How To File 941 Form Online

How To File 941 Form Online - Web mailing addresses for forms 941. Web an employer that owes employment taxes of $1,000 or less for the year can file form 944, employer’s annual federal tax return if given irs permission to do so. Learn how quickbooks online and desktop populates the lines on the form 941. Connecticut, delaware, district of columbia, georgia,. Sign up & make payroll a breeze. Web this eftps® tax payment service web site supports microsoft internet explorer for windows, google chrome for windows and mozilla firefox for windows. Employers must file a quarterly form 941 to report. It should just take a few minutes to complete, and then we’ll. How to file 941 instructions for easy to use. Ad we simplify complex tasks to give you time back and help you feel like an expert.

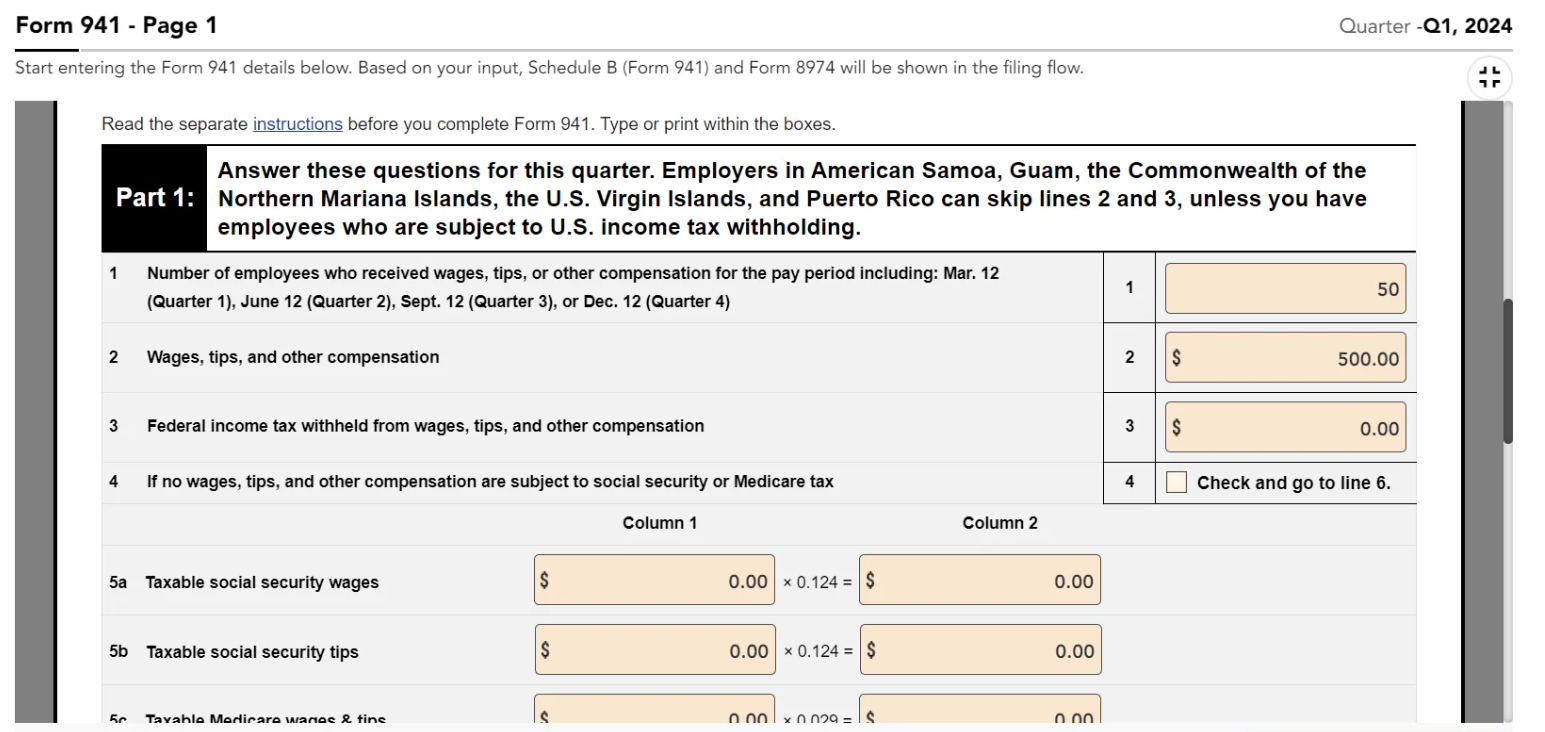

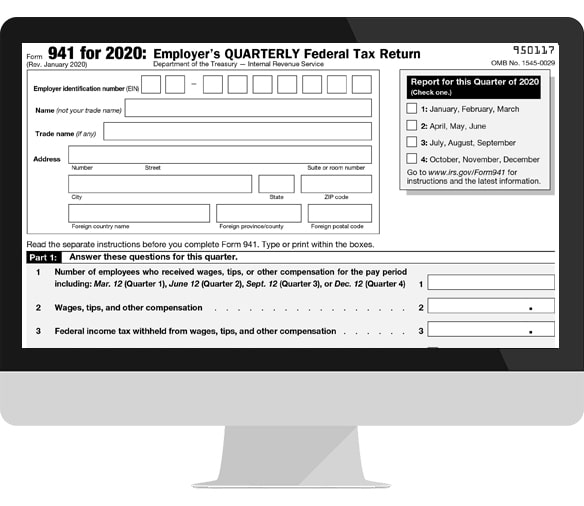

Web how quickbooks populates form 941. Complete, edit or print tax forms instantly. Web quickbooks team april 25, 2023 06:24 pm hello there, cramer. Select the 941 form from the list. Lowest price in the industry. Web fill out business information. Form 941 is a internal revenue service (irs) tax form for employers in the u.s. Web an employer that owes employment taxes of $1,000 or less for the year can file form 944, employer’s annual federal tax return if given irs permission to do so. Sign up & make payroll a breeze. Complete, edit or print tax forms instantly.

It should just take a few minutes to complete, and then we’ll. Lowest price in the industry. Complete, edit or print tax forms instantly. Sign up & make payroll a breeze. Simply the best payroll service for small business. Web quickbooks team april 25, 2023 06:24 pm hello there, cramer. Web an employer that owes employment taxes of $1,000 or less for the year can file form 944, employer’s annual federal tax return if given irs permission to do so. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Form 941 is used by employers. Web march 28, 2019.

