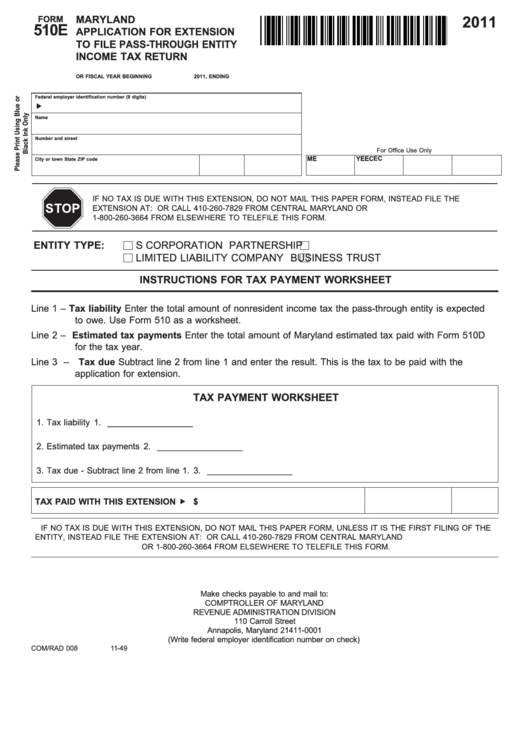

Maryland Form 510E 2022

Maryland Form 510E 2022 - Use form 510e to remit. Web this system allows instant online electronic filing of the 500e/510e forms. Show sources > form 510e is a maryland corporate income tax form. 15th day of the 3rd month following close of the tax year or period. Indicate the date to the document with the date feature. Web the extension request filing system allows businesses to instantly file for an extension online. Web subject to maryland corporation income tax. (1) enter the corporation name,. Web to access form 510e, from the main menu of the maryland return, select miscellaneous forms and schedules > extension (form 510e). Web 510c filed this tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation.

Please use the link below. This form is for income earned in tax year 2022, with tax returns due in april. How to file complete the tax payment worksheet. Use form 510e to remit. 1) telefile request an automatic extension by calling 1. Web 510c filed this tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. A 7 month extension can be granted for. Businesses can file the 500e or 510e online if they have previously filed form. Use form 500 to calculate the amount of maryland corporation income tax. (1) enter the corporation name,.

1) telefile request an automatic extension by calling 1. (1) enter the corporation name,. Please use the link below. This form is for income earned in tax year 2022, with tax returns due in april. Use form 510e to remit. Web (1) requirement to file. Show sources > form 510e is a maryland corporate income tax form. Businesses can file the 500e or 510e online if they have previously filed form. Web to access form 510e, from the main menu of the maryland return, select miscellaneous forms and schedules > extension (form 510e). Web this system allows instant online electronic filing of the 500e/510e forms.

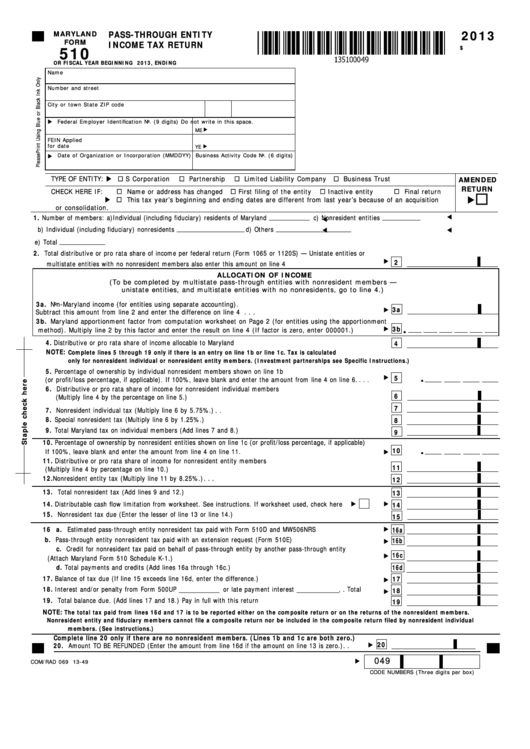

elliemeyersdesigns Maryland Form 510

This form may be used if the pte is paying tax only on. Use form 510e to remit any tax that may be due. Use form 510e to remit. Also use form 510e if this is the first. 1) telefile request an automatic extension by calling 1.

