Form 720 Pcori Fee

Form 720 Pcori Fee - Web in 2023, the irs will issue an updated form 720 for the second quarter with the pcori fees adjusted for the upcoming july 31 payment date. The irs has released a revision to irs. These fees are due each year by july 31 of the year following the last day. Web late last week, the irs issued the updated form 720, which is the april 2020 revised form. Web pcori fees are reported and paid annually using irs form 720 (quarterly federal excise tax return). 1, 2019, and before oct. Web an employer that overlooks reporting and payment of the pcori fee by its due date, mcwilliams wrote, should immediately, upon realizing the oversight, file form. Irs form 720, called the quarterly federal excise tax return, is a tax document that businesses and individuals. Web about us 720 form product / home developer: Payment amounts due in 2022 will differ based on the.

Web pcori fees are reported and paid annually using irs form 720 (quarterly federal excise tax return). Web pcori fees are reported and paid annually using irs form 720 (quarterly federal excise tax return). The irs has released a revision to irs. Web about us 720 form product / home developer: These fees are due each year by july 31 of the year following the last day. Web each year, employers must wait for the irs to update form 720 in order to pay their pcor fees with the correct form. Payment amounts due in 2022 will differ based on the. Web in 2023, the irs will issue an updated form 720 for the second quarter with the pcori fees adjusted for the upcoming july 31 payment date. Irs form 720, called the quarterly federal excise tax return, is a tax document that businesses and individuals. For plans that ended december 2022, the pcori fee is $3.00 per.

1, 2019, and before oct. 1, 2020, is $2.54 per person covered by the plan. Irs form 720, called the quarterly federal excise tax return, is a tax document that businesses and individuals. For plans that ended december 2022, the pcori fee is $3.00 per. Web late last week, the irs issued the updated form 720, which is the april 2020 revised form. These fees are due each year by july 31 of the year following the last day. Web the aca requires applicable employers to report and pay the fee once a year, using form 720 for the quarterly federal excise tax return that you can get. Web about us 720 form product / home developer: Web for fully insured plans, the pcori fee is paid by the health insurer, not the employer. Web in 2023, the irs will issue an updated form 720 for the second quarter with the pcori fees adjusted for the upcoming july 31 payment date.

Compliance Reminder PCORI Fee Notice Brinson Benefits Employee

These fees are due each year by july 31 of the year following the last day. 2023 businesses with a gross income below a specified threshold. Web pcori fees are reported and paid annually using irs form 720 (quarterly federal excise tax return). Web about us 720 form product / home developer: Irs form 720, called the quarterly federal excise.

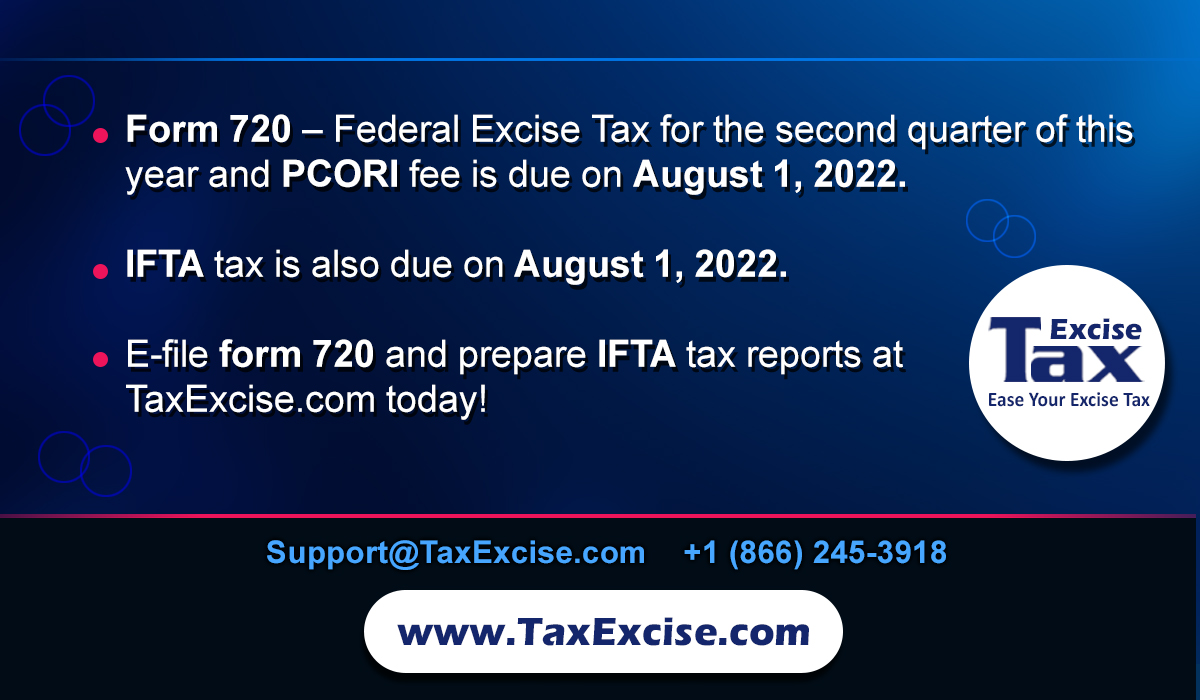

August 1 is the deadline for reporting federal excise tax form 720

2023 businesses with a gross income below a specified threshold. Therefore, the employer does not have to take action or file form 720. Web for fully insured plans, the pcori fee is paid by the health insurer, not the employer. For plans that ended december 2022, the pcori fee is $3.00 per. Web the aca requires applicable employers to report.

