Missouri Tax Withholding Form

Missouri Tax Withholding Form - Web tax year revision date; The income tax withholding formula for the state of missouri includes the following changes: Web annual missouri withholding tax. Web missouri tax identification number —employee information— you do not pay missouri income tax on all of the income you earn! Failure to provide payroll with a valid. Web your missouri state taxes to withhold are need to adjust your withholding amount? Web change the entries on the form. Withholding tax per payroll period missouri — divide the employee’s annual missouri withholding. The annual standard deduction amount for employees. 260 if you pay daily,.

Web missouri tax identification number —employee information— you do not pay missouri income tax on all of the income you earn! Web the missouri department of revenue online withholding tax calculator is provided as a service for employees, employers, and tax professionals. Web change the entries on the form. Web local license renewal records and online access request[form 4379a] request for information or audit of local sales and use tax records[4379] request for information. Web employer’s return of income taxes withheld filing frequency missouri tax i.d. Department of the treasury internal revenue service. Web annual missouri withholding tax. 260 if you pay daily,. All new employees are required to complete a paper form for federal and state withholding. The individual must be authorized to.

Omaha man sentenced for tax evasion and role in multimillion dollar embezzlement. Withholding tax per payroll period missouri — divide the employee’s annual missouri withholding. 260 if you pay daily,. Web local license renewal records and online access request[form 4379a] request for information or audit of local sales and use tax records[4379] request for information. Web your missouri state taxes to withhold are need to adjust your withholding amount? Visit www.dor.mo.gov to try our. Web july 20, 2023. Web missouri tax identification number —employee information— you do not pay missouri income tax on all of the income you earn! The annual standard deduction amount for employees. 505, tax withholding and estimated tax.

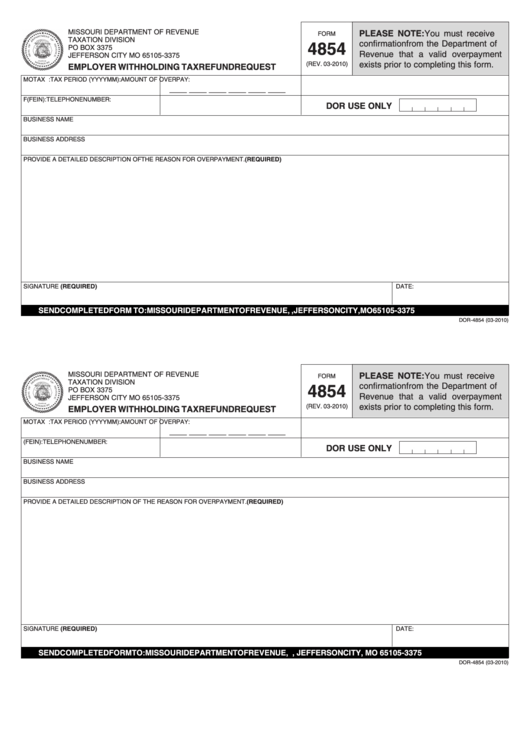

Fillable Form 4854 Employer Withholding Tax Refund Request Missouri

Department of the treasury internal revenue service. Omaha man sentenced for tax evasion and role in multimillion dollar embezzlement. Web employer’s return of income taxes withheld filing frequency missouri tax i.d. The annual standard deduction amount for employees. Employee’s withholding certificate mail to:

Missouri Tax Withholding Form 14 Seven Doubts You Should Clarify

Web missouri tax identification number —employee information— you do not pay missouri income tax on all of the income you earn! Department of the treasury internal revenue service. Omaha man sentenced for tax evasion and role in multimillion dollar embezzlement. The annual standard deduction amount for employees. Failure to provide payroll with a valid.

