Form 4864 Instructions

Form 4864 Instructions - Use form 4868 to apply for 6 more months (4 if “out of the country” (defined later under. Use this form if you are a household member and want to promise to make your income. Attach form 4684 to your tax. Web there are several ways to submit form 4868. To enter a casualty or theft loss in taxslayer pro, from the main menu of the. Web instructions for request for exemption for intending immigrant’s aidavit of support department of homeland security u.s. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Taxpayers who are out of the. Web information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file. If the line 10 amount is smaller, enter $100 on.

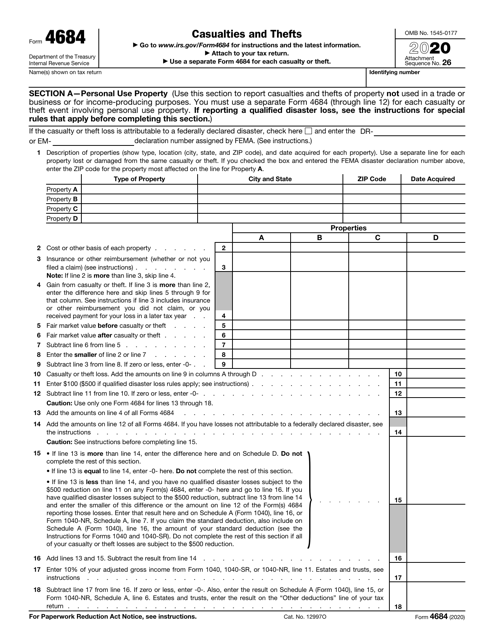

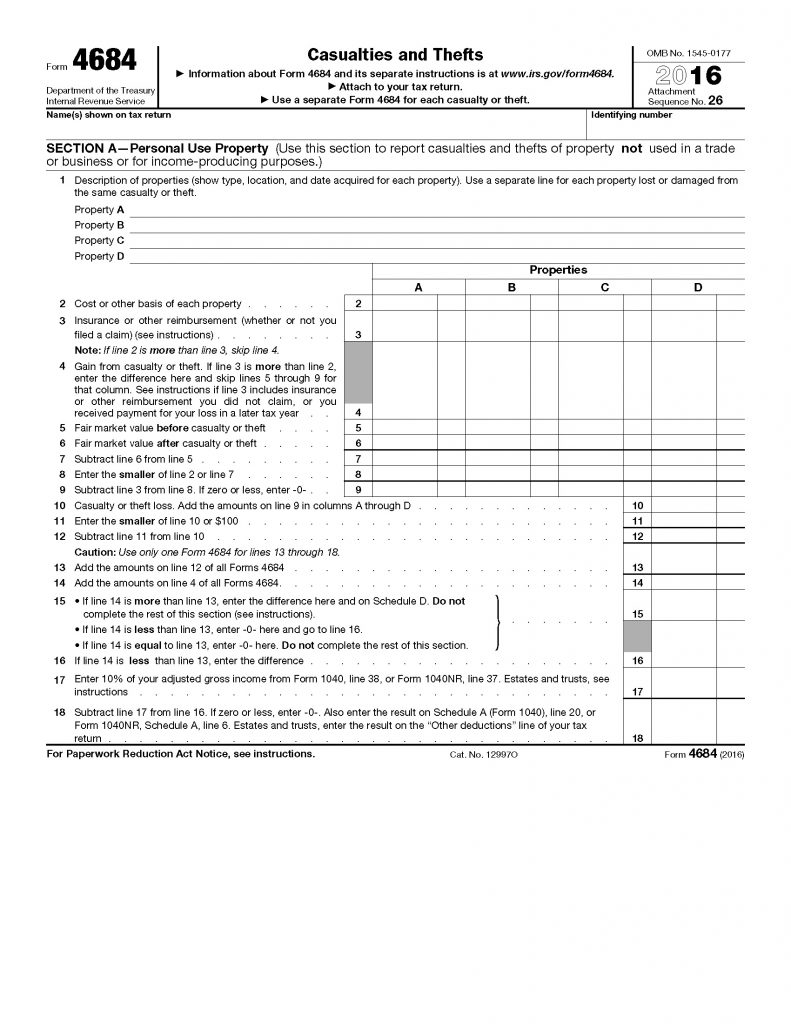

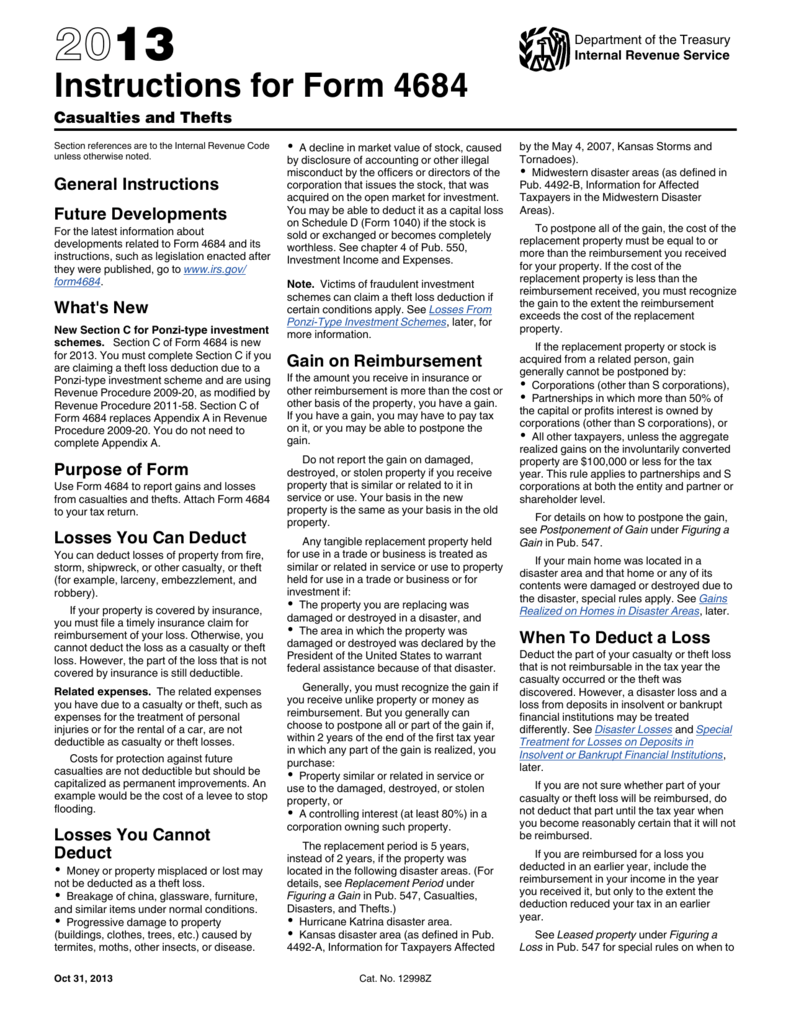

Web instructions for form 4684 casualties and thefts department of the treasury internal revenue service section references are to the internal revenue code unless otherwise. Casualties and thefts is an irs form to report gains or losses from casualties and theft which may be deductible and reduce taxable income. To enter a casualty or theft loss in taxslayer pro, from the main menu of the. Taxpayers who are out of the. Use this form if you are a household member and want to promise to make your income. However, if the casualty loss is not the result of a federally declared disaster, you must be itemize. By signing this form, you agree. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web instructions for request for exemption for intending immigrant’s aidavit of support department of homeland security u.s. Web have the form 4684 instructions handy to refer to for help in completing the form.

If the line 10 amount is smaller, enter $100 on. Web there are several ways to submit form 4868. Web information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file. Web instructions for form 4684 casualties and thefts department of the treasury internal revenue service section references are to the internal revenue code unless otherwise. Web federal form 4684 instructions future developments for the latest information about developments related to form 4684 and its instructions, such as legislation enacted. Taxpayers who are out of the. However, if the casualty loss is not the result of a federally declared disaster, you must be itemize. Use this form if you are a household member and want to promise to make your income. By signing this form, you agree. Web if the amount on line 10 is larger, enter $500 on line 11 of the form 4684 reporting the qualified disaster losses.

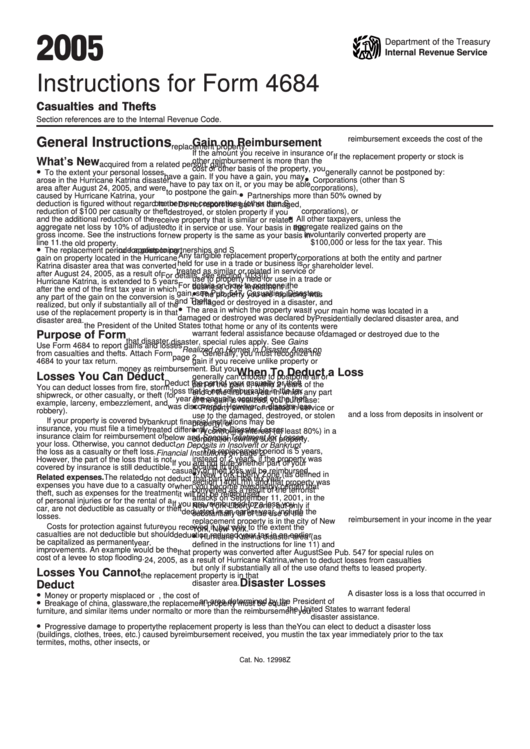

Instructions For Form 4684 Casualties And Thefts 2005 printable pdf

By signing this form, you agree. Taxpayers who are out of the. Web there are several ways to submit form 4868. Casualties and thefts is an irs form to report gains or losses from casualties and theft which may be deductible and reduce taxable income. Web claiming the deduction requires you to complete irs form 4684.

IRS Form 4684 Download Fillable PDF or Fill Online Casualties and

Web information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file. Web instructions for request for exemption for intending immigrant’s aidavit of support department of homeland security u.s. Web claiming the deduction requires you to complete irs form 4684. Taxpayers can file form 4868 by mail, but remember to get your request.

IRS Form 2553 Instructions How and Where to File This Tax Form

Relationship did you petition to get the immigrant. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Citizenship and immigration services uscis. By signing this form, you agree. Attach form 4684 to your tax.

Publication 225 Farmer's Tax Guide; Preparing the Return

Citizenship and immigration services uscis. Web federal form 4684 instructions future developments for the latest information about developments related to form 4684 and its instructions, such as legislation enacted. Casualties and thefts is an irs form to report gains or losses from casualties and theft which may be deductible and reduce taxable income. Web there are several ways to submit.

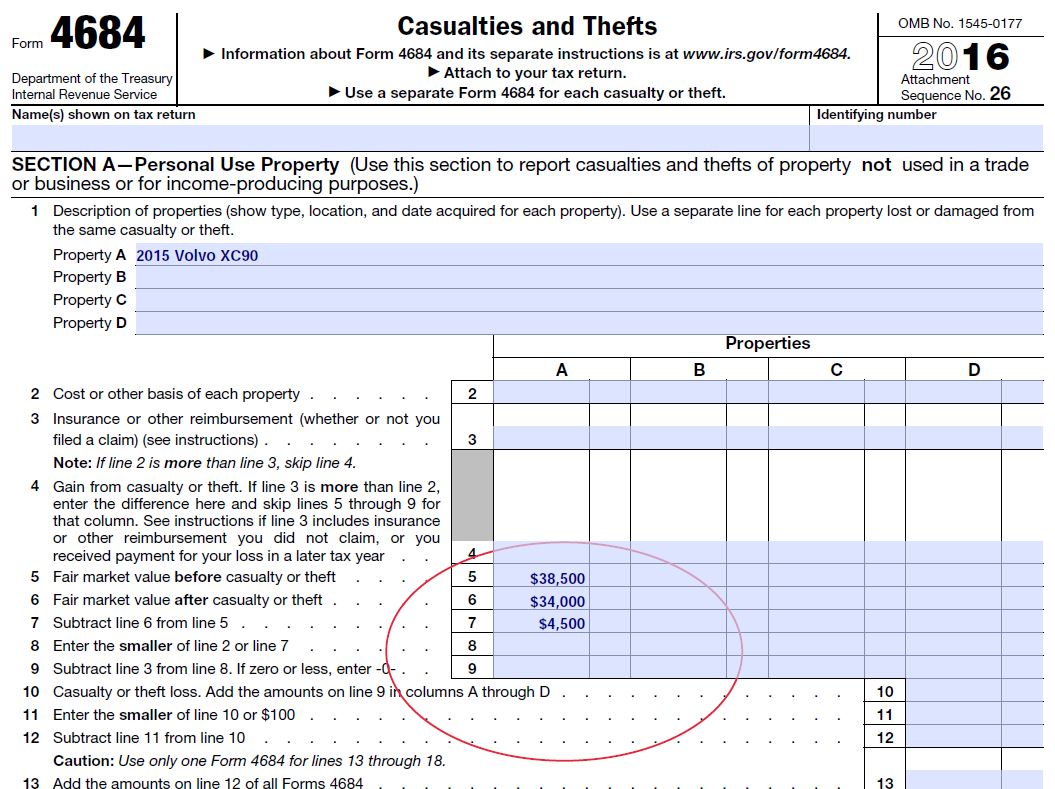

Diminished Value and Taxes, IRS form 4684 Diminished Value Car Appraisal

Use this form if you are a household member and want to promise to make your income. If the line 10 amount is smaller, enter $100 on. Casualties and thefts is an irs form to report gains or losses from casualties and theft which may be deductible and reduce taxable income. Taxpayers can file form 4868 by mail, but remember.

Form 4684 instructions 2018

Use this form if you are a household member and want to promise to make your income. By signing this form, you agree. Web september 5, 2021 10:53 am. Web information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file. Web instructions for request for exemption for intending immigrant’s aidavit of support.

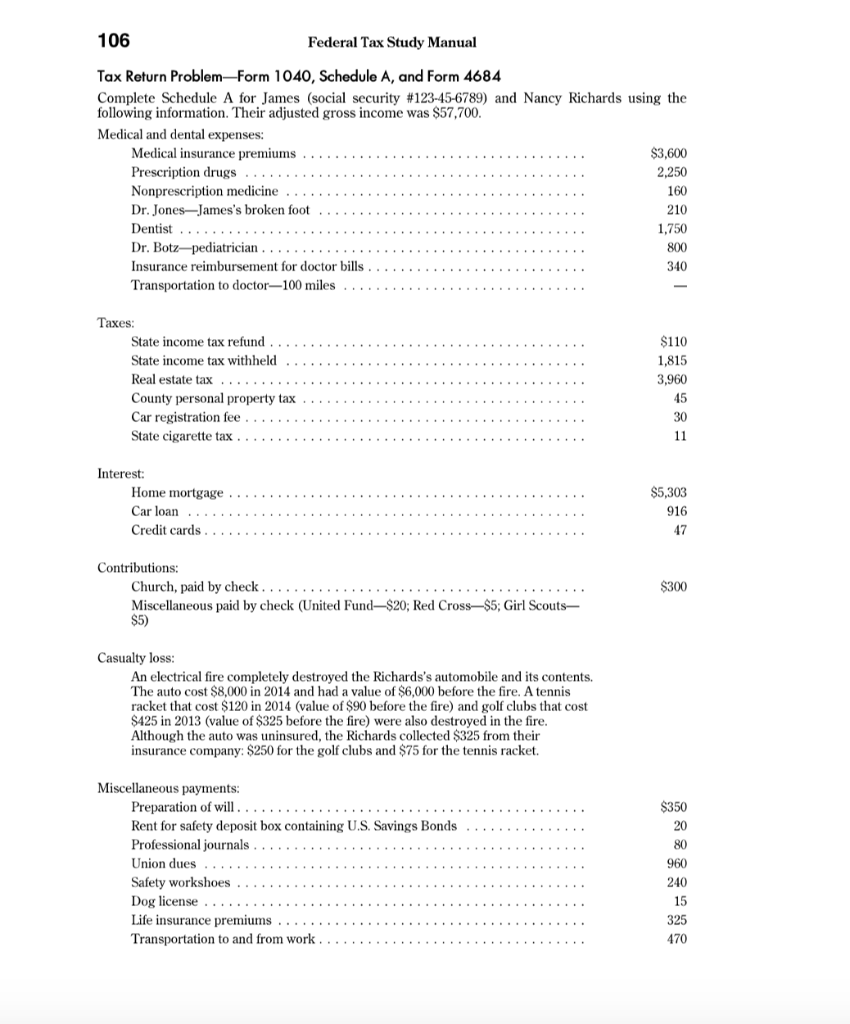

106 Federal Tax Study Manual Tax Return ProblemForm

However, if the casualty loss is not the result of a federally declared disaster, you must be itemize. To enter a casualty or theft loss in taxslayer pro, from the main menu of the. Web there are several ways to submit form 4868. Relationship did you petition to get the immigrant. By signing this form, you agree.

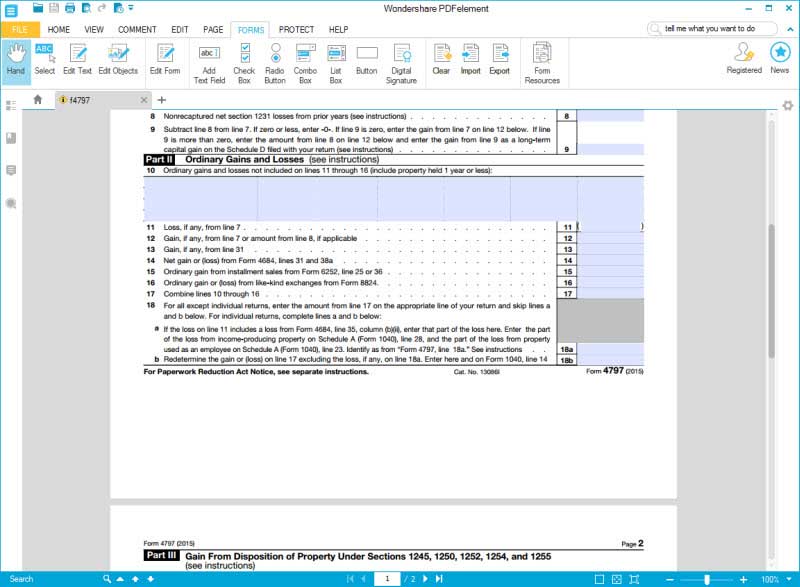

IRS Form 4797 Guide for How to Fill in IRS Form 4797

However, if the casualty loss is not the result of a federally declared disaster, you must be itemize. Use this form if you are a household member and want to promise to make your income. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Casualties and thefts is an irs.

Diminished Value and Taxes, IRS form 4684 Diminished Value of

If the line 10 amount is smaller, enter $100 on. Web have the form 4684 instructions handy to refer to for help in completing the form. Web federal form 4684 instructions future developments for the latest information about developments related to form 4684 and its instructions, such as legislation enacted. Use form 4868 to apply for 6 more months (4.

Instructions for Form 4684

Use this form if you are a household member and want to promise to make your income. Web there are several ways to submit form 4868. Use form 4868 to apply for 6 more months (4 if “out of the country” (defined later under. Citizenship and immigration services uscis. Taxpayers can file form 4868 by mail, but remember to get.

To Enter A Casualty Or Theft Loss In Taxslayer Pro, From The Main Menu Of The.

Use this form if you are a household member and want to promise to make your income. Casualties and thefts is an irs form to report gains or losses from casualties and theft which may be deductible and reduce taxable income. Relationship did you petition to get the immigrant. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day.

Web September 5, 2021 10:53 Am.

Web there are several ways to submit form 4868. Web information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file. Web have the form 4684 instructions handy to refer to for help in completing the form. Web if the amount on line 10 is larger, enter $500 on line 11 of the form 4684 reporting the qualified disaster losses.

If The Line 10 Amount Is Smaller, Enter $100 On.

Attach form 4684 to your tax. Web claiming the deduction requires you to complete irs form 4684. However, if the casualty loss is not the result of a federally declared disaster, you must be itemize. Citizenship and immigration services uscis.

Web Instructions For Form 4684 Casualties And Thefts Department Of The Treasury Internal Revenue Service Section References Are To The Internal Revenue Code Unless Otherwise.

Web instructions for request for exemption for intending immigrant’s aidavit of support department of homeland security u.s. Use form 4868 to apply for 6 more months (4 if “out of the country” (defined later under. By signing this form, you agree. Taxpayers who are out of the.