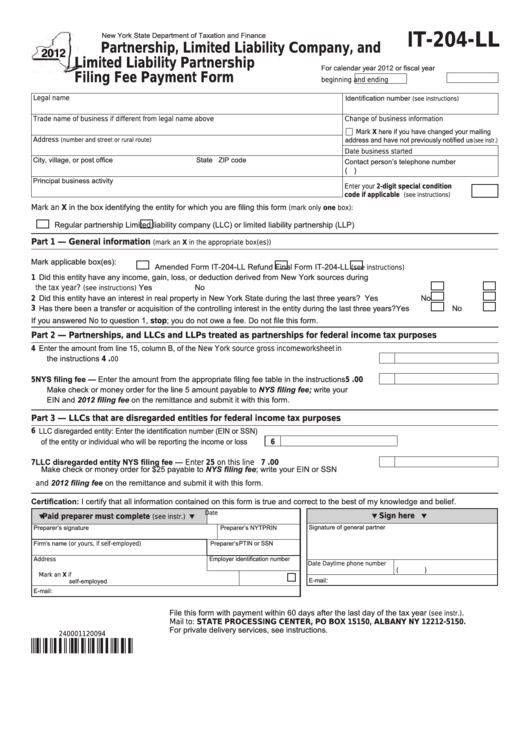

Form It 204 Ll

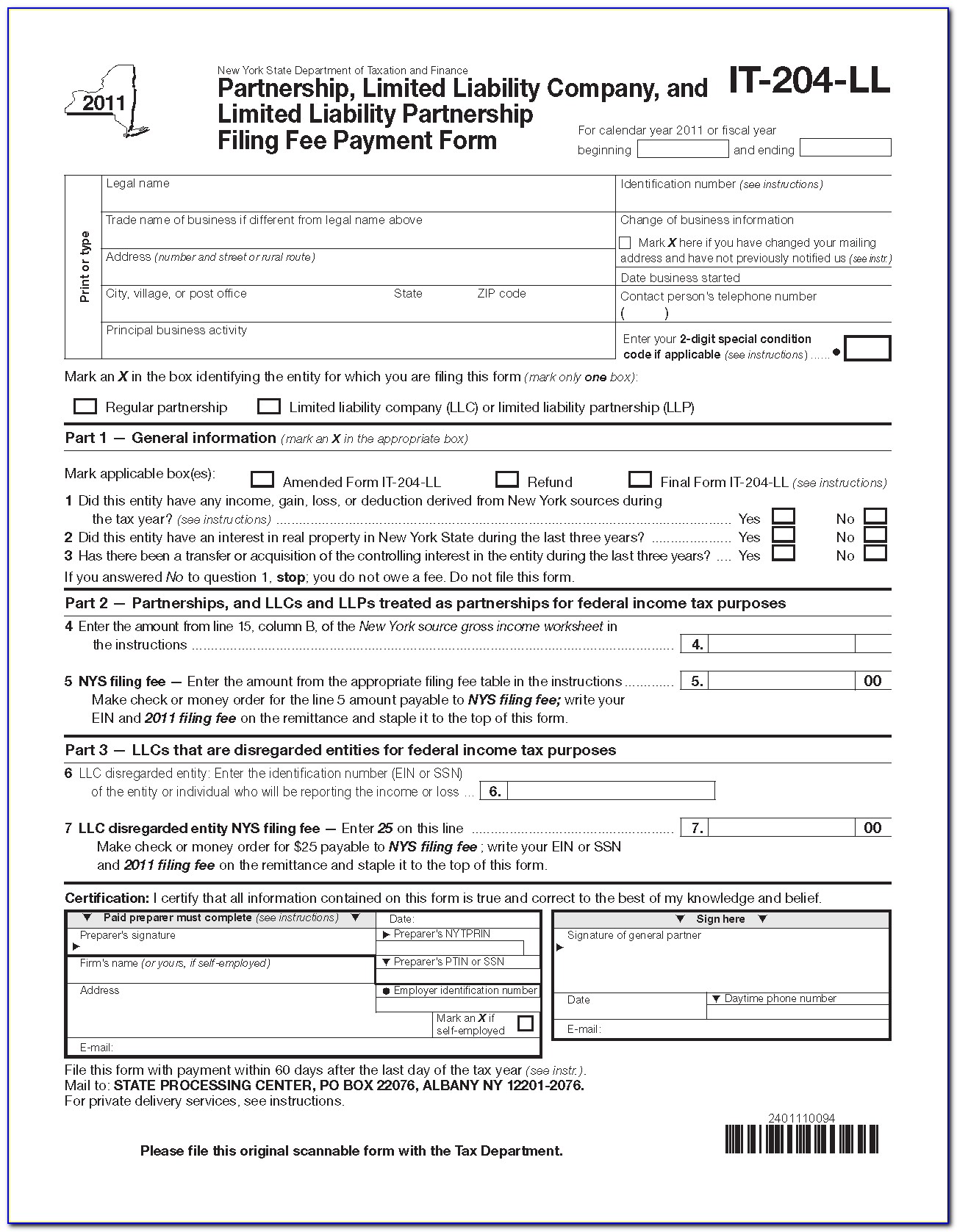

Form It 204 Ll - That has income, gain, loss, or deduction from new york sources in the current taxable year; Returns for calendar year 2022 are due march 15, 2023. And had new york source gross income for the preceding tax year of at least $1 million. Used to report income, deductions, gains, losses and credits from the operation of a partnership. Web this form is for paying the filing fee for a partnership, limited liability company, or a limited liability partnership. A partnership, llc, or llp with. Regular partnership limited liability company (llc) or limited liability partnership (llp) An or llp that is treated as a corporation for federal income tax Every llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources;

Web this form is for paying the filing fee for a partnership, limited liability company, or a limited liability partnership. Regular partnership limited liability company (llc) or limited liability partnership (llp) An or llp that is treated as a corporation for federal income tax Every llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; Returns for calendar year 2022 are due march 15, 2023. And had new york source gross income for the preceding tax year of at least $1 million. Used to report income, deductions, gains, losses and credits from the operation of a partnership. That has income, gain, loss, or deduction from new york sources in the current taxable year; A partnership, llc, or llp with.

