Qdro Form Texas

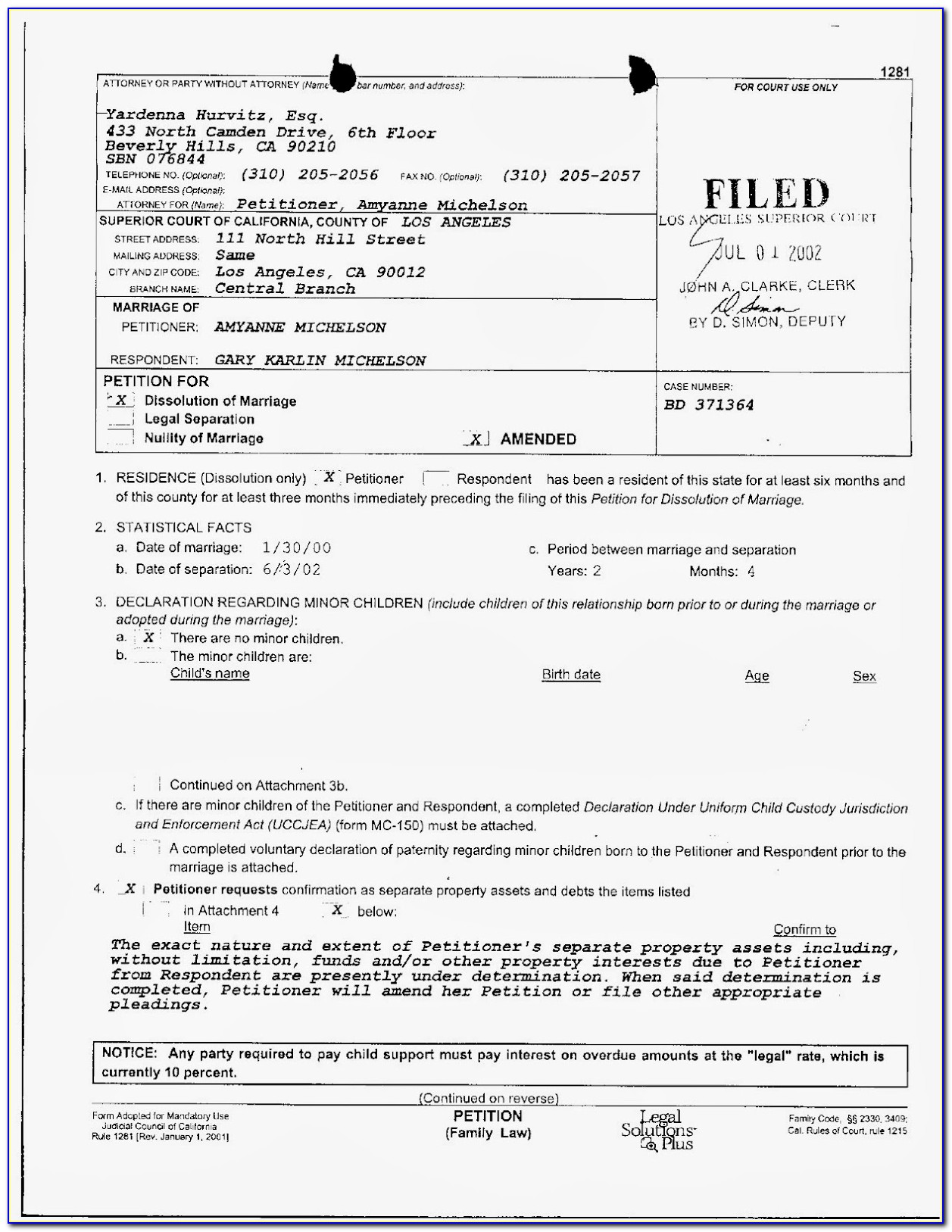

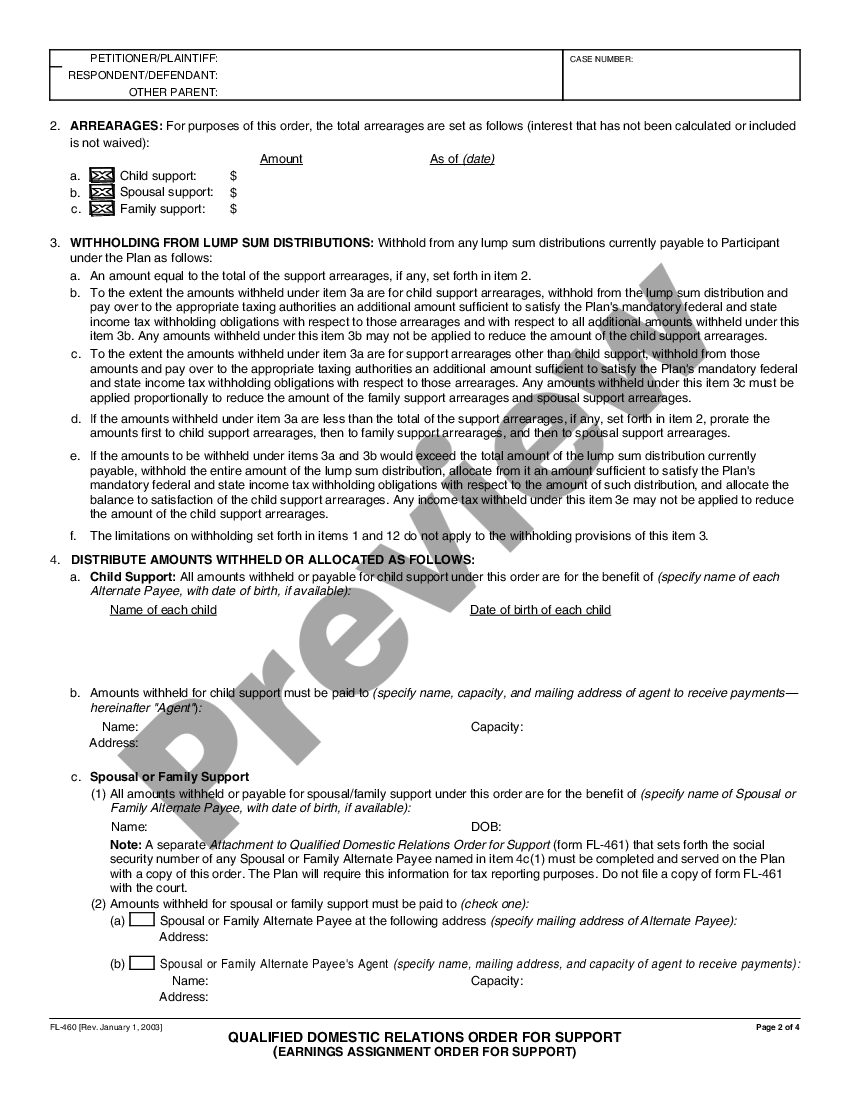

Qdro Form Texas - Try it for free now! If you and your spouse keep your own retirement funds or do not have any retirement funds, you do not need a qdro. The community property interest awarded is the alternate payee’s interest in the community property as determined by the court and may be expressed as a fraction, a percentage or a decimal. If you did not get a qdro when your decree was signed, texas law allows you to go back to the court later to get your qdro signed. Web a qdro is an order signed by the judge, separate from your divorce decree, that directs your former spouse’s employer to divide the retirement benefits according to the decree. Ad plan approval guarantee with a team of qdro specialists helping from start to finish. A qdro form is not included in this divorce set. When benefits are paid when a. Web a qdro is a legal order subsequent to a divorce or legal separation that splits and changes ownership of a retirement plan to give the divorced spouse his or her share of the asset. Ers must receive a photocopy of the divorce decree and the original certified copy of the qdro for review and approval by ers' general counsel.

