State Of Michigan Tax Exemption Form

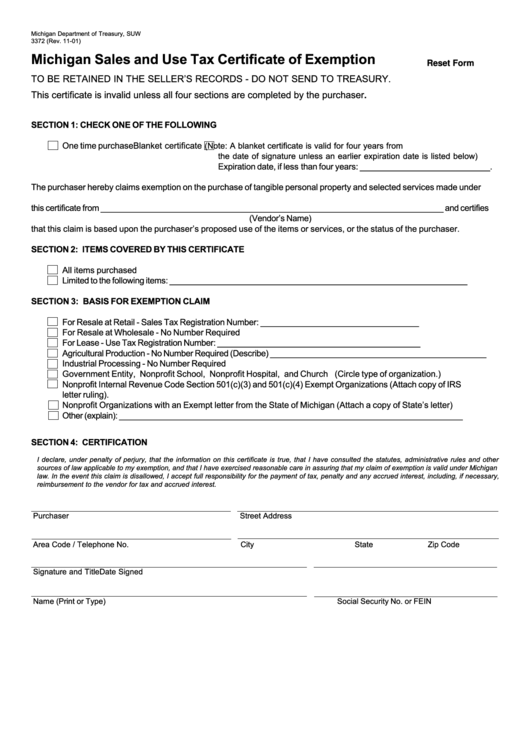

State Of Michigan Tax Exemption Form - Certificate must be retained in the seller’s records. Web in order to claim this exemption, this form must be filed with the local unit (city or township) where the personal property is located no later than february 20, 2019. Sales tax return for special events: Web request to rescind principal residence exemption. Download a pdf form 3372 sales. Web business tax forms 2023 withholding tax forms important note tax forms are tax year specific. Sales and use tax exempt status. If any of these links are broken, or you can't find the form you need, please let. Web if you would like more information about tax exemptions, visit the state of michigan department of treasury website. You must file a revised form within 10.

Download or email mi form 5076 & more fillable forms, register and subscribe now Web the charitable nonprofit housing property exemption, public act 612 of 2006, mcl 211.7kk, as amended, was created to exempt certain residential property owned by a. Web we have three michigan sales tax exemption forms available for you to print or save as a pdf file. Web michigan sales and use tax certificate of exemption instructions: Web michigan department of treasury form 3372 (rev. Sales and use tax exempt status. Michigan sales and use tax contractor eligibility statement: Web request to rescind principal residence exemption. Download a copy of the michigan general sales tax. Any altering of a form to change a tax year or any reported tax period outside.

Web business tax forms 2023 withholding tax forms important note tax forms are tax year specific. Sales tax return for special events: Look for forms using our forms search or view a list of income tax forms by year. Complete, edit or print tax forms instantly. You must file a revised form within 10. Certificate must be retained in the seller’s records. Batch cover sheet for principal. Michigan sales and use tax contractor eligibility statement: Web additional resources need a different form? Any altering of a form to change a tax year or any reported tax period outside.

Top 19 Michigan Tax Exempt Form Templates free to download in PDF format

Michigan sales and use tax contractor eligibility statement: Web request to rescind principal residence exemption. Web the charitable nonprofit housing property exemption, public act 612 of 2006, mcl 211.7kk, as amended, was created to exempt certain residential property owned by a. Certificate must be retained in the seller’s records. Web michigan sales and use tax certificate of exemption instructions:

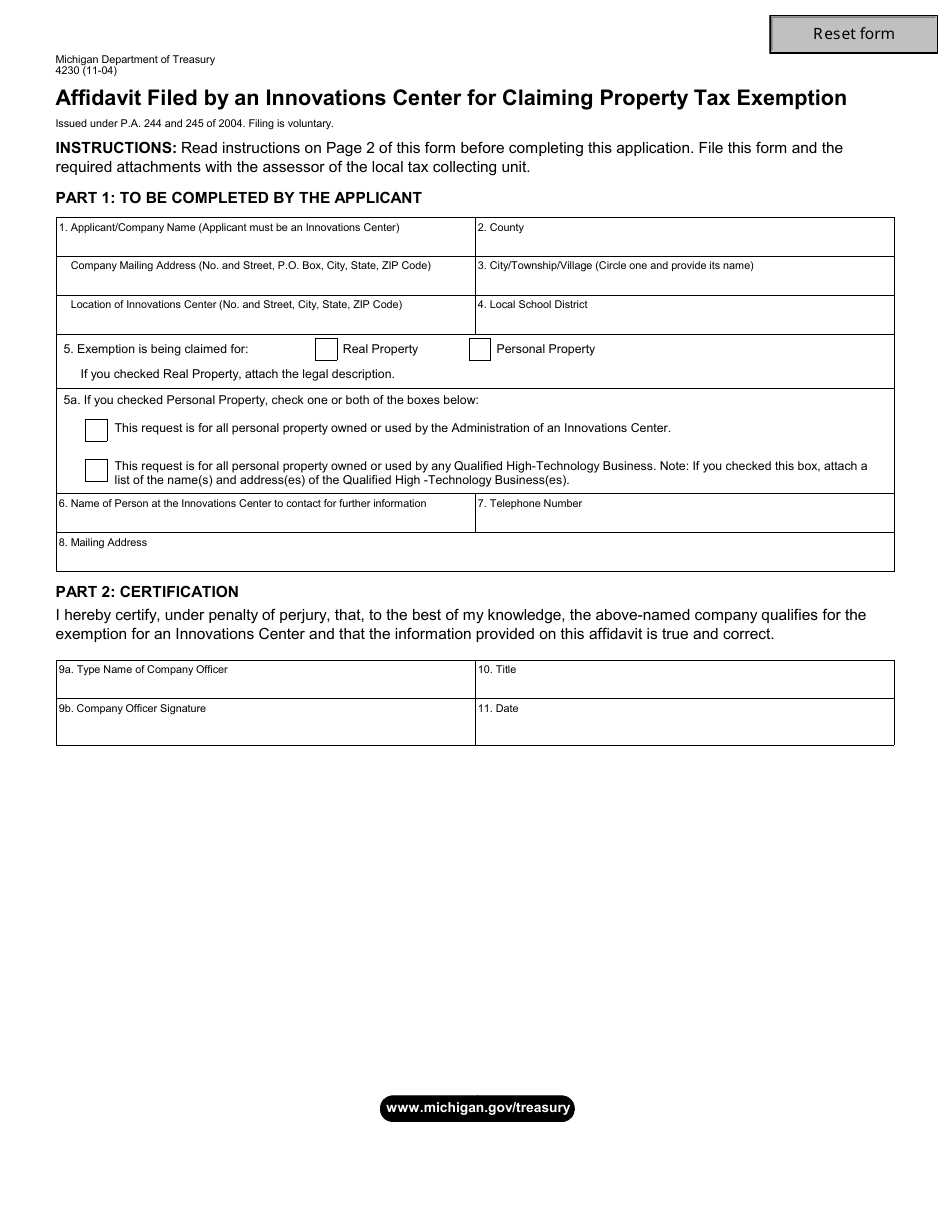

Form 4230 Download Fillable PDF or Fill Online Affidavit Filed by an

Web additional resources need a different form? Any altering of a form to change a tax year or any reported tax period outside. Web michigan sales and use tax certificate of exemption: Web the certificate that qualifying agricultural producers, organizations and other exempt entities may use, is the michigan sales and use tax certificate of exemption. Web the charitable nonprofit.

Michigan State Tax Reform Plan 2018 PDF Tax Exemption Taxpayer

Download a pdf form 3372 sales. You must file a revised form within 10. Web michigan department of treasury form 3372 (rev. Sales tax return for special events: If any of these links are broken, or you can't find the form you need, please let.

Michigan certificate of tax exemption from 3372 Fill out & sign online

Web request to rescind principal residence exemption. Web michigan sales and use tax certificate of exemption instructions: Web if you would like more information about tax exemptions, visit the state of michigan department of treasury website. Any altering of a form to change a tax year or any reported tax period outside. Web michigan sales and use tax certificate of.

Form Mi 1041 Fill Out and Sign Printable PDF Template signNow

Look for forms using our forms search or view a list of income tax forms by year. Download or email mi form 5076 & more fillable forms, register and subscribe now Web michigan department of treasury form 3372 (rev. Web the charitable nonprofit housing property exemption, public act 612 of 2006, mcl 211.7kk, as amended, was created to exempt certain.

MICHIGAN SALES AND USE TAX CERTIFICATE OF EXEMPTION

Do not send to the department of treasury. Michigan sales and use tax contractor eligibility statement: Web the certificate that qualifying agricultural producers, organizations and other exempt entities may use, is the michigan sales and use tax certificate of exemption. Certificate must be retained in the seller’s records. Web we have three michigan sales tax exemption forms available for you.

Form 5076 Right Michigan

If any of these links are broken, or you can't find the form you need, please let. Web for other michigan sales tax exemption certificates, go here. Do not send to the department of treasury. Web if you would like more information about tax exemptions, visit the state of michigan department of treasury website. Look for forms using our forms.

How to get a Certificate of Exemption in Michigan

Web the charitable nonprofit housing property exemption, public act 612 of 2006, mcl 211.7kk, as amended, was created to exempt certain residential property owned by a. Web michigan sales and use tax certificate of exemption: Web additional resources need a different form? Look for forms using our forms search or view a list of income tax forms by year. Notice.

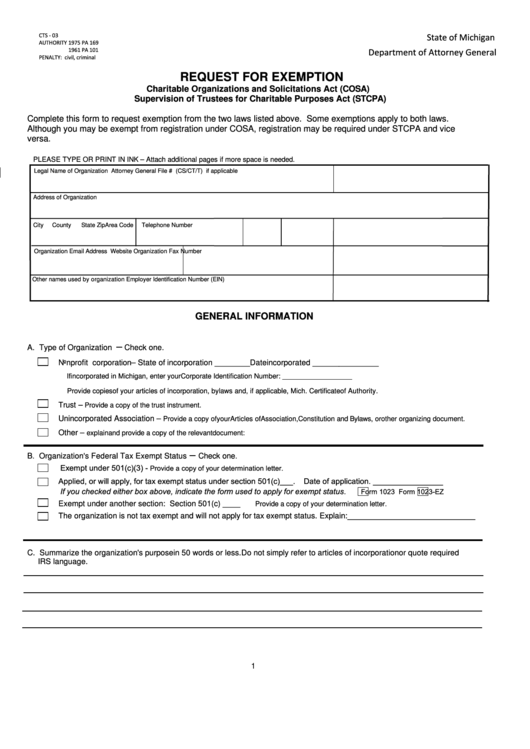

Fillable Request For Exemption State Of Michigan printable pdf download

Web michigan department of treasury form 3372 (rev. This letter serves as notice to a seller that michigan state university qualifies to buy goods and services without paying the. Web for other michigan sales tax exemption certificates, go here. Web the state also provides a $2,900 special exemption for each tax filer or dependent in the household who is deaf,.

by Carrollton Public

Michigan sales and use tax contractor eligibility statement: Web michigan department of treasury form 3372 (rev. Web in order to claim an exemption from sales or use tax, a purchaser must provide a valid claim of exemption to the vendor by completing one of the following: Batch cover sheet for principal. Notice of denial of principal residence exemption (local (city/township)).

Any Altering Of A Form To Change A Tax Year Or Any Reported Tax Period Outside.

Download a pdf form 3372 sales. Web michigan sales and use tax certificate of exemption: Sales tax return for special events: Web we have three michigan sales tax exemption forms available for you to print or save as a pdf file.

Certificate Must Be Retained In The Seller’s Records.

Web the charitable nonprofit housing property exemption, public act 612 of 2006, mcl 211.7kk, as amended, was created to exempt certain residential property owned by a. Web if you would like more information about tax exemptions, visit the state of michigan department of treasury website. This letter serves as notice to a seller that michigan state university qualifies to buy goods and services without paying the. Web additional resources need a different form?

Web In Order To Claim This Exemption, This Form Must Be Filed With The Local Unit (City Or Township) Where The Personal Property Is Located No Later Than February 20, 2019.

Complete, edit or print tax forms instantly. You must file a revised form within 10. Download or email mi form 5076 & more fillable forms, register and subscribe now Web michigan sales tax exemption form 3372 | fillable pdf issue a michigan resale certificate to vendors for purchase of items for resale.

Look For Forms Using Our Forms Search Or View A List Of Income Tax Forms By Year.

Web business tax forms 2023 withholding tax forms important note tax forms are tax year specific. Do not send to the department of treasury. Web request to rescind principal residence exemption. Web in order to claim an exemption from sales or use tax, a purchaser must provide a valid claim of exemption to the vendor by completing one of the following: