Irs Form 8825 Instructions

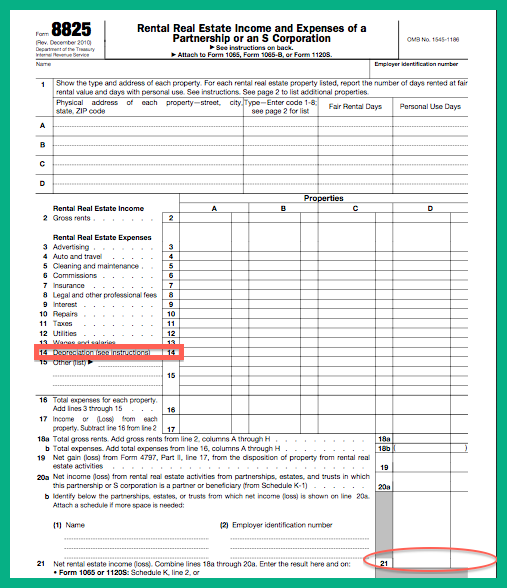

Irs Form 8825 Instructions - Then indicate the amount of income and expenses associated with that property. Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss). See the instructions for the tax return with which this form is filed. Partnerships and s corporations use form 8825 to report income and. The form allows you to record. Rental real estate income and expenses of a partnership or an s corporation. Web efile your federal tax return now efiling is easier, faster, and safer than filling out paper tax forms. You must start by identifying each property. Web irs form 8825 is a special tax form specifically for reporting the rental income and expenses of a partnership or s corporation. Web to complete the form:

December 2010) department of the treasury internal revenue service. Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate. Then indicate the amount of income and expenses associated with that property. Web for the latest information about developments related to form 8885 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8885. Web efile your federal tax return now efiling is easier, faster, and safer than filling out paper tax forms. Web developments related to form 8825 and its instructions, such as legislation enacted after they were published, go to. Use this november 2018 revision of form 8825 for tax. Partnerships and s corporations use form 8825 to report income and. File your federal and federal tax returns online with turbotax in minutes. Of the treasury, internal revenue service.

Web irs form 8825 is a special tax form specifically for reporting the rental income and expenses of a partnership or s corporation. Web efile your federal tax return now efiling is easier, faster, and safer than filling out paper tax forms. Web developments related to form 8825 and its instructions, such as legislation enacted after they were published, go to. Rental real estate income and expenses of a partnership or an s corporation. Web for the latest information about developments related to form 8885 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8885. The form allows you to record. Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss). Then indicate the amount of income and expenses associated with that property. You must start by identifying each property. December 2010) department of the treasury internal revenue service.

IRS Form 8825 Fill out & sign online DocHub

Web attach to form 1065 or form 1120s. Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss). Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss). Then indicate the amount of income and expenses.

Form 1065 U.S. Return of Partnership (2014) Free Download

Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate. Rental real estate income and expenses of a partnership or an s corporation. Web developments related to form 8825 and its instructions, such as legislation enacted after they were published, go to. Partnerships.

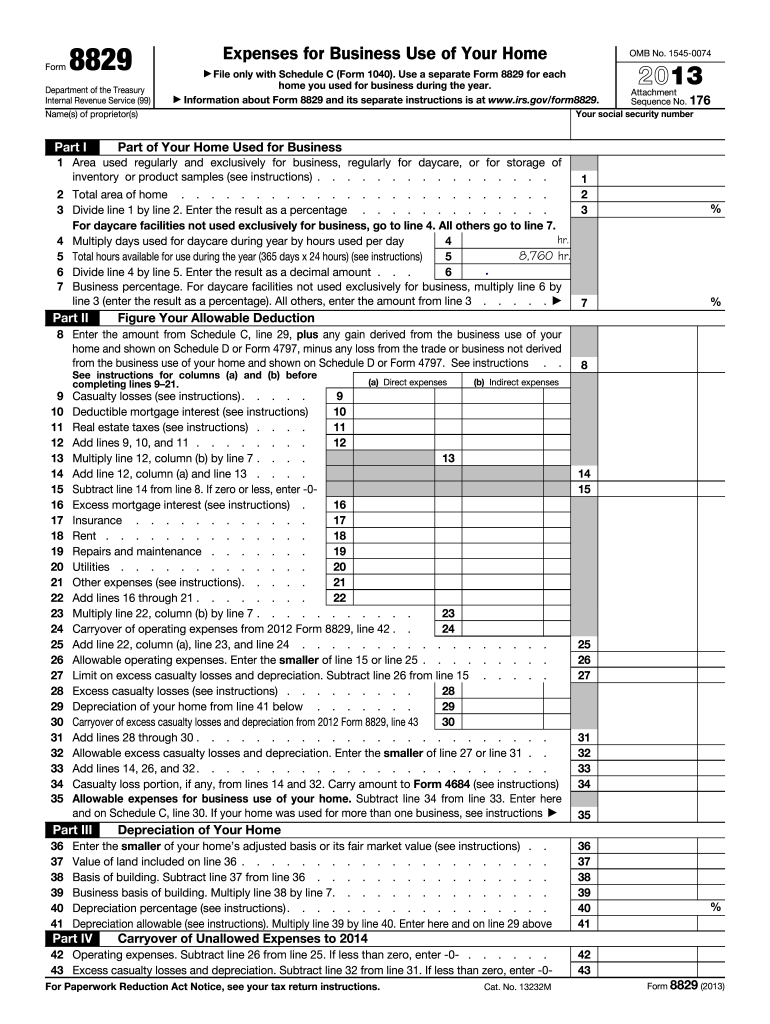

2013 Form IRS 8829 Fill Online, Printable, Fillable, Blank pdfFiller

Web for the latest information about developments related to form 8885 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8885. Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate. Ad download or email irs 8825 & more.

