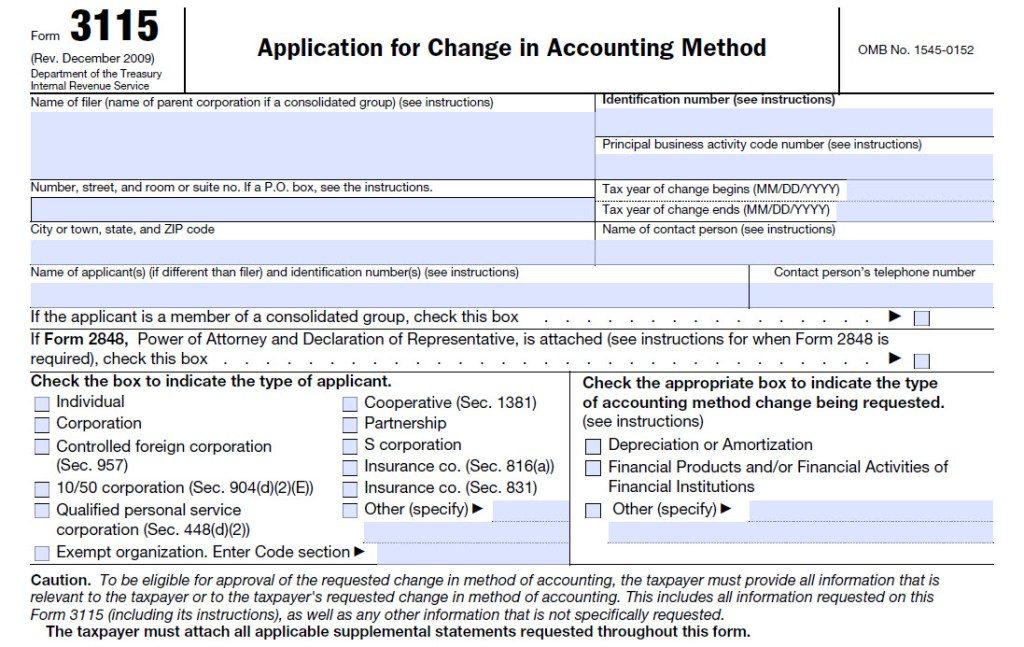

Accounting Method Change Form

Accounting Method Change Form - A taxpayer must typically file form 3115, application for change in accounting method, when requesting any accounting. Web in completing a form 3115, application for change in accounting method, to make the change in method of accounting under section 7.02 of this revenue. If a change from accrual to cash method of accounting is desired for the form 5500, is it necessary to file irs form 3115 to obtain irs approval. Web in most cases, a taxpayer requests consent to change an accounting method by filing a form 3115, application for change in accounting method. Web august 12, 2021 related topics tax tax accounting the irs on thursday updated the list of accounting method changes to which automatic change. Web in general, you must file a current form 3115 to request a change in either an overall accounting method or the accounting treatment of any item. Web the irs has released rev. Web accounting method changes are most commonly related to how (and when) an organization reports its revenue and expenses (i.e., cash vs. However, in some situations, it is possible to change a method of. Web ordinarily, you will need to file form 3115, application for change in accounting method, to change your business' method of accounting under an automatic consent revenue.

Web january 1, 2023 the irs on december 12, 2022, released an advance copy of rev. Web in general, you must file a current form 3115 to request a change in either an overall accounting method or the accounting treatment of any item. A taxpayer must typically file form 3115, application for change in accounting method, when requesting any accounting. Web in most cases, a taxpayer requests consent to change an accounting method by filing a form 3115, application for change in accounting method. Web in completing a form 3115, application for change in accounting method, to make the change in method of accounting under section 7.02 of this revenue. Web significant changes according to today’s revenue procedure, the following are among the “significant changes” to the list of automatic changes since the issuance. Web usually, an entity files form 3115 in the year of change. Web a new automatic accounting method change has been added to rev. Web typically, this is accomplished by filing form 3115, application for change in accounting method. Under the old procedure, the time for filing was the first 180 days of the tax year.