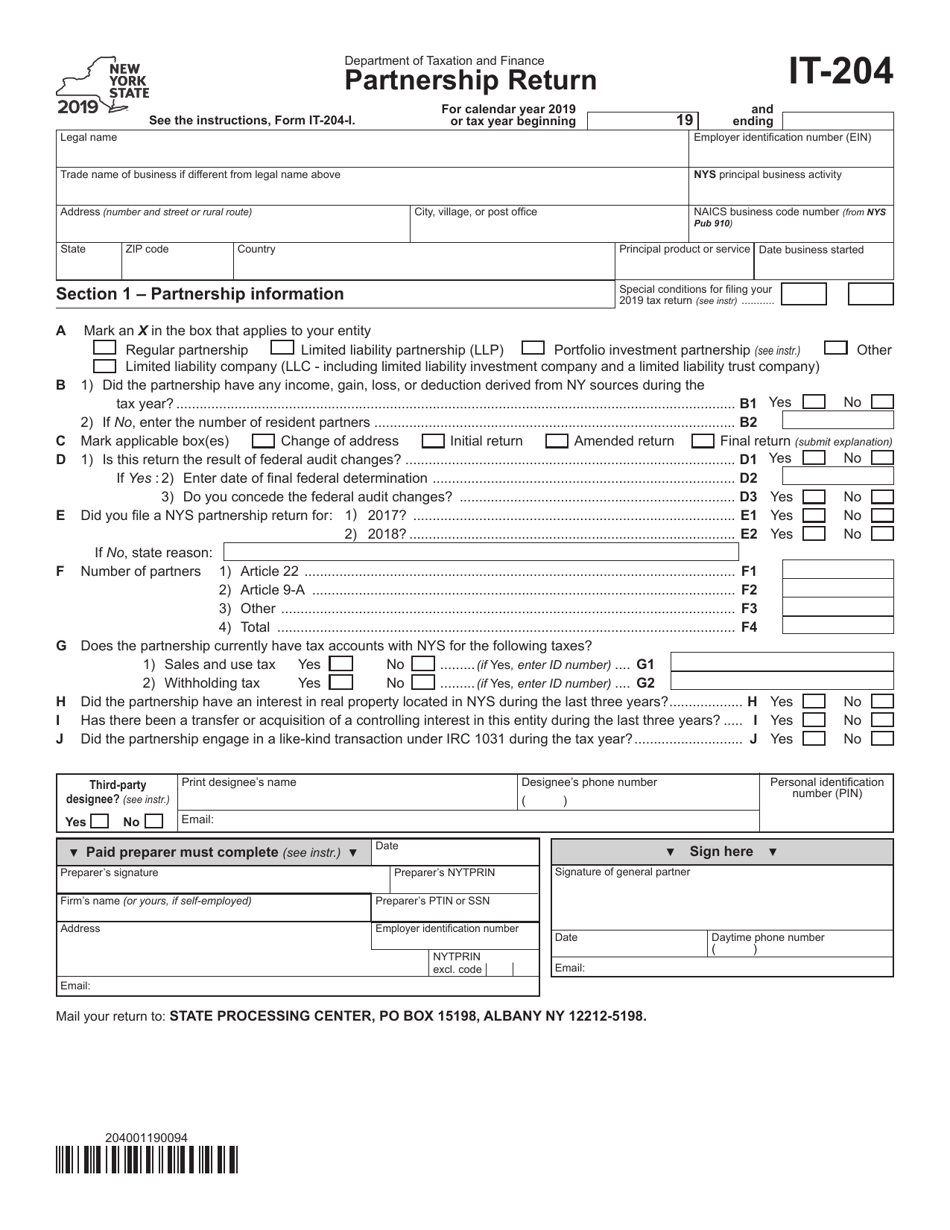

Used to report income, deductions, gains, losses and credits from the operation of a partnership. Every llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; And had new york source gross income for the preceding tax year of at least $1 million. Regular partnership limited liability company (llc) or limited liability partnership (llp) Web this form is for paying the filing fee for a partnership, limited liability company, or a limited liability partnership. A partnership, llc, or llp with. An or llp that is treated as a corporation for federal income tax Returns for calendar year 2022 are due march 15, 2023. That has income, gain, loss, or deduction from new york sources in the current taxable year;

Fillable Form It204Ll Partnership, Limited Liability Company, And

Every llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; Used to report income, deductions, gains, losses and credits from the operation of a partnership. Regular partnership limited liability company (llc) or limited liability partnership (llp) A partnership, llc, or llp with. Web this form is.

CPD Form 204 Download Fillable PDF or Fill Online South Carolina

Returns for calendar year 2022 are due march 15, 2023. An or llp that is treated as a corporation for federal income tax Web this form is for paying the filing fee for a partnership, limited liability company, or a limited liability partnership. A partnership, llc, or llp with. Used to report income, deductions, gains, losses and credits from the.

20202022 Form NY DTF IT204LL Fill Online, Printable, Fillable, Blank

Every llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; A partnership, llc, or llp with. An or llp that is treated as a corporation for federal income tax Regular partnership limited liability company (llc) or limited liability partnership (llp) Used to report income, deductions, gains,.

Form IT204 Download Fillable PDF or Fill Online Partnership Return

A partnership, llc, or llp with. Web this form is for paying the filing fee for a partnership, limited liability company, or a limited liability partnership. Returns for calendar year 2022 are due march 15, 2023. An or llp that is treated as a corporation for federal income tax And had new york source gross income for the preceding tax.

New York Llc Form It 204 Ll Form Resume Examples GwkQZrMDWV

Used to report income, deductions, gains, losses and credits from the operation of a partnership. And had new york source gross income for the preceding tax year of at least $1 million. Returns for calendar year 2022 are due march 15, 2023. Web this form is for paying the filing fee for a partnership, limited liability company, or a limited.

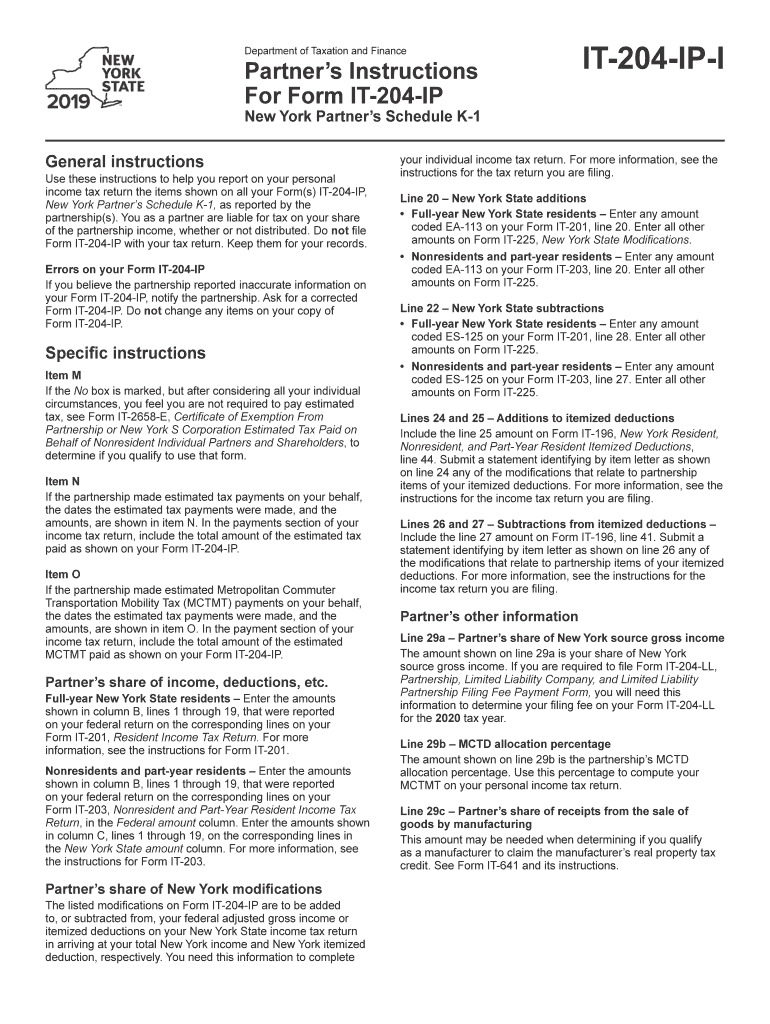

NY IT204IPI 2019 Fill out Tax Template Online US Legal Forms

Regular partnership limited liability company (llc) or limited liability partnership (llp) Used to report income, deductions, gains, losses and credits from the operation of a partnership. A partnership, llc, or llp with. An or llp that is treated as a corporation for federal income tax That has income, gain, loss, or deduction from new york sources in the current taxable.

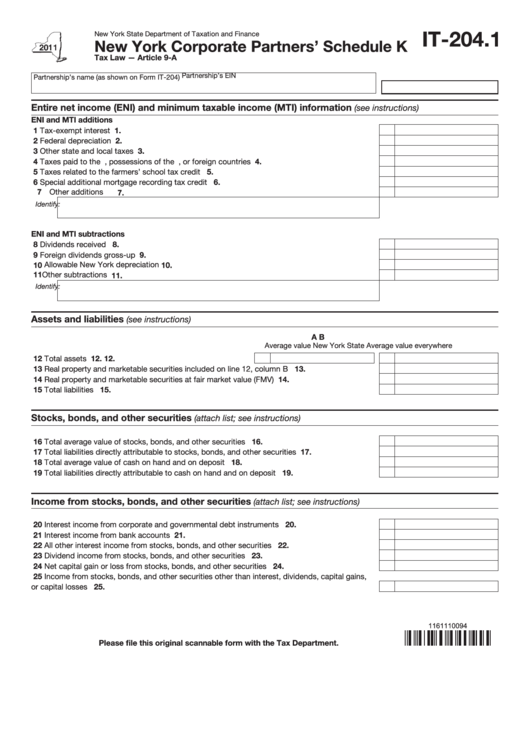

Fillable Form It204.1 New York Corporate Partners' Schedule K 2011

Regular partnership limited liability company (llc) or limited liability partnership (llp) Web this form is for paying the filing fee for a partnership, limited liability company, or a limited liability partnership. And had new york source gross income for the preceding tax year of at least $1 million. A partnership, llc, or llp with. Used to report income, deductions, gains,.

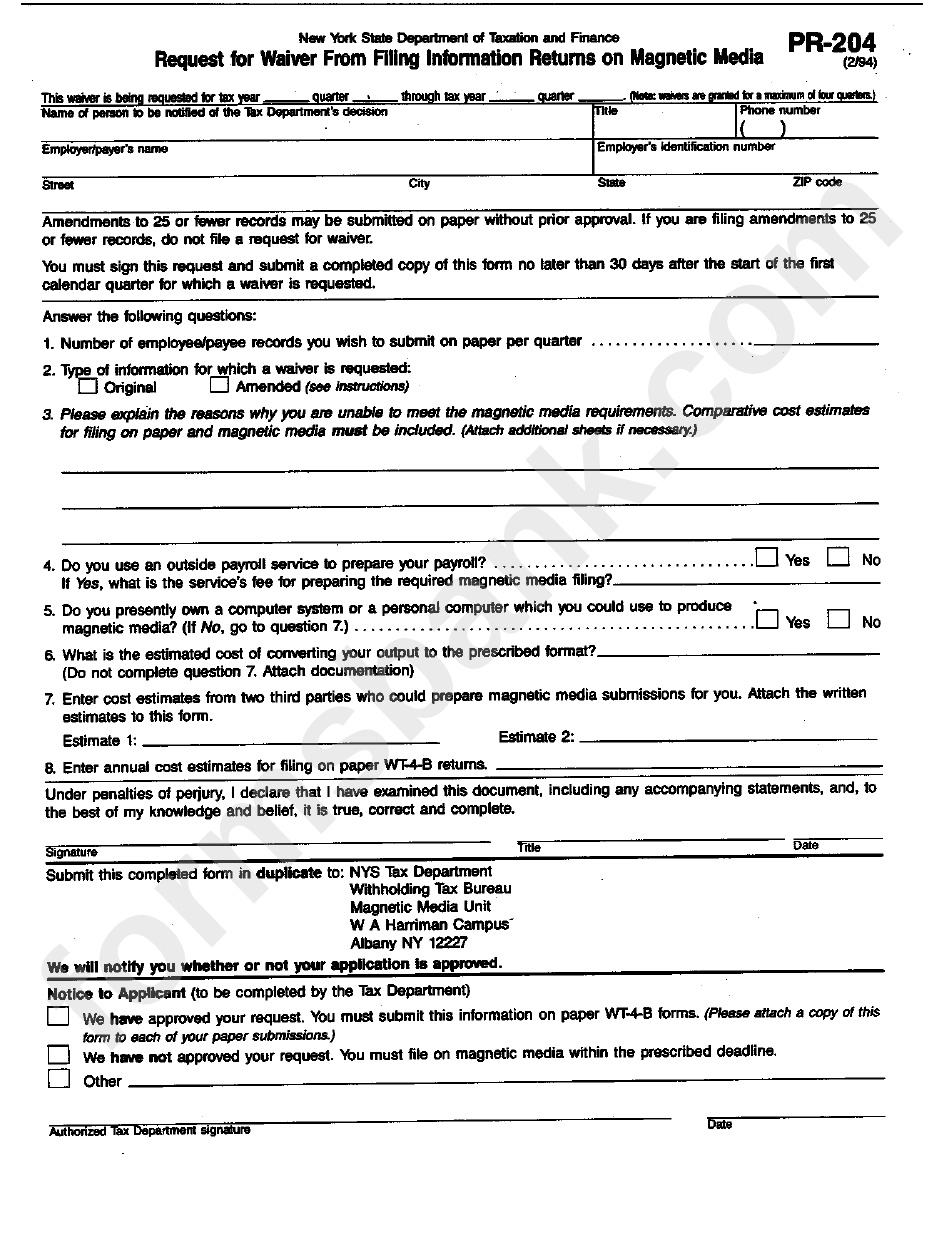

Form Pr204 Request For Waiver From Filing Information Returns On

An or llp that is treated as a corporation for federal income tax Every llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; And had new york source gross income for the preceding tax year of at least $1 million. Used to report income, deductions, gains,.

