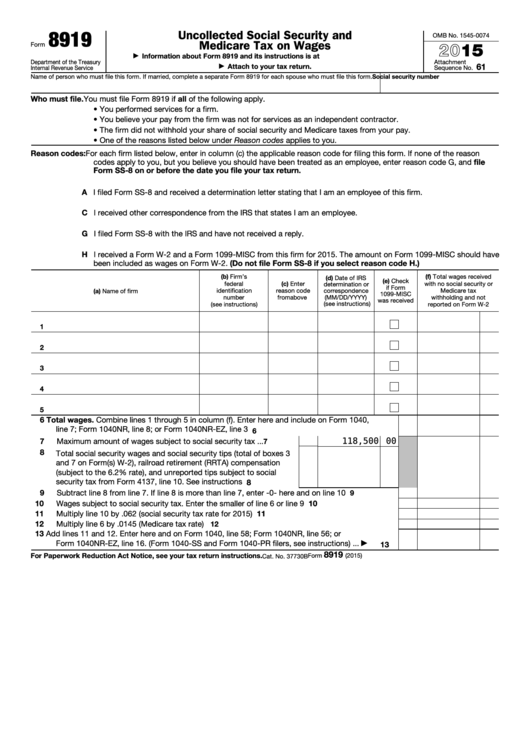

Tax Form 8919

Tax Form 8919 - Irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as. Web irs form 8919, uncollected social security and medicare tax on wages, is the tax form that taxpayers must file to figure and report their share of uncollected social. If using a private delivery service, send your returns to the street address above for the submission processing center. 61 name of person who must file this. A attach to your tax return. Department of the treasury |. Web a go to www.irs.gov/form8919 for the latest information. Web when filing a tax return, the worker uses form 8919 to calculate and report the employee’s share of uncollected social security and medicare taxes due on their. Web employees will use form 8919 to determine the amount they owe in social security and medicare taxes.

A attach to your tax return. Web to complete form 8919 in the taxact program: The taxpayer performed services for an individual or a firm. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as. Web 1973 rulon white blvd. Web form 8919, also known as “uncollected social security and medicare tax on wages,” is used by workers who were not treated as employees by their employers but believed. If using a private delivery service, send your returns to the street address above for the submission processing center. They must report the amount on irs form 8919. Web what is irs form 8919? Irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like.

Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: Web to complete form 8919 in the taxact program: Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as. Web when filing a tax return, the worker uses form 8919 to calculate and report the employee’s share of uncollected social security and medicare taxes due on their. Web if you believe that you've been misclassified as an independent contractor, form 8919 can help you report the correct employment status to the irs and ensure that. The taxpayer performed services for an individual or a firm. If using a private delivery service, send your returns to the street address above for the submission processing center. 61 name of person who must file this. They must report the amount on irs form 8919. Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file.

Form 8959 Additional Medicare Tax (2014) Free Download

They must report the amount on irs form 8919. If using a private delivery service, send your returns to the street address above for the submission processing center. Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file. Web a go to www.irs.gov/form8919 for the latest.