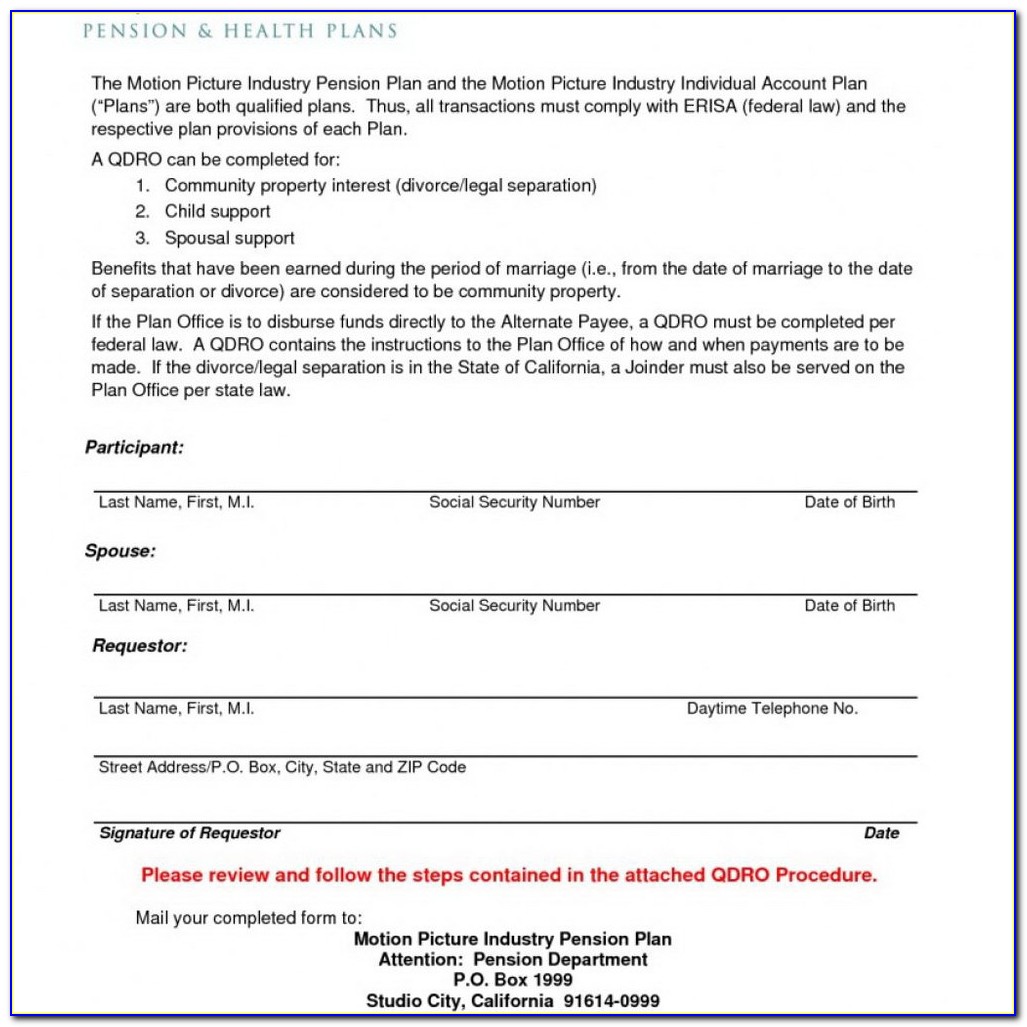

Web this model form is governed by. Ers must receive a photocopy of the divorce decree and the original certified copy of the qdro for review and approval by ers' general counsel. Ad plan approval guarantee with a team of qdro specialists helping from start to finish. 9/2015 any interest, if credited, that trs determines is attributable to these deposits or contributions. Web a qdro does not entitle either the tmrs member or the alternate payee to withdraw any part of a tmrs account immediately after the divorce. Web approval (or qualification) of a dro by trs ensures that the alternate payee will receive the portion awarded by the court at the appropriate time (usually, after trs begins distributions to the participant). This order is an integral part of the decree of divorce signed on (date of divorce decree) Defined benefit/contribution, ira, 401ks, military & gov't plans. If you and your spouse keep your own retirement funds or do not have any retirement funds, you do not need a qdro. Try it for free now!

