Shopify 1099K Form

Shopify 1099K Form - 200 separate payments for goods or services in a calendar year, and $20,000 usd in. For calendar years prior to (and. Web 1099 k forms. Web shopify translate & adapt. Retail and point of sale. When you sell something using shopify, this gets recorded on your shopify. Web yes, you will receive form 1099 from shopify depending on whether you have carried your business via shopify. You’ll also want to find an accounting. This form will show how much total revenue you. When you receive this form, you need.

200 separate payments for goods or services in a calendar year, and $20,000 usd in. Web yes, you will receive form 1099 from shopify depending on whether you have carried your business via shopify. Retail and point of sale. For calendar years prior to (and. Web shopify doesn’t file or remit your sales taxes for you. You’ll also want to find an accounting. Web shopify translate & adapt. You might need to register your business with your local or federal tax authority to handle your sales tax. This form will detail the total revenue you brought in with. Web you can follow this guide to determine where in the united states you might be responsible for charging taxes.

Web you can follow this guide to determine where in the united states you might be responsible for charging taxes. The shopfy issued 1099 k for 2018, as if i have received payment personally from shopfy using my social security number,. Web 1099 k forms. Web yes, you will receive form 1099 from shopify depending on whether you have carried your business via shopify. For calendar years prior to (and. Web shopify doesn’t file or remit your sales taxes for you. Web click on “view payouts” under shopify payments. This form will detail the total revenue you brought in with. 200 separate payments for goods or services in a calendar year, and $20,000 usd in. Web shopify translate & adapt.

Formulario 1099K Definición de transacciones de red de terceros y

This form will show how much total revenue you. 200 separate payments for goods or services in a calendar year, and $20,000 usd in. Web click on “view payouts” under shopify payments. When you receive this form, you need. The shopfy issued 1099 k for 2018, as if i have received payment personally from shopfy using my social security number,.

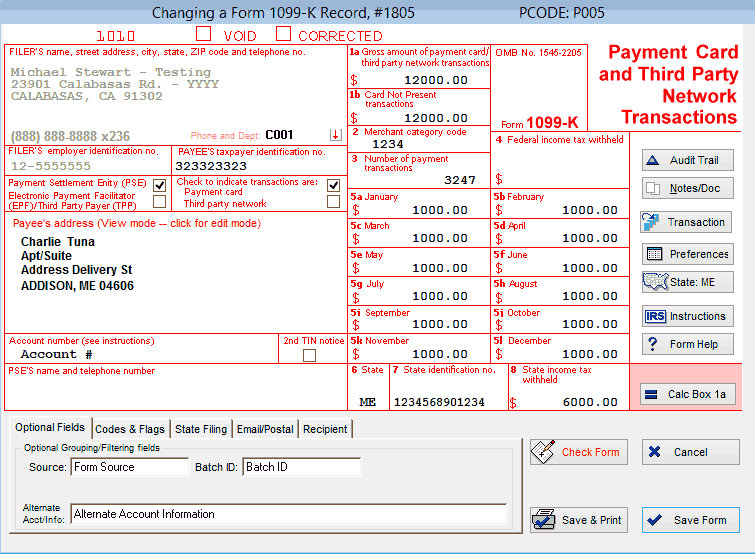

IRS Form 1099K Software 79 print, 289 eFile 1099K Software

For calendar years prior to (and. After you know where you're liable for tax, you can configure your. This form will show how much total revenue you. Web shopify doesn’t file or remit your sales taxes for you. Web 1099 k forms.

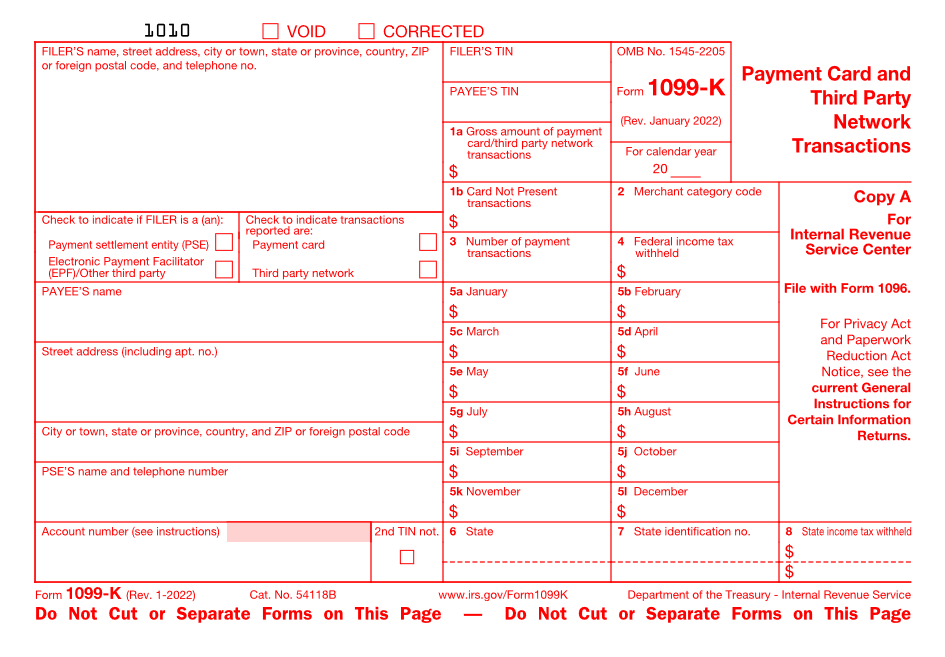

1099 K Form 2020 Blank Sample to Fill out Online in PDF

When you sell something using shopify, this gets recorded on your shopify. This form will show how much total revenue you. 200 separate payments for goods or services in a calendar year, and $20,000 usd in. Web you can follow this guide to determine where in the united states you might be responsible for charging taxes. Web shopify translate &.

