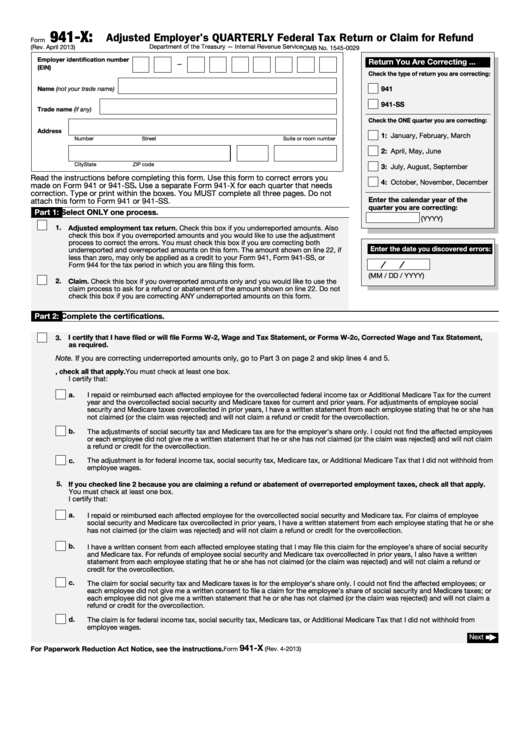

Form 941-X

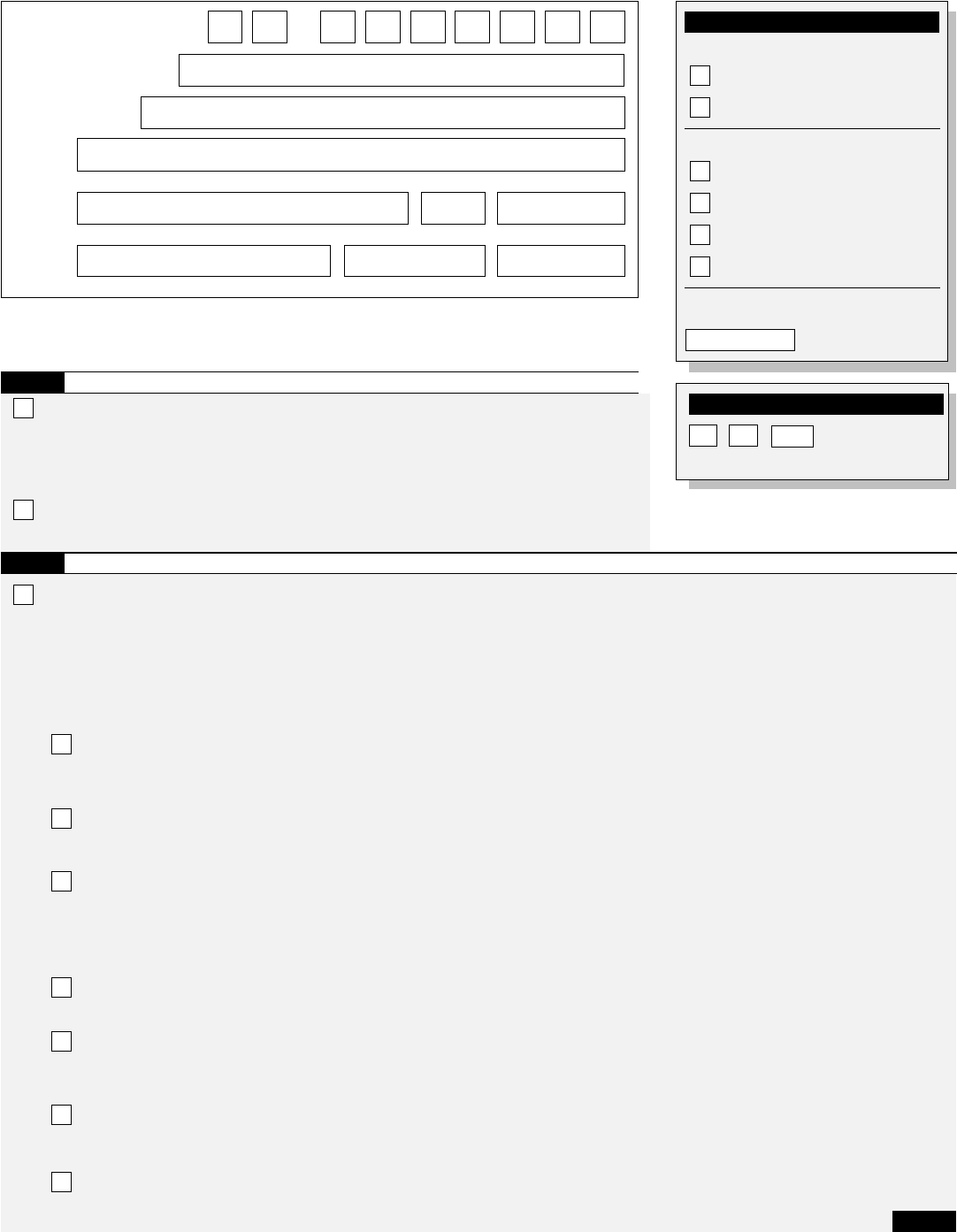

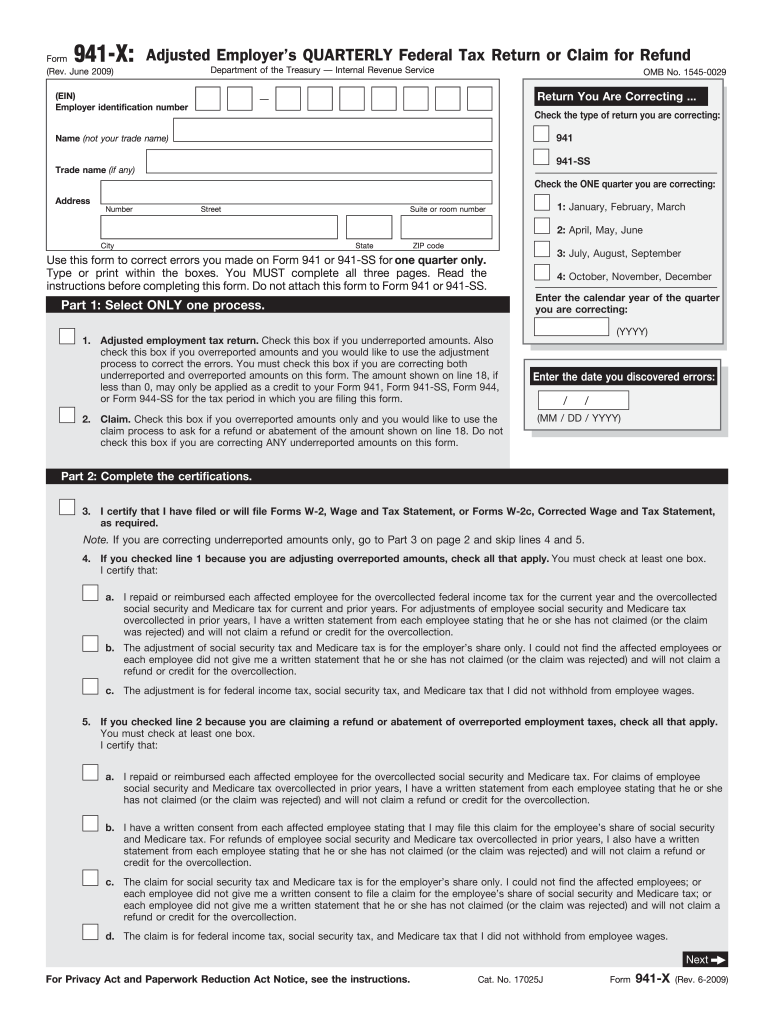

Form 941-X - Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont,. You must complete all five pages. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. See the instructions for line 42. Employer identification number (ein) — name (not your trade name) trade name (if. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction Type or print within the boxes. If you are located in.

Employer identification number (ein) — name (not your trade name) trade name (if. You must complete all five pages. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. See the instructions for line 42. Type or print within the boxes. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont,. If you are located in. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction.

Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont,. You must complete all five pages. Employer identification number (ein) — name (not your trade name) trade name (if. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Type or print within the boxes. See the instructions for line 42. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding. If you are located in. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction.