Ad plan approval guarantee with a team of qdro specialists helping from start to finish. Web a qdro is an order signed by the judge, separate from your divorce decree, that directs your former spouse’s employer to divide the retirement benefits according to the decree. Furthermore, a qdro does not allow an amount awarded to an alternate payee to be segregated into a separate account, even if the alternate payee is also a tmrs member. Web this model form is governed by. The community property interest awarded is the alternate payee’s interest in the community property as determined by the court and may be expressed as a fraction, a percentage or a decimal. Ers must receive a photocopy of the divorce decree and the original certified copy of the qdro for review and approval by ers' general counsel. Texas government code annotated chapter 804 and the rules of the employees retirement system of texas. Web trs qdro form (active member) rev. Web a qdro does not entitle either the tmrs member or the alternate payee to withdraw any part of a tmrs account immediately after the divorce. This order is intended to meet the requirements for a “qualified domestic relations order” relating to the.

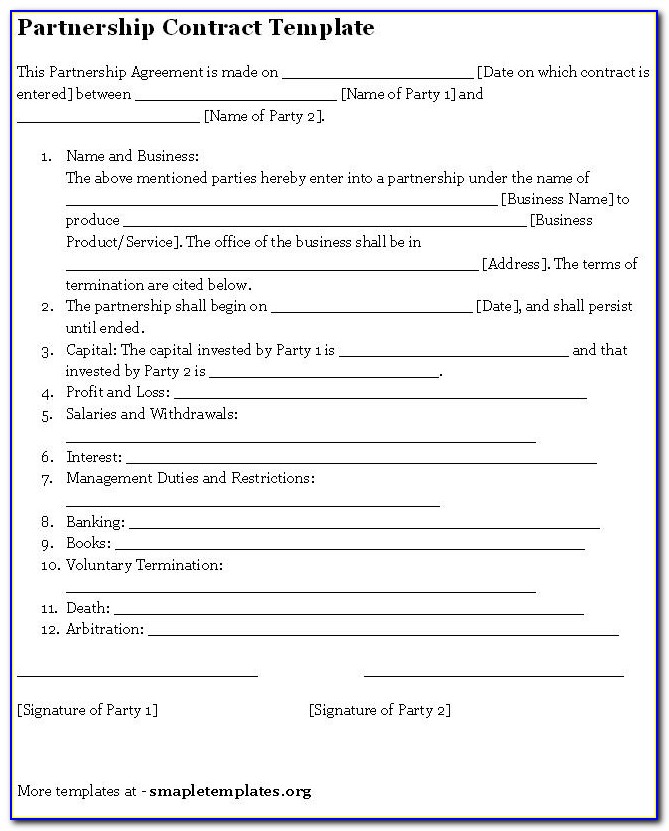

Qdro Form Arizona Form Resume Examples qlkmWmA5aj

Ad plan approval guarantee with a team of qdro specialists helping from start to finish. Web called a “qualified domestic relations order” (qdro), to make the division effective. Web qdro revised 03/2019 page 1 of 3 purpose this order is intended to meet the requirements for a “qualified domestic relations order” relating to the texas county & district retirement system,.

Qdro Form Texas Divorce Form Resume Examples 12O8d0BOr8

The community property interest awarded is the alternate payee’s interest in the community property as determined by the court and may be expressed as a fraction, a percentage or a decimal. Ad plan approval guarantee with a team of qdro specialists helping from start to finish. This order is intended to meet the requirements for a “qualified domestic relations order”.

