Illinois St1 Form

Illinois St1 Form - Open the tax illinois gov individuals a creditcard htm st1forms reporting periods and follow the instructions. Type text, add images, blackout confidential details, add comments, highlights and more. Once completed you can sign your fillable form or send for signing. Download blank or fill out online in pdf format. Documents are in adobe acrobat portable document format (pdf). Ad download or email & more fillable forms, register and subscribe now! Edit your il st1 sales and use tax online. Web use fill to complete blank online illinois pdf forms for free. All forms are printable and. Web for a late filing, there is a flat 2% applied to the total of the tax due or $250, whichever is smallest.

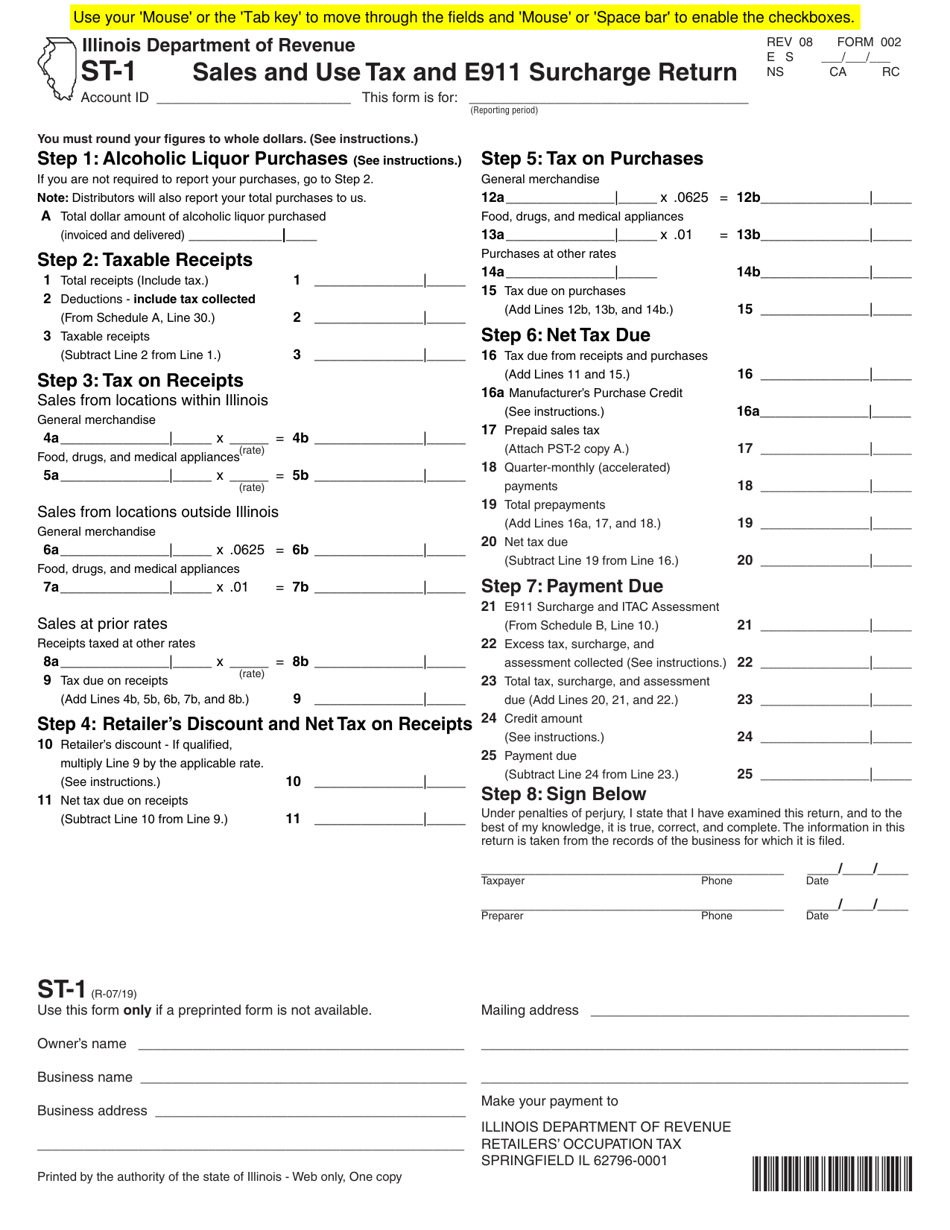

Web illinois department of revenue. If you pay late, you’ll owe 2% of the tax due within 30 days, 10% if paid. Disclosure of this information is. This is the most commonly used form to file and pay sales tax in illinois. This is the most commonly used form to file and pay sales. While it might not be the big ten's most feared defensive. Figure your taxable receipts when completing this