PCORI fee Form 720 available now

Web pcori fees are reported and paid annually using irs form 720 (quarterly federal excise tax return). 1, 2020, is $2.54 per person covered by the plan. Web an employer that overlooks reporting and payment of the pcori fee by its due date, mcwilliams wrote, should immediately, upon realizing the oversight, file form. The irs has released a revision to.

Updated Form 720 Issued For PCORI Fee Payments Woodruff Sawyer

2023 businesses with a gross income below a specified threshold. Web for fully insured plans, the pcori fee is paid by the health insurer, not the employer. Pcori fee guideline from start to finish. Therefore, the employer does not have to take action or file form 720. The irs has released a revision to irs.

Electronic filing for Form 720 ease your tax reporting

Irs form 720, called the quarterly federal excise tax return, is a tax document that businesses and individuals. Pcori fee guideline from start to finish. Web each year, employers must wait for the irs to update form 720 in order to pay their pcor fees with the correct form. Web issuers and plan sponsors who are required to pay the.

Form 720 and PCORI fee FAQs PeopleKeep

For plans that ended december 2022, the pcori fee is $3.00 per. Web pcori fees are reported and paid annually using irs form 720 (quarterly federal excise tax return). Web each year, employers must wait for the irs to update form 720 in order to pay their pcor fees with the correct form. 1, 2020, is $2.54 per person covered.

Form 720 and PCORI Fees Due July 31st Gilroy Kernan & Gilroy

Web an employer that overlooks reporting and payment of the pcori fee by its due date, mcwilliams wrote, should immediately, upon realizing the oversight, file form. Web issuers and plan sponsors who are required to pay the pcori fee as well as other liabilities on a form 720 will use their form 720 for the 2nd quarter to report and.

Form 720 is due TODAY for second quarter of 2020 and PCORI Fee for 2019

2023 businesses with a gross income below a specified threshold. Web the aca requires applicable employers to report and pay the fee once a year, using form 720 for the quarterly federal excise tax return that you can get. Web for fully insured plans, the pcori fee is paid by the health insurer, not the employer. These fees are due.

How to complete IRS Form 720 for the PatientCentered Research

Payment amounts due in 2022 will differ based on the. Pcori fee guideline from start to finish. Web for fully insured plans, the pcori fee is paid by the health insurer, not the employer. For plans that ended december 2022, the pcori fee is $3.00 per. It is reported on irs form 720.*.

PCORI Fee Reporting in Excise Tax Form 720 IRS

Web late last week, the irs issued the updated form 720, which is the april 2020 revised form. Web pcori fees are reported and paid annually using irs form 720 (quarterly federal excise tax return). 2023 businesses with a gross income below a specified threshold. Web the aca requires applicable employers to report and pay the fee once a year,.

1, 2019, And Before Oct.

These fees are due each year by july 31 of the year following the last day. Web pcori fees are reported and paid annually using irs form 720 (quarterly federal excise tax return). Web late last week, the irs issued the updated form 720, which is the april 2020 revised form. These fees are due each year by july 31 of the year.

Web For Fully Insured Plans, The Pcori Fee Is Paid By The Health Insurer, Not The Employer.

Web pcori fees are reported and paid annually using irs form 720 (quarterly federal excise tax return). Irs form 720, called the quarterly federal excise tax return, is a tax document that businesses and individuals. Web it is required to be reported only once a year in july. It is reported on irs form 720.*.

Web Each Year, Employers Must Wait For The Irs To Update Form 720 In Order To Pay Their Pcor Fees With The Correct Form.

For plans that ended december 2022, the pcori fee is $3.00 per. Web in 2023, the irs will issue an updated form 720 for the second quarter with the pcori fees adjusted for the upcoming july 31 payment date. Web an employer that overlooks reporting and payment of the pcori fee by its due date, mcwilliams wrote, should immediately, upon realizing the oversight, file form. 1, 2020, is $2.54 per person covered by the plan.

The Irs Has Released A Revision To Irs.

Web the aca requires applicable employers to report and pay the fee once a year, using form 720 for the quarterly federal excise tax return that you can get. Payment amounts due in 2022 will differ based on the. Web issuers and plan sponsors who are required to pay the pcori fee as well as other liabilities on a form 720 will use their form 720 for the 2nd quarter to report and pay the. Web about us 720 form product / home developer: