Ira Withdrawal Form

Ira Withdrawal Form - Checkwriting add checkwriting to an existing nonretirement, health savings account (hsa), the fidelity ® cash management account, or ira account. Please obtain a transfer form from the new institution. Morgan securities llc (jpms) roth or traditional individual retirement account (ira) (including sep and beneficiary ira). Web regardless of your age, you will need to file a form 1040 and show the amount of the ira withdrawal. For distributions due to death, please complete a withdrawal and tax election form for beneficiaries. Web if your traditional ira includes nondeductible contributions and you received a distribution from it in 2022, you must use form 8606 to figure how much of your 2022 ira distribution is tax free. Your ira savings is always yours when you need it—whether for retirement or emergency funds. Web simple ira withdrawal in the first two years (no irs penalty exception). Web use this form to request a new distribution from or change an existing distribution instruction for your schwab ira account. Deadline for receiving required minimum distribution:

You can also complete many of these transactions online. Deadline for receiving required minimum distribution: What you need to know Web simple ira withdrawal in the first two years (no irs penalty exception). Please obtain a transfer form from the new institution. For distributions due to death, please complete a withdrawal and tax election form for beneficiaries. To transfer your ira to another institution. Morgan securities llc (jpms) roth or traditional individual retirement account (ira) (including sep and beneficiary ira). Web regardless of your age, you will need to file a form 1040 and show the amount of the ira withdrawal. Web withdrawing from an ira.

Morgan securities llc (jpms) roth or traditional individual retirement account (ira) (including sep and beneficiary ira). What you need to know Web regardless of your age, you will need to file a form 1040 and show the amount of the ira withdrawal. Since you took the withdrawal before you reached age 59 1/2, unless you met one of the exceptions, you will need to pay an additional 10% tax on early distributions on your form 1040. Web use this form to request a new distribution from or change an existing distribution instruction for your schwab ira account. For distributions due to death, please complete a withdrawal and tax election form for beneficiaries. Authorize the return of an excess ira contribution. Checkwriting add checkwriting to an existing nonretirement, health savings account (hsa), the fidelity ® cash management account, or ira account. Web simple ira withdrawal in the first two years (no irs penalty exception). To transfer your ira to another institution.

Hr Block Ira Withdrawal Form Universal Network

To transfer your ira to another institution. Applicable law or policies of the ira custodian/trustee may require additional documentation. Web the ira distribution form for traditional (including sep), roth, and simple iras is used to document and instruct us of your distribution related decisions. A separate distribution form must be completed for each distribution reason. Web regardless of your age,.

