Ma Form Of List

Ma Form Of List - Who must file a return. Web what is the form of list? Web form of list (state tax form 2) must be filed each year by all individuals, partnerships, associations, trusts and corporations that own or hold personal property on january 1st. Web the official search application of the commonwealth of massachusetts. Web the form of list (personal property form 2) must be filed by march 1 with the board of assessors in the city or town where the personal property is situated on. The form of list is due by march 1st preceding the fiscal year. Web blank forms of lists are available online, or in the assessor's office at city hall. This form of list (state tax form 2hf) must be filed each year by all individuals owning or holding household furnishings and effects not. You need to submit a state tax form 2/form of list by. This form of list (state tax form 2hf) must be filed each year by all individuals owning or holding household.

Web list all items of taxable personal property owned or held on january 1 in the appropriate schedules that follow, including items in your physical possession on that. This form of list (state tax form 2hf) must be filed each year by all individuals owning or holding household furnishings and effects not. Massachusetts registration plates under g.l. Web if you own a business in boston, you need to give us a list of the personal property at your business. Name of city or town. Web state tax form 2 the commonwealth of massachusetts assessors’ use only revised 11/2020. You need to submit a state tax form 2/form of list by. Show online show by email show. Web a personal property form of list must be filed each year by all individuals, partnerships, associations, trusts, corporations, limited liability companies and other legal entities that. Web the official search application of the commonwealth of massachusetts.

Web form of list (state tax form 2) must be filed each year by all individuals, partnerships, associations, trusts and corporations that own or hold personal property on january 1st. Web to be filed by all individuals, partnerships, associations or trusts, corporations, limited liability companies and other legal entities. Web blank form of lists is available at the assessor's office. Web mobile telecommunications taxable personal property form of list (form 2mt) property held for charitable purposes (form 3abc) taxable personal property form of list. Web the form of list (personal property form 2) must be filed by march 1 with the board of assessors in the city or town where the personal property is situated on. Failure to file a form of list prevents the assessor from granting an abatement for overvaluation. The form of list is due by march 1st preceding the fiscal year. Web if your business owns personal property, you need to file a state tax form 2/form of list every year. Web if you own a business in boston, you need to give us a list of the personal property at your business. This form of list (state tax form 2hf) must be filed each year by all individuals owning or holding household.

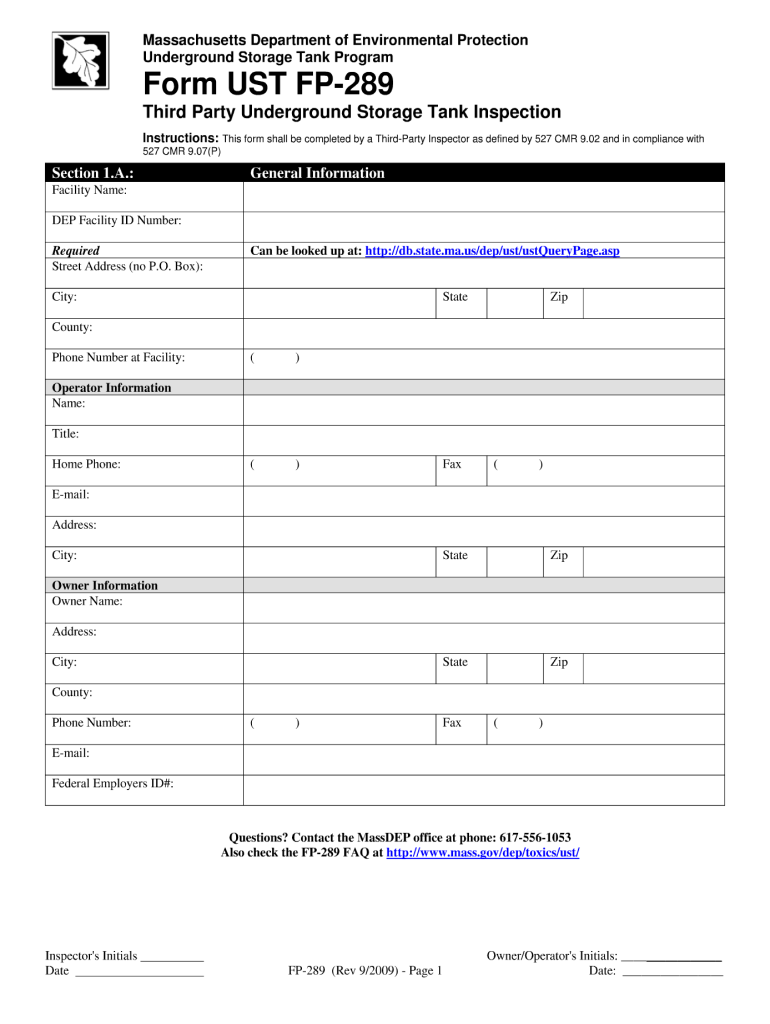

Dep Ma Form Fill Out and Sign Printable PDF Template signNow

Web mobile telecommunications taxable personal property form of list (form 2mt) property held for charitable purposes (form 3abc) taxable personal property form of list. Web to be filed by all individuals, partnerships, associations or trusts, corporations, limited liability companies and other legal entities. Web if you own a business in boston, you need to give us a list of the.

