How Much Is A 2290 Form

How Much Is A 2290 Form - Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross. 2290 schedule 1 is proof of highway tax paid to the internal revenue service. The cost to file a form 2290 depends on the weight of the vehicle and whether or not it is a logging vehicle (these. All the services are at much affordable rates in the market. Easy, fast, secure & free to try. Allow four weeks for your new ein to be established in our systems before filing your form 2290. Web the tax calculator is a computing application of truckdues.com that gives you the estimated tax amount of truck tax form 2290 for your vehicles. There is now a much easier way to submit your 2290 irs form. Web keep your trucking company operations legal, saving you time and the costs of expensive fines. Electronic filing for faster processing of your tax returns.

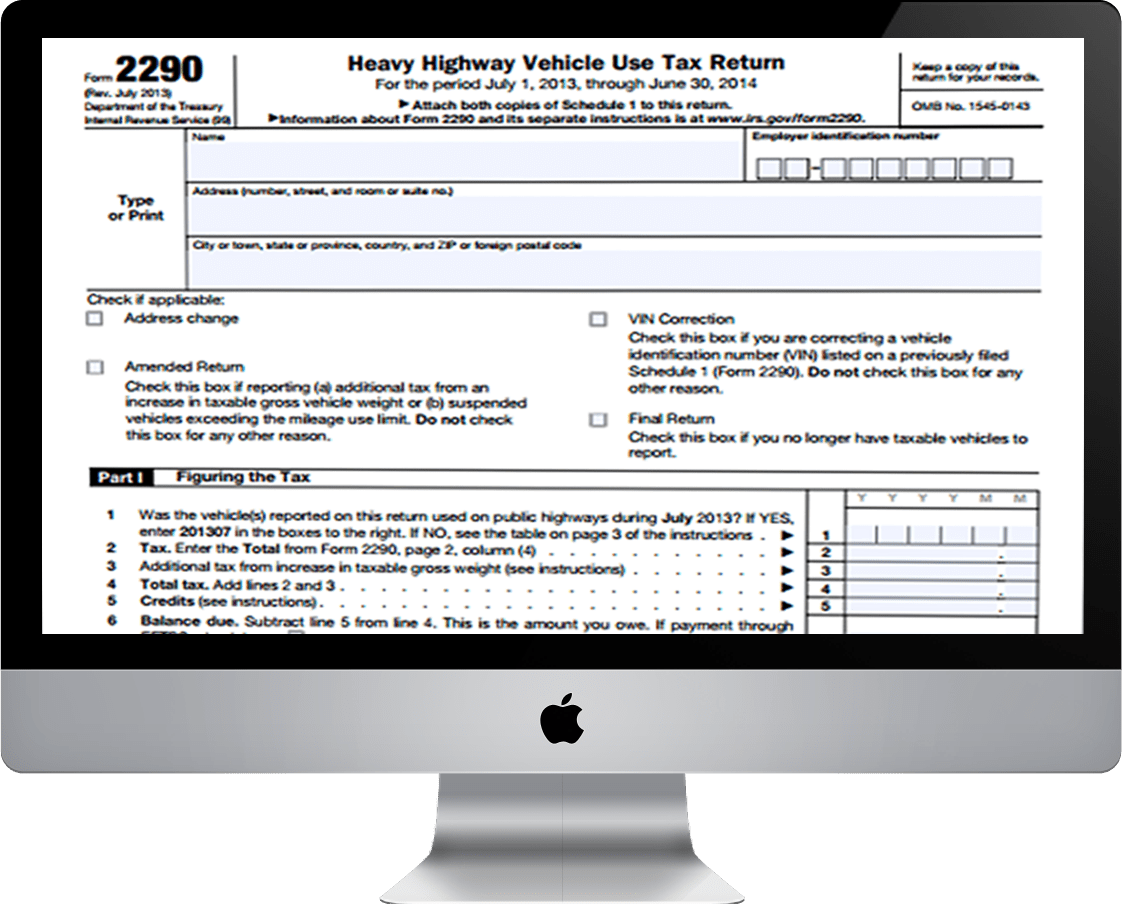

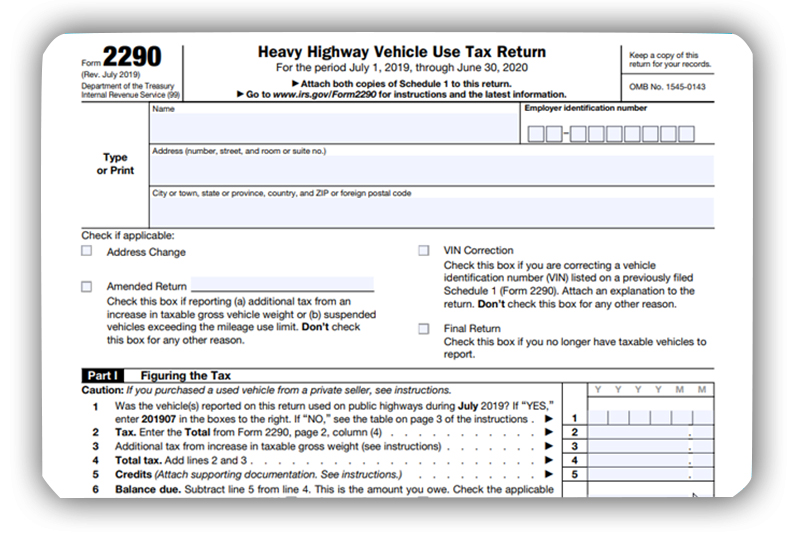

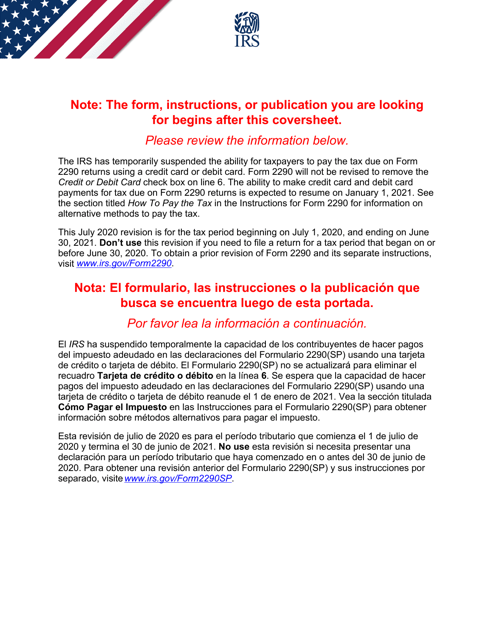

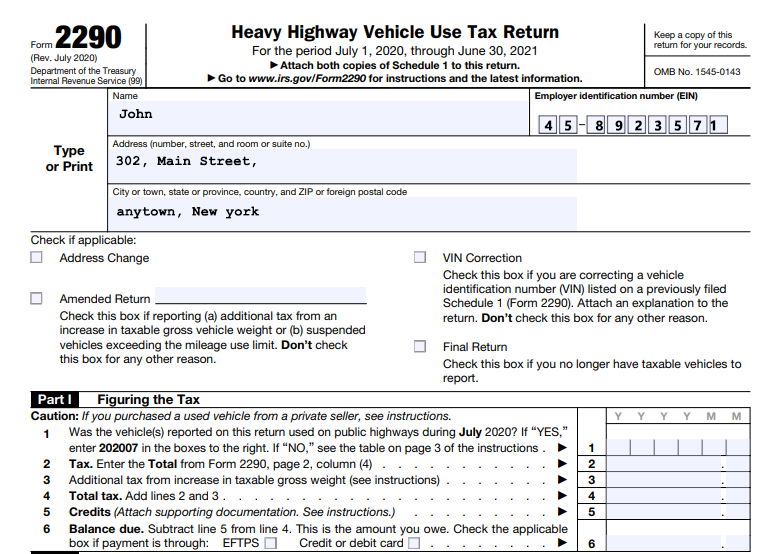

Web heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30, 2022 attach both copies of. Web annual subscription (1 ein, unlimited forms and unlimited trucks): Web how much does it cost to file a form 2290? All the services are at much affordable rates in the market. Web the tax calculator is a computing application of truckdues.com that gives you the estimated tax amount of truck tax form 2290 for your vehicles. Easy, fast, secure & free to try. Web if you place an additional taxable truck registered in your name on the road during any month other than july, you are liable for the heavy highway vehicle use tax (form. Web don't have an ein? Mini fleet (2 vehicles) $ 25.90: And you can do this too, even if.

Taxpayers who are reporting 25 or more. There is now a much easier way to submit your 2290 irs form. Web form 2290 taxtax calculator app. Web form 2290 schedule 1 proof and uses. Web general instructions purpose of form use form 2290 for the following actions. 2290 schedule 1 is proof of highway tax paid to the internal revenue service. Web heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30, 2022 attach both copies of. Web if you place an additional taxable truck registered in your name on the road during any month other than july, you are liable for the heavy highway vehicle use tax (form. Medium fleet (25 to 100 vehicles) $ 89.90: Easy, fast, secure & free to try.

File 20222023 Form 2290 Electronically 2290 Schedule 1

File your 2290 online & get schedule 1 in minutes. Every trucker operating heavy vehicles on public highways. Small fleet (3 to 24 vehicles) $ 44.90: All the services are at much affordable rates in the market. Web don't have an ein?

