Form 941-X Employee Retention Credit

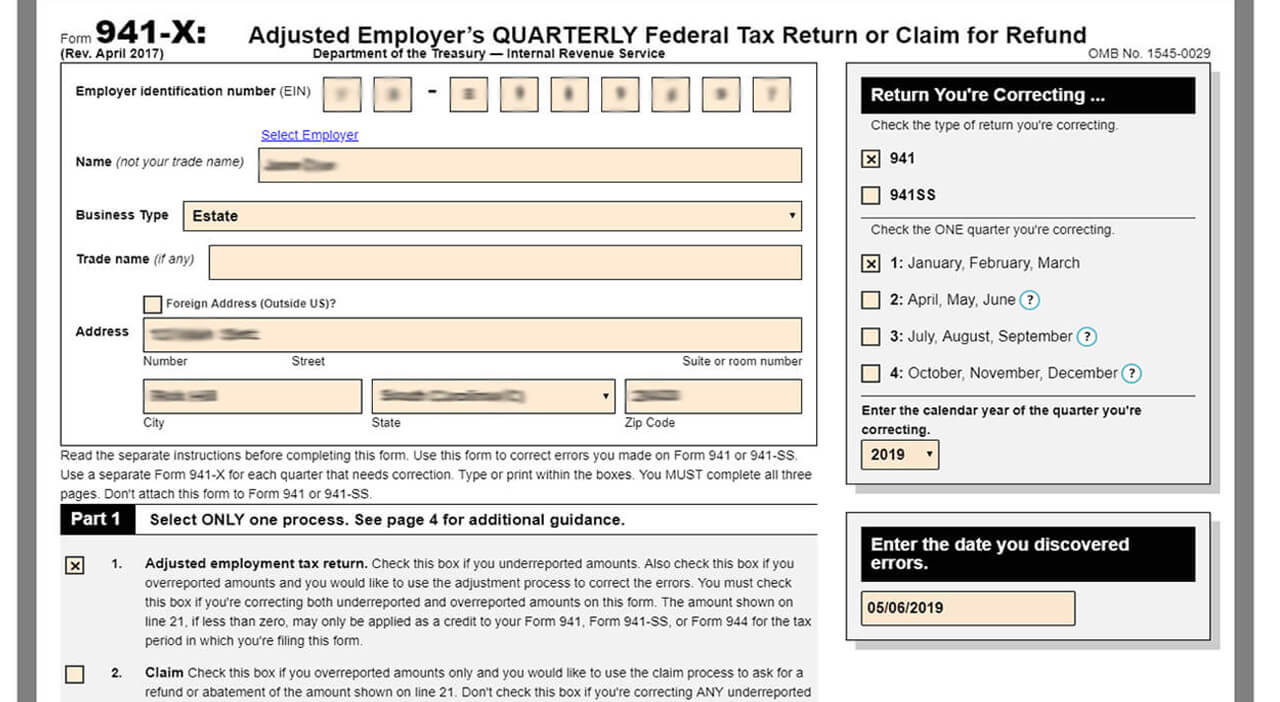

Form 941-X Employee Retention Credit - Mark whether the form is for an adjusted employment tax return or claim (you can only check off one). Web you have two options to file: Ad unsure if you qualify for erc? Ad get a payroll tax refund & receive up to $26k per employee even if you received ppp funds. Qualified health plan expenses allocable to the employee retention credit. Web once you have the form, follow these steps: If you believe your company is eligible to receive the employee. Gather your 941, payroll log,. If you claimed the employee retention credit for wages paid after june 30, 2021, and before january 1, 2022, and you make any. Many people do not know.

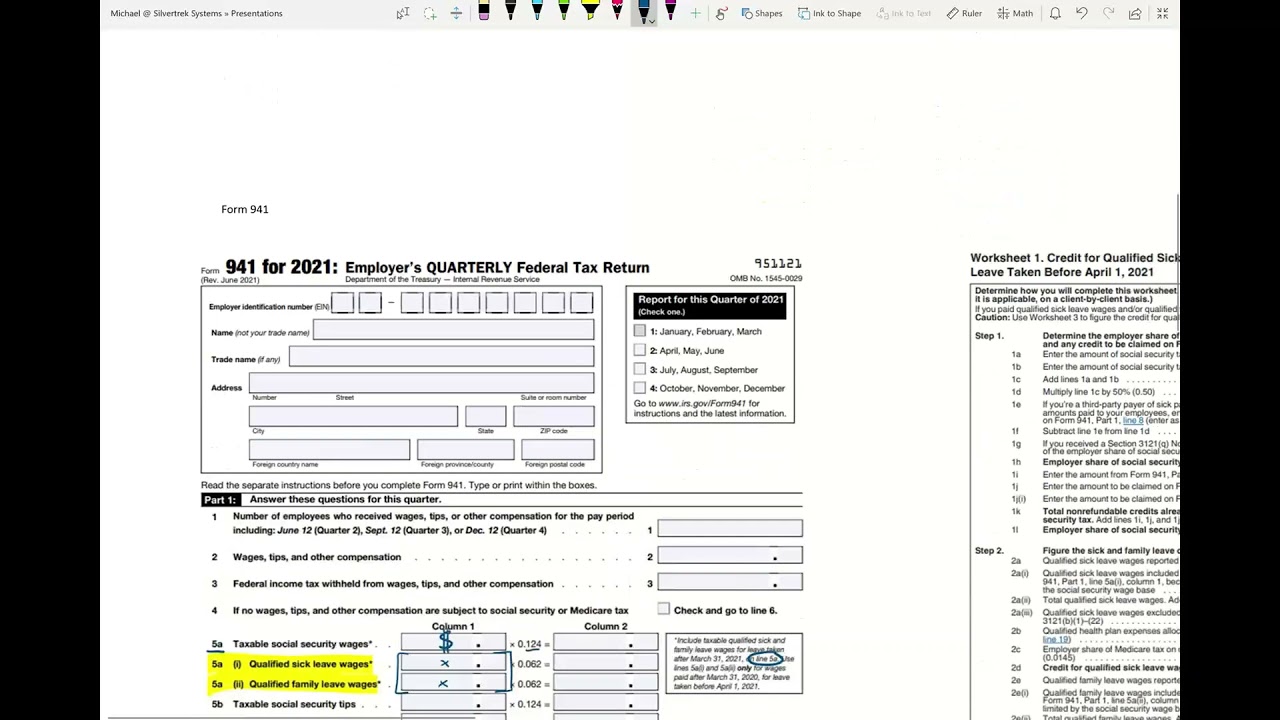

Web irs form 941 is the form you regularly file quarterly with your payroll. Many people do not know. Gather your 941, payroll log,. Mark whether the form is for an adjusted employment tax return or claim (you can only check off one). Web consequently, most employers will need to instead file an amended return or claim for refund for the quarters ended in june, september and december of 2020 using. Qualified health plan expenses allocable to the employee retention credit. Qualified health plan expenses allocable to the employee retention credit are. To complete the form, you’ll need to. “the irs claims to have doubled the amount of employee. Irs commissioner danny werfel is calling for a potential early end to the employee retention credit as the number of what he called “legitimate.

Gather your 941, payroll log,. Web irs form 941 is the form you regularly file quarterly with your payroll. Work with an experienced professional. Web 2 days agothe employee retention credit, or erc,. You will use worksheet 2 to make changes to the refundable portion of the employee tax credit that. Web 2 days agojul 31, 2023. Web using worksheet 2 to update form 941x: “the irs claims to have doubled the amount of employee. To complete the form, you’ll need to. Web you have two options to file:

Employee Retention Credit (ERC) Form 941X Everything You Need to Know

If you believe your company is eligible to receive the employee. Web 2 days agothe employee retention credit, or erc,. Didn’t get requested ppp loan forgiveness? If you claimed the employee retention credit for wages paid after june 30, 2021, and before january 1, 2022, and you make any. Gather your 941, payroll log,.