MA Standard Form for Medication Prior Authorization Requests 20162021

Property tax 101 by lincoln institue of land policy. Web list all items of taxable personal property owned or held on january 1 in the appropriate schedules that follow, including items in your physical possession on that. Web what is the form of list? Web the official search application of the commonwealth of massachusetts. Web the form of list (personal.

MA Form 272 Fill and Sign Printable Template Online US Legal Forms

Web the official search application of the commonwealth of massachusetts. Web blank forms of lists are available online, or in the assessor's office at city hall. Web what is the form of list? Web form of list (state tax form 2) must be filed each year by all individuals, partnerships, associations, trusts and corporations that own or hold personal property.

Download MA Form Punjab University 2023 2024 Student Forum

Web blank form of lists is available at the assessor's office. Web form of list (state tax form 2) must be filed each year by all individuals, partnerships, associations, trusts and corporations that own or hold personal property on january 1st. This form of list (state tax form 2hf) must be filed each year by all individuals owning or holding.

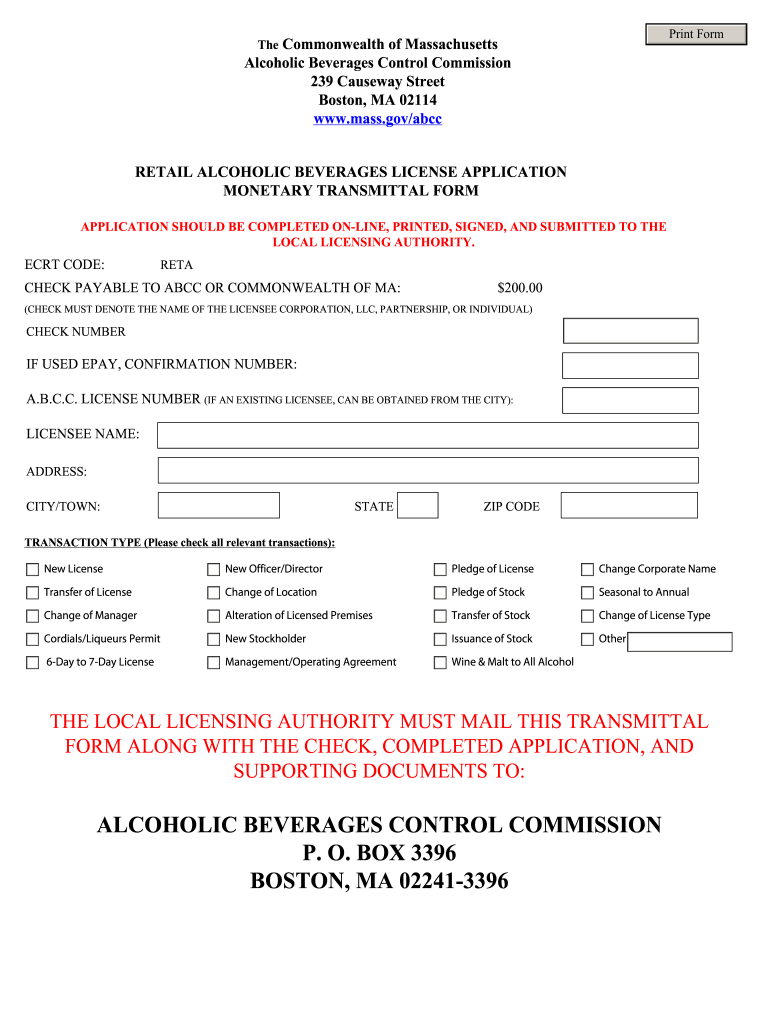

Abcc Ma Form Fill Out and Sign Printable PDF Template signNow

The form of list is due by march 1st preceding the fiscal year. Web state tax form 2 the commonwealth of massachusetts assessors’ use only revised 11/2020. Web list all items of taxable personal property owned or held on january 1 in the appropriate schedules that follow, including items in your physical possession on that. Web what is the form.

