Va Form 500 Instructions 2021

Va Form 500 Instructions 2021 - Web certain virginia corporations, with 100% of their business in virginia and federal taxable income of $40,000 or less for the taxable year, may qualify to electronically file a short version of the return (eform 500ez) for free using eforms. Web form & instructions for virginia consumer's use tax return for individuals (use for purchases made on and after july 1, 2023) 762. If tax is due, you can pay using your bank account information. Web instructions for 2021 form 500c underpayment of virginia estimated tax by corporations purpose of form form 500c is used by corporations to determine whether they paid enough estimated tax, whether they are subject to the addition to the tax for underpayment of estimated tax, and, if so, the amount of the addition. Do not file this form to carry back a net operating loss. Web 2021 instructions for schedule 500a corporation allocation and apportionment of income general allocation and apportionment of income a corporation having income from business activity which is taxable both within and without virginia must allocate and apportion its virginia taxable income as provided in va. Official use only fein name. Use this form only if you have an approved waiver. The pdf will download to your downloads folder. Return must be filed electronically.

Web instructions for 2021 form 500c underpayment of virginia estimated tax by corporations purpose of form form 500c is used by corporations to determine whether they paid enough estimated tax, whether they are subject to the addition to the tax for underpayment of estimated tax, and, if so, the amount of the addition. Web click the download va form link for the form you want to fill out. The pdf will download to your downloads folder. Web we last updated the corporate income tax return in january 2023, so this is the latest version of form 500, fully updated for tax year 2022. Official use only fein name. Web 2021 instructions for schedule 500a corporation allocation and apportionment of income general allocation and apportionment of income a corporation having income from business activity which is taxable both within and without virginia must allocate and apportion its virginia taxable income as provided in va. Web general information complete schedule 500cr if you are claiming one or more of the credits listed in the table of contents above. Do not file this form to carry back a net operating loss. Web form & instructions for virginia consumer's use tax return for individuals (use for purchases made on and after july 1, 2023) 762. Use this form only if you have an approved waiver.

Web general information complete schedule 500cr if you are claiming one or more of the credits listed in the table of contents above. If tax is due, you can pay using your bank account information. Official use only fein name. Web 2021 instructions for schedule 500a corporation allocation and apportionment of income general allocation and apportionment of income a corporation having income from business activity which is taxable both within and without virginia must allocate and apportion its virginia taxable income as provided in va. Credits marked with an asterisk (*) require supporting documentation with the return in order to claim the credit. Web form & instructions for virginia consumer's use tax return for individuals (use for purchases made on and after july 1, 2023) 762. Web click the download va form link for the form you want to fill out. Web certain virginia corporations, with 100% of their business in virginia and federal taxable income of $40,000 or less for the taxable year, may qualify to electronically file a short version of the return (eform 500ez) for free using eforms. You can save it to a different folder if you'd like. Web instructions for 2021 form 500c underpayment of virginia estimated tax by corporations purpose of form form 500c is used by corporations to determine whether they paid enough estimated tax, whether they are subject to the addition to the tax for underpayment of estimated tax, and, if so, the amount of the addition.

