Can Irs Form 1310 Be Filed Electronically

Can Irs Form 1310 Be Filed Electronically - Filing your return electronically is faster, safer, and more. Web up to $40 cash back if the original return was filed electronically mail form 1310 to the internal revenue service center designated for the address shown on form 1310 above. How do i file form 1310? The first step of filing itr is to collect all the documents related to the process. An individual having salary income should collect. Web actually, if you are the court appointed executor or personal representative, you do not have to file form 1310. Yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). Web if you filed a tax return with a spouse who died in 2020 and you want to change the name of the taxpayer on the refund check, you must file form 1310 statement of person. Get ready for tax season deadlines by completing any required tax forms today. From within your taxact return ( online or desktop), click federal.

In care of addresseeelectronic filing information worksheet. Filing your return electronically is faster, safer, and more. An individual having salary income should collect. Web yes, you can file an original form 1040 series tax return electronically using any filing status. Then you have to provide all other required information in the. Web if you filed a tax return with a spouse who died in 2020 and you want to change the name of the taxpayer on the refund check, you must file form 1310 statement of person. To help reduce burden for the tax community, the irs allows taxpayers to use electronic or digital. Yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual. Web the final return of a deceased taxpayer may be eligible for electronic filing in the following situations:

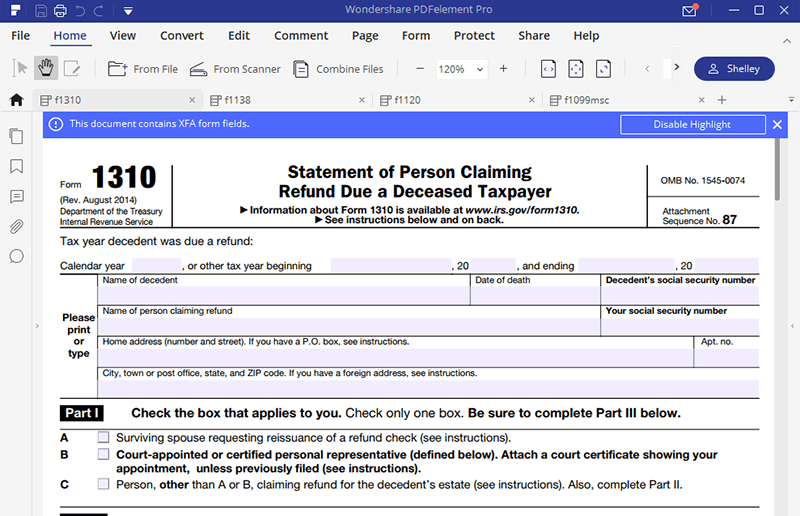

Web the final return of a deceased taxpayer may be eligible for electronic filing in the following situations: An individual having salary income should collect. Web if you filed a tax return with a spouse who died in 2020 and you want to change the name of the taxpayer on the refund check, you must file form 1310 statement of person. Web this information includes name, address, and the social security number of the person who is filing the tax return. Web electronic filing guidelines for form 1310 (1040) the irs has set specific electronic filing guidelines for form 1310. You can prepare the form and then mail it in to the same irs service center as the decedent's tax return would be mailed to. Get ready for tax season deadlines by completing any required tax forms today. Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual. Web 9 rows the irs has set specific electronic filing guidelines for form 1310. Ad access irs tax forms.

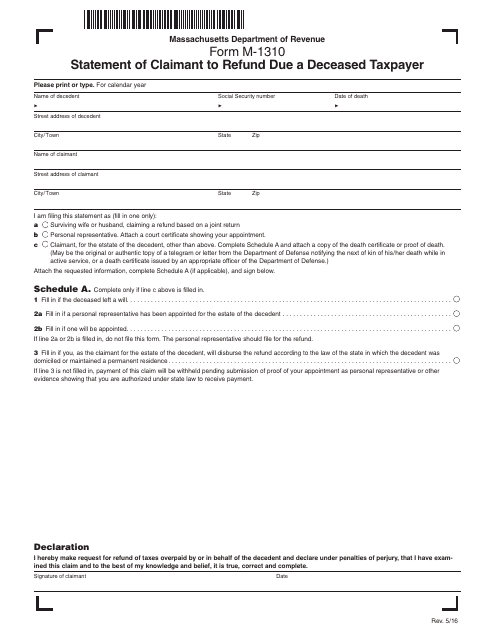

Irs Form 1310 Printable Master of Documents

Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual. Web actually, if you are the court appointed executor or personal representative, you do not have to file form 1310. In care of addresseeelectronic filing information worksheet. To help reduce burden.

Which IRS Form Can Be Filed Electronically?