Web january 1, 2023 the irs on december 12, 2022, released an advance copy of rev. Web august 12, 2021 related topics tax tax accounting the irs on thursday updated the list of accounting method changes to which automatic change. Web in most cases, a taxpayer requests consent to change an accounting method by filing a form 3115, application for change in accounting method. Web usually, an entity files form 3115 in the year of change. Web a new automatic accounting method change has been added to rev. Web typically, this is accomplished by filing form 3115, application for change in accounting method. Web automatic change procedures: Web ordinarily, you will need to file form 3115, application for change in accounting method, to change your business' method of accounting under an automatic consent revenue. Web in completing a form 3115, application for change in accounting method, to make the change in method of accounting under section 7.02 of this revenue. If a change from accrual to cash method of accounting is desired for the form 5500, is it necessary to file irs form 3115 to obtain irs approval.

Tax Accounting Methods

A taxpayer must typically file form 3115, application for change in accounting method, when requesting any accounting. Web the irs has released rev. Under the old procedure, the time for filing was the first 180 days of the tax year. Web usually, an entity files form 3115 in the year of change. Web a new automatic accounting method change has.

Choosing the right accounting method for tax purposes Kehlenbrink

Web significant changes according to today’s revenue procedure, the following are among the “significant changes” to the list of automatic changes since the issuance. Under the old procedure, the time for filing was the first 180 days of the tax year. Web august 12, 2021 related topics tax tax accounting the irs on thursday updated the list of accounting method.

Accounting Method Changes for Construction Companies

Web august 12, 2021 related topics tax tax accounting the irs on thursday updated the list of accounting method changes to which automatic change. Web usually, an entity files form 3115 in the year of change. Web in completing a form 3115, application for change in accounting method, to make the change in method of accounting under section 7.02 of.

The Best HOA Accounting Method Cash, Accrual, Or Modified Accrual?

Web automatic change procedures: Web in general, you must file a current form 3115 to request a change in either an overall accounting method or the accounting treatment of any item. A taxpayer must typically file form 3115, application for change in accounting method, when requesting any accounting. Under the old procedure, the time for filing was the first 180.

Impact of Depreciable Life Accounting Method Change on Adjusted Taxable

Web typically, this is accomplished by filing form 3115, application for change in accounting method. A taxpayer must typically file form 3115, application for change in accounting method, when requesting any accounting. Web in completing a form 3115, application for change in accounting method, to make the change in method of accounting under section 7.02 of this revenue. Web august.

Accrual method of accounting Accounting & Finance blog

Web usually, an entity files form 3115 in the year of change. Web accounting method changes are most commonly related to how (and when) an organization reports its revenue and expenses (i.e., cash vs. Web significant changes according to today’s revenue procedure, the following are among the “significant changes” to the list of automatic changes since the issuance. Web in.

