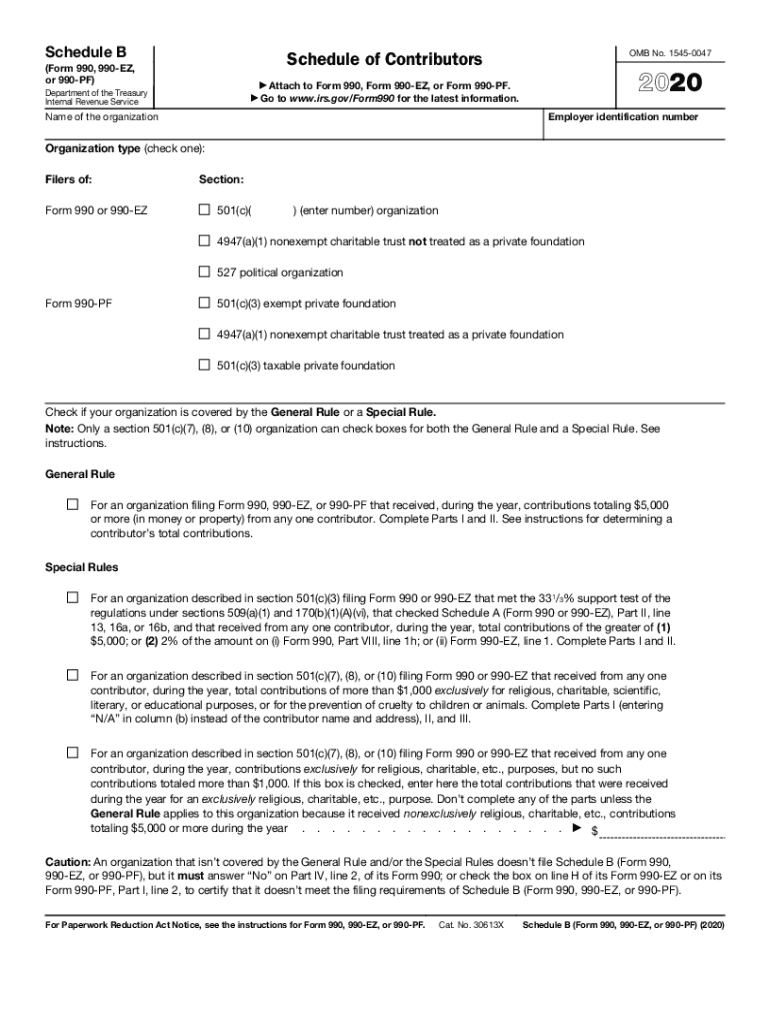

Irs Form 990 Ez Schedule B

Irs Form 990 Ez Schedule B - All organizations must complete and attach schedule b pdf or certify the. Upload, modify or create forms. Get form charitable trust not treated as a private foundation 527 political. Web use a 990 ez schedule b form 2015 template to make your document workflow more streamlined. Web the information provided will enable you to file a more complete return and reduce the chances the irs will need to contact you. For paperwork reduction act notice, see the. Complete, edit or print tax forms instantly. A for the 2021 calendar year, or tax year. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today.

For paperwork reduction act notice, see the. Ad download or email form 990 sb & more fillable forms, register and subscribe now! Web the information provided will enable you to file a more complete return and reduce the chances the irs will need to contact you. If you checked 12d of part i, complete sections a and d, and complete part v.). Corporation trust association other add lines 5b, 6c, and 7b to line 9 to. Web additional schedules are required to be completed depending on the activities and type of organization. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web internal revenue service public charity status and public support complete if the organization is a section 501(c)(3) organization or a section 4947(a)(1) nonexempt.

Ad download or email form 990 sb & more fillable forms, register and subscribe now! Deliver the particular prepared document. Corporation trust association other add lines 5b, 6c, and 7b to line 9 to. Try it for free now! Web schedule b (form 990) department of the treasury internal revenue service. Web the information provided will enable you to file a more complete return and reduce the chances the irs will need to contact you. Upload, modify or create forms. Web additional schedules are required to be completed depending on the activities and type of organization. Get ready for tax season deadlines by completing any required tax forms today. Web internal revenue service public charity status and public support complete if the organization is a section 501(c)(3) organization or a section 4947(a)(1) nonexempt.

Gallery of Irs form 990 Ez Schedule B Instructions Unique Ibss Federal

After the form is fully gone, media completed. Ad access irs tax forms. So, for organizations that operate on calendar. Deliver the particular prepared document. Web internal revenue service public charity status and public support complete if the organization is a section 501(c)(3) organization or a section 4947(a)(1) nonexempt.

Printable Form 990ez 2019 Printable Word Searches

Ad access irs tax forms. Ad access irs tax forms. Web generally, the organizations should. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly.

IRS Form 990 IRS Form 990EZ Schedule A Download Fillable PDF 2018

All organizations must complete and attach schedule b pdf or certify the. Try it for free now! Ad access irs tax forms. Web required to attach schedule b (form 990). Upload, modify or create forms.

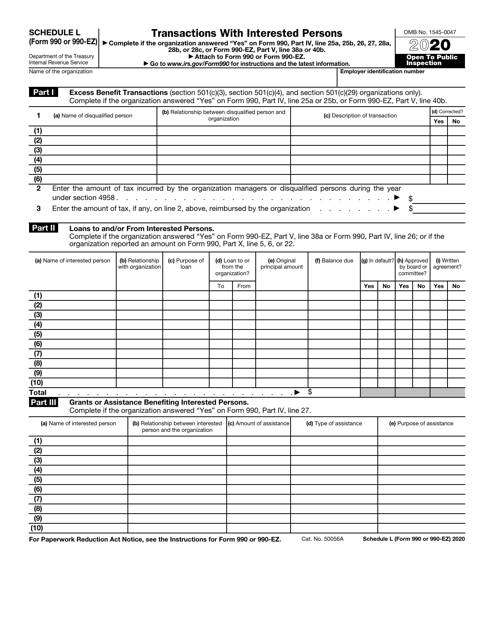

IRS Form 990 (990EZ) Schedule L Download Fillable PDF or Fill Online

Deliver the particular prepared document. Web required to attach schedule b (form 990). The following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web the information provided will enable you to file a more complete return and reduce the chances the irs will need to contact you. Upload, modify or create forms.

Form 990, 990EZ, 990PF (Sch B) Schedule of Contributors (2015) Free

Corporation trust association other add lines 5b, 6c, and 7b to line 9 to. Web generally, the organizations should. Try it for free now! Get ready for tax season deadlines by completing any required tax forms today. A for the 2021 calendar year, or tax year.

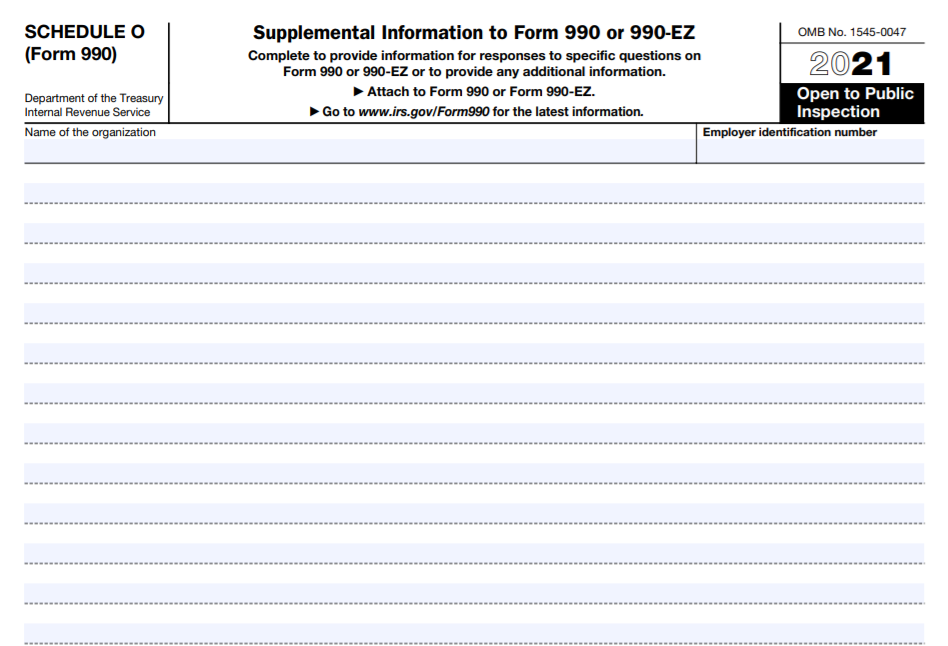

IRS Form 990 Schedule O Instructions Supplemental Information

Complete, edit or print tax forms instantly. Ad access irs tax forms. Web internal revenue service public charity status and public support complete if the organization is a section 501(c)(3) organization or a section 4947(a)(1) nonexempt. A for the 2021 calendar year, or tax year. Ad download or email form 990 sb & more fillable forms, register and subscribe now!

