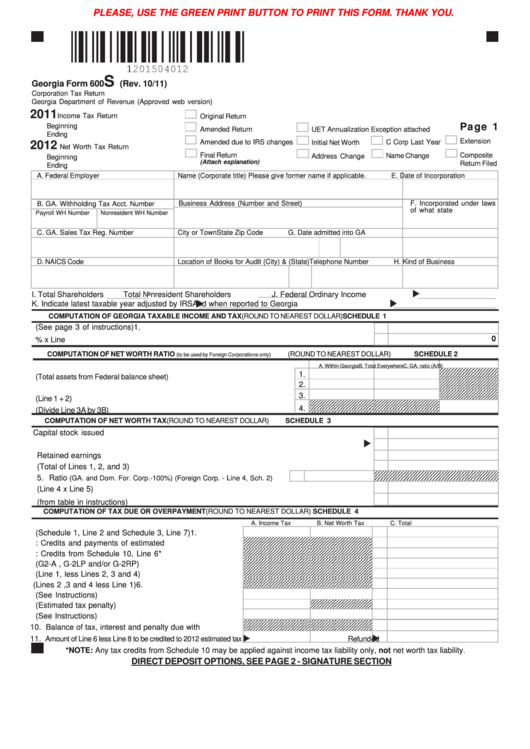

Fillable Form 600s Corporation Tax Return printable pdf download

Checking number account number savings routing It also provides for the imposition of a net worth tax. Web georgia law recognizes an election to file as an s corporation under the provisions of the i.r.c. Corporation income tax general instructions booklet. Web department of revenue 2022 corporation income tax general instructions file form 600 and pay the tax electronically.

6 600 Forms And Templates free to download in PDF

Georgia ratio (divide line 3a by 3b). Web georgia individual income tax returns must be received or postmarked by the april 18, 2023 due date. 06/20/19) page 1 corporation tax return georgia department of revenue (approved web version) 2019 income tax return beginning ending original return consolidated ga parent return (attach approval). Credit card payments it 611 rev. Web georgia.

Corporation Form 600 Instructions

Georgia individual income tax is based on the taxpayer's federal adjusted gross income, adjustments that are required by georgia law, and the taxpayers filing requirements. Complete, save and print the form online using your browser. 2022 it611 corporate income tax instruction booklet (871.18 kb) 2021 it611 corporate income tax instruction booklet (587.11 kb) 2020 it611 corporate income tax instruction booklet.

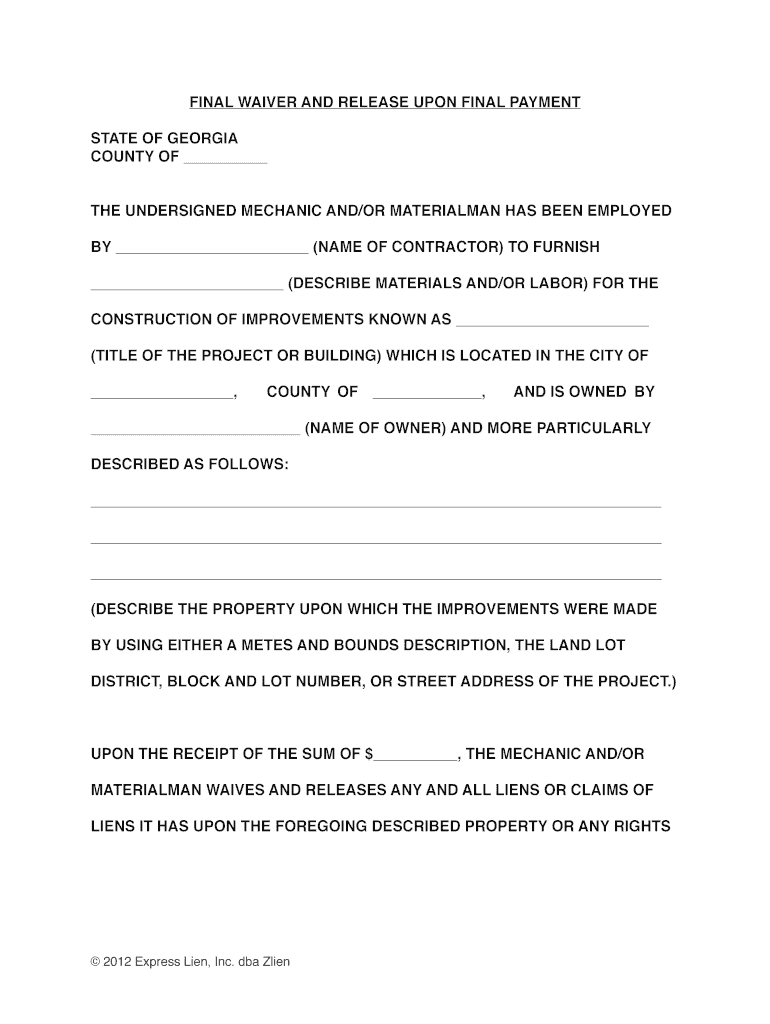

Lien Waiver Form 2021 Fill Out and Sign Printable PDF

If direct deposit is not selected, a paper check will be issued. Complete, save and print the form online using your browser. Georgia individual income tax is based on the taxpayer's federal adjusted gross income, adjustments that are required by georgia law, and the taxpayers filing requirements. Georgia taxable income (line 5 less line 6 or schedule 7, line 9)..

2005 Form GA DoR 600S Fill Online, Printable, Fillable, Blank pdfFiller

Corporation income tax general instructions booklet. Georgia individual income tax is based on the taxpayer's federal adjusted gross income, adjustments that are required by georgia law, and the taxpayers filing requirements. Complete, save and print the form online using your browser. Credit card payments it 611 rev. Checking number account number savings routing

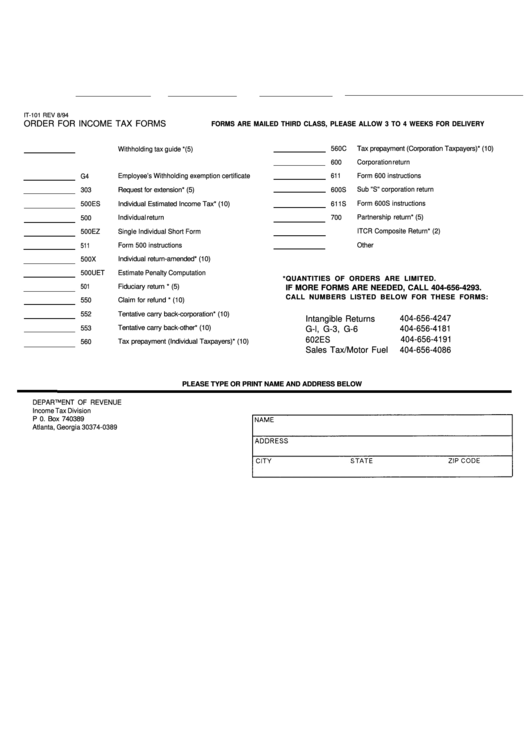

Form It101 Order For Tax Forms printable pdf download

Web georgia form 600 (rev. Complete, save and print the form online using your browser. Kemp governor electronic filing the georgia department of revenue accepts visa, american Web georgia individual income tax returns must be received or postmarked by the april 18, 2023 due date. Due dates for partnership returns partnership returns are due on or before the 15th day.

2+ Offer to Purchase Real Estate Form Free Download

2022 it611 corporate income tax instruction booklet (871.18 kb) 2021 it611 corporate income tax instruction booklet (587.11 kb) 2020 it611 corporate income tax instruction booklet (2.63 mb) 2019 it611 corporate income tax instruction booklet. Direct deposit options (for u.s. Georgia taxable income (line 5 less line 6 or schedule 7, line 9). If direct deposit is not selected, a paper.

GSA SF 600 1984 Fill and Sign Printable Template Online US Legal Forms

06/20/19) page 1 corporation tax return georgia department of revenue (approved web version) 2019 income tax return beginning ending original return consolidated ga parent return (attach approval). It also provides for the imposition of a net worth tax. To successfully complete the form, you must download and use the current version of adobe acrobat reader. Accounts only) see booklet for.

2018 Form GA DoR 600 Fill Online, Printable, Fillable, Blank pdfFiller

Web georgia individual income tax returns must be received or postmarked by the april 18, 2023 due date. Corporation income tax general instructions booklet. 06/20/19) page 1 corporation tax return georgia department of revenue (approved web version) 2019 income tax return beginning ending original return consolidated ga parent return (attach approval). Due dates for partnership returns partnership returns are due.

Corporation Income Tax General Instructions Booklet.

Credit card payments it 611 rev. To successfully complete the form, you must download and use the current version of adobe acrobat reader. Checking number account number savings routing Georgia ratio (divide line 3a by 3b).

2022 It611 Corporate Income Tax Instruction Booklet (871.18 Kb) 2021 It611 Corporate Income Tax Instruction Booklet (587.11 Kb) 2020 It611 Corporate Income Tax Instruction Booklet (2.63 Mb) 2019 It611 Corporate Income Tax Instruction Booklet.

Complete, save and print the form online using your browser. Accounts only) see booklet for further instructions. Direct deposit options (for u.s. Web georgia individual income tax returns must be received or postmarked by the april 18, 2023 due date.

Visit Our Website Dor.georgia.gov For More Information.

Georgia taxable income (line 5 less line 6 or schedule 7, line 9). 06/20/19) page 1 corporation tax return georgia department of revenue (approved web version) 2019 income tax return beginning ending original return consolidated ga parent return (attach approval). Kemp governor electronic filing the georgia department of revenue accepts visa, american Due dates for partnership returns partnership returns are due on or before the 15th day of the 3rd month following the close of the taxable year.

Web Georgia Form 600 (Rev.

It also provides for the imposition of a net worth tax. If direct deposit is not selected, a paper check will be issued. Web corporate income and net worth tax returns (form 600) must be filed on or before the 15th day of the 4th month. Web department of revenue 2022 corporation income tax general instructions file form 600 and pay the tax electronically.