File Form 2290 Online & Get IRS Stamped Schedule 1 in Minutes

Web general instructions purpose of form use form 2290 for the following actions. Every trucker operating heavy vehicles on public highways. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Taxpayers who are reporting 25 or more. Medium fleet (25 to 100 vehicles) $ 89.90:

Instructions For Form 2290 For 2018 Form Resume Examples djVaq1nVJk

Allow four weeks for your new ein to be established in our systems before filing your form 2290. Web general instructions purpose of form use form 2290 for the following actions. Web may 31, 2023 when it’s tax time, anyone who drives trucks for a living knows it’s also time to file form 2290. There is now a much easier.

√99以上 2290 form irs.gov 6319142290 form irs.gov

Electronic filing for faster processing of your tax returns. Allow four weeks for your new ein to be established in our systems before filing your form 2290. Small fleet (3 to 24 vehicles) $ 44.90: Taxpayers who are reporting 25 or more. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs.

Instant IRS Form 2290 Schedule 1 Proof Efile 2290 Form HVUT 2290

Medium fleet (25 to 100 vehicles) $ 89.90: Web if you place an additional taxable truck registered in your name on the road during any month other than july, you are liable for the heavy highway vehicle use tax (form. The cost to file a form 2290 depends on the weight of the vehicle and whether or not it is.

Download Form 2290 for Free Page 3 FormTemplate

Web don't have an ein? Web calculate 2290 heavy vehicle use tax online using the hvut calculator accurately and get the digital watermarked schedule 1 to the registered email address. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. But how much does it cost to file a 2290? Easy, fast, secure & free.

202021 IRS Printable Form 2290 Fill & Download 2290 for 6.90

Web form 2290 schedule 1 proof and uses. File your 2290 online & get schedule 1 in minutes. Every trucker operating heavy vehicles on public highways. One truck (single vehicle) $ 14.90: Web the tax calculator is a computing application of truckdues.com that gives you the estimated tax amount of truck tax form 2290 for your vehicles.

ExpressTruckTax Efile Form 2290 & Get Schedule 1 in Minutes

Allow four weeks for your new ein to be established in our systems before filing your form 2290. Web may 31, 2023 when it’s tax time, anyone who drives trucks for a living knows it’s also time to file form 2290. Every trucker operating heavy vehicles on public highways. Taxpayers who are reporting 25 or more. Web the heavy highway.

File IRS Form 2290 Online Heavy Vehicle Use Tax (HVUT) Return

2290 schedule 1 is proof of highway tax paid to the internal revenue service. Easy, fast, secure & free to try. All the services are at much affordable rates in the market. Web don't have an ein? Web the tax calculator is a computing application of truckdues.com that gives you the estimated tax amount of truck tax form 2290 for.

20232024 Form 2290 Generator Fill, Create & Download 2290

Web keep your trucking company operations legal, saving you time and the costs of expensive fines. Mini fleet (2 vehicles) $ 25.90: Web how much does it cost to file a form 2290? Medium fleet (25 to 100 vehicles) $ 89.90: And it does apply on highway motor vehicles with a taxable gross weight of 55,000 pounds or.

Easy, Fast, Secure & Free To Try.

Web heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30, 2022 attach both copies of. The cost to file a form 2290 depends on the weight of the vehicle and whether or not it is a logging vehicle (these. Our free 2290 tax calculator app for iphone, ipad, or android device can give you a glimpse into your 2290 tax filing future. Web calculate 2290 heavy vehicle use tax online using the hvut calculator accurately and get the digital watermarked schedule 1 to the registered email address.

Figure And Pay The Tax Due On Highway Motor Vehicles Used During The Period With A Taxable Gross.

Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Web how much does it cost to file a form 2290? Web form 2290 taxtax calculator app. Web general instructions purpose of form use form 2290 for the following actions.

Web Form 2290 Schedule 1 Proof And Uses.

Every trucker operating heavy vehicles on public highways. Medium fleet (25 to 100 vehicles) $ 89.90: Web if you place an additional taxable truck registered in your name on the road during any month other than july, you are liable for the heavy highway vehicle use tax (form. Small fleet (3 to 24 vehicles) $ 44.90:

And It Does Apply On Highway Motor Vehicles With A Taxable Gross Weight Of 55,000 Pounds Or.

Do your truck tax online & have it efiled to the irs! Allow four weeks for your new ein to be established in our systems before filing your form 2290. Web the tax calculator is a computing application of truckdues.com that gives you the estimated tax amount of truck tax form 2290 for your vehicles. Web the heavy highway vehicle use tax is based on a vehicle gross taxable weight.