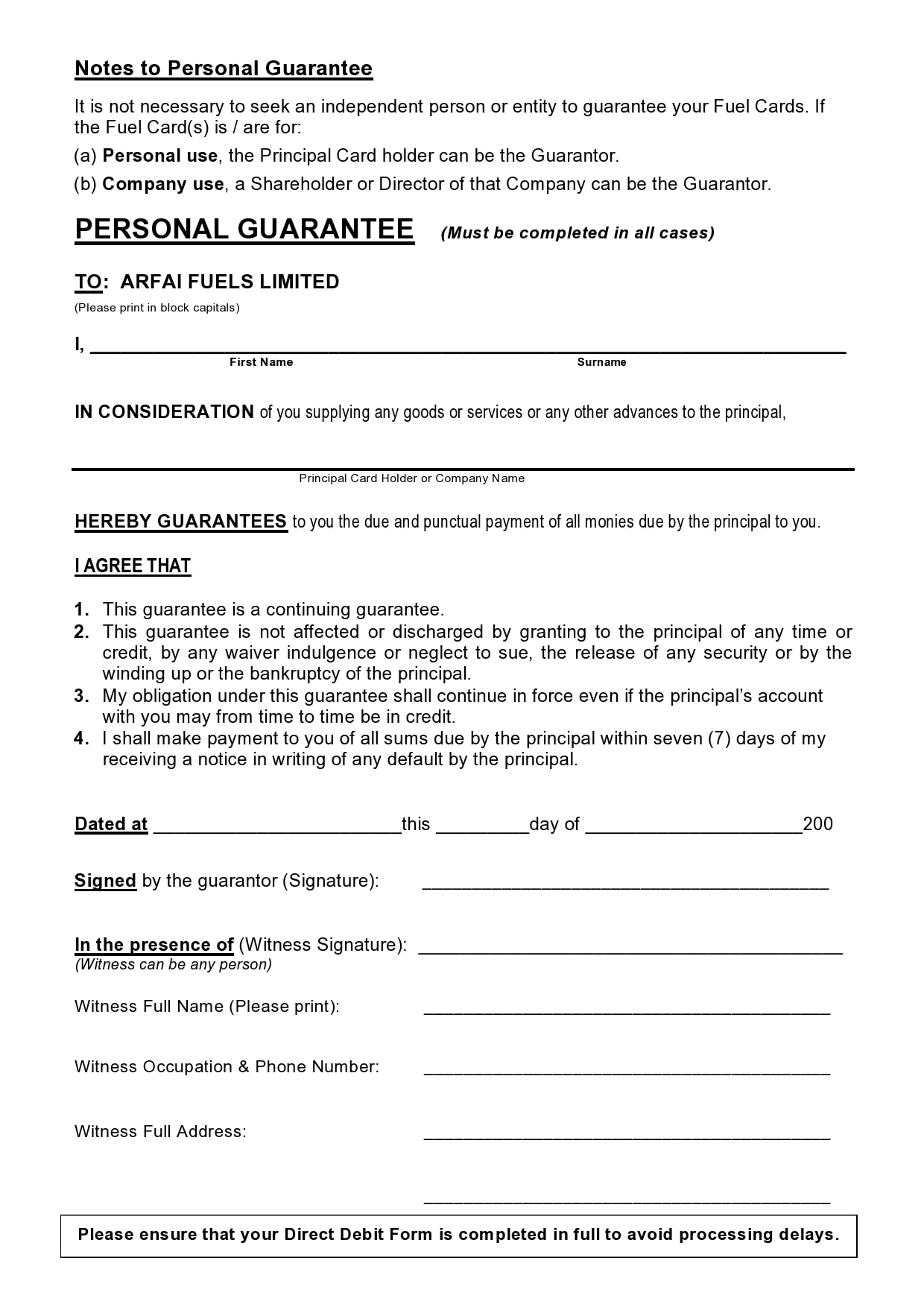

Personal Guarantor Form

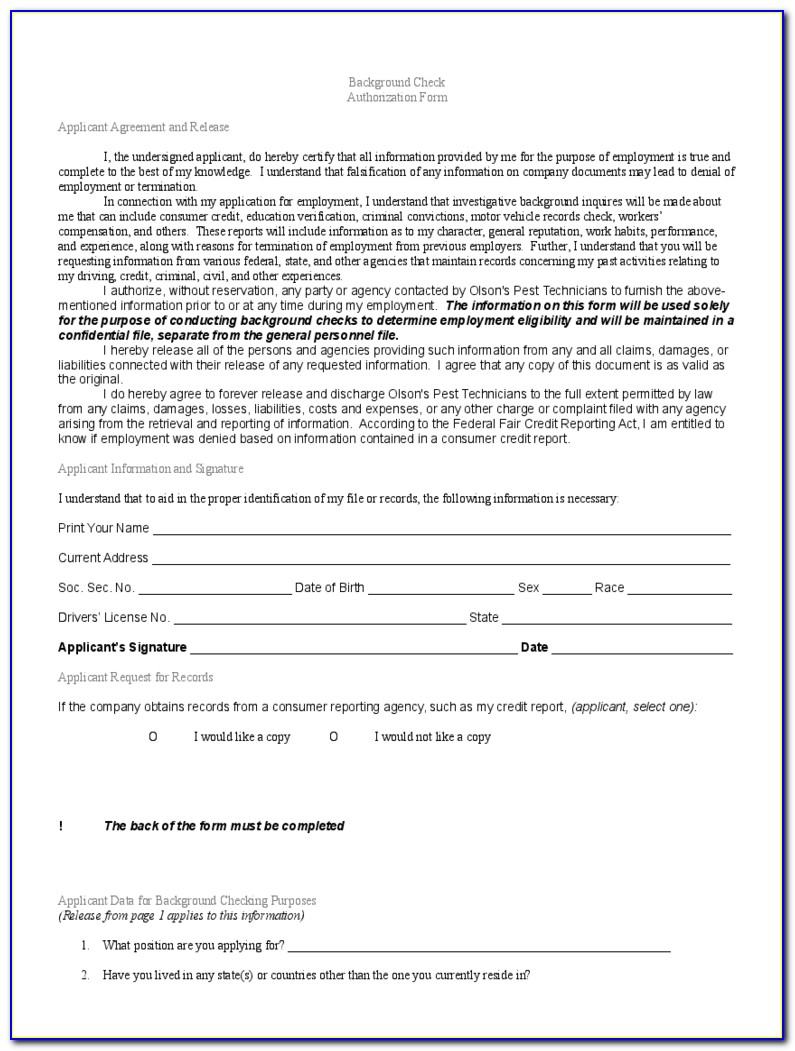

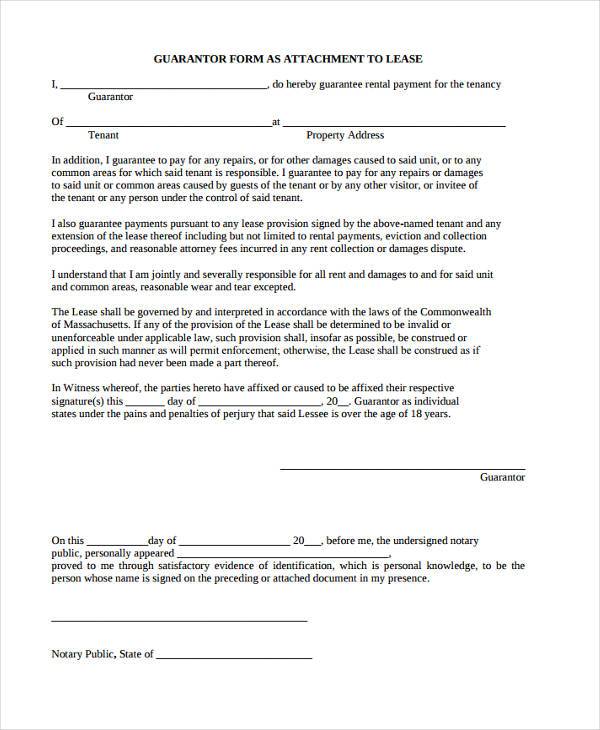

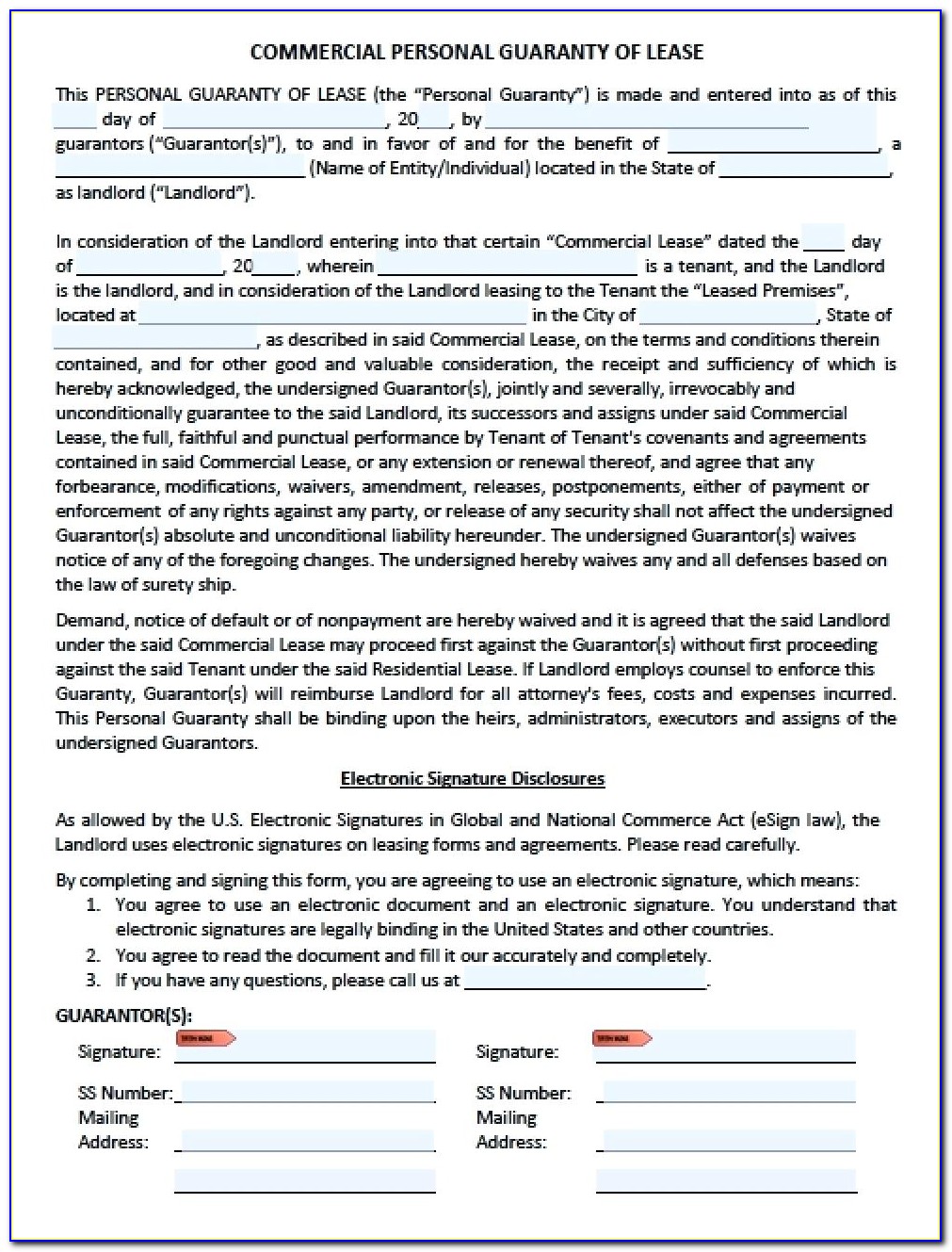

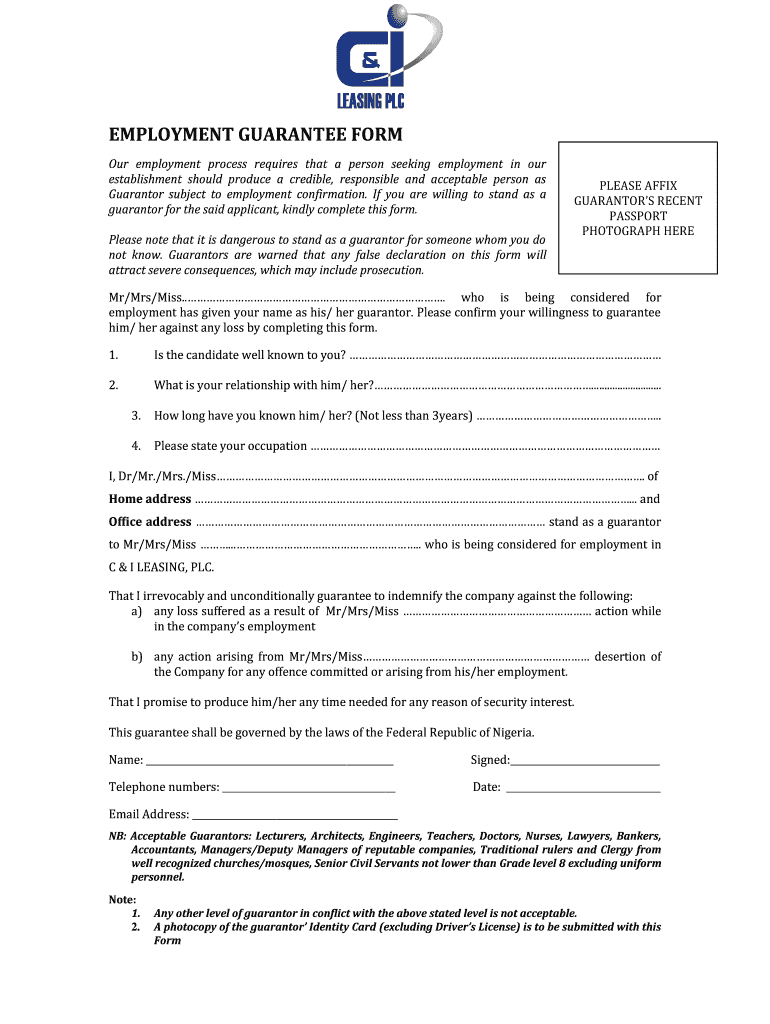

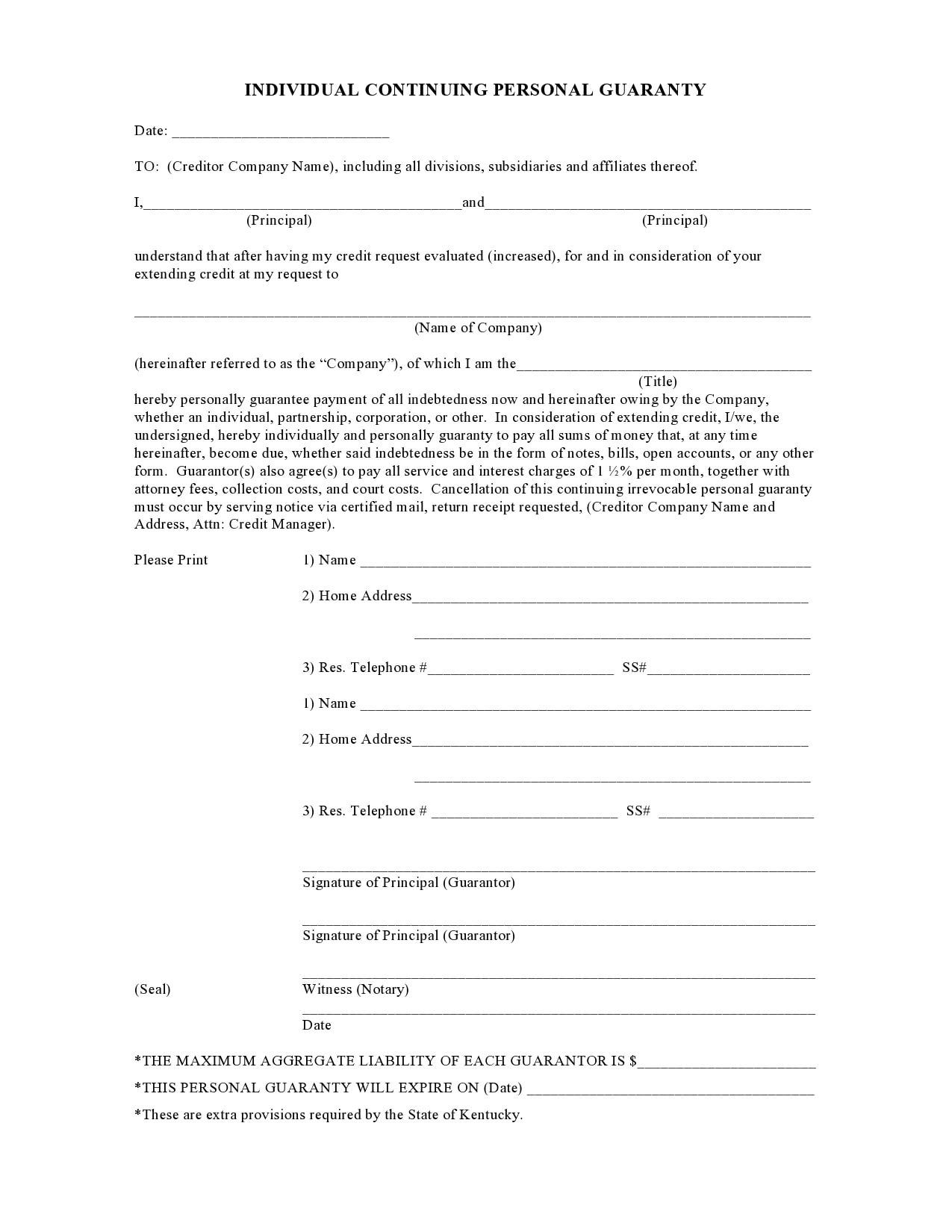

Personal Guarantor Form - Both the tenant and the guarantor are equally accountable for the payment of rent. Sba form 148 (10/98) previous editions obsolete. Fill in your personal information accurately, including your name, address, and contact details. Web create document updated april 14, 2023 a real estate (lease) personal guarantee requires a third party (“guarantor”) to fulfill the obligations of a lease in the event of default by the tenant who is under contract. The guarantor, by assuming the liabilities of the tenant, is benefiting the tenant. Sba lenders may use this form. As a borrower, it’s pretty easy to get a personal loan when you have a guarantor. Personal guarantees help businesses get credit when. Web the lease personal guarantee form involves the tenant, landlord, and guarantor. Web free 7+ personal guarantee forms in pdf;

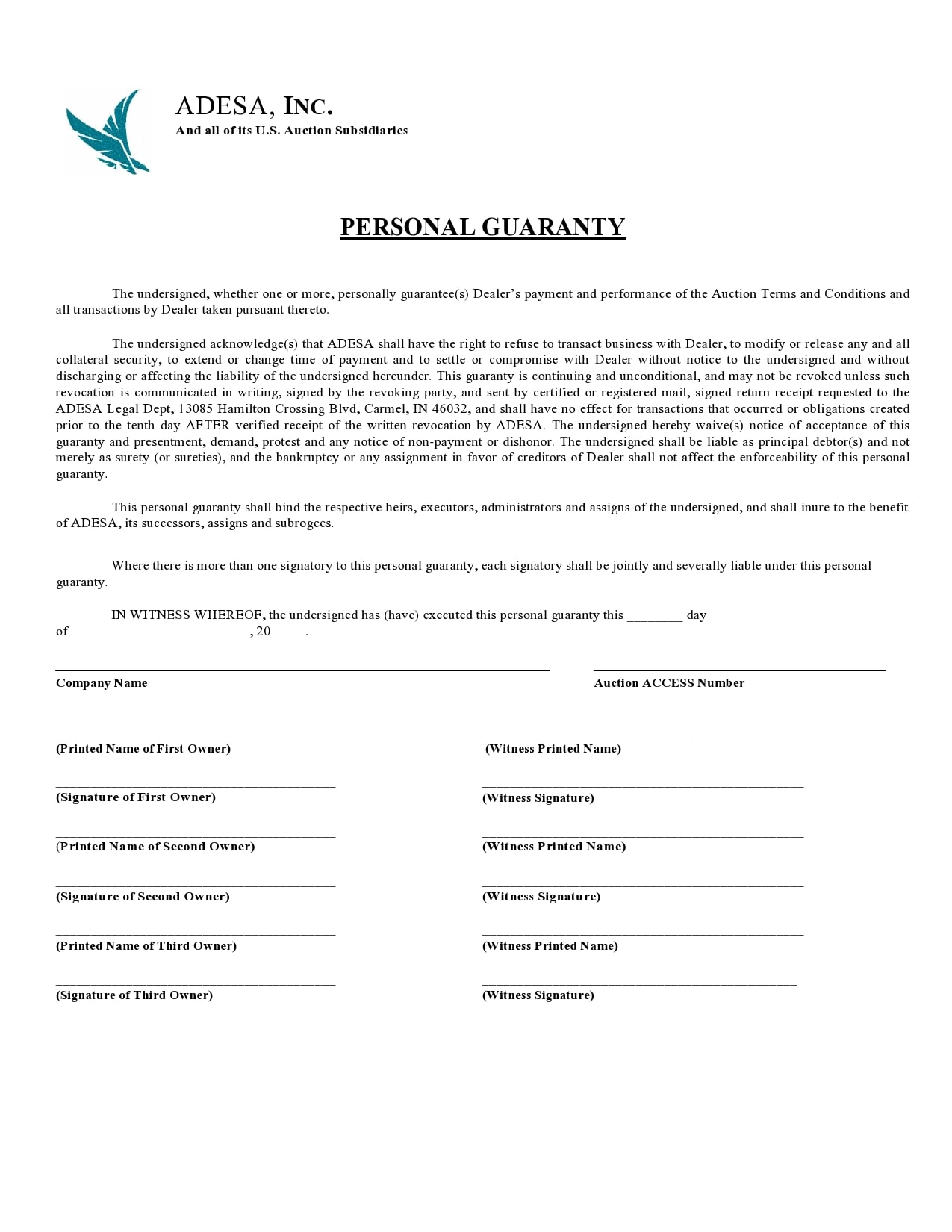

Web as a guarantor, you’re responsible for paying back a personal loan in case the borrower cannot. Therefore, if the business defaults on its loan payments, the lender has the right to seize the business owner’s personal assets to. Due to the risks posed by unsecured loans, some lenders might not typically approve a. A release of guarantee form is a document that allows a guarantor to free themselves from being financially and/or legally bound to a contract. Free 6+ guaranty agreement contract forms in pdf doc; Web a loan personal guarantee is a document that allows an individual (“guarantor”) to be held responsible for money loaned if it is not paid back by a borrower. By signing below, each individual or entity becomes obligated as guarantor under this guarantee. Free 3+ release of personal guarantee form in pdf doc; Free 4+ security guard application forms pdf; Web a guarantee is when a person agrees to take responsibility for repaying a debt if the debtor can no longer pay it.

Customizing this personal guarantee form is simple with jotform’s online form builder. Click on the link or visit www.sampleforms.com to view our form templates and examples that you can use now! A loan personal guarantee form is used in situations where the borrower has a low/poor credit rating, and the lender. Web a personal guarantee is a legal promise made by an individual to repay credit issued to their business using their own personal assets in the event that the business is unable to repay the debt. Web the guarantor shall pay, reimburse, and indemnify linwood for any and all reasonable attorneys’ fees, court costs, and finance or interest charges arising or resulting from the failure of purchaser to perform, satisfy, or observe any. Web guarantor acknowledges that guarantor has read and understands the significance of all terms of the note and this guarantee, including all waivers. By signing below, each individual or entity becomes obligated as guarantor under this guarantee. Sba lenders may use this form. This gives a lender added security that the loaned amount will be repaid, especially for borrowers with fair or bad credit. Personal guarantees help businesses get credit when.

Employee Guarantor's Form Samples 10 Free Personal Guarantee Form

Web personal guarantor unconditionally guarantees the full and complete performance by dealer of every obligation set forth in the dealer agreement.personal guarantor agrees that, upon dealer’s default under the dealer agreement and vantage’s demand, personal guarantor shall immediately pay any dealer indebtedness due vantage under the. Web the lease personal guarantee form involves the tenant, landlord, and guarantor. Web a.

Guarantor Form For Driver 20202021 Fill and Sign Printable Template

Web as a guarantor, you’re responsible for paying back a personal loan in case the borrower cannot. Web a guarantor form is a document that certifies a guarantor’s decision to assume liability if a particular individual does not fulfill the terms of an agreement. Sba form 148 (10/98) previous editions obsolete. This means that if the tenant doesn’t pay rent.

30 Best Personal Guarantee Forms & Templates TemplateArchive

Free 6+ guaranty agreement contract forms in pdf doc; Web a guarantor form is a document that certifies a guarantor’s decision to assume liability if a particular individual does not fulfill the terms of an agreement. Web a loan personal guarantee form is a written document that allows a person, referred to as a guarantor, to be held responsible for.