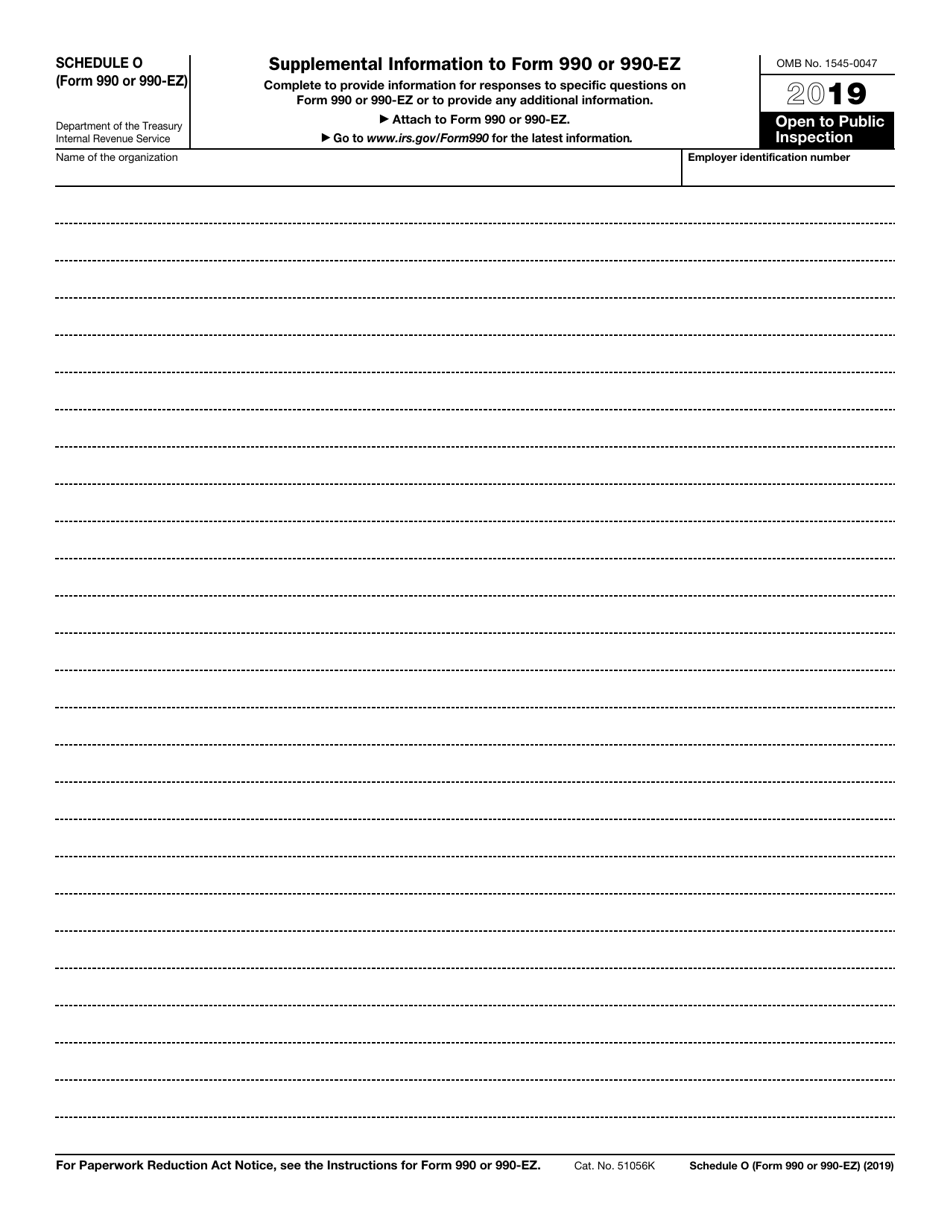

IRS Form 990 (990EZ) Schedule O Download Fillable PDF or Fill Online

So, for organizations that operate on calendar. Get form charitable trust not treated as a private foundation 527 political. Web additional schedules are required to be completed depending on the activities and type of organization. Web form 990 schedules with instructions. Web generally, the organizations should.

2018 Form IRS 990 Schedule O Fill Online, Printable, Fillable, Blank

Web generally, the organizations should. Deliver the particular prepared document. Get ready for tax season deadlines by completing any required tax forms today. Web internal revenue service public charity status and public support complete if the organization is a section 501(c)(3) organization or a section 4947(a)(1) nonexempt. Web required to attach schedule b (form 990).

2020 Form IRS 990 Schedule B Fill Online, Printable, Fillable, Blank

Web generally, the organizations should. The following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Get ready for tax season deadlines by completing any required tax forms today. Corporation trust association other add lines 5b, 6c, and 7b to line 9 to. A for the 2021 calendar year, or tax year.

Upload, Modify Or Create Forms.

Ad download or email form 990 sb & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. All organizations must complete and attach schedule b pdf or certify the. Get ready for tax season deadlines by completing any required tax forms today.

Ad Access Irs Tax Forms.

A for the 2021 calendar year, or tax year. Complete, edit or print tax forms instantly. Web required to attach schedule b (form 990). Try it for free now!

Ad Access Irs Tax Forms.

Corporation trust association other add lines 5b, 6c, and 7b to line 9 to. Web schedule b (form 990) department of the treasury internal revenue service. Try it for free now! For paperwork reduction act notice, see the.

If You Checked 12D Of Part I, Complete Sections A And D, And Complete Part V.).

The following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web generally, the organizations should. Web internal revenue service public charity status and public support complete if the organization is a section 501(c)(3) organization or a section 4947(a)(1) nonexempt. Web the information provided will enable you to file a more complete return and reduce the chances the irs will need to contact you.