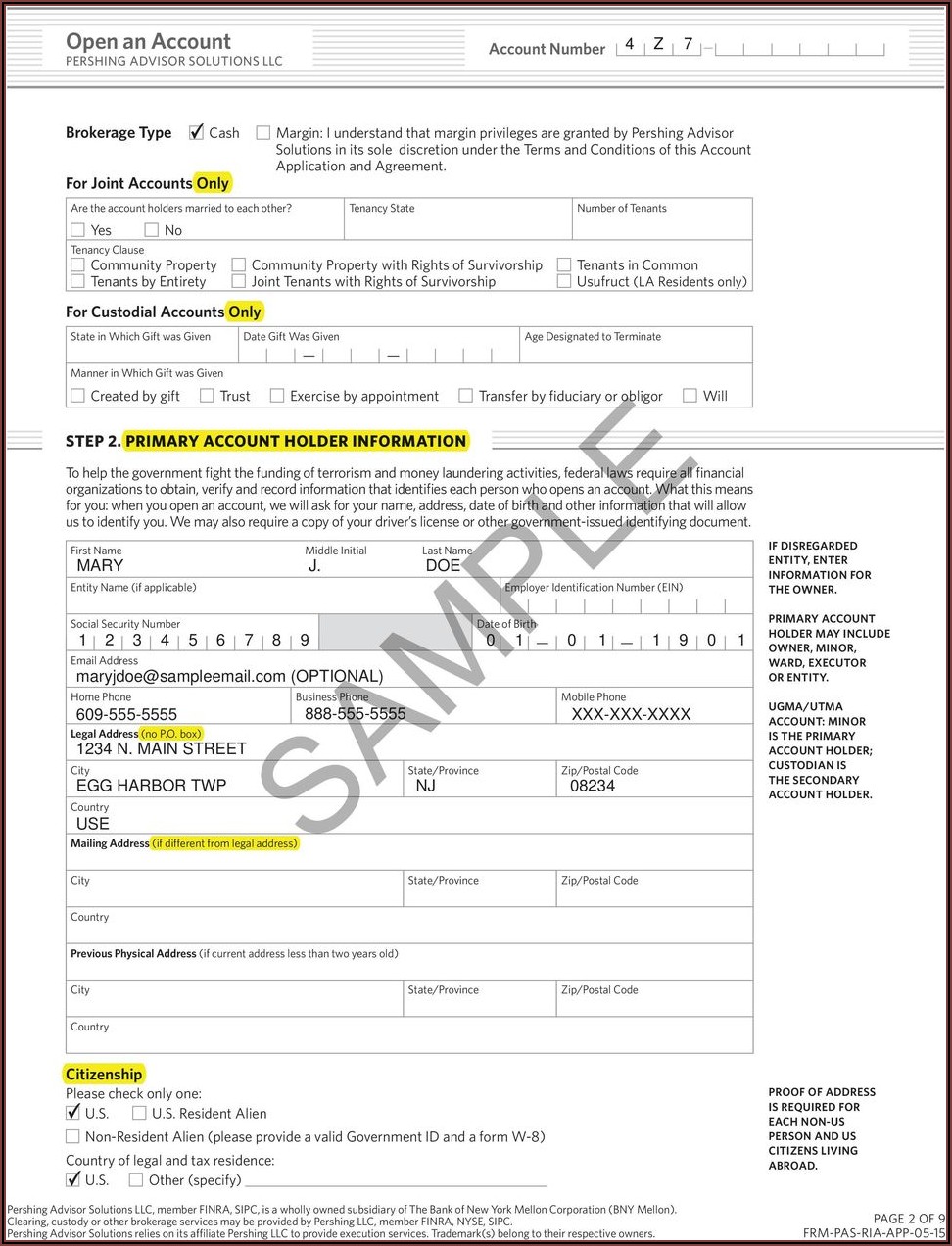

Pershing Ira Withdrawal Form Form Resume Examples goVLdJqpVv

Before you withdraw, we’ll help you understand below how your age and other factors impact the way the irs. For distributions due to death, please complete a withdrawal and tax election form for beneficiaries. Web regardless of your age, you will need to file a form 1040 and show the amount of the ira withdrawal. Web if your traditional ira.

Fidelity Ira Distribution Request Form Universal Network

What you need to know Morgan securities llc (jpms) roth or traditional individual retirement account (ira) (including sep and beneficiary ira). Your ira savings is always yours when you need it—whether for retirement or emergency funds. Deadline for receiving required minimum distribution: For distributions due to death, please complete a withdrawal and tax election form for beneficiaries.

Roth Ira Withdrawal Form Universal Network

Before you withdraw, we’ll help you understand below how your age and other factors impact the way the irs. Web the ira distribution form for traditional (including sep), roth, and simple iras is used to document and instruct us of your distribution related decisions. Web use this form to request a new distribution from or change an existing distribution instruction.

Pershing Ira Distribution Form Fill Online, Printable, Fillable

You can also complete many of these transactions online. A separate distribution form must be completed for each distribution reason. Authorize the return of an excess ira contribution. Web the ira distribution form for traditional (including sep), roth, and simple iras is used to document and instruct us of your distribution related decisions. Deadline for receiving required minimum distribution:

Ira Withdrawal Form Merrill Lynch Universal Network

Before you withdraw, we’ll help you understand below how your age and other factors impact the way the irs. A separate distribution form must be completed for each distribution reason. Web if your traditional ira includes nondeductible contributions and you received a distribution from it in 2022, you must use form 8606 to figure how much of your 2022 ira.

