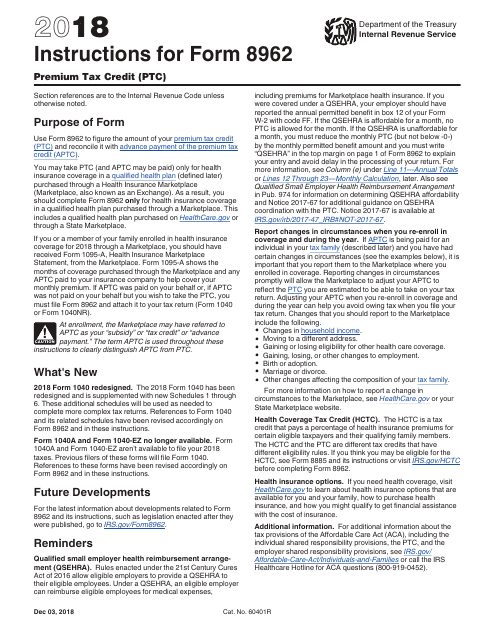

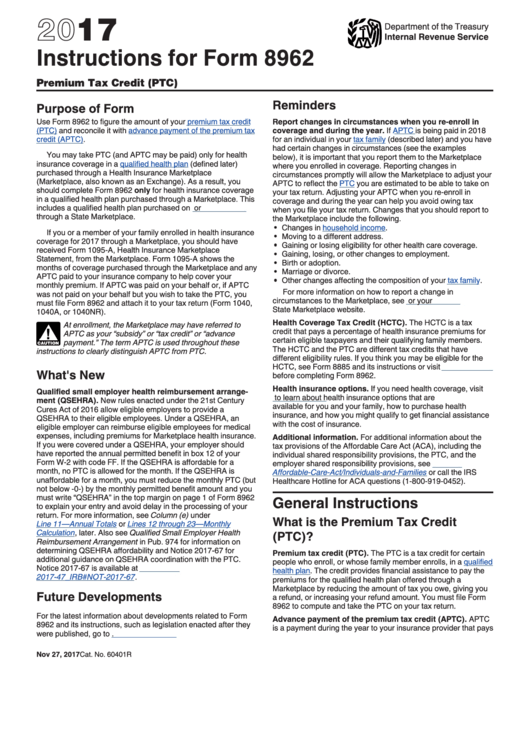

Form 8962 Instructions

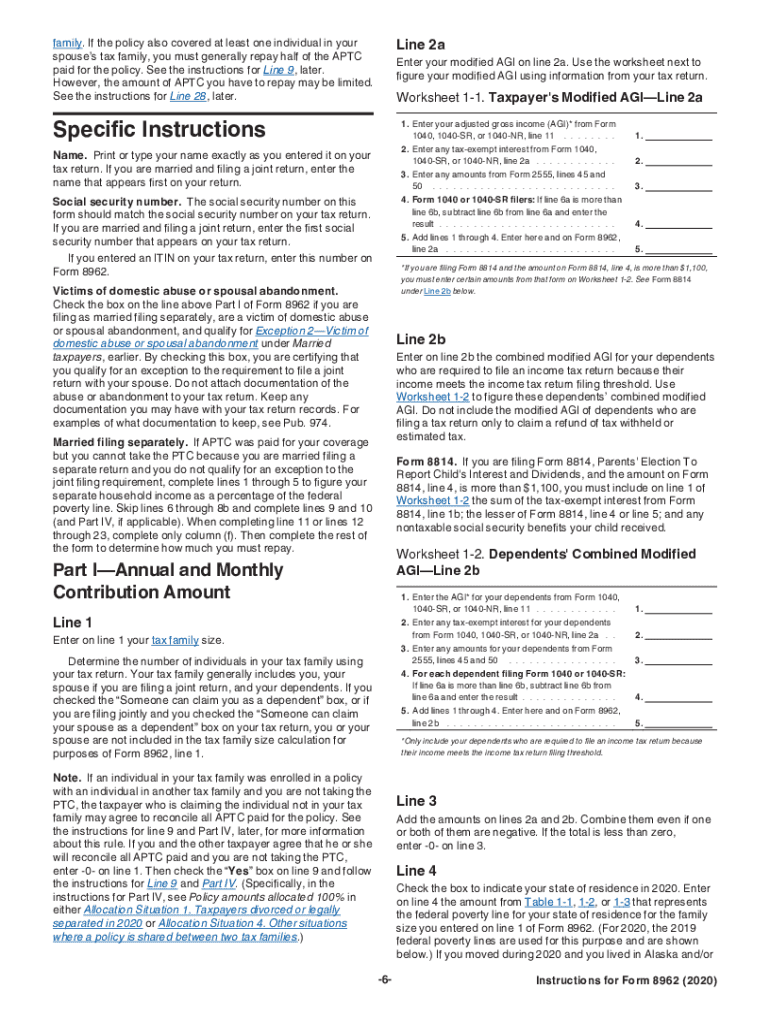

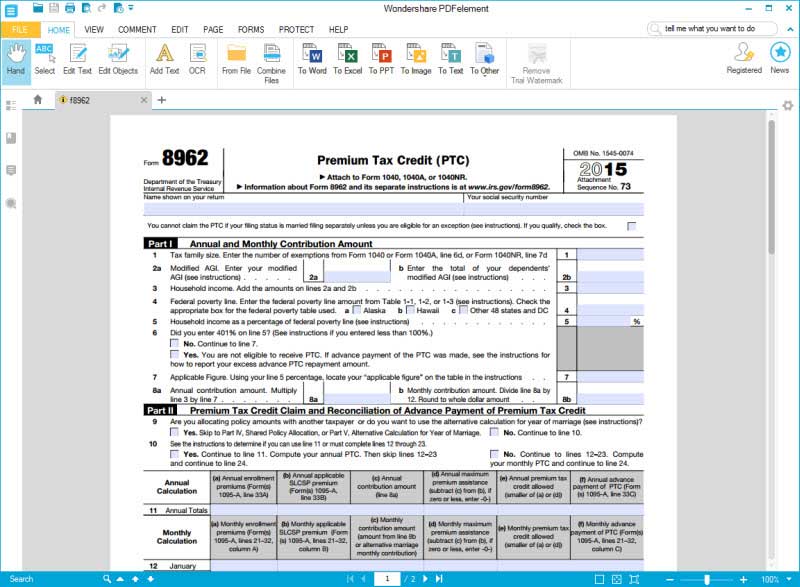

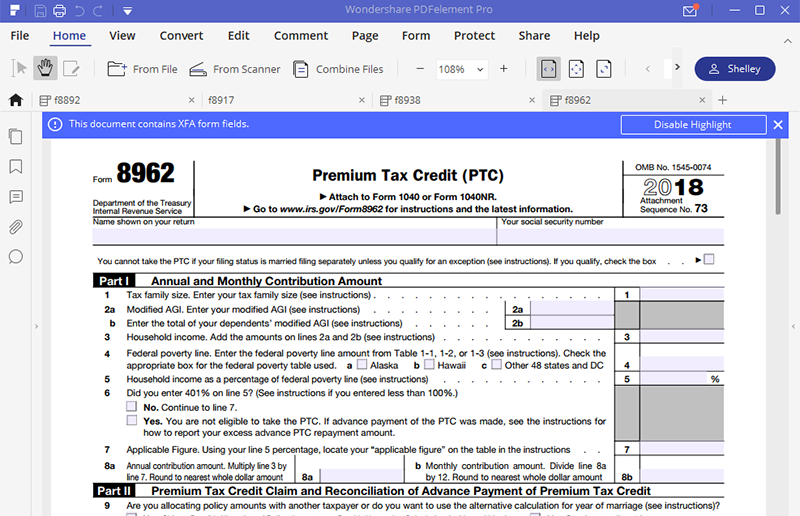

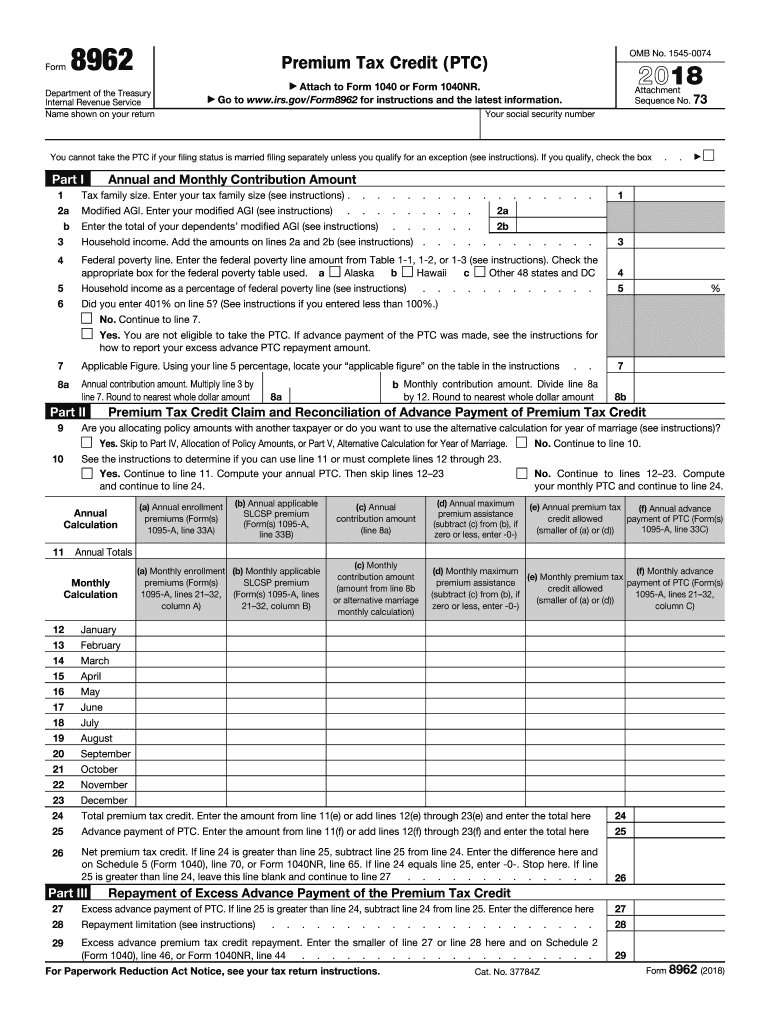

Form 8962 Instructions - Instructions for irs form 8962: The tax credit we’re concerned with today is. Instructions for form 8971 and schedule a (09/2016) instructions for form 8971 and schedule a (09/2016. Web updated december 20, 2022. Instructions for form 8966 (2022) instructions for form 8966 (2022) i8966.pdf: Part v—alternative calculation for year of marriage election. Now on to part ii, premium tax credit claim and reconciliation of advance payment of premium tax credit. For instructions and the latest information. By the end of part i, you’ll have your annual and monthly contribution amounts (lines 8a and 8b). Instructions for form 8963 (01/2020) instructions for form 8963 (01/2020) i8963.pdf:

There are several different types of tax credits, each one an entity unto itself. When you move through the program’s questionnaire format, this form should be generated for you if you’re filing taxes electronically. Web download the premium tax credit (form 8962) the irs website has form 8962, which is free to download. In other words, they all have their own set of rules and regulations to follow. This benefit can often increase the amount of tax refund you’ll receive. Instructions for irs form 8962: Part v—alternative calculation for year of marriage election. This form is only used by taxpayers who purchased a health plan through the health insurance marketplace, including healthcare.gov. A tax credit is a tax benefit. Web consult the table in the irs instructions for form 8962 to fill out the form.

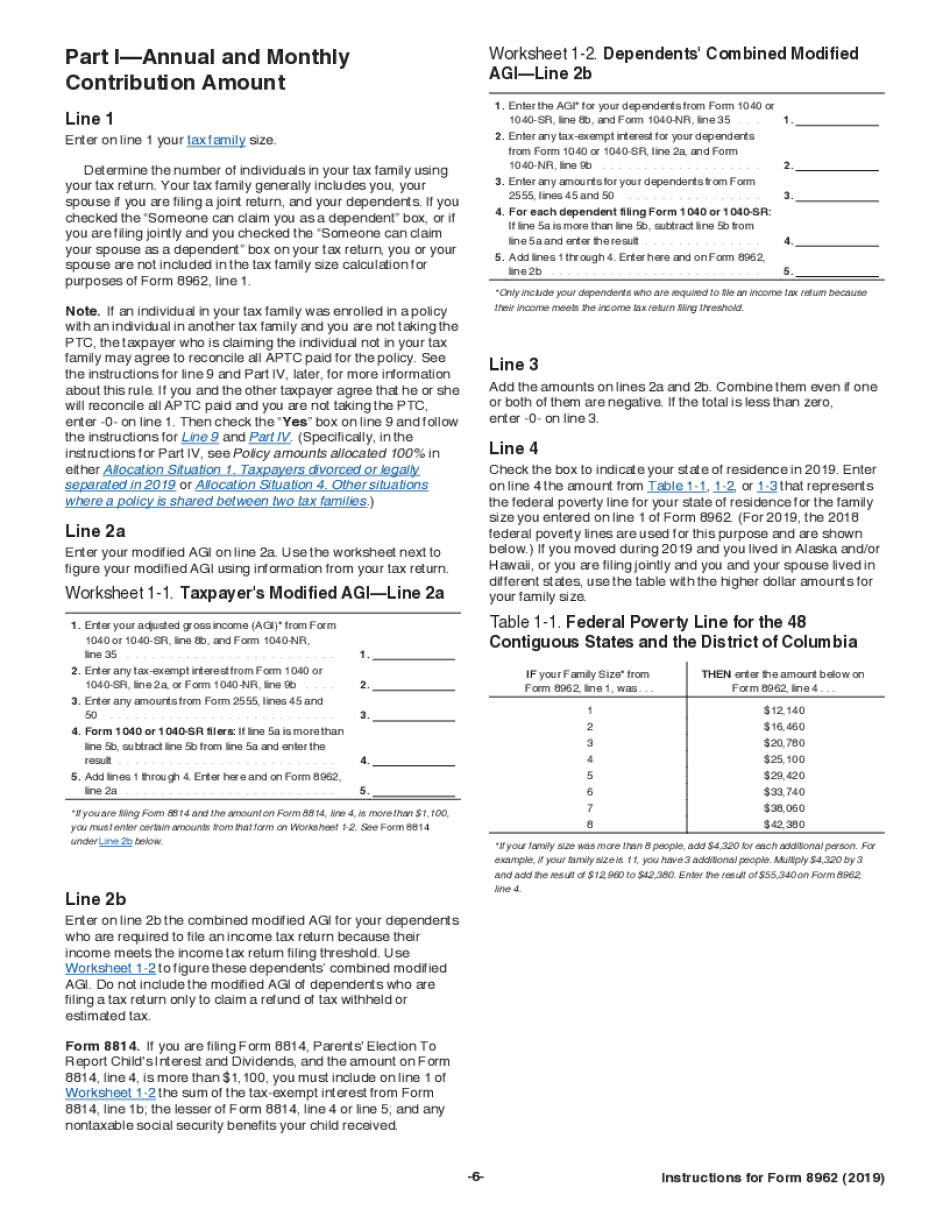

Web instructions for form 8962 (2022) instructions for form 8962 (2022) i8962.pdf: Instructions for form 8971 and schedule a (09/2016) instructions for form 8971 and schedule a (09/2016. Web instructions for irs form 8962. Web updated december 20, 2022. Part v—alternative calculation for year of marriage election. Web consult the table in the irs instructions for form 8962 to fill out the form. A tax credit is a tax benefit. Web form 8962, premium tax credit. Part i is where you record annual and monthly contribution amounts using your family size, modified adjusted gross income , and household income. Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance.

Download Instructions for IRS Form 8962 Premium Tax Credit (Ptc) PDF

Instructions for form 8963 (01/2020) instructions for form 8963 (01/2020) i8963.pdf: You’ll use this form to “reconcile” — to find out if you used more or less premium tax credit than you qualify for. Web instructions for irs form 8962. Web consult the table in the irs instructions for form 8962 to fill out the form. The tax credit we’re.

