Form M1Pr Instructions

Form M1Pr Instructions - Web form code form name ; This form is for income earned in tax year 2022,. Web complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. Web check the first box and follow the onscreen instructions. If you qualify, complete the 2022. 2020 form m1pr, homestead credit refund (for homeowners). It can also be filed to acquire a renter’s property tax refund. Review the 2022 form m1pr instructions to see if you qualify for these refunds. If you are filing as a renter, include any certificates. Web fill online, printable, fillable, blank 2021 form m1pr, homestead credit refund (for homeowners) (minnesota department of revenue) form.

Web we last updated minnesota form m1pr instructions in february 2023 from the minnesota department of revenue. If you are filing as a renter, include any certificates of rent. Keep reading this post to see m1pr. Web complete and send us form m1pr, homestead credit refund (for homeowners) and renters property tax refund. Renter homeowner nursing home or adult. Web for details, see the instructions for form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. Download/run the special efile express m1pr installation. Web federal adjusted gross income (from line 1 of form m1, see instructions if you did not file form m1). After the state elections campaign fund and nongame wildlife fund screens, you'll come to the filing. Web form code form name ;

Start completing the fillable fields and. If you are filing as a renter, include any certificates. Web form code form name ; Review the 2022 form m1pr instructions to see if you qualify for these refunds. If you qualify, complete the 2022. Use get form or simply click on the template preview to open it in the editor. Keep reading this post to see m1pr. 18 check all that apply: Web fill online, printable, fillable, blank 2021 form m1pr, homestead credit refund (for homeowners) (minnesota department of revenue) form. Life estate if you retain an.

M1PR Broyce Control, UK

Download/run the special efile express m1pr installation. 18 check all that apply: Web we last updated minnesota form m1pr instructions in february 2023 from the minnesota department of revenue. After the state elections campaign fund and nongame wildlife fund screens, you'll come to the filing. Web fill online, printable, fillable, blank 2021 form m1pr, homestead credit refund (for homeowners) (minnesota.

M1PR Instructions 2022 2023

These forms have to be. 18 check all that apply: Renter homeowner nursing home or adult. Web we last updated minnesota form m1pr instructions in february 2023 from the minnesota department of revenue. Homestead credit refund and renter’s property tax refund instruction booklet:

2018 An Even Better Tax Refund Forms and Instructions > Form M1PR

2020 form m1pr, homestead credit refund (for homeowners). Web check the first box and follow the onscreen instructions. Web for details, see the instructions for form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. Homestead credit refund and renter’s property tax refund instruction booklet: Web if you have not filed 2022 form m1pr yet:

Fill Free fillable M1pr 19 2019 M1PR, Property Tax Refund Return PDF form

Review the 2022 form m1pr instructions to see if you qualify for these refunds. It can also be filed to acquire a renter’s property tax refund. Life estate if you retain an. 18 check all that apply: Web form m1pr is filed by homeowners to claim a homestead credit refund.

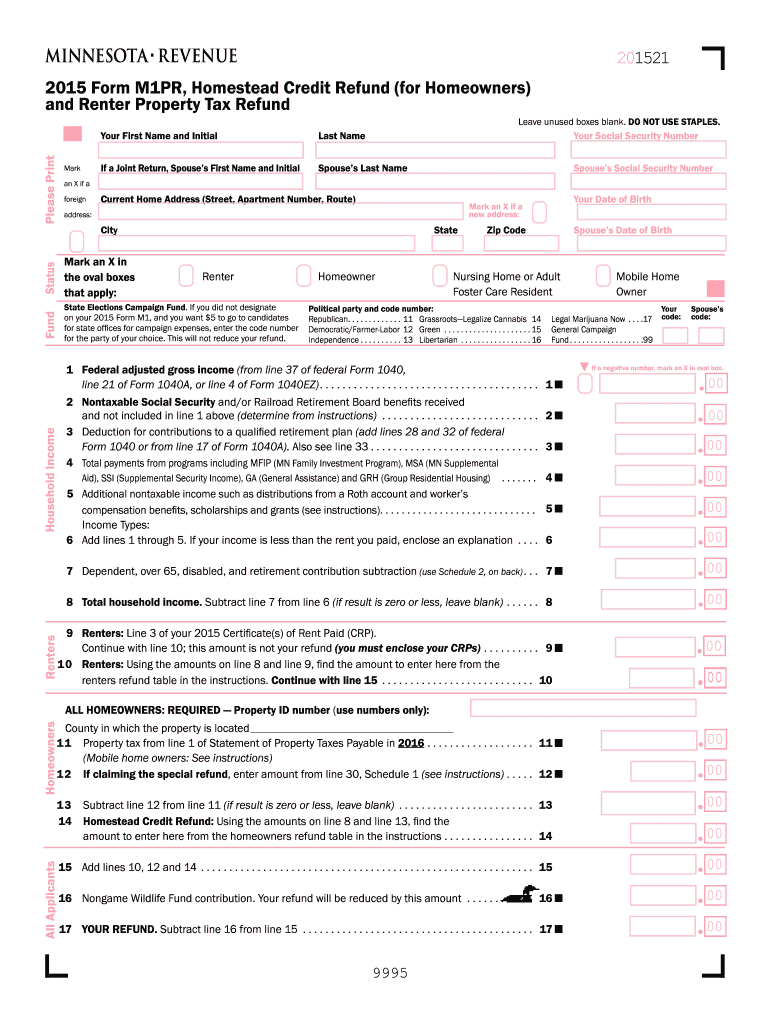

M1pr 2015 form Fill out & sign online DocHub

Use get form or simply click on the template preview to open it in the editor. It can also be filed to acquire a renter’s property tax refund. Life estate if you retain an. This form is for income earned in tax year 2022,. These forms have to be.