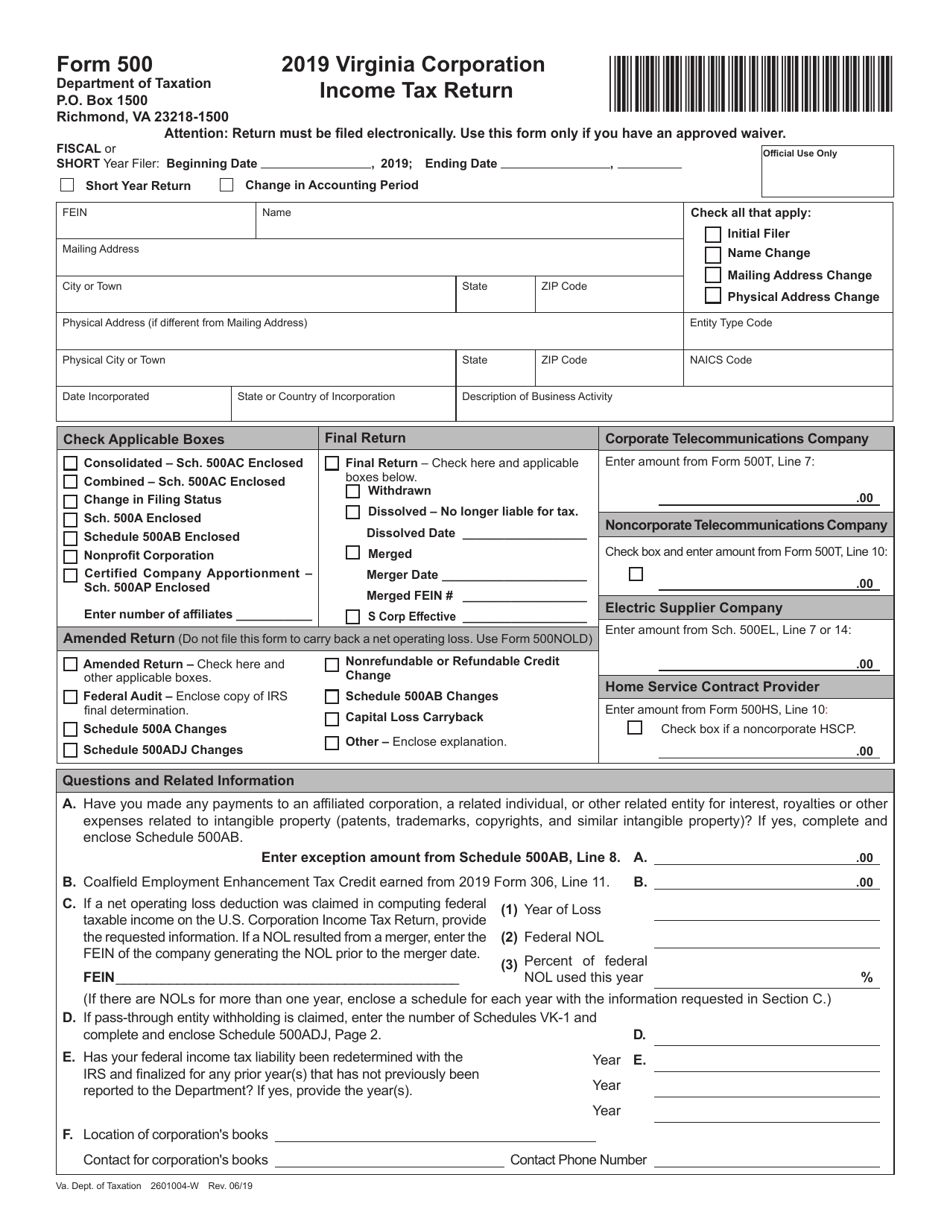

Form 500 Download Fillable PDF or Fill Online Virginia Corporation

Web click the download va form link for the form you want to fill out. Web general information complete schedule 500cr if you are claiming one or more of the credits listed in the table of contents above. Web for taxable years beginning on and after january 1, 2021, the annual caps for the research and development and major research.