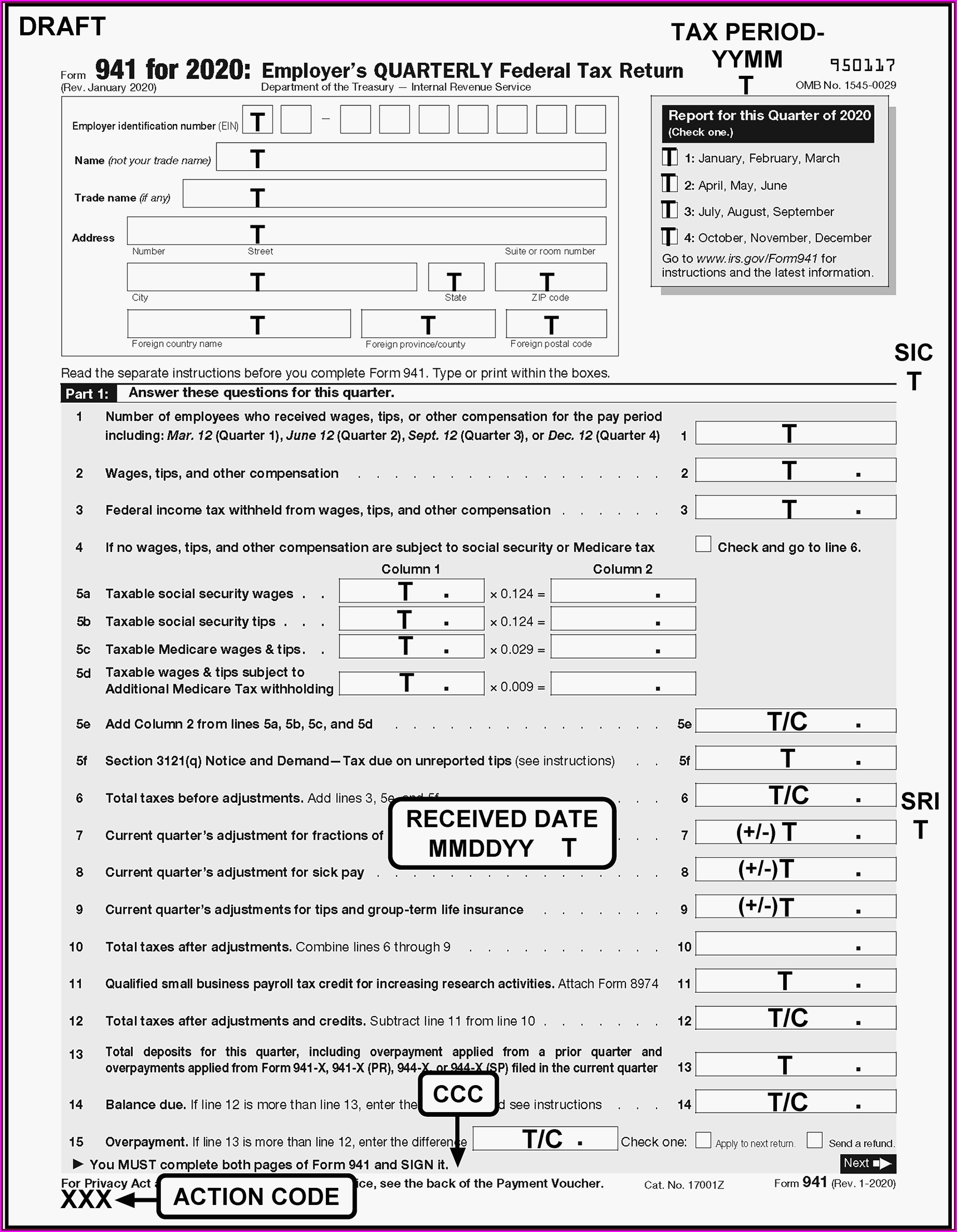

941 X Form Fill Out and Sign Printable PDF Template signNow

July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Type or print within the boxes. You must complete all five pages. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to.

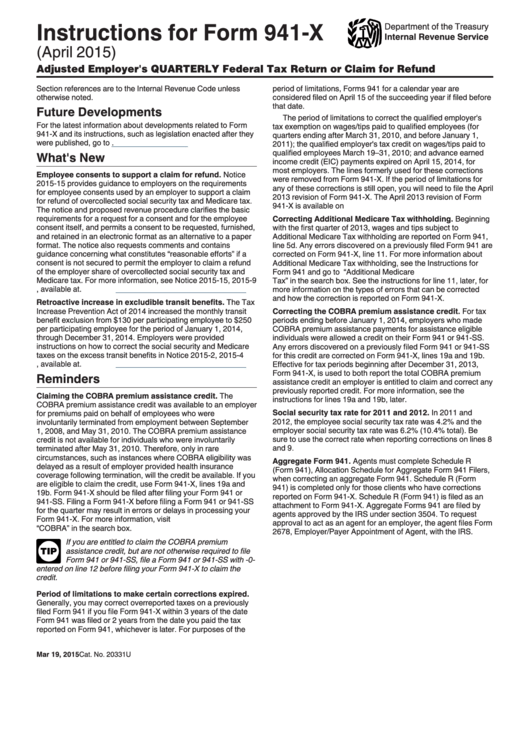

Irs.gov Form 941 X Instructions Form Resume Examples 1ZV8dX3V3X

Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont,. July 2020) adjusted employer’s quarterly federal tax return.