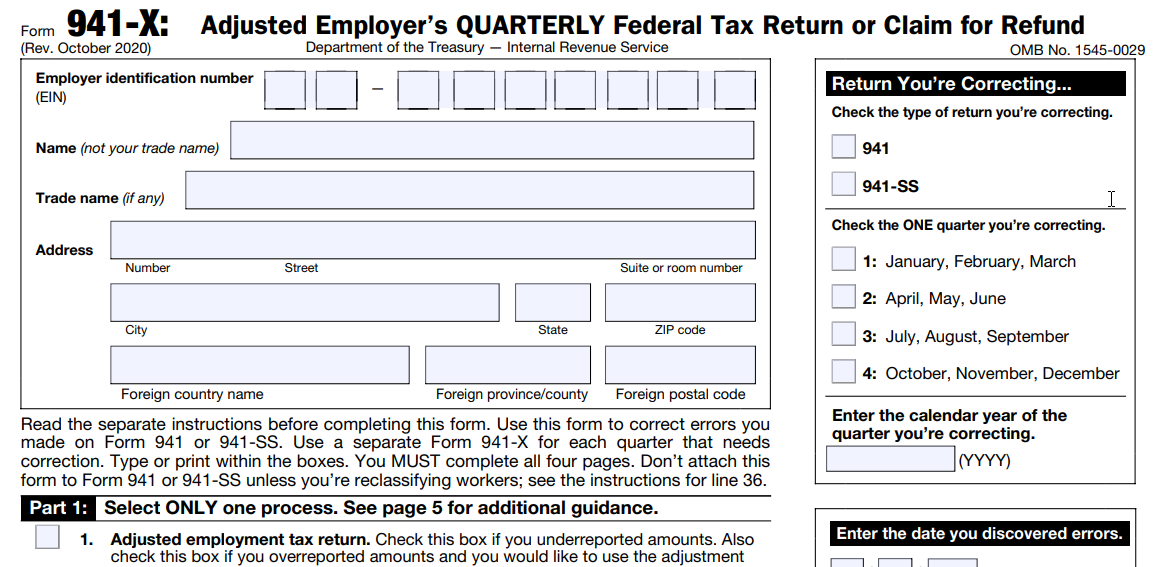

IRS Form 941 Online Filing for 2023 EFile 941 for 4.95/form

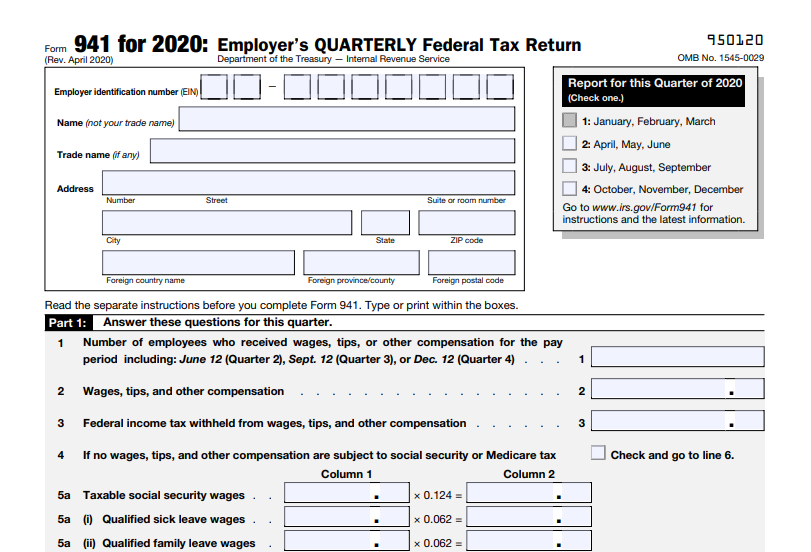

I'll be happy to walk you through the process of. Web march 28, 2019. I'm glad that you posted here in the community. Ad irs 941 inst & more fillable forms, register and subscribe now! At the top portion of form 941, fill in your ein, business name, trade name (if applicable), and business address.

File 941 Online How to File 2023 Form 941 electronically

It should just take a few minutes to complete, and then we’ll. Web fill out business information. Web how quickbooks populates form 941. Learn how quickbooks online and desktop populates the lines on the form 941. Web visit eftps.gov to enroll.

EFile your IRS Form 941 for the tax year 2020

Web march 28, 2019. Web mailing addresses for forms 941. Employers must file a quarterly form 941 to report. I'll be happy to walk you through the process of. I'm glad that you posted here in the community.

