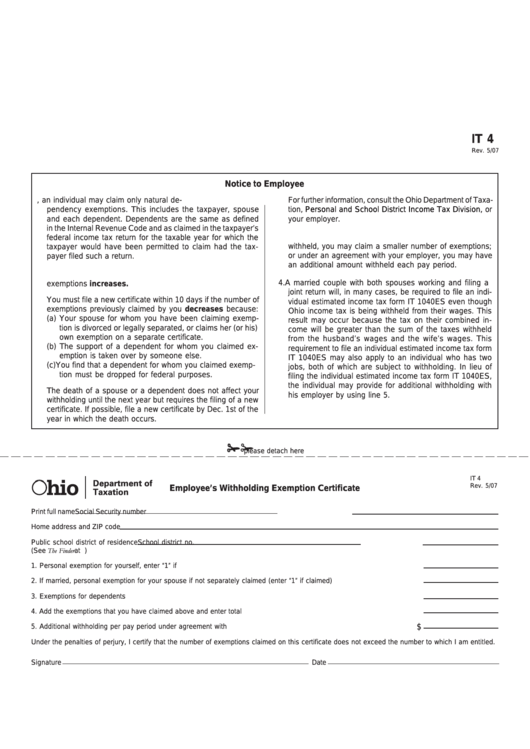

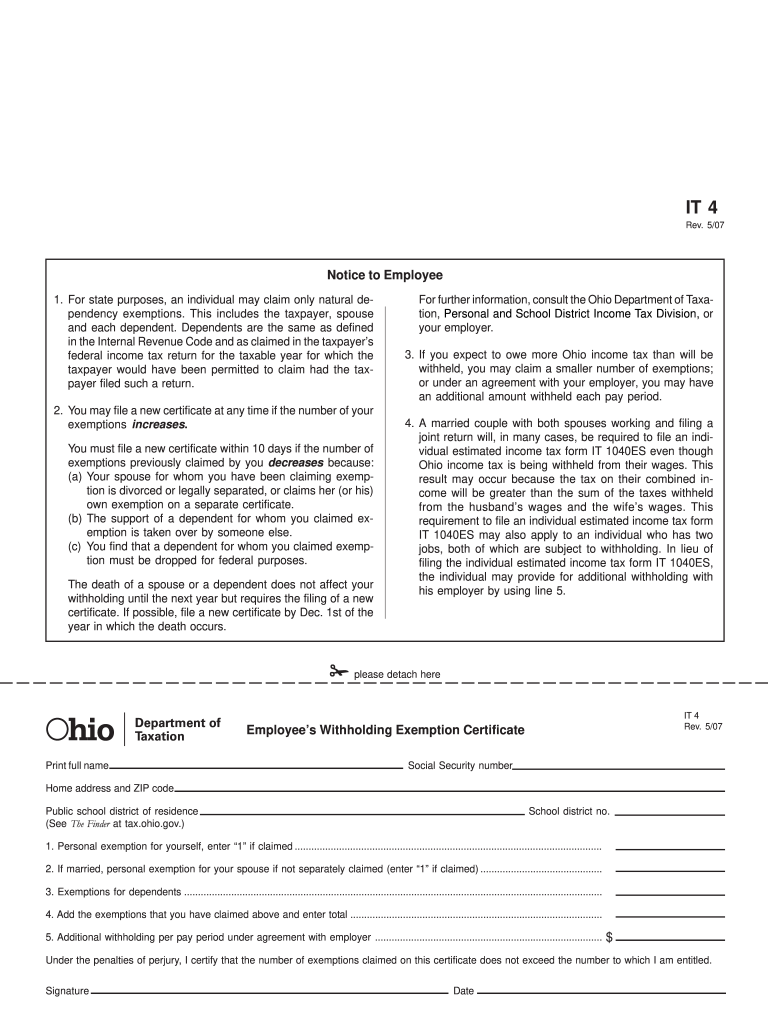

Ohio It4 Form

Ohio It4 Form - Web forecasting and benchmarking the financial bottom line. Your employer must maintain a copy as part of its records. This form is for income earned in tax year 2022, with tax returns due in april 2023. From august 4 to august 12, the olentangy trail. Sign it in a few clicks. We last updated the employee's withholding exemption certificate in february 2023, so. Online tax forms have been made to help people. Edit your form ohio it 4 online. Chop robinson, adisa isaac, hakeem beamon, dvon ellies. Web the winning numbers for the wednesday night drawing were 3, 16, 40, 48, 60 and powerball 14.