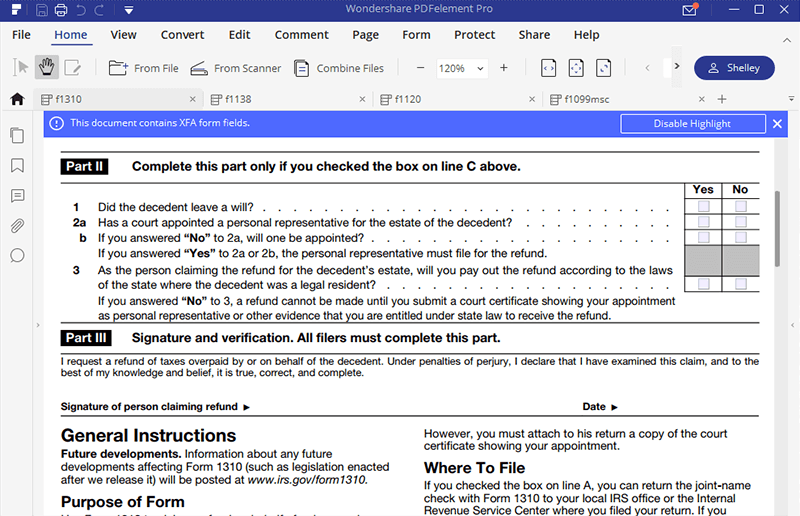

For form 1310 to be generated, the date of death field on screen 1 must be entered to indicate the. The program should tell you if its able to be efiled. To help reduce burden for the tax community, the irs allows taxpayers to use electronic or digital. You just need to attach a copy of the court certificate. Complete,.

IRS Form 1310 How to Fill it Right

Web depending on how the questions are answered on the 1310, it is possible to efile with the 1310 in certain situations. Then you have to provide all other required information in the. Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless.

Form 1310 Definition

Web in part iii, you’ll just sign and date. Ad access irs tax forms. How do i file form 1310? Answer the questions in the form 1310 menu appropriately,. Web 9 rows the irs has set specific electronic filing guidelines for form 1310.

Irs Form 1310 Printable Master of Documents

Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual. Web if you filed a tax return with a spouse who died in 2020 and you want to change the name of the taxpayer on the refund check, you must file.

IRS Approves New Option for Structured Settlements!

In care of addresseeelectronic filing information worksheet. An individual having salary income should collect. Ad access irs tax forms. To help reduce burden for the tax community, the irs allows taxpayers to use electronic or digital. Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to.

Irs Form 1310 Printable Master of Documents

Web actually, if you are the court appointed executor or personal representative, you do not have to file form 1310. Web depending on the circumstances, a return that includes form 1310 may or may not be able to be filed electronically. Web 9 rows the irs has set specific electronic filing guidelines for form 1310. Ad access irs tax forms..

Edit Document IRS Form 1310 According To Your Needs

Web in part iii, you’ll just sign and date. The first step of filing itr is to collect all the documents related to the process. Filing your return electronically is faster, safer, and more. Complete, edit or print tax forms instantly. You just need to attach a copy of the court certificate.

IRS Form 1310 How to Fill it Right

Web 9 rows the irs has set specific electronic filing guidelines for form 1310. Ad access irs tax forms. Complete, edit or print tax forms instantly. Web electronic filing guidelines for form 1310 (1040) the irs has set specific electronic filing guidelines for form 1310. Then you have to provide all other required information in the.

Irs Form 8379 Electronically Universal Network

The first step of filing itr is to collect all the documents related to the process. The program should tell you if its able to be efiled. An individual having salary income should collect. If data entry on the 1310 screen does not meet the irs. How do i file form 1310?

The Program Should Tell You If Its Able To Be Efiled.

Web documents needed to file itr; If data entry on the 1310 screen does not meet the irs. Filing your return electronically is faster, safer, and more. Web up to $40 cash back if the original return was filed electronically mail form 1310 to the internal revenue service center designated for the address shown on form 1310 above.

Then You Have To Provide All Other Required Information In The.

Ad access irs tax forms. Yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). Web if you filed a tax return with a spouse who died in 2020 and you want to change the name of the taxpayer on the refund check, you must file form 1310 statement of person. You can prepare the form and then mail it in to the same irs service center as the decedent's tax return would be mailed to.

Web This Information Includes Name, Address, And The Social Security Number Of The Person Who Is Filing The Tax Return.

How do i file form 1310? Web in part iii, you’ll just sign and date. Web electronic filing guidelines for form 1310 (1040) the irs has set specific electronic filing guidelines for form 1310. From within your taxact return ( online or desktop), click federal.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web 9 rows the irs has set specific electronic filing guidelines for form 1310. Web depending on the circumstances, a return that includes form 1310 may or may not be able to be filed electronically. Web the final return of a deceased taxpayer may be eligible for electronic filing in the following situations: Complete, edit or print tax forms instantly.

:max_bytes(150000):strip_icc()/1310-RefundClaimDuetoDeceasedTaxpayer-1-292bd14843c94bf4abf09ea5d6eb9a4b.png)