12 Form Irs Seven Ways On How To Prepare For 12 Form Irs AH STUDIO Blog

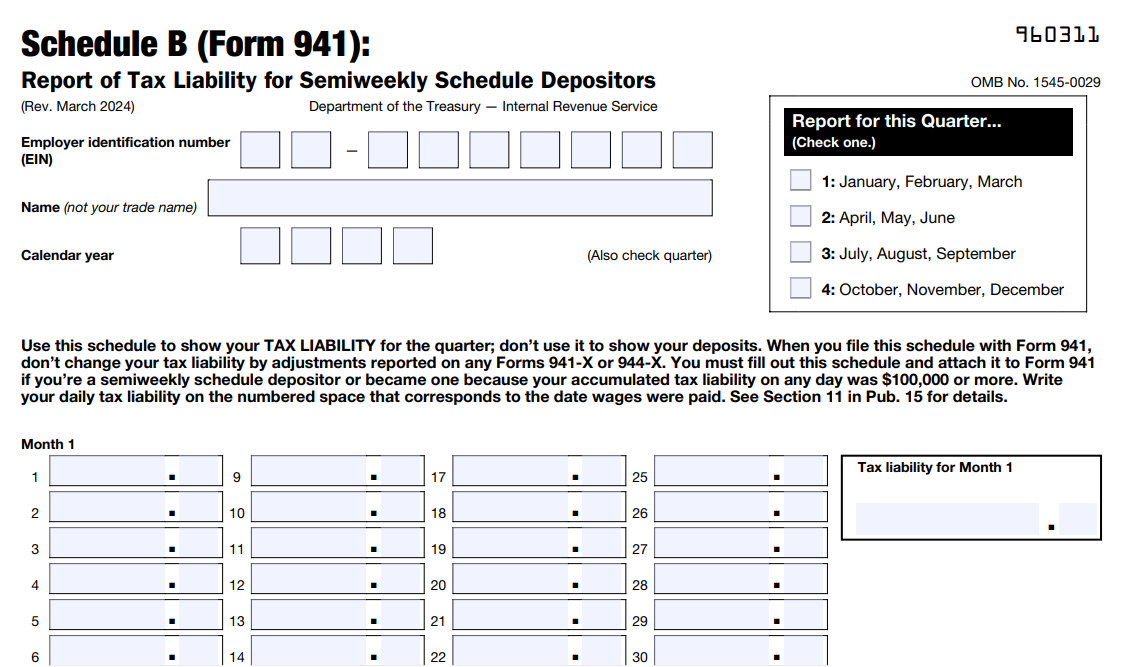

Web visit eftps.gov to enroll. Web quickbooks team april 25, 2023 06:24 pm hello there, cramer. Off to the right side,. Web fill out business information. Web 1 choose tax year & quarter 2 enter social security & medicare taxes 3 enter deposit schedule & tax liability 4 choose irs payment methods 5 review your.

Where To File Form 941?

How to file 941 instructions for easy to use. Form 941 is used by employers. Learn how quickbooks online and desktop populates the lines on the form 941. Web fill out business information. Sign up & make payroll a breeze.

EFile Form 941 for 2022 File 941 Electronically at 4.95

Click the payroll tab, then file forms. Web an employer that owes employment taxes of $1,000 or less for the year can file form 944, employer’s annual federal tax return if given irs permission to do so. Electronic filing options for employment taxes: Web march 28, 2019. Select the 941 form from the list.

2019 Form IRS 941 Fill Online, Printable, Fillable, Blank pdfFiller

Off to the right side,. Form 941 is used by employers. Sign up & make payroll a breeze. Based upon irs sole proprietor data as of 2022, tax year 2021. Complete, edit or print tax forms instantly.

File 941 Online Efile 941 for 4.95 Form 941 for 2020

Connecticut, delaware, district of columbia, georgia,. Web quickbooks team april 25, 2023 06:24 pm hello there, cramer. Form 940, employer's federal unemployment (futa) tax return; Lowest price in the industry. At the top portion of form 941, fill in your ein, business name, trade name (if applicable), and business address.

File Form 941 Online for 2019 Express941

Complete, edit or print tax forms instantly. Web 1 choose tax year & quarter 2 enter social security & medicare taxes 3 enter deposit schedule & tax liability 4 choose irs payment methods 5 review your. Web employers use this form to report their withholding amounts for federal income taxes and fica taxes (social security and medicare) from employees paychecks.

File 941 Online Efile 941 for 4.95 IRS Form 941 for 2022

Form 941 is a internal revenue service (irs) tax form for employers in the u.s. Sign up & make payroll a breeze. Sign up & make payroll a breeze. Complete your tax setup before you can pay or file payroll taxes, make sure you complete your tax setup. Web mailing addresses for forms 941.

Ad Irs 941 Inst & More Fillable Forms, Register And Subscribe Now!

Web march 28, 2019. Web 1 choose tax year & quarter 2 enter social security & medicare taxes 3 enter deposit schedule & tax liability 4 choose irs payment methods 5 review your. Ad we simplify complex tasks to give you time back and help you feel like an expert. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file.

I'll Be Happy To Walk You Through The Process Of.

Web click the employees menu. Simply the best payroll service for small business. Sign up & make payroll a breeze. Web how quickbooks populates form 941.

Complete, Edit Or Print Tax Forms Instantly.

Select the 941 form from the list. Form 941 is used by employers. Learn how quickbooks online and desktop populates the lines on the form 941. Lowest price in the industry.

Form 940, Employer's Federal Unemployment (Futa) Tax Return;

Web an employer that owes employment taxes of $1,000 or less for the year can file form 944, employer’s annual federal tax return if given irs permission to do so. Complete, edit or print tax forms instantly. Based upon irs sole proprietor data as of 2022, tax year 2021. I'm glad that you posted here in the community.