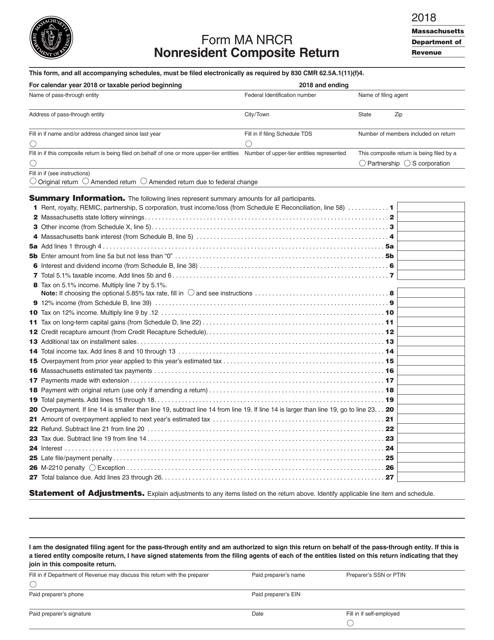

Form MA Download Printable PDF or Fill Online Nonresident Composite

Web what is the form of list? This form of list (state tax form 2hf) must be filed each year by all individuals owning or holding household furnishings and effects not. Property tax 101 by lincoln institue of land policy. Web the form of list (personal property form 2) must be filed by march 1 with the board of assessors.

MA Form 10 2007 Fill and Sign Printable Template Online US Legal Forms

Web mobile telecommunications taxable personal property form of list (form 2mt) property held for charitable purposes (form 3abc) taxable personal property form of list. Web what is the form of list? Massachusetts registration plates under g.l. Web state tax form 2 the commonwealth of massachusetts assessors’ use only revised 11/2020. Web list all items of taxable personal property owned or.

MA State Tax Form 128 2000 Fill out Tax Template Online US Legal Forms

Web general information who must file a return. Web if you own a business in boston, you need to give us a list of the personal property at your business. Massachusetts registration plates under g.l. Web a personal property form of list must be filed each year by all individuals, partnerships, associations, trusts, corporations, limited liability companies and other legal.

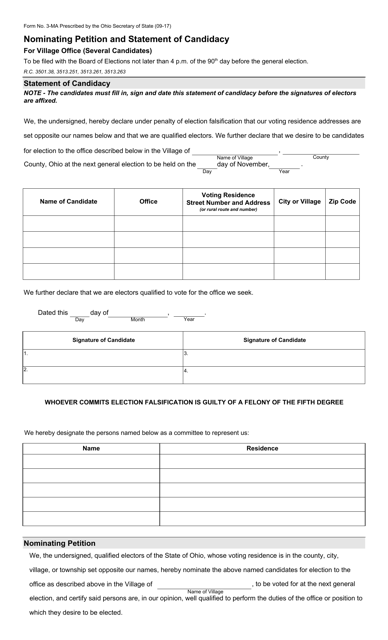

Form 3MA Download Fillable PDF or Fill Online Nominating Petition and

Show online show by email show. Web general information who must file a return. Property tax 101 by lincoln institue of land policy. Web state tax form 2 the commonwealth of massachusetts assessors’ use only revised 11/2020. Web this form of list (state tax form 2hf) must be filed each year by all.

MA Form PC 20162021 Fill and Sign Printable Template Online US

Show online show by email show. Web state tax form 2 the commonwealth of massachusetts assessors’ use only revised 11/2020. Web form of list (state tax form 2) must be filed each year by all individuals, partnerships, associations, trusts and corporations that own or hold personal property on january 1st. Web if your business owns personal property, you need to.

The Form Of List Is Due By March 1St Preceding The Fiscal Year.

Web to be filed by all individuals, partnerships, associations or trusts, corporations, limited liability companies and other legal entities. Web to be filed by all individuals, partnerships, associations or trusts, corporations, limited liability companies and other legal entities. Web if you own a business in boston, you need to give us a list of the personal property at your business. Web form of list (state tax form 2) must be filed each year by all individuals, partnerships, associations, trusts and corporations that own or hold personal property on january 1st.

Web A Personal Property Form Of List Must Be Filed Each Year By All Individuals, Partnerships, Associations, Trusts, Corporations, Limited Liability Companies And Other Legal Entities That.

Name of city or town. Taxpayers are not required to estimate the value of the. Web the official search application of the commonwealth of massachusetts. Failure to file a form of list prevents the assessor from granting an abatement for overvaluation.

Web General Information Who Must File A Return.

Web if your business owns personal property, you need to file a state tax form 2/form of list every year. Web what is the form of list? Property tax 101 by lincoln institue of land policy. Web list all items of taxable personal property owned or held on january 1 in the appropriate schedules that follow, including items in your physical possession on that.

Show Online Show By Email Show.

Search the commonwealth's web properties to more easily find the services and information you are. Web blank forms of lists are available online, or in the assessor's office at city hall. Web state tax form 2 the commonwealth of massachusetts assessors’ use only revised 11/2020. This form of list (state tax form 2hf) must be filed each year by all individuals owning or holding household.