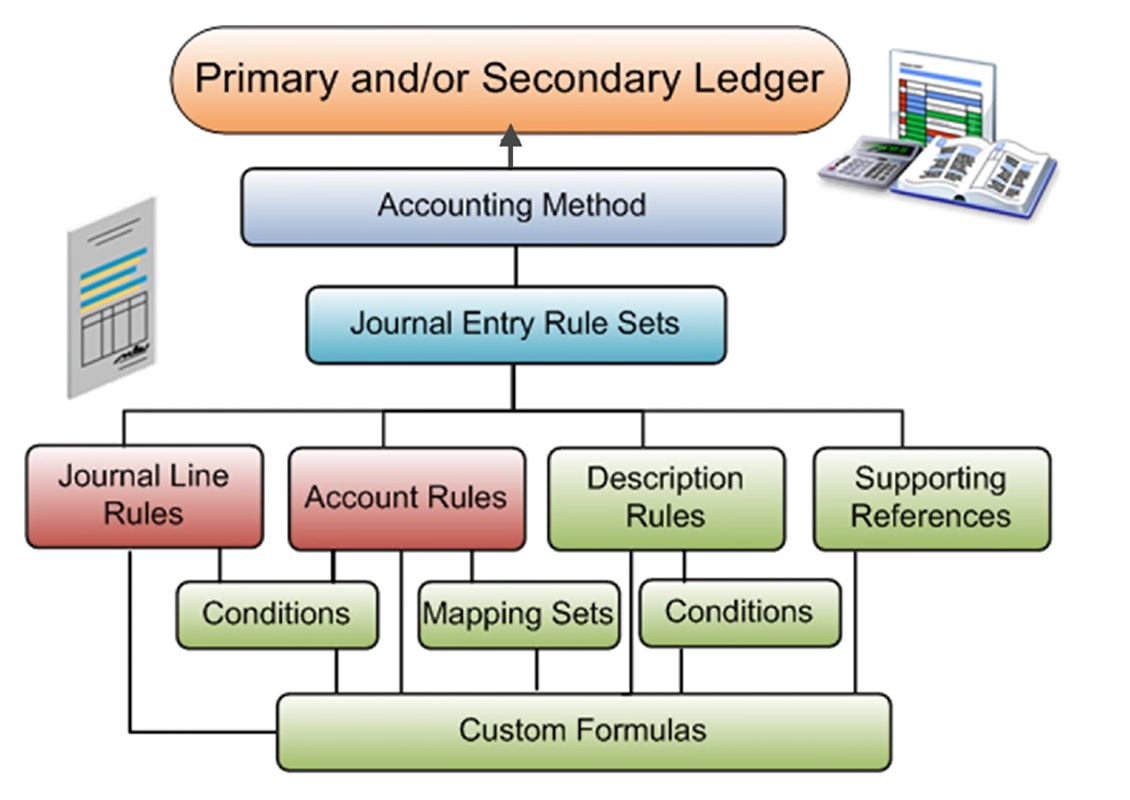

The Oracle Prodigy Overview of Configuring Accounting Rules in Oracle

Under the old procedure, the time for filing was the first 180 days of the tax year. If a change from accrual to cash method of accounting is desired for the form 5500, is it necessary to file irs form 3115 to obtain irs approval. Web automatic change procedures: Web usually, an entity files form 3115 in the year of.

The Best Accounting Method for Your Business Wilke & Associates, CPAs

Web january 1, 2023 the irs on december 12, 2022, released an advance copy of rev. Under the old procedure, the time for filing was the first 180 days of the tax year. Web accounting method changes are most commonly related to how (and when) an organization reports its revenue and expenses (i.e., cash vs. If a change from accrual.

Form 3115 Application for Change in Accounting Method Editorial Stock

Under the old procedure, the time for filing was the first 180 days of the tax year. Web accounting method changes are most commonly related to how (and when) an organization reports its revenue and expenses (i.e., cash vs. Web ordinarily, you will need to file form 3115, application for change in accounting method, to change your business' method of.

Accounting Method Description Schedule C Accounting Methods

Web the irs has released rev. Web typically, this is accomplished by filing form 3115, application for change in accounting method. Web january 1, 2023 the irs on december 12, 2022, released an advance copy of rev. Web a new automatic accounting method change has been added to rev. Web accounting method changes are most commonly related to how (and.

If A Change From Accrual To Cash Method Of Accounting Is Desired For The Form 5500, Is It Necessary To File Irs Form 3115 To Obtain Irs Approval.

Web in general, you must file a current form 3115 to request a change in either an overall accounting method or the accounting treatment of any item. Web in completing a form 3115, application for change in accounting method, to make the change in method of accounting under section 7.02 of this revenue. Web august 12, 2021 related topics tax tax accounting the irs on thursday updated the list of accounting method changes to which automatic change. Web in most cases, a taxpayer requests consent to change an accounting method by filing a form 3115, application for change in accounting method.

Web Usually, An Entity Files Form 3115 In The Year Of Change.

Web ordinarily, you will need to file form 3115, application for change in accounting method, to change your business' method of accounting under an automatic consent revenue. Web accounting method changes are most commonly related to how (and when) an organization reports its revenue and expenses (i.e., cash vs. Under the old procedure, the time for filing was the first 180 days of the tax year. Web significant changes according to today’s revenue procedure, the following are among the “significant changes” to the list of automatic changes since the issuance.

Web January 1, 2023 The Irs On December 12, 2022, Released An Advance Copy Of Rev.

Web a new automatic accounting method change has been added to rev. Web typically, this is accomplished by filing form 3115, application for change in accounting method. A taxpayer must typically file form 3115, application for change in accounting method, when requesting any accounting. Web automatic change procedures:

Web The Irs Has Released Rev.

However, in some situations, it is possible to change a method of.