How to Claim ERTC Retroactive Employee Retention Tax Credit [Form 941

Web consequently, most employers will need to instead file an amended return or claim for refund for the quarters ended in june, september and december of 2020 using. “the irs claims to have doubled the amount of employee. Web once you have the form, follow these steps: Gather your 941, payroll log,. To claim the employee retention credit, utilize line.

COVID19 Relief Legislation Expands Employee Retention Credit

If you believe your company is eligible to receive the employee. Web once you have the form, follow these steps: “the irs claims to have doubled the amount of employee. Ad stentam is the nations leading tax technology firm. To complete the form, you’ll need to.

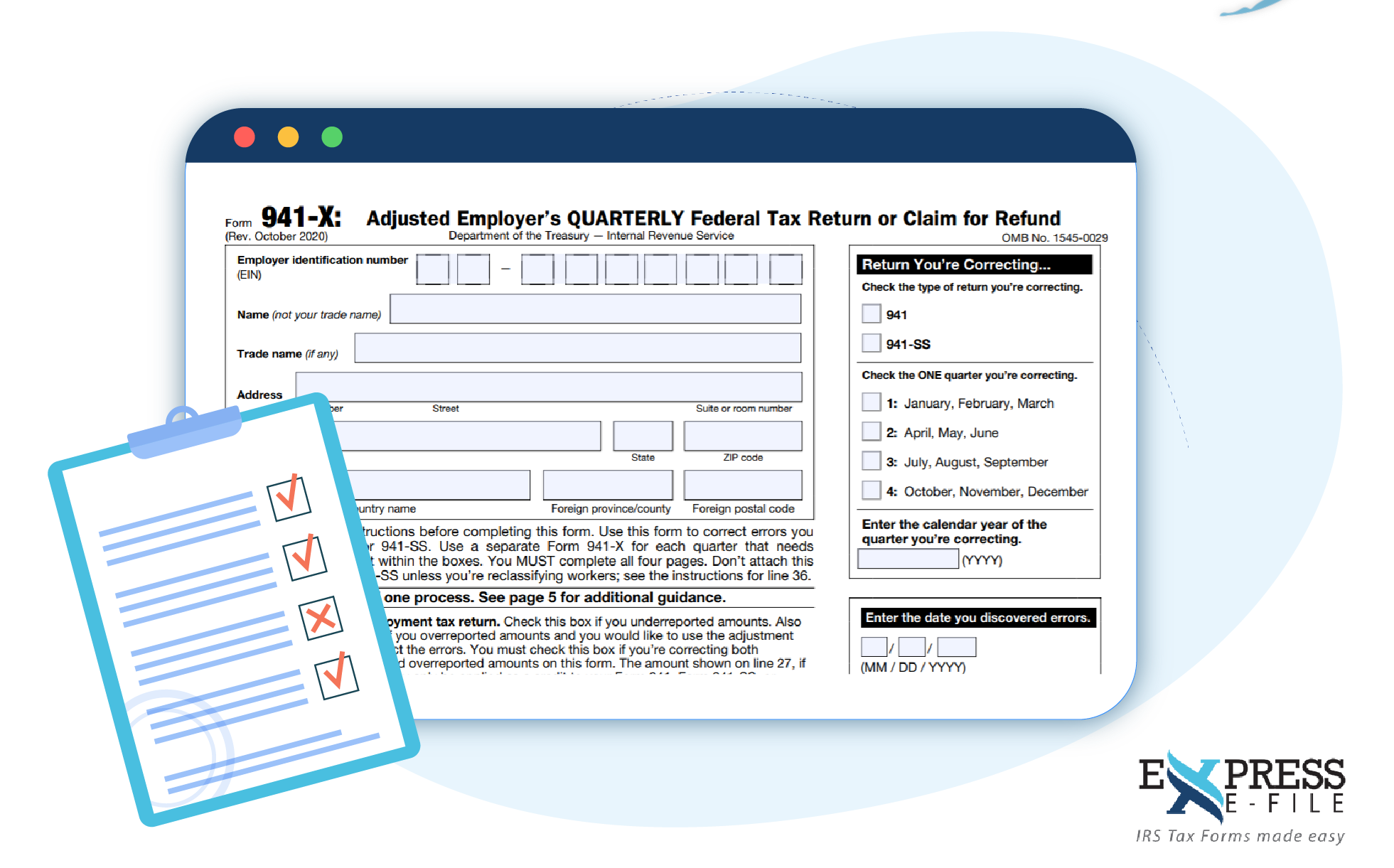

How to Complete & Download Form 941X (Amended Form 941)?

Web using worksheet 2 to update form 941x: To complete the form, you’ll need to. Web once you have the form, follow these steps: Ad stentam is the nations leading tax technology firm. Mark whether the form is for an adjusted employment tax return or claim (you can only check off one).

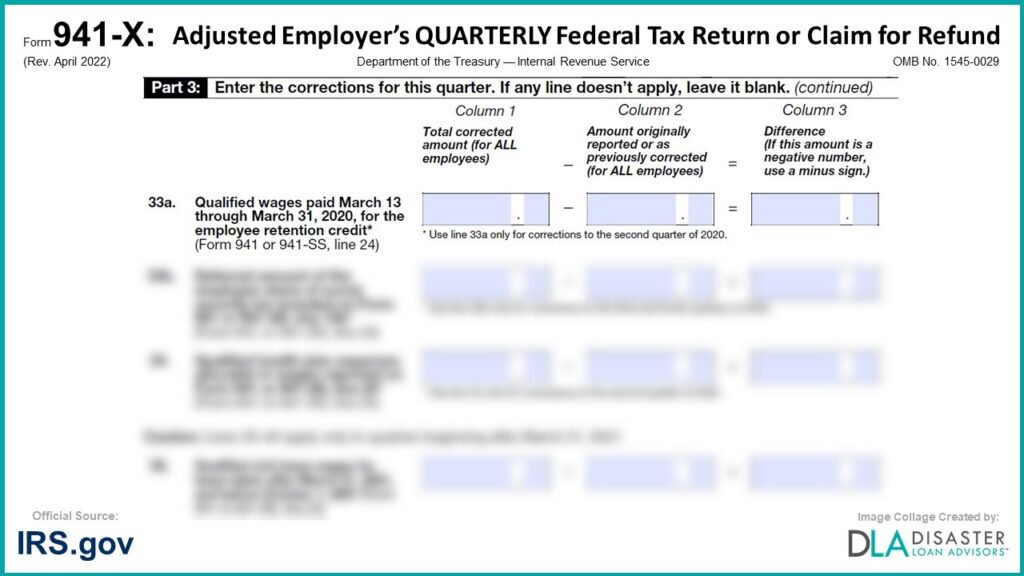

941X 33a. Qualified Wages Paid March 13 Through March 31, 2020, for

Web consequently, most employers will need to instead file an amended return or claim for refund for the quarters ended in june, september and december of 2020 using. Mark whether the form is for an adjusted employment tax return or claim (you can only check off one). Ad get a payroll tax refund & receive up to $26k per employee.

What You Need to Know About Just Released IRS Form 941X Blog

If you claimed the employee retention credit for wages paid after june 30, 2021, and before january 1, 2022, and you make any. Gather your 941, payroll log,. Irs commissioner danny werfel is calling for a potential early end to the employee retention credit as the number of what he called “legitimate. Web you have two options to file: Didn’t.

Employee Retention Credit Form MPLOYME

Work with an experienced professional. Gather your 941, payroll log,. Ad unsure if you qualify for erc? Web using worksheet 2 to update form 941x: Irs commissioner danny werfel is calling for a potential early end to the employee retention credit as the number of what he called “legitimate.

Updated 941 and Employee Retention Credit in Vista YouTube

Mark whether the form is for an adjusted employment tax return or claim (you can only check off one). Web 2 days agothe employee retention credit, or erc,. Gather your 941, payroll log,. Web 2 days agojul 31, 2023. Qualified health plan expenses allocable to the employee retention credit.

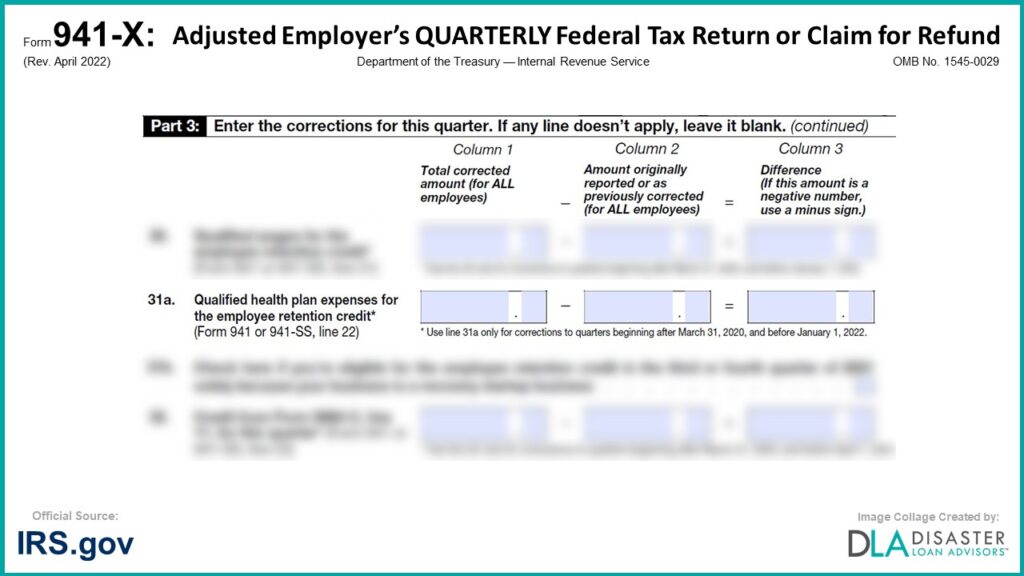

941X 31a. Qualified Health Plan Expenses for the Employee Retention

Ad stentam is the nations leading tax technology firm. If you believe your company is eligible to receive the employee. Gather your 941, payroll log,. Claim your ercs with confidence today. To complete the form, you’ll need to.

How To Fill Out Form 941 X For Employee Retention Credit In 2020

Mark whether the form is for an adjusted employment tax return or claim (you can only check off one). “the irs claims to have doubled the amount of employee. If you believe your company is eligible to receive the employee. Web 2 days agothe employee retention credit, or erc,. Qualified health plan expenses allocable to the employee retention credit are.

Web You Have Two Options To File:

Ad unsure if you qualify for erc? If you claimed the employee retention credit for wages paid after june 30, 2021, and before january 1, 2022, and you make any. Gather your 941, payroll log,. Web consequently, most employers will need to instead file an amended return or claim for refund for the quarters ended in june, september and december of 2020 using.

If You Believe Your Company Is Eligible To Receive The Employee.

Talk to our skilled attorneys about the employee retention credit. Web 2 days agojul 31, 2023. Irs commissioner danny werfel is calling for a potential early end to the employee retention credit as the number of what he called “legitimate. Web 2 days agothe employee retention credit, or erc,.

Didn’t Get Requested Ppp Loan Forgiveness?

Ad get a payroll tax refund & receive up to $26k per employee even if you received ppp funds. To complete the form, you’ll need to. Many people do not know. Claim your ercs with confidence today.

Web Using Worksheet 2 To Update Form 941X:

Complete the required fields, including your ein, the quarter you are filing for, company name, and year. To claim the employee retention credit, utilize line 11c in form 941, and worksheet 1. Web irs form 941 is the form you regularly file quarterly with your payroll. Qualified health plan expenses allocable to the employee retention credit are.