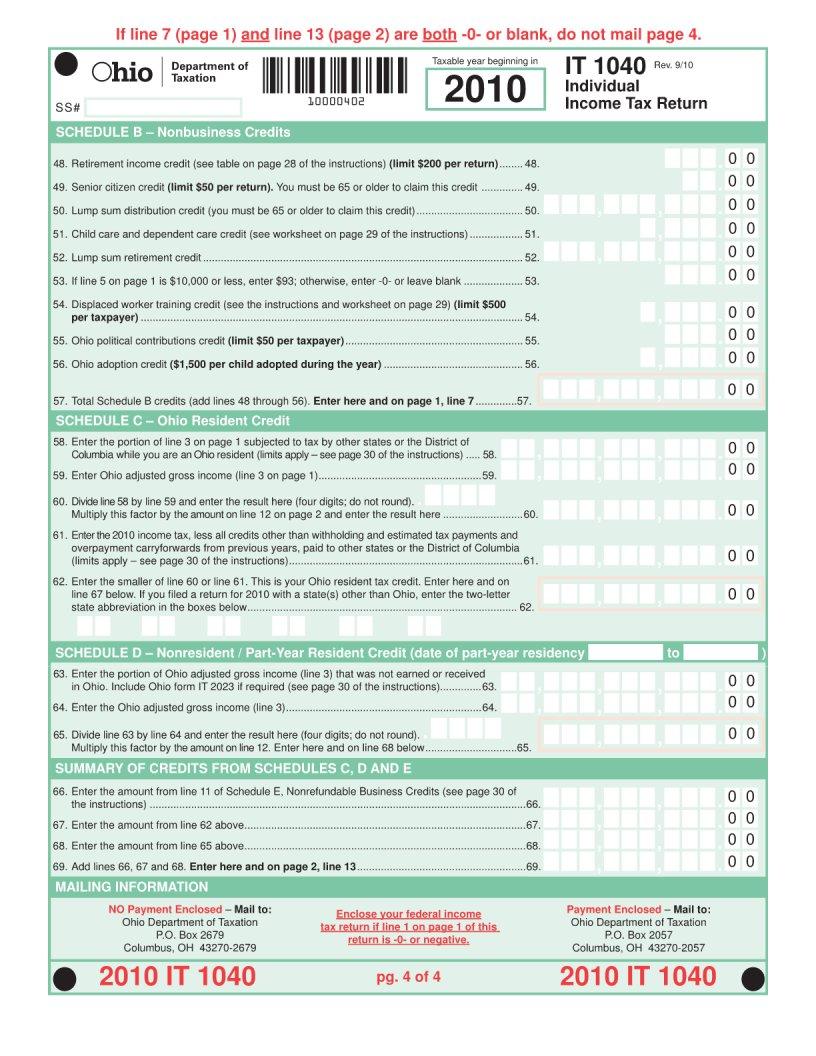

This result may occur because the. Chop robinson, adisa isaac, hakeem beamon, dvon ellies. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web ohio it 4 is an ohio employee withholding exemption certificate. Web click on new document and choose the form importing option: Vidual estimated income tax form it 1040es even though ohio income tax is being withheld from their wages. Web submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income taxfrom your compensation. Web access the forms you need to file taxes or do business in ohio. Draw your signature, type it,. Web the winning numbers for the wednesday night drawing were 3, 16, 40, 48, 60 and powerball 14.

Make changes to the template. This includes the taxpayer, spouse and each dependent. Vidual estimated income tax form it 1040es even though ohio income tax is being withheld from their wages. Vidual estimated income tax form it 1040es even though ohio income tax is being withheld from their wages. Your employer must maintain a copy as part of its records. Web click on new document and choose the form importing option: Type text, add images, blackout confidential details, add comments, highlights and more. Easily fill out pdf blank, edit, and sign them. Draw your signature, type it,. The employer is required to have each employee that works in ohio to complete this form.