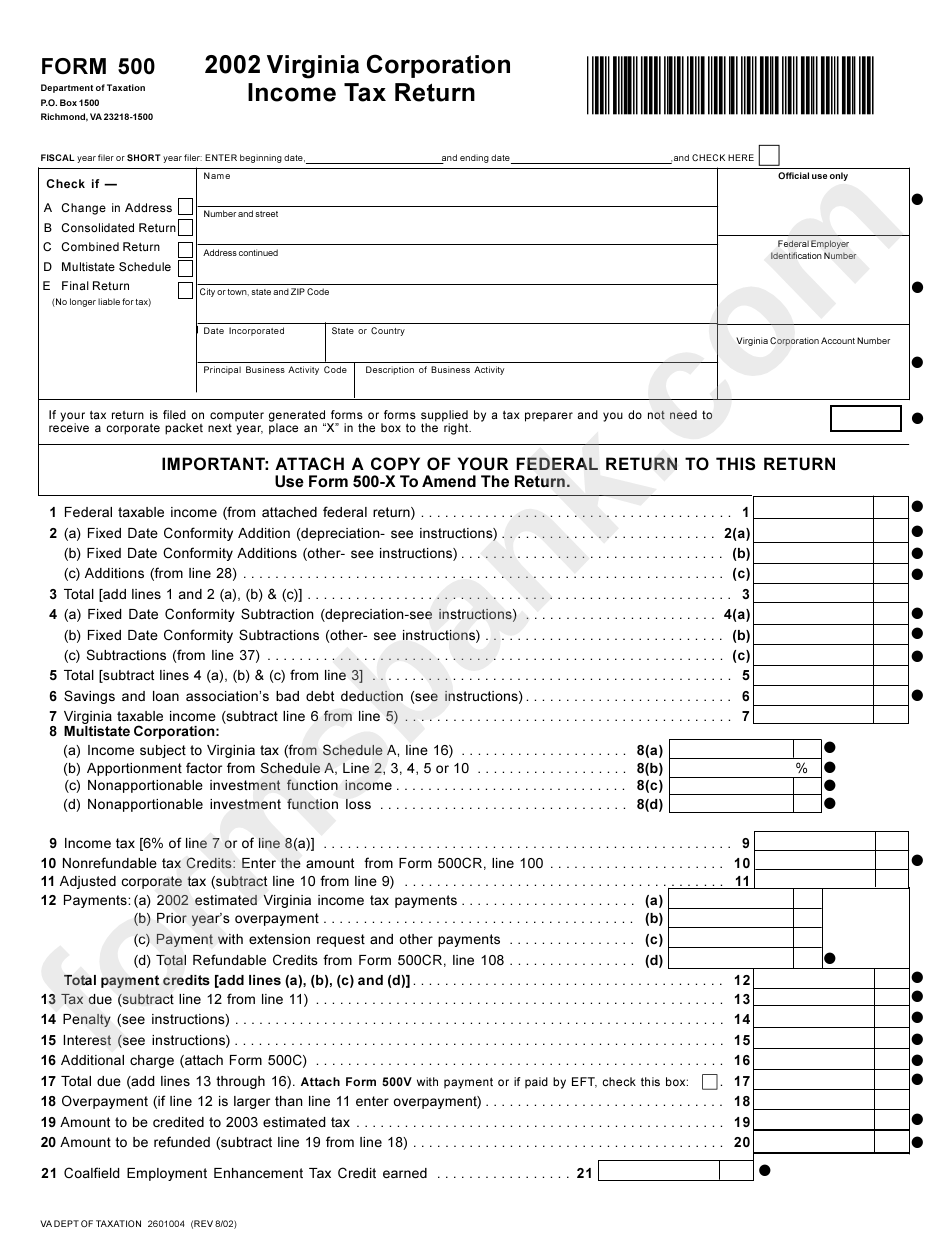

Form 500 Virginia Corporation Tax Return 2002 printable pdf

Web click the download va form link for the form you want to fill out. Official use only fein name. The pdf will download to your downloads folder. Web for taxable years beginning on and after january 1, 2021, the annual caps for the research and development and major research and development tax credits have increased. Web 2021 instructions for.

2019 Form GA DoR 500NOL Fill Online, Printable, Fillable, Blank

Web 2021 instructions for schedule 500a corporation allocation and apportionment of income general allocation and apportionment of income a corporation having income from business activity which is taxable both within and without virginia must allocate and apportion its virginia taxable income as provided in va. Web for taxable years beginning on and after january 1, 2021, the annual caps for.

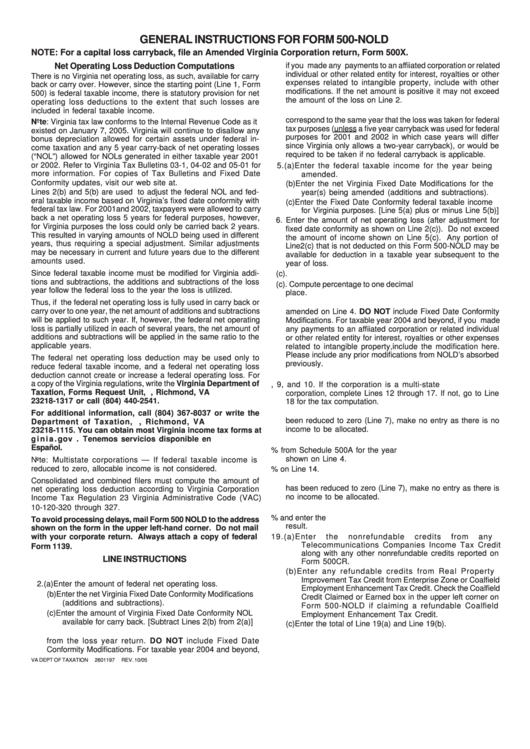

General Instructions For Form 500Nold printable pdf download

Web for taxable years beginning on and after january 1, 2021, the annual caps for the research and development and major research and development tax credits have increased. If tax is due, you can pay using your bank account information. The pdf will download to your downloads folder. Official use only fein name. Request your military records, including dd214

2019 Form VA DoT 763 Fill Online, Printable, Fillable, Blank pdfFiller

Web instructions for 2021 form 500c underpayment of virginia estimated tax by corporations purpose of form form 500c is used by corporations to determine whether they paid enough estimated tax, whether they are subject to the addition to the tax for underpayment of estimated tax, and, if so, the amount of the addition. Web form & instructions for virginia consumer's.

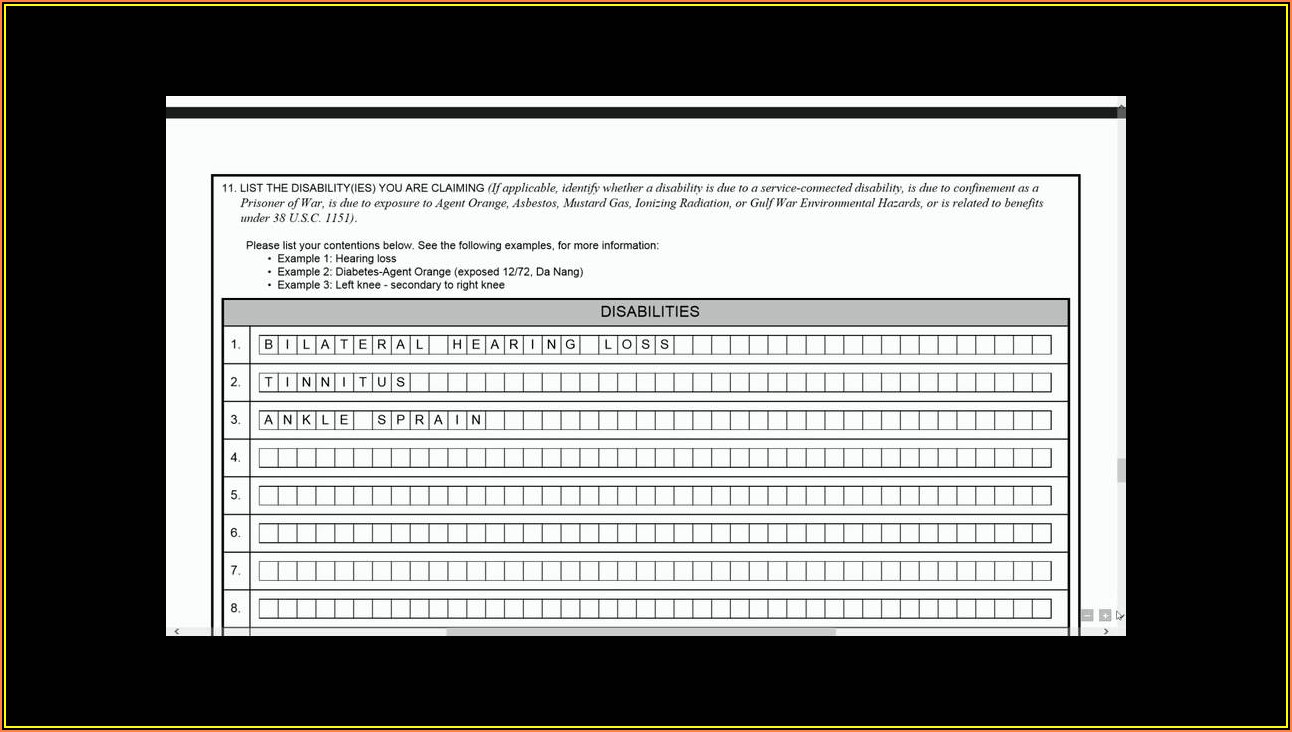

Va Form 21 4138 Instructions Form Resume Examples GM9Ow6k9DL

Official use only fein name. Web form & instructions for virginia consumer's use tax return for individuals (use for purchases made on and after july 1, 2023) 762. Credits marked with an asterisk (*) require supporting documentation with the return in order to claim the credit. Do not file this form to carry back a net operating loss. Return must.

20152021 Form VA 210958 Fill Online, Printable, Fillable, Blank

Return must be filed electronically. Use this form only if you have an approved waiver. Web click the download va form link for the form you want to fill out. Web 2021 instructions for schedule 500a corporation allocation and apportionment of income general allocation and apportionment of income a corporation having income from business activity which is taxable both within.

20172022 Form VA 21P530 Fill Online, Printable, Fillable, Blank

Credits marked with an asterisk (*) require supporting documentation with the return in order to claim the credit. Official use only fein name. Web find out how to change your address and other contact information in your va.gov profile for disability compensation, claims and appeals, va health care, and other benefits. Web certain virginia corporations, with 100% of their business.

Va Form 10 583 20202021 Fill and Sign Printable Template Online US

Web click the download va form link for the form you want to fill out. Use this form only if you have an approved waiver. Official use only fein name. Web general information complete schedule 500cr if you are claiming one or more of the credits listed in the table of contents above. Do not file this form to carry.