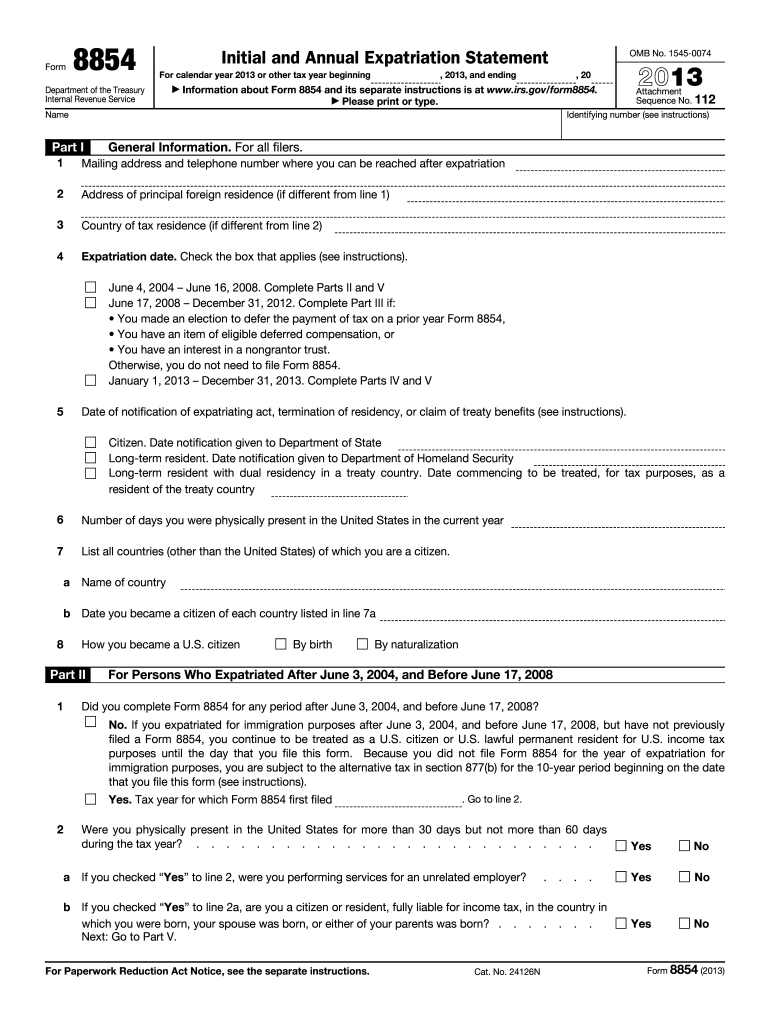

2013 Form IRS 8854 Fill Online, Printable, Fillable, Blank pdfFiller

For some of the western states, the following addresses were previously used: They must report the amount on irs form 8919. Web 1973 rulon white blvd. A attach to your tax return. Web to complete form 8919 in the taxact program:

20182022 Form CA ADOPT200 Fill Online, Printable, Fillable, Blank

They must report the amount on irs form 8919. Web 1973 rulon white blvd. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as. For some of the western states, the following addresses were previously used: Web what is.

Form 1099NEC Nonemployee Compensation (1099NEC)

Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as. They must report the amount.

Form 8959 Additional Medicare Tax (2014) Free Download

Web irs form 8919, uncollected social security and medicare tax on wages, is the tax form that taxpayers must file to figure and report their share of uncollected social. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as..

Form 8919 2021 Fill Online, Printable, Fillable, Blank pdfFiller

Web what is irs form 8919? A attach to your tax return. 61 name of person who must file this. Web if you believe that you've been misclassified as an independent contractor, form 8919 can help you report the correct employment status to the irs and ensure that. The taxpayer performed services for an individual or a firm.

Fillable Form 8919 Uncollected Social Security And Medicare Tax On

Web irs form 8919, uncollected social security and medicare tax on wages, is the tax form that taxpayers must file to figure and report their share of uncollected social. They must report the amount on irs form 8919. For some of the western states, the following addresses were previously used: Web what is irs form 8919? 61 name of person.

Form 8919 Uncollected Social Security and Medicare Tax on Wages (2014

Web what is irs form 8919? Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file. Web if you believe that you've been misclassified as an independent contractor, form 8919 can help you report the correct employment status to the irs and ensure that. Web when.

IRS expands crypto question on draft version of 1040 Accounting Today

Web employees will use form 8919 to determine the amount they owe in social security and medicare taxes. From within your taxact return ( online or desktop), click federal. If using a private delivery service, send your returns to the street address above for the submission processing center. For some of the western states, the following addresses were previously used:.

What is Form 8919 Uncollected Social Security and Medicare Tax on

Web 1973 rulon white blvd. Web to complete form 8919 in the taxact program: A attach to your tax return. Web when filing a tax return, the worker uses form 8919 to calculate and report the employee’s share of uncollected social security and medicare taxes due on their. For some of the western states, the following addresses were previously used:

Web 1973 Rulon White Blvd.

Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file. From within your taxact return ( online or desktop), click federal. Irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like. If using a private delivery service, send your returns to the street address above for the submission processing center.

The Taxpayer Performed Services For An Individual Or A Firm.

Web when filing a tax return, the worker uses form 8919 to calculate and report the employee’s share of uncollected social security and medicare taxes due on their. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: They must report the amount on irs form 8919.

Web Employees Will Use Form 8919 To Determine The Amount They Owe In Social Security And Medicare Taxes.

Web if you believe that you've been misclassified as an independent contractor, form 8919 can help you report the correct employment status to the irs and ensure that. A attach to your tax return. Web to complete form 8919 in the taxact program: Department of the treasury |.

61 Name Of Person Who Must File This.

Web form 8919, also known as “uncollected social security and medicare tax on wages,” is used by workers who were not treated as employees by their employers but believed. For some of the western states, the following addresses were previously used: Web what is irs form 8919? Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as.