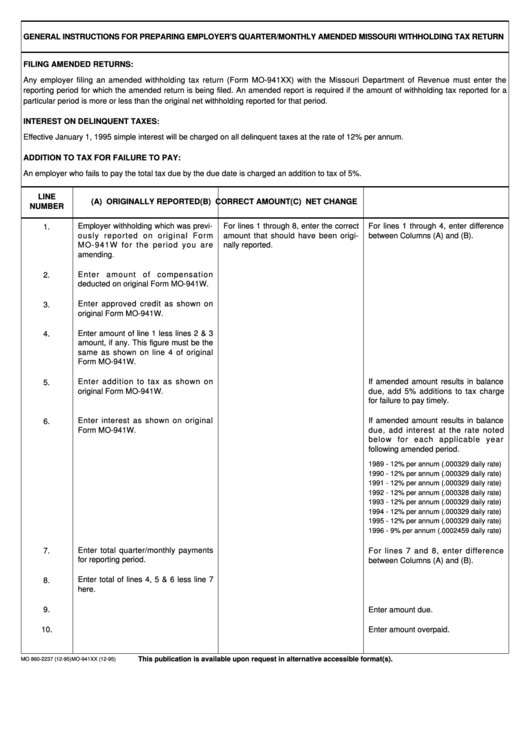

Top Mo941 X Form Templates free to download in PDF format

Web tax year revision date; Web the missouri department of revenue online withholding tax calculator is provided as a service for employees, employers, and tax professionals. Web july 20, 2023. Web change the entries on the form. Web employer’s return of income taxes withheld filing frequency missouri tax i.d.

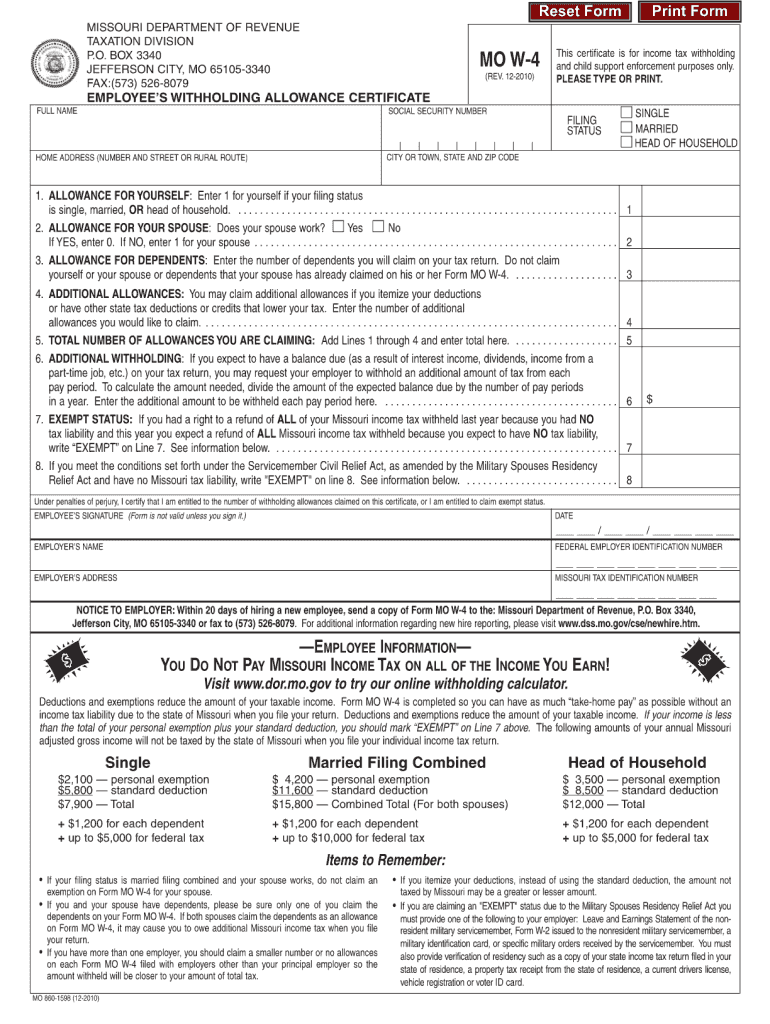

Missouri Form MO W4 App

Web july 20, 2023. Department of the treasury internal revenue service. Snohomish county tax preparer pleads guilty to assisting in the. Web tax year revision date; The request for mail order forms may be used to order one copy or.

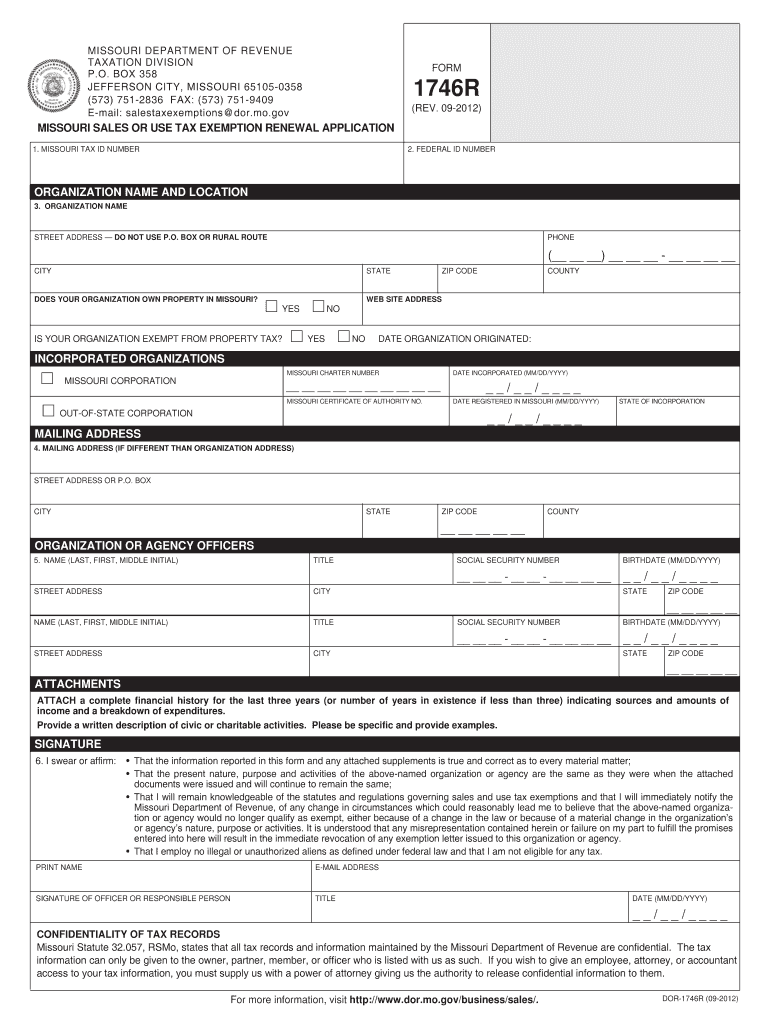

Missouri Sales Tax form 149 Beautiful Financial Analyst

Omaha man sentenced for tax evasion and role in multimillion dollar embezzlement. Web change the entries on the form. Employee’s withholding certificate mail to: 505, tax withholding and estimated tax. The annual standard deduction amount for employees.

Mo W4 2021 Form 2022 W4 Form

Snohomish county tax preparer pleads guilty to assisting in the. Web july 20, 2023. 260 if you pay daily,. Web missouri tax identification number —employee information— you do not pay missouri income tax on all of the income you earn! Web your missouri state taxes to withhold are need to adjust your withholding amount?

Form 8816 Fill Out and Sign Printable PDF Template signNow

The request for mail order forms may be used to order one copy or. Web change the entries on the form. Snohomish county tax preparer pleads guilty to assisting in the. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in.

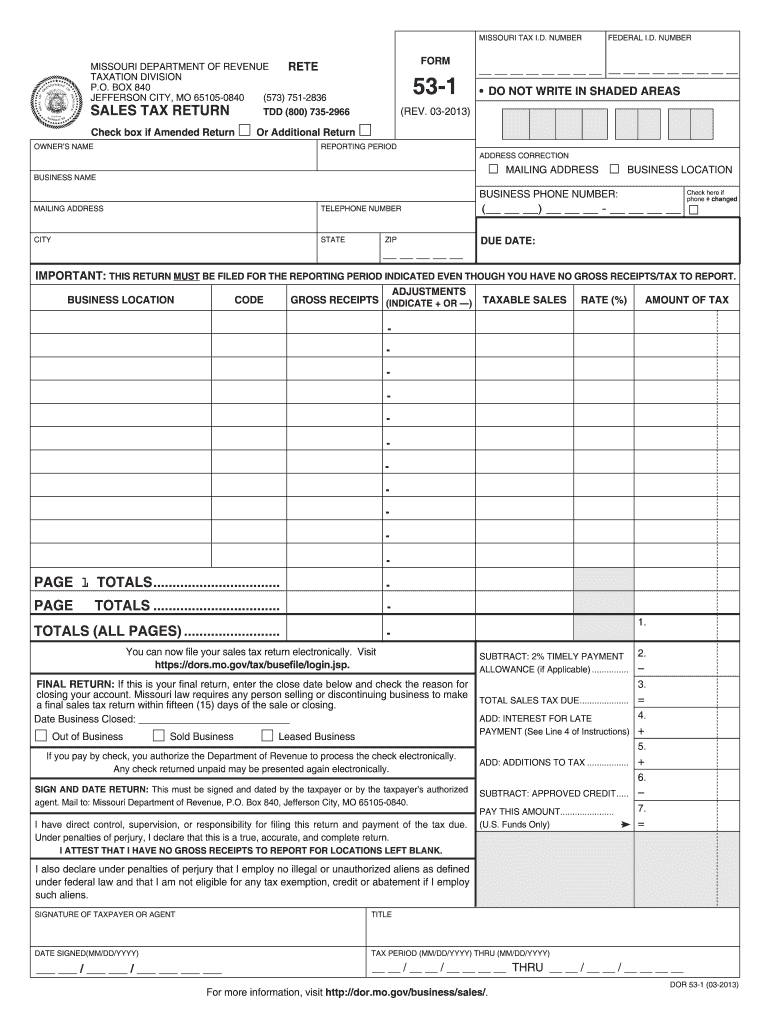

Missouri Sales Tax Form 53 1 Instruction Fill Out and Sign Printable

Web july 20, 2023. Failure to provide payroll with a valid. Employee’s withholding certificate mail to: 260 if you pay daily,. Web employer’s return of income taxes withheld filing frequency missouri tax i.d.