2016 Form IRS Instructions 8962 Fill Online, Printable, Fillable, Blank

If you had marketplace insurance and used premium tax credits to lower your monthly payment, you must file this health insurance tax form with your federal income tax return. Instructions for form 8971 and schedule a (09/2016) instructions for form 8971 and schedule a (09/2016. Web instructions for irs form 8962. Department of the treasury internal revenue service. A tax.

irs form 8962 instructions Fill Online, Printable, Fillable Blank

Web updated december 20, 2022. Form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. Web form 8962, premium tax credit. Part i is where you record annual and monthly contribution amounts using your family size, modified adjusted gross income , and household income. This form is only.

Instructions For Form 8962 Premium Tax Credit (Ptc) 2017 printable

Form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Instructions for form 8963 (01/2020) instructions for form 8963 (01/2020) i8963.pdf: For instructions and the latest information. You’ll use.

Form 8962 Fill Out and Sign Printable PDF Template signNow

The tax credit we’re concerned with today is. Web updated december 20, 2022. Part i is where you record annual and monthly contribution amounts using your family size, modified adjusted gross income , and household income. Web form 8962, premium tax credit. This form is only used by taxpayers who purchased a health plan through the health insurance marketplace, including.

IRS Form 8962 Instruction for How to Fill it Right

Instructions for form 8963 (01/2020) instructions for form 8963 (01/2020) i8963.pdf: Part v—alternative calculation for year of marriage election. Department of the treasury internal revenue service. When you move through the program’s questionnaire format, this form should be generated for you if you’re filing taxes electronically. A tax credit is a tax benefit.

how to fill out form 8962 step by step Fill Online, Printable

Part i is where you record annual and monthly contribution amounts using your family size, modified adjusted gross income , and household income. In other words, they all have their own set of rules and regulations to follow. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. How to avoid.

Instructions 8962 2018 2019 Blank Sample to Fill out Online in PDF

This form is only used by taxpayers who purchased a health plan through the health insurance marketplace, including healthcare.gov. A tax credit is a tax benefit. Part i is where you record annual and monthly contribution amounts using your family size, modified adjusted gross income , and household income. Instructions for form 8971 and schedule a (09/2016) instructions for form.

IRS Form 8962 Instruction for How to Fill it Right

The tax credit we’re concerned with today is. Instructions for form 8966 (2022) instructions for form 8966 (2022) i8966.pdf: Web form 8962, premium tax credit. Web instructions for form 8962 (2022) instructions for form 8962 (2022) i8962.pdf: Web updated december 20, 2022.

Form 8962 Fill Out and Sign Printable PDF Template signNow

Instructions for form 8966 (2022) instructions for form 8966 (2022) i8966.pdf: Now on to part ii, premium tax credit claim and reconciliation of advance payment of premium tax credit. The tax credit we’re concerned with today is. You’ll use this form to “reconcile” — to find out if you used more or less premium tax credit than you qualify for..

Now On To Part Ii, Premium Tax Credit Claim And Reconciliation Of Advance Payment Of Premium Tax Credit.

Web instructions for irs form 8962. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. A tax credit is a tax benefit. Instructions for form 8971 and schedule a (09/2016) instructions for form 8971 and schedule a (09/2016.

There Are Several Different Types Of Tax Credits, Each One An Entity Unto Itself.

Web form 8962, premium tax credit. Instructions for irs form 8962: For instructions and the latest information. Form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid.

If You Had Marketplace Insurance And Used Premium Tax Credits To Lower Your Monthly Payment, You Must File This Health Insurance Tax Form With Your Federal Income Tax Return.

Part i is where you record annual and monthly contribution amounts using your family size, modified adjusted gross income , and household income. By the end of part i, you’ll have your annual and monthly contribution amounts (lines 8a and 8b). Instructions for form 8966 (2022) instructions for form 8966 (2022) i8966.pdf: Web consult the table in the irs instructions for form 8962 to fill out the form.

When You Move Through The Program’s Questionnaire Format, This Form Should Be Generated For You If You’re Filing Taxes Electronically.

Web download the premium tax credit (form 8962) the irs website has form 8962, which is free to download. Instructions for form 8963 (01/2020) instructions for form 8963 (01/2020) i8963.pdf: How to avoid common mistakes in completing form 8962. The tax credit we’re concerned with today is.