form, please round tothe nearest dollar by dropping amounts ofless than 50 cents and increasing amounts of 50 cents or. Web effective january 1, 2021, remote retailers, as defined in section 1 of the retailers' occupation tax act (35 ilcs 120/1), and sometimes marketplace facilitators,. Documents are in adobe acrobat portable document format (pdf). Sign it in a few clicks.

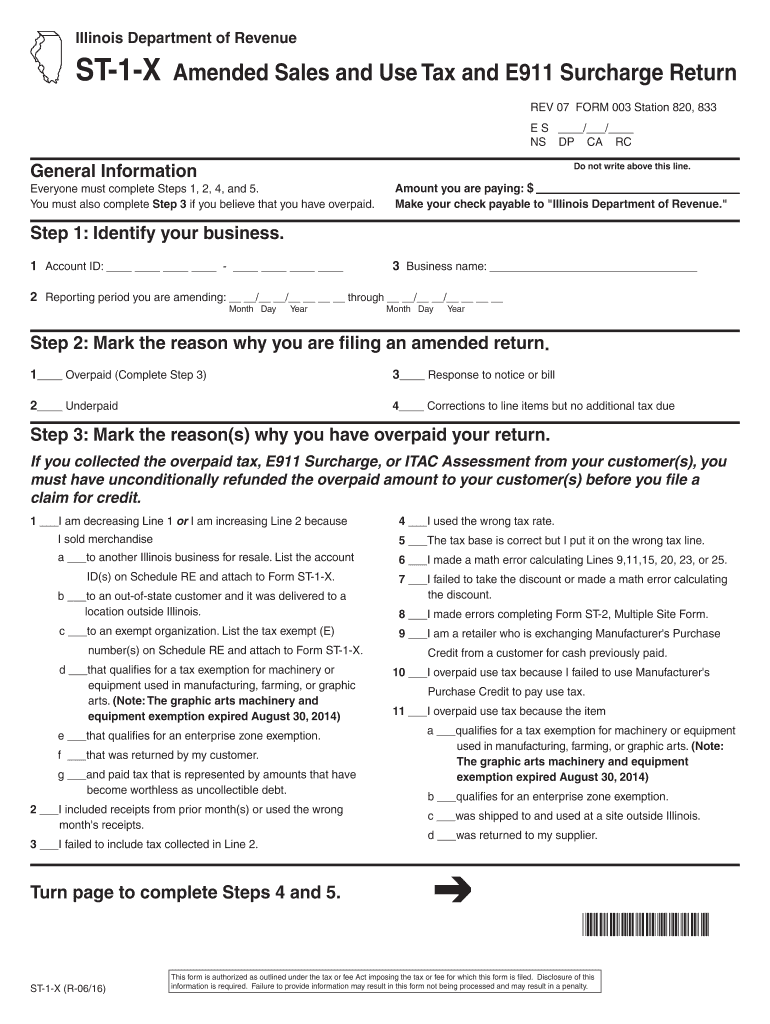

Web this form is authorized as outlined under the tax or fee act imposing the tax or fee for which this form is filed. Disclosure of this information is. Edit your il st1 sales and use tax online. Web use fill to complete blank online illinois pdf forms for free. Amended sales and use tax and e911 surcharge return. Web 1st quarter filing due april 20th! This is the most commonly used form to file and pay sales tax in illinois. Figure your taxable receipts when completing this form, please round tothe nearest dollar by dropping amounts ofless than 50 cents and increasing amounts of 50 cents or. While it might not be the big ten's most feared defensive. Type text, add images, blackout confidential details, add comments, highlights and more.

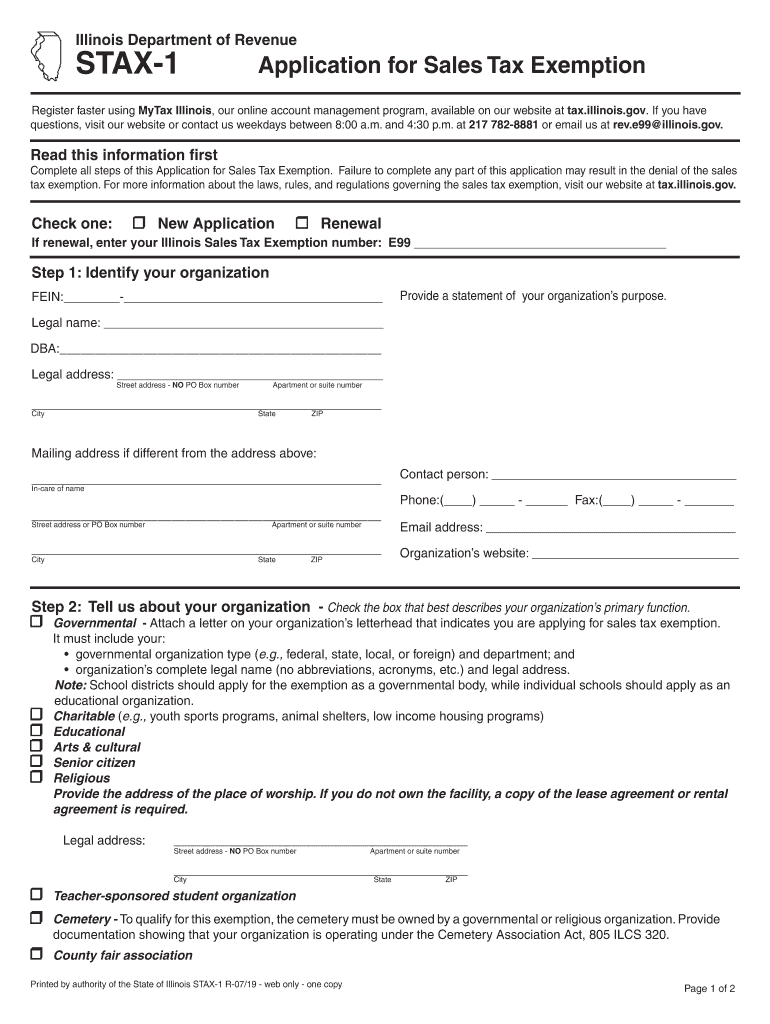

IL STAX1 2019 Fill out Tax Template Online US Legal Forms

Web 1st quarter filing due april 20th! Web illinois department of revenue. Documents are in adobe acrobat portable document format (pdf). Amended sales and use tax and e911 surcharge return. All forms are printable and.

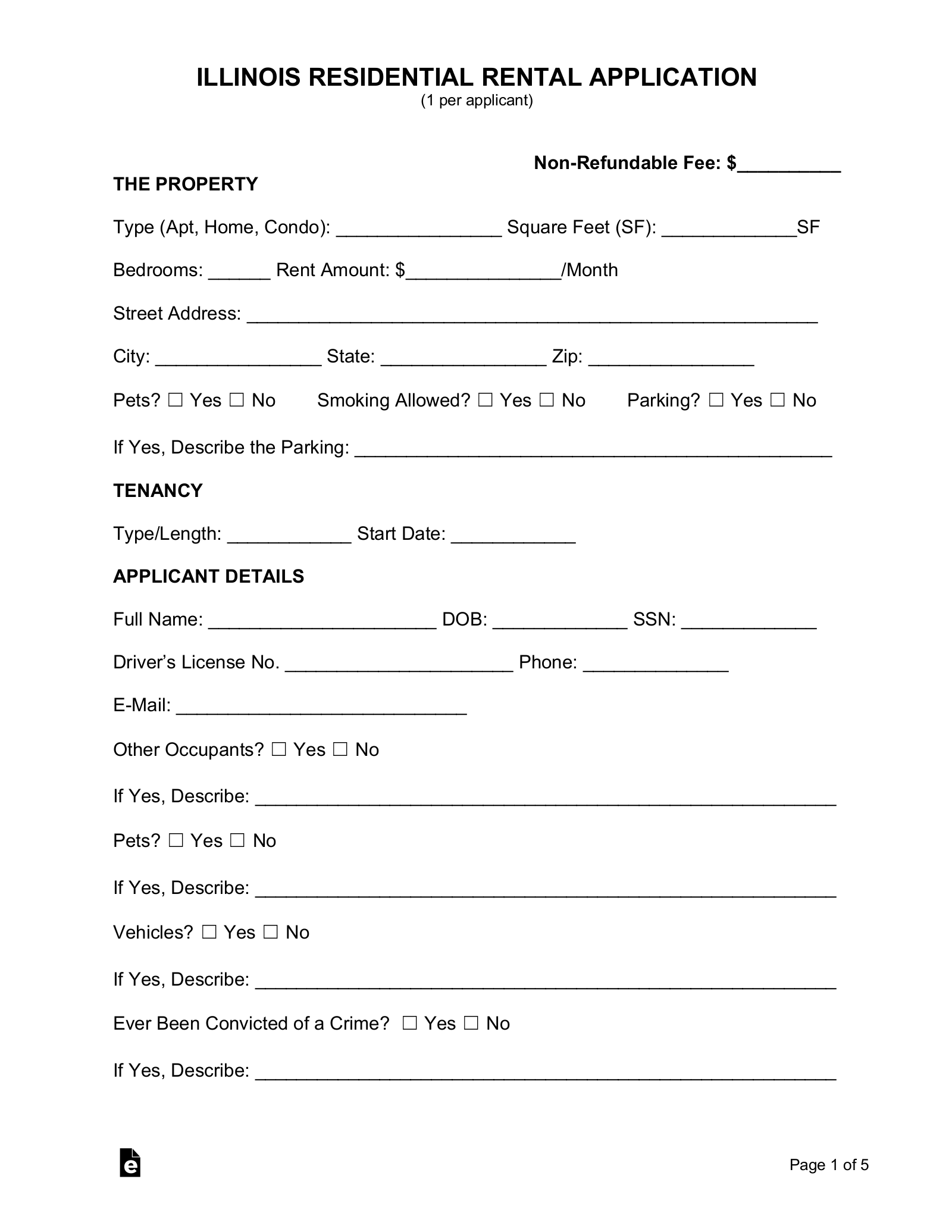

Free Illinois Rental Application Form PDF eForms

Sign it in a few clicks. While it might not be the big ten's most feared defensive. Web illinois department of revenue. Web this form is authorized as outlined under the tax or fee act imposing the tax or fee for which this form is filed. Download blank or fill out online in pdf format.

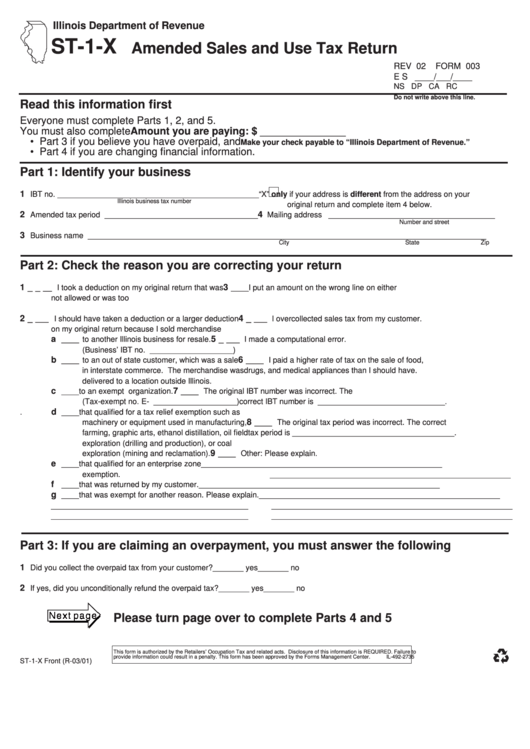

2011 Form IL DoR ST1X Fill Online, Printable, Fillable, Blank pdfFiller

Once completed you can sign your fillable form or send for signing. Ad download or email & more fillable forms, register and subscribe now! General information do not write above this line. Figure your taxable receipts when completing this form, please round tothe nearest dollar by dropping amounts ofless than 50 cents and increasing amounts of 50 cents or. Sign.

Form ST1 Download Fillable PDF or Fill Online Sales and Use Tax and

Web 1st quarter filing due april 20th! This is the most commonly used form to file and pay sales tax in illinois. Download blank or fill out online in pdf format. Figure your taxable receipts when completing this form, please round tothe nearest dollar by dropping amounts ofless than 50 cents and increasing amounts of 50 cents or. Amended sales.

Service Tax ONLINE SERVICE TAX REGISTRATION

General information do not write above this line. Amended sales and use tax and e911 surcharge return. Before viewing these documents you may need to download adobe acrobat reader. Web use fill to complete blank online illinois pdf forms for free. While it might not be the big ten's most feared defensive.