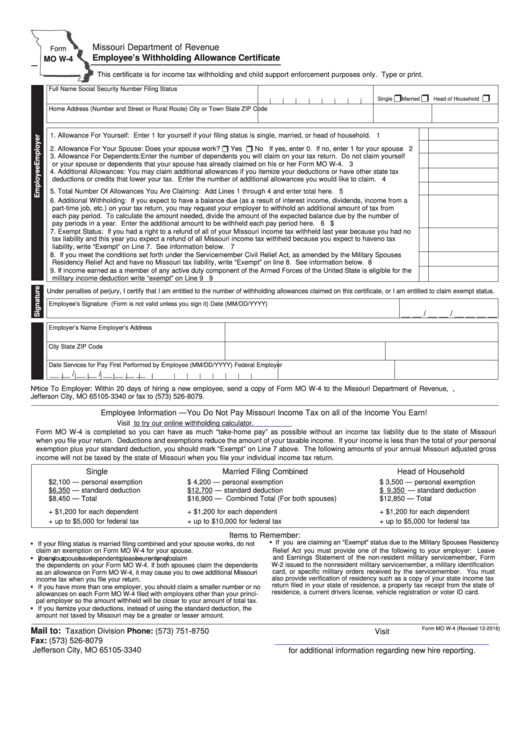

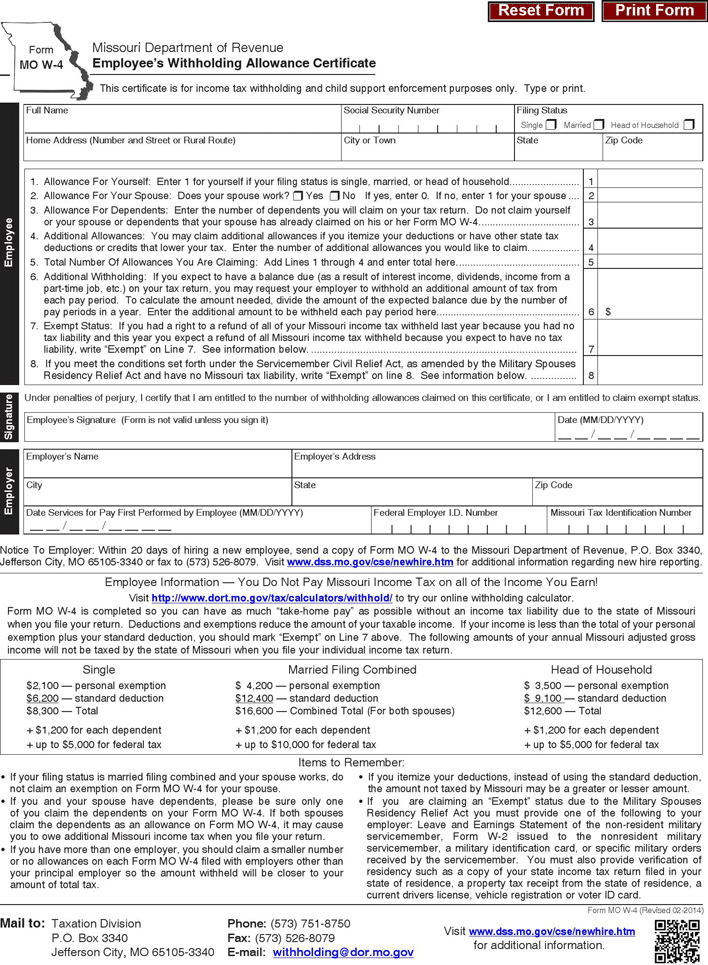

Fillable Form Mo W4 Employee'S Withholding Allowance Certificate

505, tax withholding and estimated tax. Web missouri tax identification number —employee information— you do not pay missouri income tax on all of the income you earn! Web annual missouri withholding tax. Web employer’s return of income taxes withheld filing frequency missouri tax i.d. Failure to provide payroll with a valid.

State Tax Withholding Forms Template Free Download Speedy Template

Web your missouri state taxes to withhold are need to adjust your withholding amount? Employee’s withholding certificate mail to: Department of the treasury internal revenue service. Web annual missouri withholding tax. The income tax withholding formula for the state of missouri includes the following changes:

Web The Missouri Department Of Revenue Online Withholding Tax Calculator Is Provided As A Service For Employees, Employers, And Tax Professionals.

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web employer’s return of income taxes withheld filing frequency missouri tax i.d. Snohomish county tax preparer pleads guilty to assisting in the. Web change the entries on the form.

505, Tax Withholding And Estimated Tax.

Failure to provide payroll with a valid. Web your missouri state taxes to withhold are need to adjust your withholding amount? Web tax year revision date; Web annual missouri withholding tax.

Web July 20, 2023.

The individual must be authorized to. Web missouri tax identification number —employee information— you do not pay missouri income tax on all of the income you earn! 260 if you pay daily,. The income tax withholding formula for the state of missouri includes the following changes:

Withholding Tax Per Payroll Period Missouri — Divide The Employee’s Annual Missouri Withholding.

Web local license renewal records and online access request[form 4379a] request for information or audit of local sales and use tax records[4379] request for information. Department of the treasury internal revenue service. Employee’s withholding certificate mail to: Omaha man sentenced for tax evasion and role in multimillion dollar embezzlement.