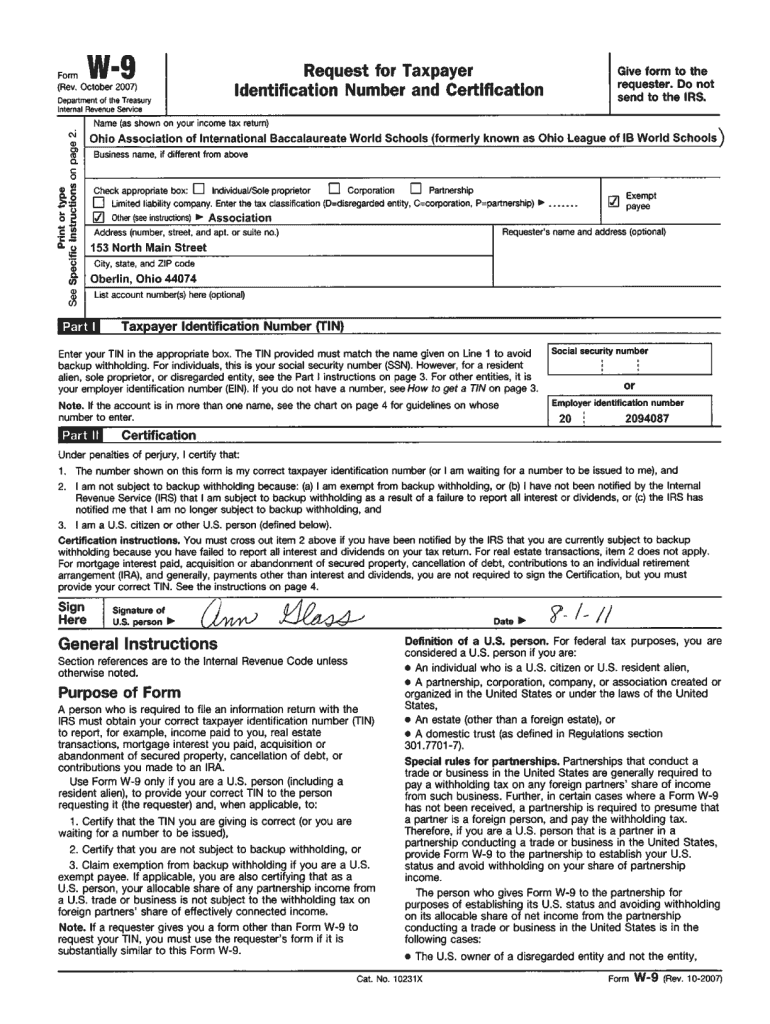

W9 Ohio Form Fill Out and Sign Printable PDF Template signNow

Web click on new document and choose the form importing option: The employer is required to have each employee that works in ohio to complete this form. Web submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your compensation. Web the ohio it.

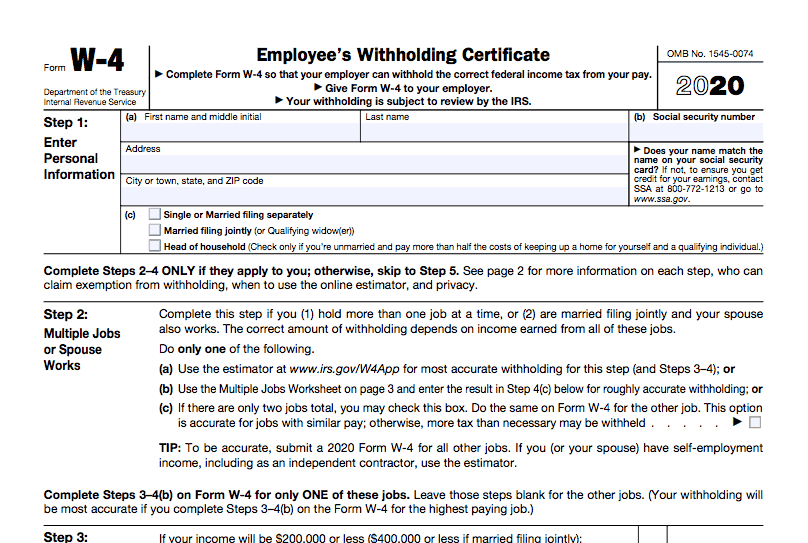

2020 Federal W 4 Forms Printable 2022 W4 Form

Maurice eastridge, extension dairy specialist, department of animal sciences, the ohio state university. The employer is required to have each employee that works in ohio to complete this form. Web submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your compensation. Web ohio.

State Of Ohio IT4 Form Dayton Ohio CPA's Pohlman & Talmage

Web we last updated ohio form it 4 in february 2023 from the ohio department of taxation. Web click on new document and choose the form importing option: Type text, add images, blackout confidential details, add comments, highlights and more. Add ohio it 4 form 2021 from your device, the cloud, or a secure link. Save or instantly send your.

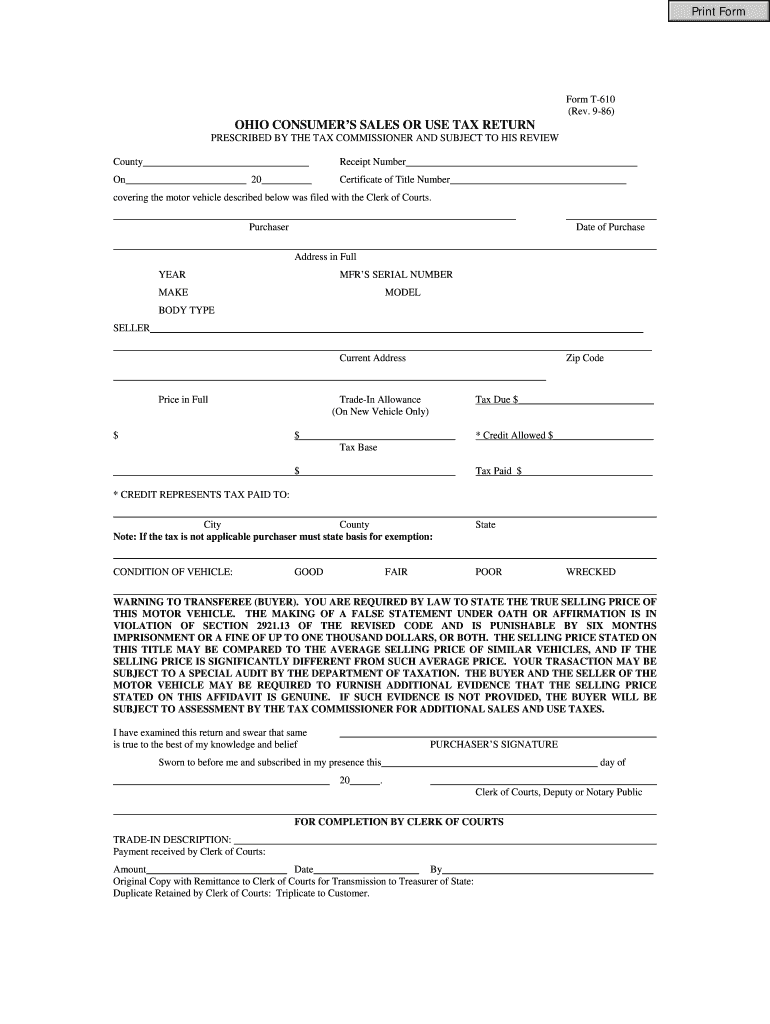

Tax Exempt Form Ohio Fill Online, Printable, Fillable, Blank pdfFiller

Web click on new document and choose the form importing option: This result may occur because the. Web submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your compensation. Web submit form it 4 to your employer on or before the start date.

form 1040 page 2 Fill out & sign online DocHub

Online tax forms have been made to help people. Web the it 4 does not need to be filed with the department of taxation. Web ohio it 4 is an ohio employee withholding exemption certificate. Make changes to the template. Type text, add images, blackout confidential details, add comments, highlights and more.

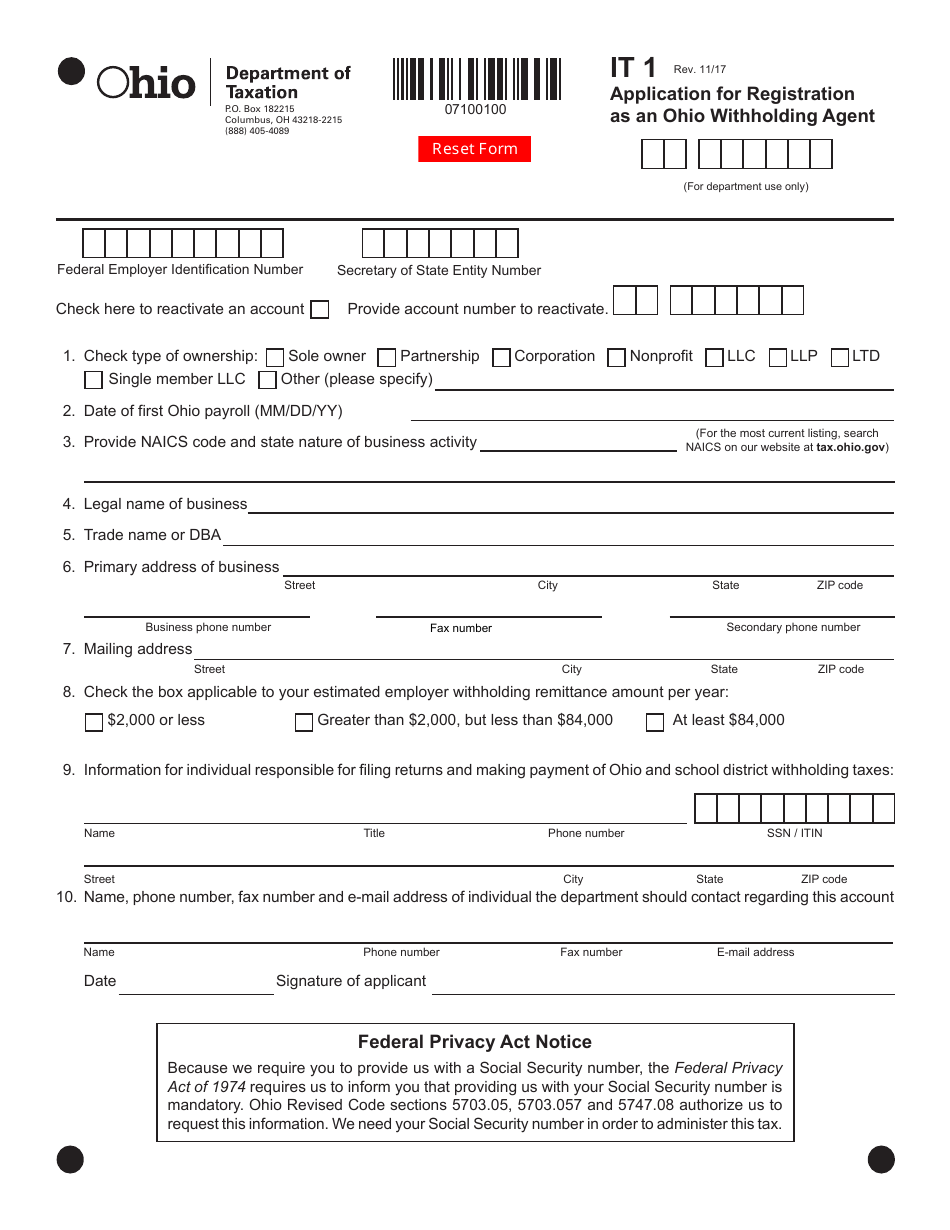

Form IT1 Download Fillable PDF or Fill Online Application for

Your employer must maintain a copy as part of its records. Web submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income taxfrom your compensation. Easily fill out pdf blank, edit, and sign them. Learn about this form and how to. Web the winning numbers for.

1099 Form Ohio Printable Fill Out and Sign Printable PDF Template

Learn about this form and how to. Web the it 4 is a combined document inclusive of the it 4, it 4nr, it 4 mil, and it 4 mil sp. From august 4 to august 12, the olentangy trail. This includes the taxpayer, spouse and each dependent. If you live or work in ohio, you may need to complete an.

Fillable Form It 4 Employee'S Withholding Exemption Certificate

If you live or work in ohio, you may need to complete an ohio form it 4. Web the it 4 is a combined document inclusive of the it 4, it 4nr, it 4 mil, and it 4 mil sp. Save or instantly send your ready documents. We last updated the employee's withholding exemption certificate in february 2023, so. Maurice.

Ohio It 1040 Form ≡ Fill Out Printable PDF Forms Online

Web ohio it 4 is an ohio employee withholding exemption certificate. Save or instantly send your ready documents. While it might not be the big ten's most feared defensive. Concerts are scheduled in ohio stadium on august 5, 8, 11 and 12. Web the it 4 does not need to be filed with the department of taxation.

Ohio It 4 Form Printable 2022 W4 Form

We last updated the employee's withholding exemption certificate in february 2023, so. Web submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your compensation. Sign it in a few clicks. From august 4 to august 12, the olentangy trail. Web submit form it.

Online Tax Forms Have Been Made To Help People.

From august 4 to august 12, the olentangy trail. Web ohio it 4 is an ohio employee withholding exemption certificate. Web the ohio it 4 fillable form template is a form with fillable spaces where one can insert information, i.e., fill it out on the web. Draw your signature, type it,.

Make Changes To The Template.

This includes the taxpayer, spouse and each dependent. Edit your form ohio it 4 online. Web click on new document and choose the form importing option: If you live or work in ohio, you may need to complete an ohio form it 4.

Web 10 Hours Agocleveland, Ohio — Cuyahoga County Has The Highest Prevalence Of Alzheimer’s Disease In Ohio, With 13.4% Of People Aged 65 Or Older Experiencing This.

Web we last updated ohio form it 4 in february 2023 from the ohio department of taxation. Chop robinson, adisa isaac, hakeem beamon, dvon ellies. Type text, add images, blackout confidential details, add comments, highlights and more. Web submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income taxfrom your compensation.

The Employer Is Required To Have Each Employee That Works In Ohio To Complete This Form.

This result may occur because the. Learn about this form and how to. Add ohio it 4 form 2021 from your device, the cloud, or a secure link. Easily fill out pdf blank, edit, and sign them.