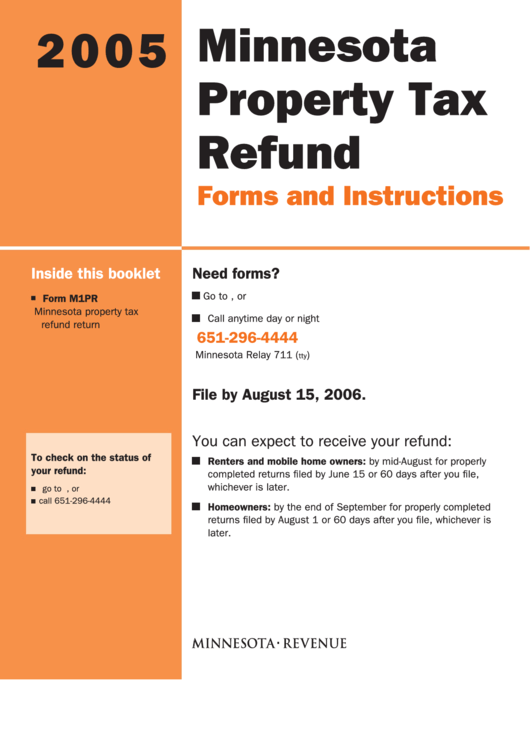

Form M1pr Minnesota Property Tax Refund Return Instructions 2005

If you qualify, complete the 2022. These forms have to be. Life estate if you retain an. Web refund table in the instructions. After the state elections campaign fund and nongame wildlife fund screens, you'll come to the filing.

Fill Free fillable 2020 Form M1PR, Homestead Credit Refund (for

This form is for income earned in tax year 2022,. Web refund table in the instructions. Web fill online, printable, fillable, blank 2020 form m1pr, homestead credit refund (for homeowners) (minnesota department of revenue) form. Renter homeowner nursing home or adult. These forms have to be.

Fill Free fillable American Immigration Lawyers Association PDF forms

Web fill online, printable, fillable, blank 2020 form m1pr, homestead credit refund (for homeowners) (minnesota department of revenue) form. 2020 form m1pr, homestead credit refund (for homeowners). Web fill online, printable, fillable, blank 2021 form m1pr, homestead credit refund (for homeowners) (minnesota department of revenue) form. This form is for income earned in tax year 2022,. Homestead credit refund and.

Minnesota Property Tax Refund Fill Out and Sign Printable PDF

Web if you have not filed 2022 form m1pr yet: Homestead credit refund and renter’s property tax refund instruction booklet: Keep reading this post to see m1pr. After the state elections campaign fund and nongame wildlife fund screens, you'll come to the filing. Web fill online, printable, fillable, blank 2021 form m1pr, homestead credit refund (for homeowners) (minnesota department of.

M1PR Instructions 2022 2023

Review the 2022 form m1pr instructions to see if you qualify for these refunds. It can also be filed to acquire a renter’s property tax refund. Web fill online, printable, fillable, blank 2020 form m1pr, homestead credit refund (for homeowners) (minnesota department of revenue) form. Web we last updated minnesota form m1pr instructions in february 2023 from the minnesota department.

Homestead Credit Refund And Renter’s Property Tax Refund Instruction Booklet:

Life estate if you retain an. Web complete and send us form m1pr, homestead credit refund (for homeowners) and renters property tax refund. Use get form or simply click on the template preview to open it in the editor. These forms have to be.

After The State Elections Campaign Fund And Nongame Wildlife Fund Screens, You'll Come To The Filing.

Web complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. Web if you have not filed 2022 form m1pr yet: Start completing the fillable fields and. Web for details, see the instructions for form m1pr, homestead credit refund (for homeowners) and renter's property tax refund.

Review The 2022 Form M1Pr Instructions To See If You Qualify For These Refunds.

Web fill online, printable, fillable, blank 2020 form m1pr, homestead credit refund (for homeowners) (minnesota department of revenue) form. 18 check all that apply: Keep reading this post to see m1pr. Download/run the special efile express m1pr installation.

Web We Last Updated Minnesota Form M1Pr Instructions In February 2023 From The Minnesota Department Of Revenue.

This form is for income earned in tax year 2022,. Renter homeowner nursing home or adult. Web form m1pr is filed by homeowners to claim a homestead credit refund. Web you will need the crp to determine your refund, if any, and you must include what is called a form m1pr with the crp when it is filed.