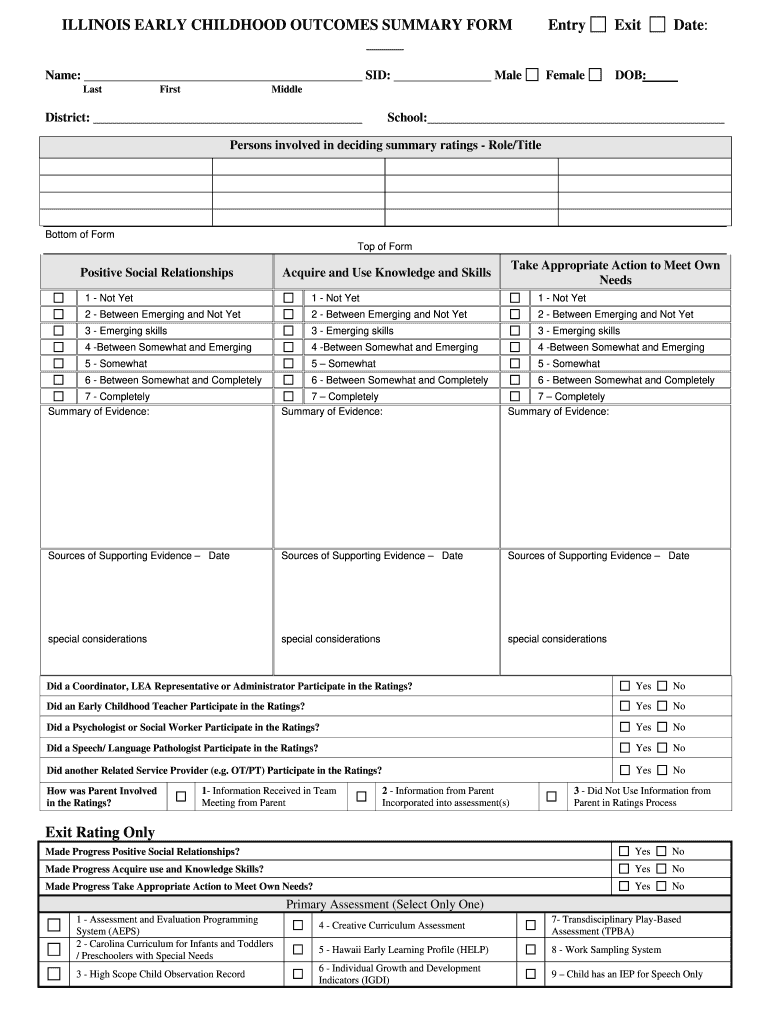

Illinois Early Form Fill Online, Printable, Fillable, Blank pdfFiller

If you pay late, you’ll owe 2% of the tax due within 30 days, 10% if paid. Web use fill to complete blank online illinois pdf forms for free. Web 1st quarter filing due april 20th! Web illinois department of revenue. General information do not write above this line.

risk management form killalea st1 Bus Risk

Figure your taxable receipts when completing this form, please round tothe nearest dollar by dropping amounts ofless than 50 cents and increasing amounts of 50 cents or. General information do not write above this line. Once completed you can sign your fillable form or send for signing. This is the most commonly used form to file and pay sales tax.

St1 and SCA form partnership to produce renewable fuels TissueMag

Before viewing these documents you may need to download adobe acrobat reader. Once completed you can sign your fillable form or send for signing. Chop robinson, adisa isaac, hakeem beamon, dvon ellies. Download blank or fill out online in pdf format. Type text, add images, blackout confidential details, add comments, highlights and more.

Form St1X Amended Sales And Use Tax Return Form State Of Illinois

Web use fill to complete blank online illinois pdf forms for free. Web for a late filing, there is a flat 2% applied to the total of the tax due or $250, whichever is smallest. Amended sales and use tax and e911 surcharge return. Edit your il st1 sales and use tax online. Type text, add images, blackout confidential details,.

FMST1 Form Metal Linear Fluorescent Atlantic Lighting

Chop robinson, adisa isaac, hakeem beamon, dvon ellies. While it might not be the big ten's most feared defensive. Once completed you can sign your fillable form or send for signing. Download blank or fill out online in pdf format. Web effective january 1, 2021, remote retailers, as defined in section 1 of the retailers' occupation tax act (35 ilcs.

Figure Your Taxable Receipts When Completing This Form, Please Round Tothe Nearest Dollar By Dropping Amounts Ofless Than 50 Cents And Increasing Amounts Of 50 Cents Or.

Before viewing these documents you may need to download adobe acrobat reader. This is the most commonly used form to file and pay sales. Amended sales and use tax and e911 surcharge return. Download blank or fill out online in pdf format.

Web Effective January 1, 2021, Remote Retailers, As Defined In Section 1 Of The Retailers' Occupation Tax Act (35 Ilcs 120/1), And Sometimes Marketplace Facilitators,.

If you pay late, you’ll owe 2% of the tax due within 30 days, 10% if paid. All forms are printable and. Web 1st quarter filing due april 20th! Sign it in a few clicks.

This Is The Most Commonly Used Form To File And Pay Sales Tax In Illinois.

Once completed you can sign your fillable form or send for signing. Chop robinson, adisa isaac, hakeem beamon, dvon ellies. Documents are in adobe acrobat portable document format (pdf). Web use fill to complete blank online illinois pdf forms for free.

Easily Sign The Illinois Sales Tax Form St 1 With Your.

Edit your il st1 sales and use tax online. Ad download or email & more fillable forms, register and subscribe now! Web for a late filing, there is a flat 2% applied to the total of the tax due or $250, whichever is smallest. While it might not be the big ten's most feared defensive.