Free Qdro Form Pdf Universal Network

Web a qdro is a legal order subsequent to a divorce or legal separation that splits and changes ownership of a retirement plan to give the divorced spouse his or her share of the asset. Although a judge signs a dro, it is trs that determines whether that order is qualified. Title 34, part iv texas administrative code. Texas government.

Free Qdro Form Florida Form Resume Examples EpDLjbEOxR

A qdro form is not included in this divorce set. This order is an integral part of the decree of divorce signed on (date of divorce decree) Web qdro revised 03/2019 page 1 of 3 purpose this order is intended to meet the requirements for a “qualified domestic relations order” relating to the texas county & district retirement system, hereinafter.

Do It Yourself Qdro Form Qdro Waiver Form Form Resume Examples

Try it for free now! Ad plan approval guarantee with a team of qdro specialists helping from start to finish. Defined benefit/contribution, ira, 401ks, military & gov't plans. When benefits are paid when a. Web a qdro does not entitle either the tmrs member or the alternate payee to withdraw any part of a tmrs account immediately after the divorce.

Qualified Domestic Relations Order Qdro Sample Forms Form Resume

Ers must receive a photocopy of the divorce decree and the original certified copy of the qdro for review and approval by ers' general counsel. Web labor has jurisdiction to interpret the qdro provisions set forth in section 206(d)(3) of erisa and section 414(p) of the code (except to the extent provided in section 401(n) of the code) and the.

Qdro Form Texas Divorce Universal Network

Web this model form is governed by. Upload, modify or create forms. If you and your spouse keep your own retirement funds or do not have any retirement funds, you do not need a qdro. Web a qdro does not entitle either the tmrs member or the alternate payee to withdraw any part of a tmrs account immediately after the.

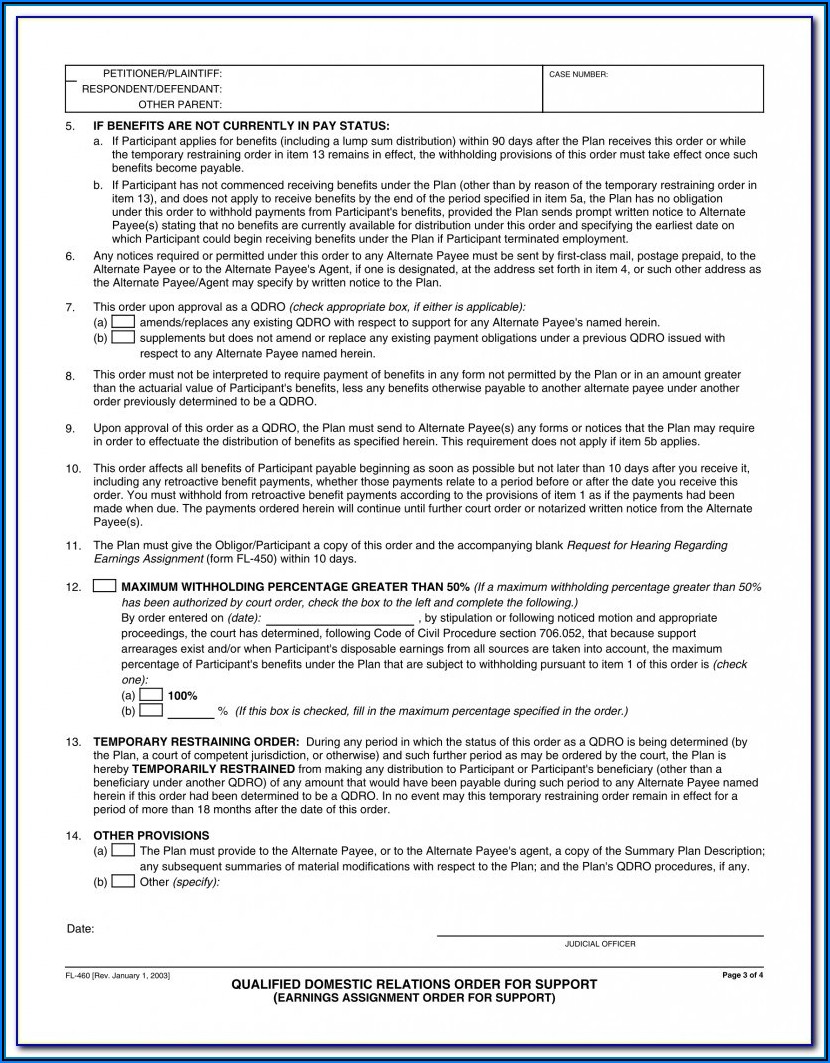

California Qualified Domestic Relations Order for Support Qualified

Web labor has jurisdiction to interpret the qdro provisions set forth in section 206(d)(3) of erisa and section 414(p) of the code (except to the extent provided in section 401(n) of the code) and the provisions governing fiduciary duties owed with respect to domestic relations orders and qdros. It is recommended that you hire a lawyer to prepare a qdro..

Free Qdro Form Arizona Form Resume Examples Wk9yDr723D

If you and your spouse keep your own retirement funds or do not have any retirement funds, you do not need a qdro. Upload, modify or create forms. Web a qdro does not entitle either the tmrs member or the alternate payee to withdraw any part of a tmrs account immediately after the divorce. Defined benefit/contribution, ira, 401ks, military &.

Understanding QDRO In Texas Divorces Vaught Law Firm

This order is intended to meet the requirements for a “qualified domestic relations order” relating to the. Furthermore, a qdro does not allow an amount awarded to an alternate payee to be segregated into a separate account, even if the alternate payee is also a tmrs member. Web a qdro does not entitle either the tmrs member or the alternate.

Web Approval (Or Qualification) Of A Dro By Trs Ensures That The Alternate Payee Will Receive The Portion Awarded By The Court At The Appropriate Time (Usually, After Trs Begins Distributions To The Participant).

Texas government code annotated chapter 804 and the rules of the employees retirement system of texas. Plan approval guarantee with 9 point review process to make sure the qdro is approved. Ad frs investment plan & more fillable forms, register and subscribe now! Web a qdro is a legal order subsequent to a divorce or legal separation that splits and changes ownership of a retirement plan to give the divorced spouse his or her share of the asset.

Web A Qdro Is An Order Signed By The Judge, Separate From Your Divorce Decree, That Directs Your Former Spouse’s Employer To Divide The Retirement Benefits According To The Decree.

Web called a “qualified domestic relations order” (qdro), to make the division effective. Web this model form is governed by. This order is an integral part of the decree of divorce signed on (date of divorce decree) Defined benefit/contribution, ira, 401ks, military & gov't plans.

If You And Your Spouse Keep Your Own Retirement Funds Or Do Not Have Any Retirement Funds, You Do Not Need A Qdro.

Furthermore, a qdro does not allow an amount awarded to an alternate payee to be segregated into a separate account, even if the alternate payee is also a tmrs member. Although a judge signs a dro, it is trs that determines whether that order is qualified. A qdro form is not included in this divorce set. Web labor has jurisdiction to interpret the qdro provisions set forth in section 206(d)(3) of erisa and section 414(p) of the code (except to the extent provided in section 401(n) of the code) and the provisions governing fiduciary duties owed with respect to domestic relations orders and qdros.

Upload, Modify Or Create Forms.

Try it for free now! The community property interest awarded is the alternate payee’s interest in the community property as determined by the court and may be expressed as a fraction, a percentage or a decimal. It is recommended that you hire a lawyer to prepare a qdro. Web a qdro does not entitle either the tmrs member or the alternate payee to withdraw any part of a tmrs account immediately after the divorce.