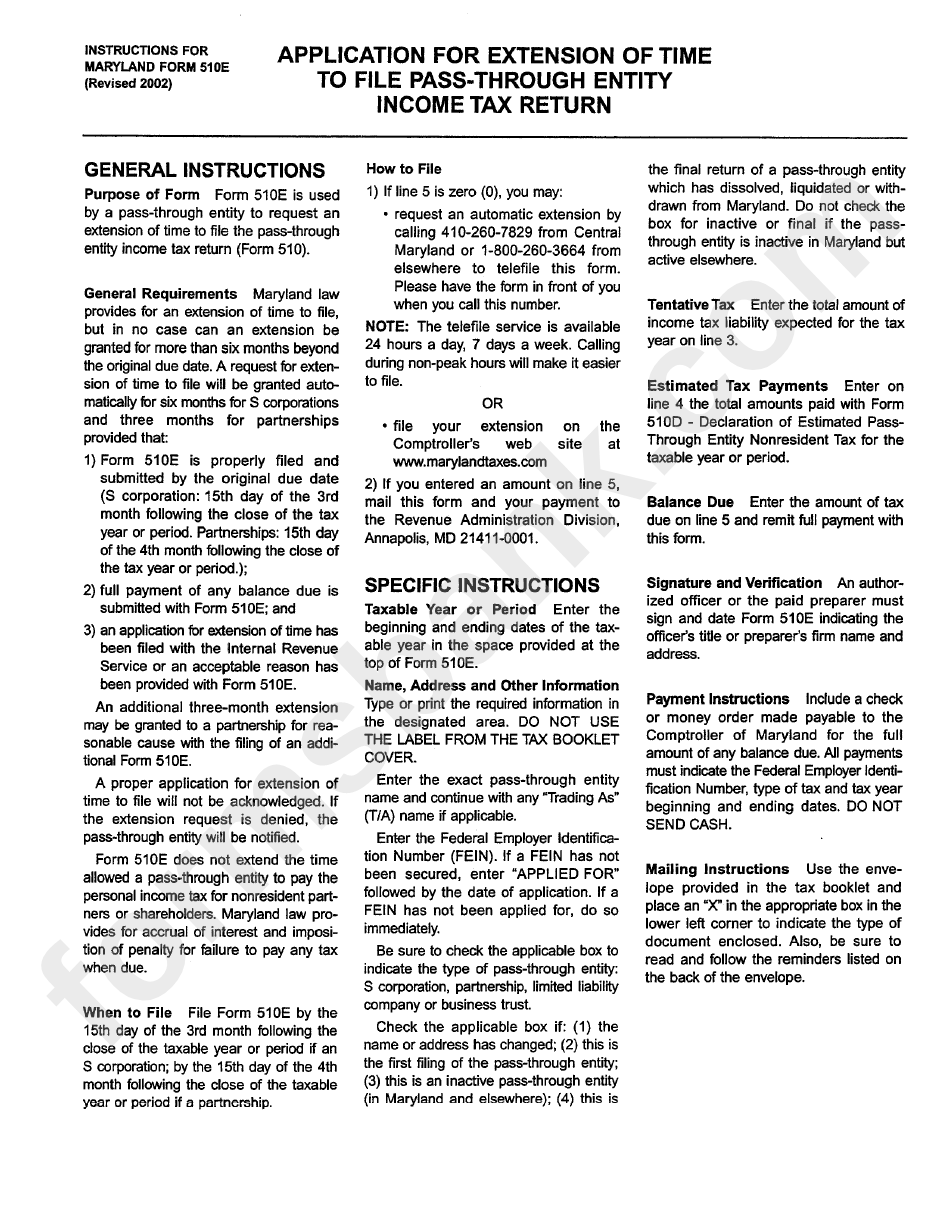

Instructions For Maryland Form 510e Application For Extension Oftime

(1) enter the corporation name,. Web this system allows instant online electronic filing of the 500e/510e forms. Businesses can file the 500e or 510e online if they have previously filed form. An automatic extension will be granted if filed by the due date. This form is for income earned in tax year 2022, with tax returns due in april.

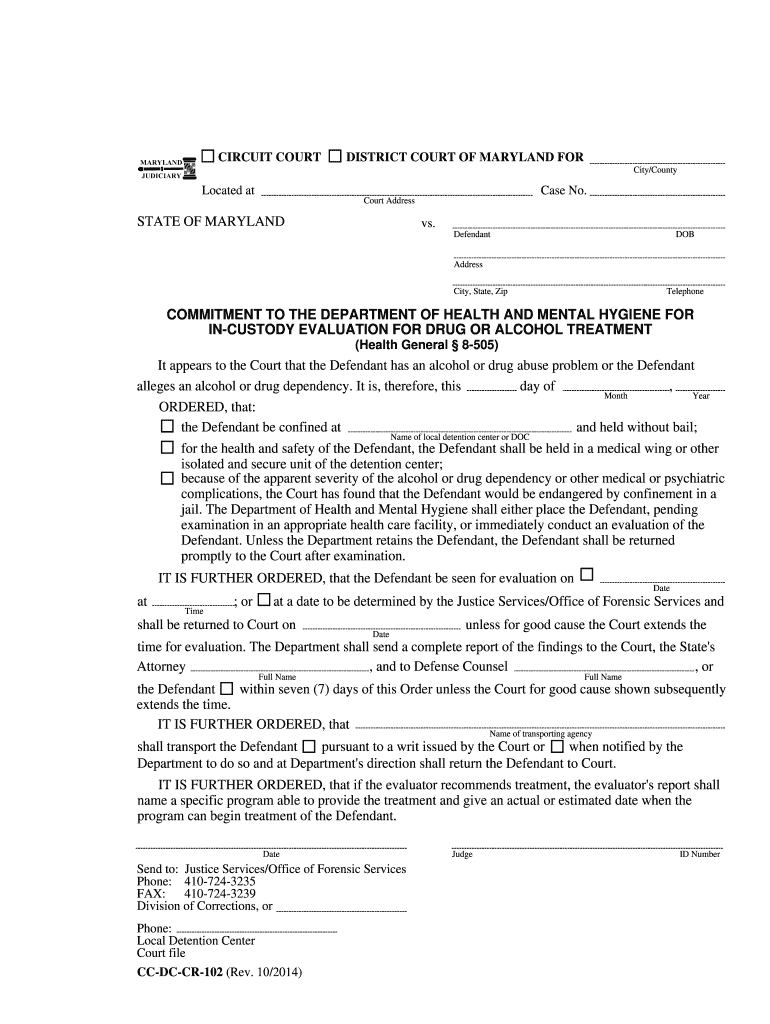

8505 Inmate Program Form Fill Out and Sign Printable PDF Template

How to file complete the tax payment worksheet. Also use form 510e if this is the first. Web we last updated maryland form 510e from the comptroller of maryland in november 2022. 15th day of the 3rd month following close of the tax year or period. Web subject to maryland corporation income tax.

PROFORM 510E BEDIENUNGSANLEITUNG Pdf Download ManualsLib

Use form 510e to remit. Web we last updated maryland form 510e from the comptroller of maryland in november 2022. Web the extension request filing system allows businesses to instantly file for an extension online. Web to access form 510e, from the main menu of the maryland return, select miscellaneous forms and schedules > extension (form 510e). Web (1) requirement.

elliemeyersdesigns Maryland Form 510

Businesses can file the 500e or 510e online if they have previously filed form. Web we last updated maryland form 510e from the comptroller of maryland in november 2022. Use form 510e to remit. (1) enter the corporation name,. Web we last updated maryland form 510e in november 2022 from the maryland comptroller of maryland.

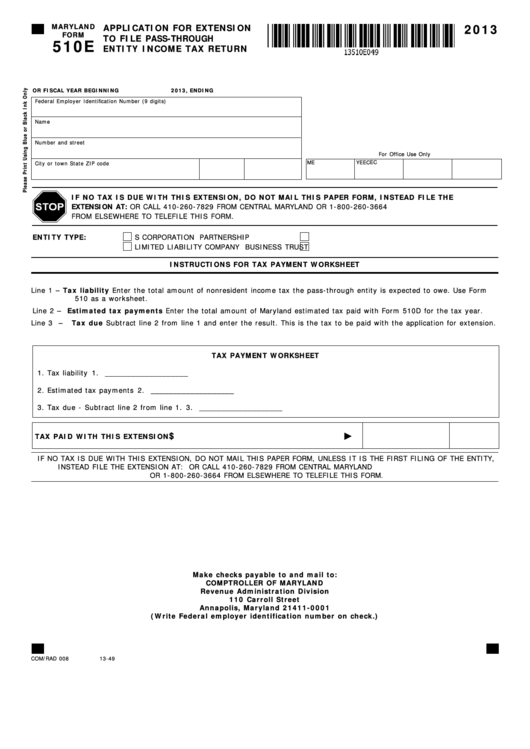

Fillable Maryland Form 510e Application For Extension To File Pass

An automatic extension will be granted if filed by the due date. A 7 month extension can be granted for. Also use form 510e if this is the first. Use form 510e to remit any tax that may be due. 15th day of the 3rd month following close of the tax year or period.