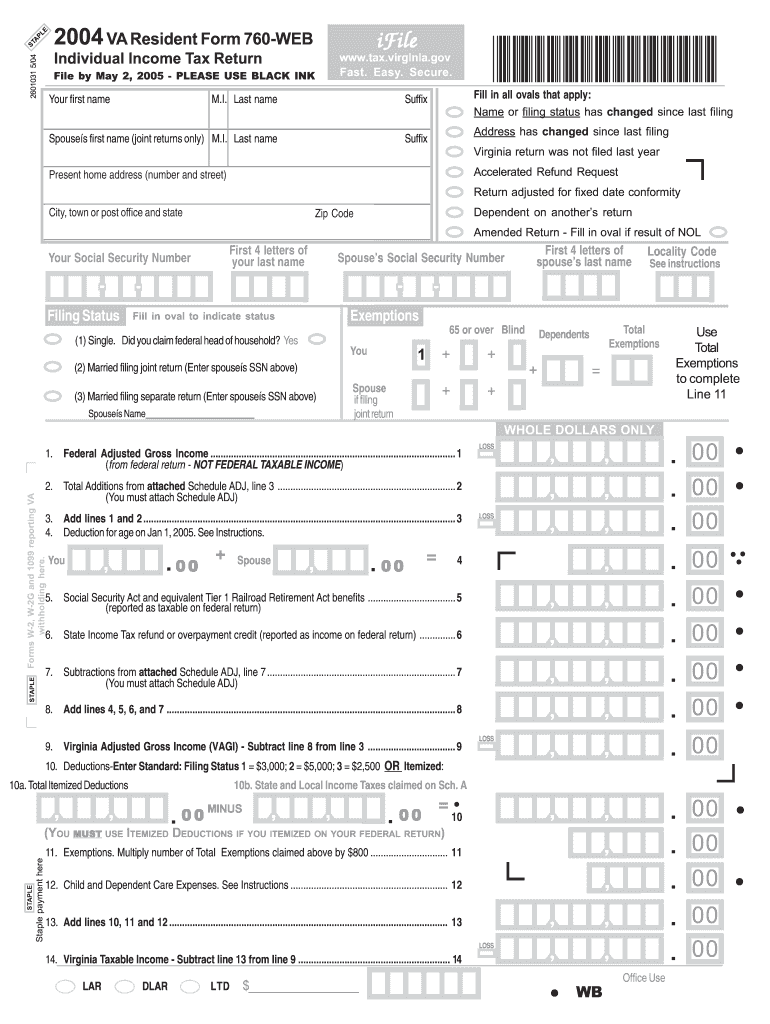

VA DoT 760 2004 Fill out Tax Template Online US Legal Forms

Web general information complete schedule 500cr if you are claiming one or more of the credits listed in the table of contents above. Official use only fein name. Request your military records, including dd214 The pdf will download to your downloads folder. Use this form only if you have an approved waiver.

Web For Taxable Years Beginning On And After January 1, 2021, The Annual Caps For The Research And Development And Major Research And Development Tax Credits Have Increased.

Web we last updated the corporate income tax return in january 2023, so this is the latest version of form 500, fully updated for tax year 2022. Request your military records, including dd214 Return must be filed electronically. If tax is due, you can pay using your bank account information.

You Can Save It To A Different Folder If You'd Like.

The research and development tax credit limit increased from. Web click the download va form link for the form you want to fill out. Use this form only if you have an approved waiver. Credits marked with an asterisk (*) require supporting documentation with the return in order to claim the credit.

Web 2021 Virginia Corporation *Vacorp121888* Income Tax Return Form 500 Virginia Department Of Taxation P.o.

Web find out how to change your address and other contact information in your va.gov profile for disability compensation, claims and appeals, va health care, and other benefits. The pdf will download to your downloads folder. Official use only fein name. Web certain virginia corporations, with 100% of their business in virginia and federal taxable income of $40,000 or less for the taxable year, may qualify to electronically file a short version of the return (eform 500ez) for free using eforms.

Web Form & Instructions For Virginia Consumer's Use Tax Return For Individuals (Use For Purchases Made On And After July 1, 2023) 762.

Web general information complete schedule 500cr if you are claiming one or more of the credits listed in the table of contents above. Web 2021 instructions for schedule 500a corporation allocation and apportionment of income general allocation and apportionment of income a corporation having income from business activity which is taxable both within and without virginia must allocate and apportion its virginia taxable income as provided in va. Do not file this form to carry back a net operating loss. Web instructions for 2021 form 500c underpayment of virginia estimated tax by corporations purpose of form form 500c is used by corporations to determine whether they paid enough estimated tax, whether they are subject to the addition to the tax for underpayment of estimated tax, and, if so, the amount of the addition.