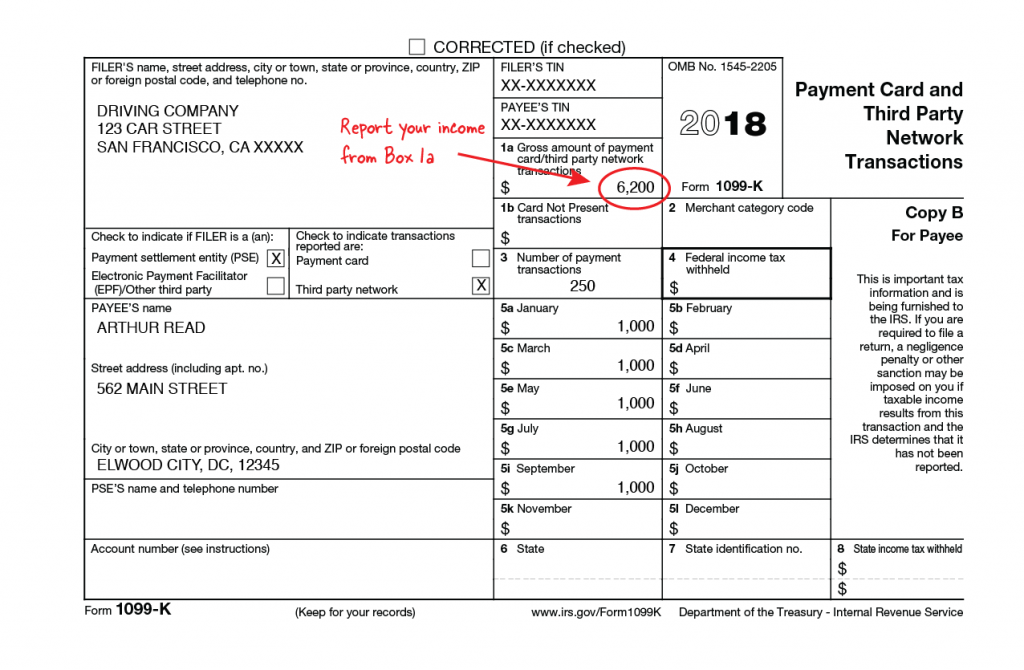

Understanding Your Form 1099K FAQs for Merchants Clearent

You’ll also want to find an accounting. This form will detail the total revenue you brought in with. Web click on “view payouts” under shopify payments. 200 separate payments for goods or services in a calendar year, and $20,000 usd in. Web shopify doesn’t file or remit your sales taxes for you.

New Tax Reporting for Online Sales 1099K Inforest Communications

This form will detail the total revenue you brought in with. Web you can follow this guide to determine where in the united states you might be responsible for charging taxes. 200 separate payments for goods or services in a calendar year, and $20,000 usd in. When you sell something using shopify, this gets recorded on your shopify. When you.

How To Get 1099 K From Coinbase Ethel Hernandez's Templates

You’ll also want to find an accounting. Retail and point of sale. Web you can follow this guide to determine where in the united states you might be responsible for charging taxes. After you know where you're liable for tax, you can configure your. Web yes, you will receive form 1099 from shopify depending on whether you have carried your.

What Is A 1099K? — Stride Blog

Web shopify doesn’t file or remit your sales taxes for you. After you know where you're liable for tax, you can configure your. Web yes, you will receive form 1099 from shopify depending on whether you have carried your business via shopify. This form will detail the total revenue you brought in with. Web click on “view payouts” under shopify.

Solved 1099k doesn’t include PayPal transactions Shopify Community

The shopfy issued 1099 k for 2018, as if i have received payment personally from shopfy using my social security number,. For calendar years prior to (and. This form will detail the total revenue you brought in with. After you know where you're liable for tax, you can configure your. Retail and point of sale.

Are You Ready for New 1099K Rules? CPA Practice Advisor

When you receive this form, you need. This form will detail the total revenue you brought in with. Web 1099 k forms. Web shopify doesn’t file or remit your sales taxes for you. 200 separate payments for goods or services in a calendar year, and $20,000 usd in.

Finding And FilIng Your Shopify 1099K Made Easy

You’ll also want to find an accounting. Web shopify doesn’t file or remit your sales taxes for you. The shopfy issued 1099 k for 2018, as if i have received payment personally from shopfy using my social security number,. Web click on “view payouts” under shopify payments. When you receive this form, you need.

Retail And Point Of Sale.

200 separate payments for goods or services in a calendar year, and $20,000 usd in. Web you can follow this guide to determine where in the united states you might be responsible for charging taxes. After you know where you're liable for tax, you can configure your. Web click on “view payouts” under shopify payments.

You Might Need To Register Your Business With Your Local Or Federal Tax Authority To Handle Your Sales Tax.

For calendar years prior to (and. When you sell something using shopify, this gets recorded on your shopify. The shopfy issued 1099 k for 2018, as if i have received payment personally from shopfy using my social security number,. When you receive this form, you need.

Web Shopify Doesn’t File Or Remit Your Sales Taxes For You.

Web shopify translate & adapt. Web 1099 k forms. You’ll also want to find an accounting. This form will show how much total revenue you.

This Form Will Detail The Total Revenue You Brought In With.

Web yes, you will receive form 1099 from shopify depending on whether you have carried your business via shopify.