Fillable Form 510e Maryland Application For Extension To File Pass

Web we last updated maryland form 510e in november 2022 from the maryland comptroller of maryland. Indicate the date to the document with the date feature. Please use the link below. 15th day of the 3rd month following close of the tax year or period. Businesses can file the 500e or 510e online if they have previously filed form.

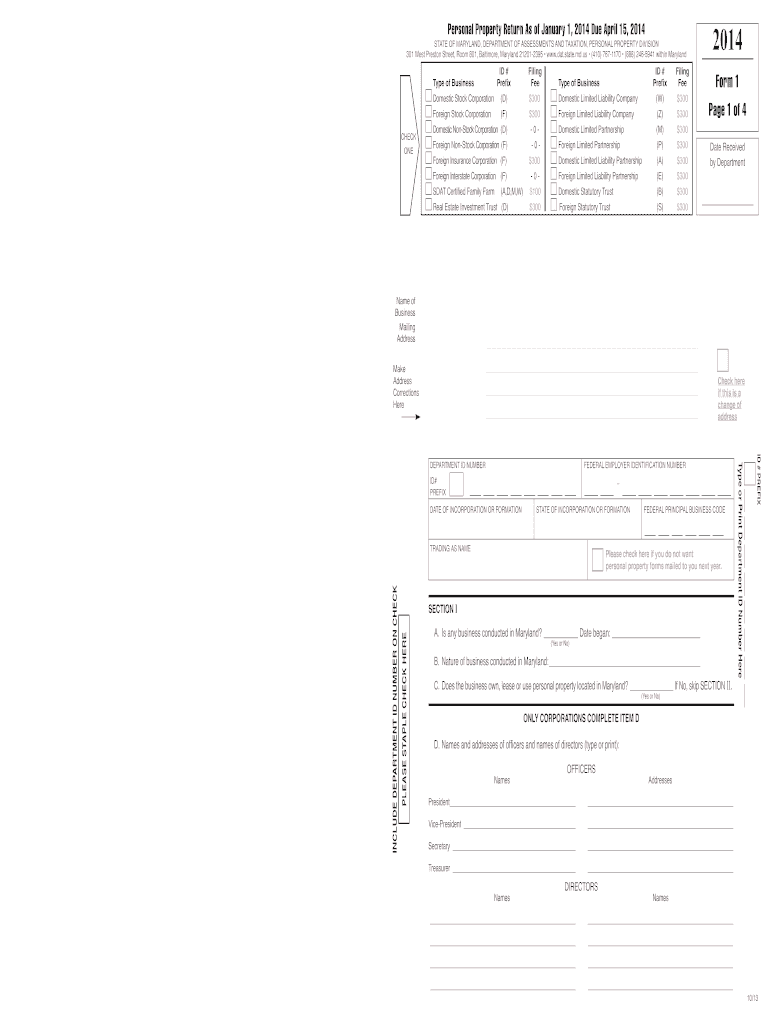

Maryland Form 1 Fill Out and Sign Printable PDF Template signNow

Web to access form 510e, from the main menu of the maryland return, select miscellaneous forms and schedules > extension (form 510e). (1) enter the corporation name,. How to file complete the tax payment worksheet. This form is for income earned in tax year 2022, with tax returns due in april. Businesses can file the 500e or 510e online if.

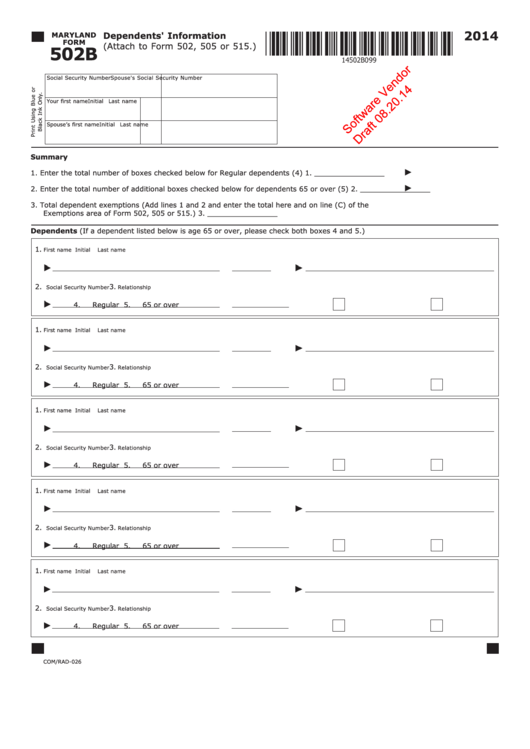

Maryland Form 502b Draft Dependents' Information 2014 printable pdf

Web we last updated maryland form 510e from the comptroller of maryland in november 2022. If line 3 is zero, file in one of the following ways: Also use form 510e if this is the first. Web 510c filed this tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. This form may.

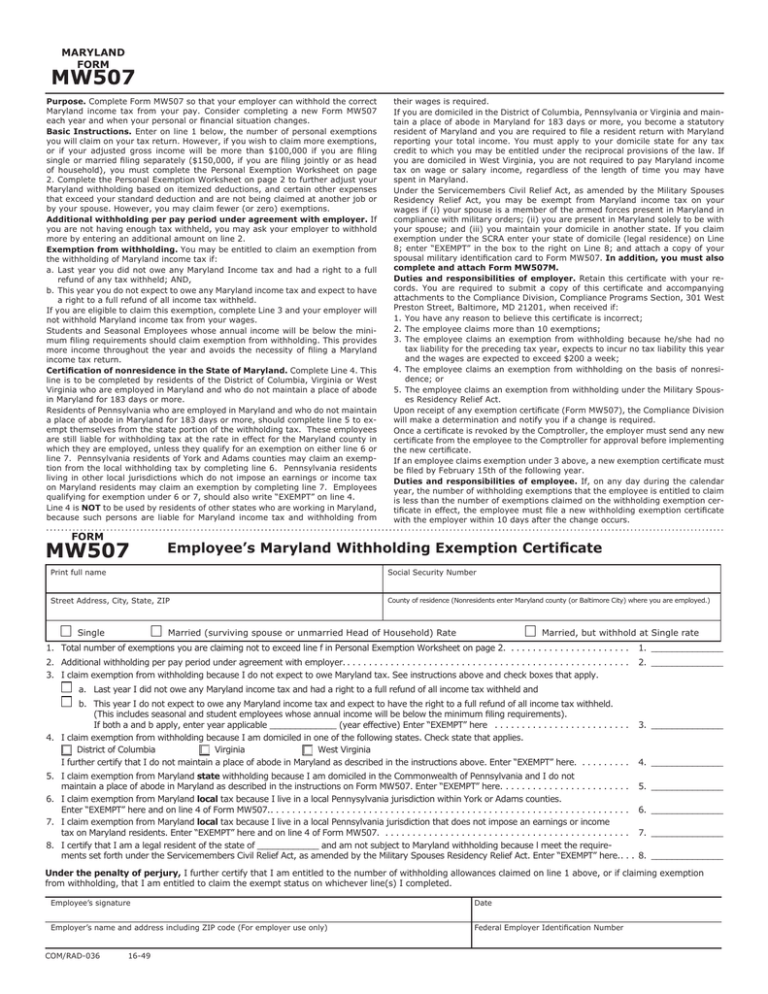

MW507 MARYLAND FORM

Web this system allows instant online electronic filing of the 500e/510e forms. Use form 500 to calculate the amount of maryland corporation income tax. Also use form 510e if this is the first. Web be used for form 510e. Web we last updated maryland form 510e from the comptroller of maryland in november 2022.

An Automatic Extension Will Be Granted If Filed By The Due Date.

Web we last updated maryland form 510e from the comptroller of maryland in november 2022. Use form 510e to remit any tax that may be due. A 7 month extension can be granted for. Web we last updated maryland form 510e in november 2022 from the maryland comptroller of maryland.

Businesses Can File The 500E Or 510E Online If They Have Previously Filed Form.

Use form 500 to calculate the amount of maryland corporation income tax. Web this system allows instant online electronic filing of the 500e/510e forms. Also use form 510e if this is the first. If line 3 is zero, file in one of the following ways:

Show Sources > Form 510E Is A Maryland Corporate Income Tax Form.

Indicate the date to the document with the date feature. Web subject to maryland corporation income tax. 15th day of the 3rd month following close of the tax year or period. (1) enter the corporation name,.

How To File Complete The Tax Payment Worksheet.

Web be used for form 510e. Web 510c filed this tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. 1) telefile request an automatic extension by calling 1. Web to access form 510e, from the main menu of the maryland return, select miscellaneous forms and schedules > extension (form 510e).