Bank Of India Borrowers Guarantors Profile Form Fill Online

Web a loan personal guarantee form is a written document that allows a person, referred to as a guarantor, to be held responsible for the personal loan given by the lender to the borrower in case the borrower fails to repay the loan. As a borrower, it’s pretty easy to get a personal loan when you have a guarantor. Free.

FREE 8+ Sample Guarantor Agreement Forms in PDF MS Word

A loan personal guarantee form is used in situations where the borrower has a low/poor credit rating, and the lender. Customizing this personal guarantee form is simple with jotform’s online form builder. Both the tenant and the guarantor are equally accountable for the payment of rent. Personal guarantees help businesses get credit when. Start by carefully reading the instructions provided.

Sample Of Employee Guarantor's Form In Nigeria FREE 9+ Sample

Web if you need to guarantee someone's credit worthiness, you can use our personal guaranty form. If you agree to become a guarantor, you may need a personal guarantee form. Sba form 148 (10/98) previous editions obsolete. Sba lenders may use this form. Web a loan personal guarantee is a document that allows an individual (“guarantor”) to be held responsible.

Employee Guarantor's Form Samples / Personal Guarantee Form For A Lease

Both the tenant and the guarantor are equally accountable for the payment of rent. Print or download your contract for immediate use. Fill in your personal information accurately, including your name, address, and contact details. Web as a guarantor, you’re responsible for paying back a personal loan in case the borrower cannot. Lenders often ask for personal guarantees because they.

Guarantor Form Fill Online, Printable, Fillable, Blank pdfFiller

Web a guarantee is when a person agrees to take responsibility for repaying a debt if the debtor can no longer pay it. Web create document updated april 14, 2023 a real estate (lease) personal guarantee requires a third party (“guarantor”) to fulfill the obligations of a lease in the event of default by the tenant who is under contract..

30 Best Personal Guarantee Forms & Templates TemplateArchive

Start by carefully reading the instructions provided on the form. Both the tenant and the guarantor are equally accountable for the payment of rent. Web need a personal guarantee form? Sba lenders may use this form. Web a personal guarantee is an individual’s legal promise to repay credit issued to a business for which they serve as an executive or.

FREE 8+ Sample Guarantor Agreement Forms in PDF MS Word

A loan personal guarantee form is used in situations where the borrower has a low/poor credit rating, and the lender. Provide details about your employment or income, such as your employer's name, job title, and monthly salary. Web need a personal guarantee form? This is common for loan agreements and lease documents after expiration or when the contract has been.

By Signing Below, Each Individual Or Entity Becomes Obligated As Guarantor Under This Guarantee.

Customizing this personal guarantee form is simple with jotform’s online form builder. Web a personal guarantee is a provision a lender puts in a business loan agreement that requires owners to be personally responsible for their company’s debt in case of default. Web a personal guarantee form for loan is a document that enables a person, known as a guarantor, to take responsibility for a personal loan if it’s not paid back by a borrower. Web how to fill out a guarantor form:

Web As A Guarantor, You’re Responsible For Paying Back A Personal Loan In Case The Borrower Cannot.

Lenders often ask for personal guarantees because they have concerns over the credit history, age or financial stability of your business. This gives a lender added security that the loaned amount will be repaid, especially for borrowers with fair or bad credit. Whether you want a bank to loan money to a family member, or hold off on collections for his or her late phone bill, being a guarantor comes with the responsibility that you will repay their debt if they do not. It is to be completed by the guarantor who has agreed to take responsibility if an individual breaks the terms of an agreement.

Free 6+ Guaranty Agreement Contract Forms In Pdf Doc;

Web a guarantor form is a document that certifies a guarantor’s decision to assume liability if a particular individual does not fulfill the terms of an agreement. Web a personal guarantee is a signed agreement between lender and borrower where the borrower agrees to be personally responsible for the loan should their business default. Web a personal guarantee is a legal promise made by an individual to repay credit issued to their business using their own personal assets in the event that the business is unable to repay the debt. Free 9+ sample personal agreement forms in sample, example.

Sba Lenders May Use This Form.

Web need a personal guarantee form? Therefore, if the business defaults on its loan payments, the lender has the right to seize the business owner’s personal assets to. Web guarantor acknowledges that guarantor has read and understands the significance of all terms of the note and this guarantee, including all waivers. This means that if the tenant doesn’t pay rent or breaks the lease for other reasons, the guarantor would be held liable.