Form 8825 Rental Real Estate and Expenses of a Partnership or

See the instructions for the tax return with which this form is filed. Web form 8825, rental real estate income and expenses of a partnership or an s corporation (online) imprint [washington, d.c.] : Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real.

20202022 Form IRS 9423 Fill Online, Printable, Fillable, Blank pdfFiller

The form allows you to record. December 2010) department of the treasury internal revenue service. Use this november 2018 revision of form 8825 for tax. Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss). Then indicate the amount of income and expenses associated with that property.

Fill Free fillable Form 1065 U.S. Return of Partnership 2019

December 2010) department of the treasury internal revenue service. See the instructions for the tax return with which this form is filed. Web developments related to form 8825 and its instructions, such as legislation enacted after they were published, go to. Web to complete the form: Web form 8825, rental real estate income and expenses of a partnership or an.

Form 8825 Rental Real Estate and Expenses of a Partnership or

You must start by identifying each property. Partnerships and s corporations use form 8825 to report income and. Web irs form 8825 is a special tax form specifically for reporting the rental income and expenses of a partnership or s corporation. Web to complete the form: Web attach to form 1065 or form 1120s.

Linda Keith CPA » All about the 8825

December 2010) department of the treasury internal revenue service. You must start by identifying each property. Web to hear from you. Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss). Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate.

OMB Archives PDFfiller Blog

Use this november 2018 revision of form 8825 for tax. Rental real estate income and expenses of a partnership or an s corporation. Web developments related to form 8825 and its instructions, such as legislation enacted after they were published, go to. Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate.

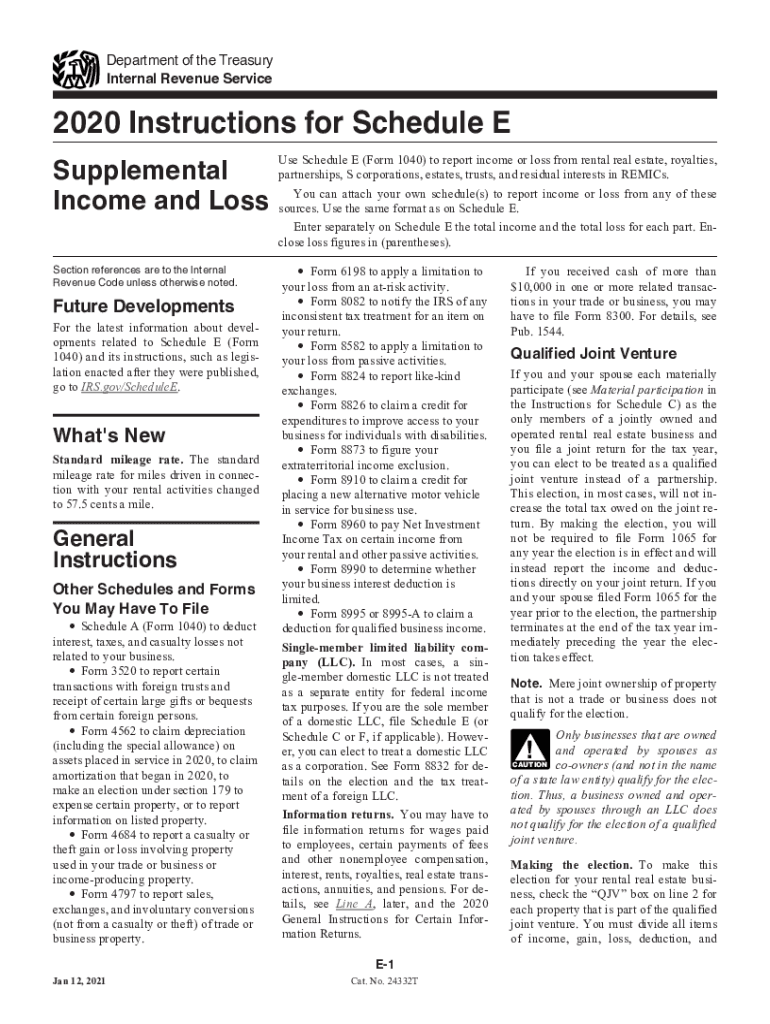

2020 Form IRS Instruction 1040 Schedule E Fill Online, Printable

Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate. Then indicate the amount of income and expenses associated with that property. Web for the latest information about developments related to form 8885 and its instructions, such as legislation enacted after they were.

Then Indicate The Amount Of Income And Expenses Associated With That Property.

Web form 8825, rental real estate income and expenses of a partnership or an s corporation (online) imprint [washington, d.c.] : Web to complete the form: Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss). Web developments related to form 8825 and its instructions, such as legislation enacted after they were published, go to.

Web Irs Form 8825 Is A Special Tax Form Specifically For Reporting The Rental Income And Expenses Of A Partnership Or S Corporation.

Web to hear from you. Of the treasury, internal revenue service. See the instructions for the tax return with which this form is filed. Partnerships and s corporations use form 8825 to report income and.

Use This November 2018 Revision Of Form 8825 For Tax.

Web below are solutions to frequently asked questions about entering form 8825, rental real estate income and expenses of a partnership or an s corporation, in the. Web efile your federal tax return now efiling is easier, faster, and safer than filling out paper tax forms. Web for the latest information about developments related to form 8885 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8885. Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss).

Ad Download Or Email Irs 8825 & More Fillable Forms, Register And Subscribe Now!

Web attach to form 1065 or form 1120s. File your federal and federal tax returns online with turbotax in minutes. December 2010) department of the treasury internal revenue service. When using irs form 8825, determine the number of months the property was in service by dividing the fair rental days by 30.