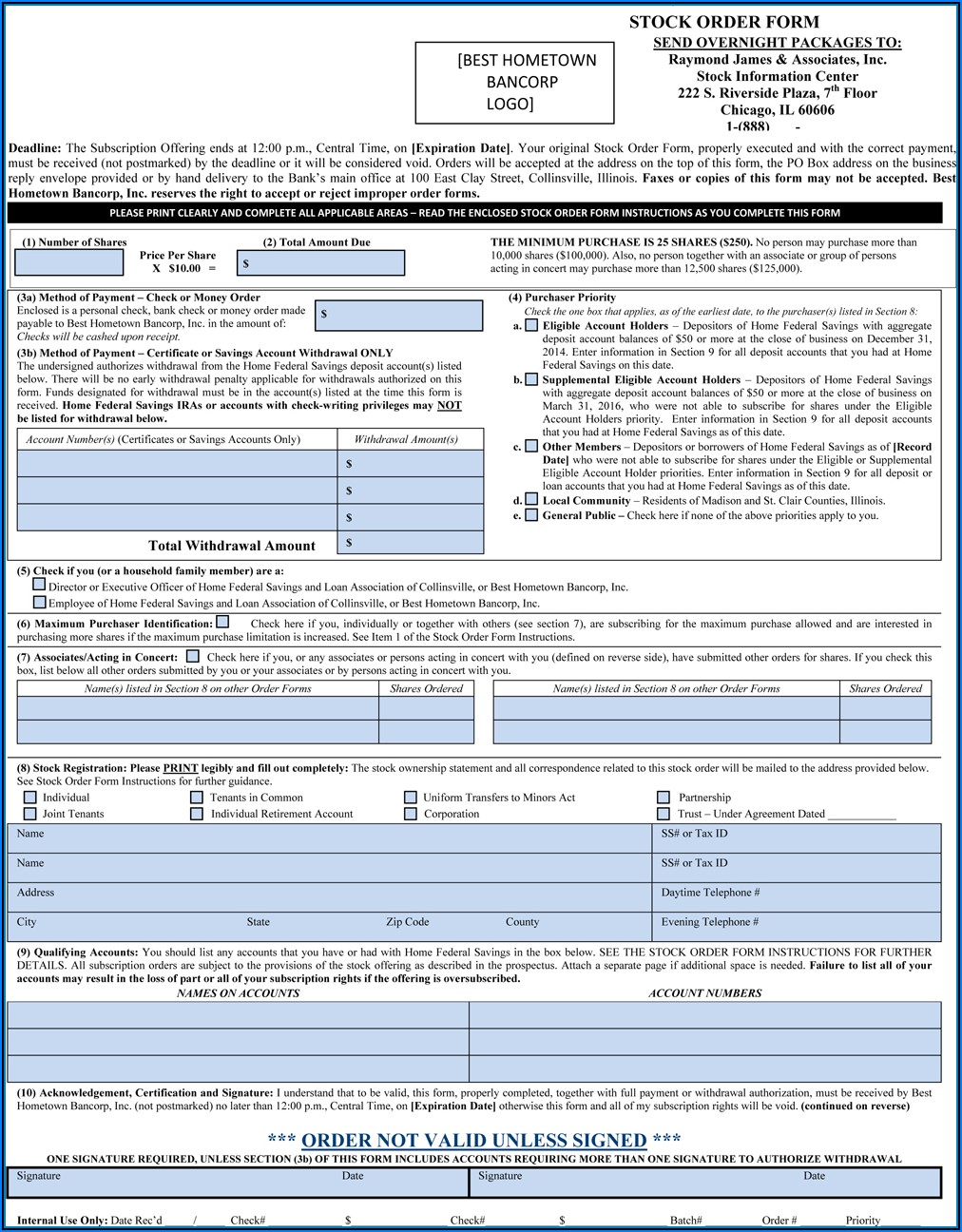

Raymond James Ira Withdrawal Form Form Resume Examples 1ZV8a11N23

Morgan securities llc (jpms) roth or traditional individual retirement account (ira) (including sep and beneficiary ira). Authorize the return of an excess ira contribution. Your ira savings is always yours when you need it—whether for retirement or emergency funds. Ira inherit an ira from a spouse or non. Web use this form to request a new distribution from or change.

Metlife Ira Withdrawal Form Universal Network

Please obtain a transfer form from the new institution. Before you withdraw, we’ll help you understand below how your age and other factors impact the way the irs. Web use this form to request a new distribution from or change an existing distribution instruction for your schwab ira account. Morgan securities llc (jpms) roth or traditional individual retirement account (ira).

Ira Withdrawal Authorization Form 20202021 Fill and Sign Printable

Web use this form to request a new distribution from or change an existing distribution instruction for your schwab ira account. Your ira savings is always yours when you need it—whether for retirement or emergency funds. A separate distribution form must be completed for each distribution reason. Deadline for receiving required minimum distribution: To transfer your ira to another institution.

Traditional Ira Distribution Tax Form Universal Network

Web the ira distribution form for traditional (including sep), roth, and simple iras is used to document and instruct us of your distribution related decisions. Web if your traditional ira includes nondeductible contributions and you received a distribution from it in 2022, you must use form 8606 to figure how much of your 2022 ira distribution is tax free. Web.

Checkwriting Add Checkwriting To An Existing Nonretirement, Health Savings Account (Hsa), The Fidelity ® Cash Management Account, Or Ira Account.

Before you withdraw, we’ll help you understand below how your age and other factors impact the way the irs. Authorize the return of an excess ira contribution. Your ira savings is always yours when you need it—whether for retirement or emergency funds. Web regardless of your age, you will need to file a form 1040 and show the amount of the ira withdrawal.

Web The Ira Distribution Form For Traditional (Including Sep), Roth, And Simple Iras Is Used To Document And Instruct Us Of Your Distribution Related Decisions.

You can also complete many of these transactions online. Applicable law or policies of the ira custodian/trustee may require additional documentation. Web withdrawing from an ira. Web simple ira withdrawal in the first two years (no irs penalty exception).

Morgan Securities Llc (Jpms) Roth Or Traditional Individual Retirement Account (Ira) (Including Sep And Beneficiary Ira).

Web if your traditional ira includes nondeductible contributions and you received a distribution from it in 2022, you must use form 8606 to figure how much of your 2022 ira distribution is tax free. Please obtain a transfer form from the new institution. To transfer your ira to another institution. Ira inherit an ira from a spouse or non.

For Distributions Due To Death, Please Complete A Withdrawal And Tax Election Form For Beneficiaries.

Web use this form to request a new distribution from or change an existing distribution instruction for your schwab ira account. Since you took the withdrawal before you reached age 59 1/2, unless you met one of the exceptions, you will need to pay an additional 10% tax on early distributions on your form 1040. Deadline for receiving required minimum distribution: What you need to know