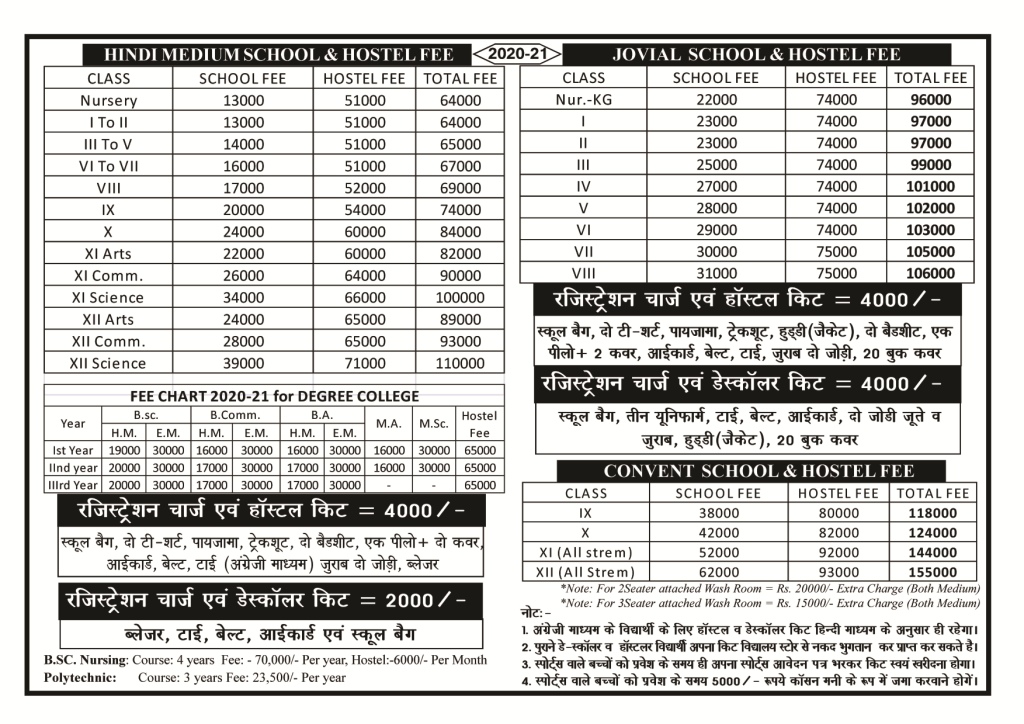

Fee Details

Regular partnership limited liability company (llc) or limited liability partnership (llp) A partnership, llc, or llp with. An or llp that is treated as a corporation for federal income tax Returns for calendar year 2022 are due march 15, 2023. Every llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from.

Ics Form 204 ≡ Fill Out Printable PDF Forms Online

Every llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; An or llp that is treated as a corporation for federal income tax A partnership, llc, or llp with. Returns for calendar year 2022 are due march 15, 2023. And had new york source gross income.

Returns For Calendar Year 2022 Are Due March 15, 2023.

Used to report income, deductions, gains, losses and credits from the operation of a partnership. And had new york source gross income for the preceding tax year of at least $1 million. A partnership, llc, or llp with. Every llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources;

Regular Partnership Limited Liability Company (Llc) Or Limited Liability Partnership (Llp)

That has income, gain, loss, or deduction from new york sources in the current taxable year; An or llp that is treated as a corporation for federal income tax Web this form is for paying the filing fee for a partnership, limited liability company, or a limited liability partnership.