What You Need to Know About Just Released IRS Form 941X Blog

July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Type or print within the boxes. Employee wages, income tax withheld from wages, taxable social security.

Form 941X Edit, Fill, Sign Online Handypdf

You must complete all five pages. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Type or print within the boxes. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Employer identification number (ein).

Form 941 X Fill Out and Sign Printable PDF Template signNow

Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont,. See the instructions for line 42. Employer identification number (ein) — name (not your trade name) trade name (if. Therefore, you may need to amend your income tax return (for.

How to Complete & Download Form 941X (Amended Form 941)?

See the instructions for line 42. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky,.

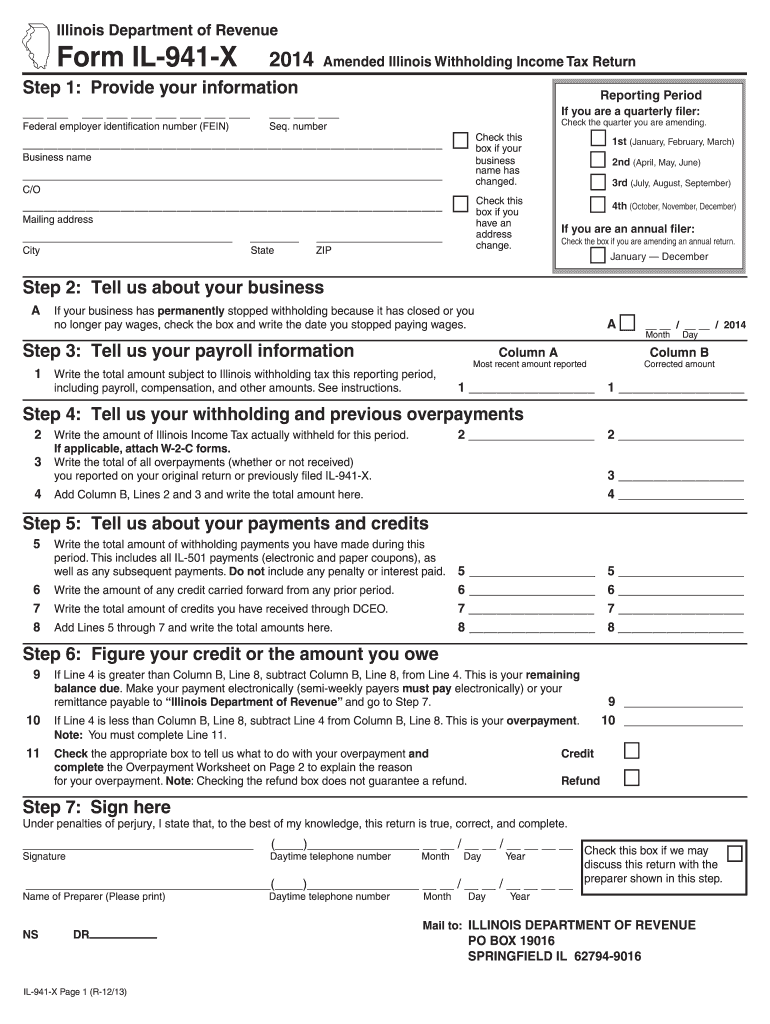

Il 941 X Form Fill Out and Sign Printable PDF Template signNow

See the instructions for line 42. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction If you.

IRS Form 941X Complete & Print 941X for 2021

July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120,.

Fillable Form 941X Adjusted Employer'S Quarterly Federal Tax Return

You must complete all five pages. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Type or print within the boxes. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island,.

Instructions For Form 941x Adjusted Employer's Quarterly Federal Tax

Employer identification number (ein) — name (not your trade name) trade name (if. You must complete all five pages. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. If you are located in. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan,.

If You Are Located In.

See the instructions for line 42. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont,. Type or print within the boxes. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no.

Employee Wages, Income Tax Withheld From Wages, Taxable Social Security Wages, Taxable Social Security Tips, Taxable Medicare Wages And Tips, Taxable Wages And Tips Subject To Additional Medicare Tax Withholding.

You must complete all five pages. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction Employer identification number (ein) — name (not your trade name) trade name (if. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction.