Empower Retirement Transfer Out Form

Empower Retirement Transfer Out Form - Hsa investment options for consumers. And when you open an ira with us, we make it easy. As of the year of distribution: These include 401(k), 403(b) and more. Investors should carefully consider a fund’s investment objectives, risks, charges and expenses before investing. Web prudential retirement is a prudential financial business. Empower retirement plan employee login. Personalized features and modern tools that make retirement planning easier for individuals, plan sponsors and financial professionals. Taxpayer identification number (tin) are entered on the first. Web empower employees can access their retirement accounts to check balances, view retirement plan activity and more.

Web send your completed incoming rollover election form with required documentation attached to: Taxpayer identification number (tin) are entered on the first. Do not send payment to the address below. Empower retirement plan employee login. And when you open an ira with us, we make it easy. These include 401(k), 403(b) and more. Web reach out if you have questions about your workplace retirement plan. Web empower employees can access their retirement accounts to check balances, view retirement plan activity and more. Form for consumers to enroll in hsa. Web prudential retirement is a prudential financial business.

Web handy tips for filling out empower retirement separation from employment withdrawal request online. A direct rollover is a distribution that is made payable to a retirement plan trustee (or ira) for the benefit of (fbo) the participant (or ira account. Web reach out if you have questions about your workplace retirement plan. Web securities, when presented, are offered and/or distributed by empower financial services, inc., member finra/sipc. Web use this form for a direct rollover: Efsi is an affiliate of empower retirement, llc; Web choose the investments you would like to transfer money from. Investors should carefully consider a fund’s investment objectives, risks, charges and expenses before investing. Make sure all nine digits of your u.s. These include 401(k), 403(b) and more.

Empower Retirement Plan Forms Form Resume Examples edV16kB2q6

Personalized features and modern tools that make retirement planning easier for individuals, plan sponsors and financial professionals. Web handy tips for filling out empower retirement separation from employment withdrawal request online. Investors should carefully consider a fund’s investment objectives, risks, charges and expenses before investing. (1) you must have been invested in. Web 1 funds rolled over from a pretax.

Working at Empower Retirement Glassdoor

(1) you must have been invested in. Taxpayer identification number (tin) are entered on the first. Form for consumers to enroll in hsa. Do not send payment to the address below. Web empower employees can access their retirement accounts to check balances, view retirement plan activity and more.

Empower Retirement to acquire retirement plan business of MassMutual

A direct rollover is a distribution that is made payable to a retirement plan trustee (or ira) for the benefit of (fbo) the participant (or ira account. Empower retirement plan employee login. Investors should carefully consider a fund’s investment objectives, risks, charges and expenses before investing. Make sure all nine digits of your u.s. Personalized features and modern tools that.

New Client Engagements Fuel Growth for Westfourth Communications

Hsa investment options for consumers. Click continue to the next step. enter the dollar amount you would like to transfer out of the selected investment. Web send your completed incoming rollover election form with required documentation attached to: Taxpayer identification number (tin) are entered on the first. Do not send payment to the address below.

Empower Retirement iPad App EST Designs

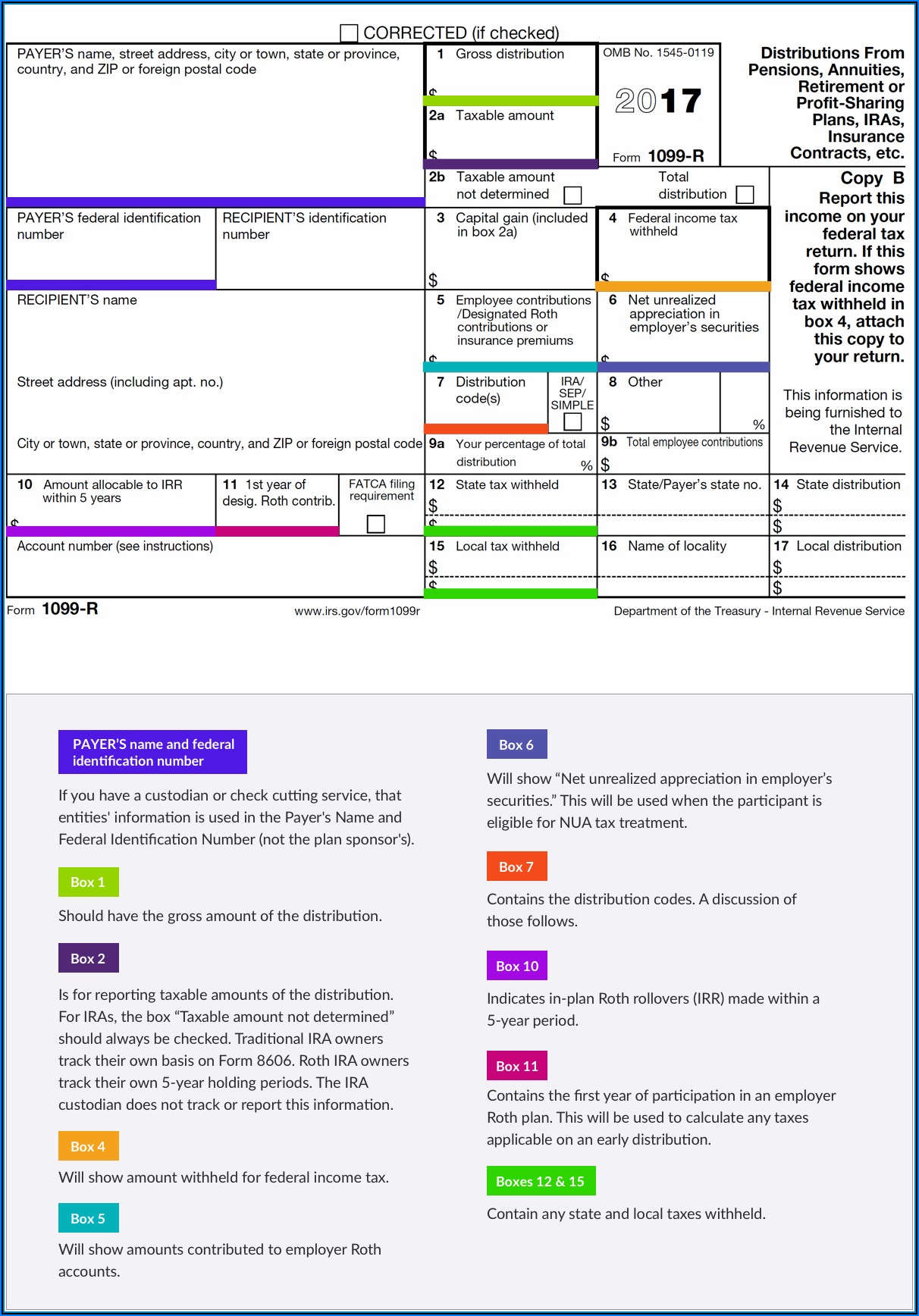

Web 1 funds rolled over from a pretax retirement account to a roth account are subject to income tax. As of the year of distribution: Web securities, when presented, are offered and/or distributed by empower financial services, inc., member finra/sipc. Empower retirement plan employee login. Personalized features and modern tools that make retirement planning easier for individuals, plan sponsors and.

Empower Retirement A Few.... The UnRetired Entrepreneur

Web reach out if you have questions about your workplace retirement plan. Web 1 funds rolled over from a pretax retirement account to a roth account are subject to income tax. Make sure all nine digits of your u.s. Empower retirement plan employee login. Web send your completed incoming rollover election form with required documentation attached to:

Empower Retirement to Acquire FullService Retirement Business of

Web send your completed incoming rollover election form with required documentation attached to: Web complete all pages of the withdrawal form. Web rollover process when you are ready to leave bechtel, or when you reach age 591⁄2 or older, you have several options when it comes to distributing your money from the. Web 1 funds rolled over from a pretax.

Videos — Key Retirement Solutions

Click continue to the next step. enter the dollar amount you would like to transfer out of the selected investment. Form for consumers to enroll in hsa. Investors should carefully consider a fund’s investment objectives, risks, charges and expenses before investing. Web 1 funds rolled over from a pretax retirement account to a roth account are subject to income tax..

Pentegra 401k Withdrawal Form Universal Network

Form for consumers to enroll in hsa. These include 401(k), 403(b) and more. Hsa investment options for consumers. Web handy tips for filling out empower retirement separation from employment withdrawal request online. Web send your completed incoming rollover election form with required documentation attached to:

Empower Retirement Plan Forms Form Resume Examples edV16kB2q6

Web complete all pages of the withdrawal form. Hsa investment options for consumers. Web rollover process when you are ready to leave bechtel, or when you reach age 591⁄2 or older, you have several options when it comes to distributing your money from the. Web use this form for a direct rollover: Personalized features and modern tools that make retirement.

Taxpayer Identification Number (Tin) Are Entered On The First.

(1) you must have been invested in. Web complete all pages of the withdrawal form. Web reach out if you have questions about your workplace retirement plan. Make sure all nine digits of your u.s.

Personalized Features And Modern Tools That Make Retirement Planning Easier For Individuals, Plan Sponsors And Financial Professionals.

Web rollover process when you are ready to leave bechtel, or when you reach age 591⁄2 or older, you have several options when it comes to distributing your money from the. These include 401(k), 403(b) and more. As of the year of distribution: Web empower employees can access their retirement accounts to check balances, view retirement plan activity and more.

Empower Retirement Plan Employee Login.

Web send your completed incoming rollover election form with required documentation attached to: Efsi is an affiliate of empower retirement, llc; Form for consumers to enroll in hsa. Click continue to the next step. enter the dollar amount you would like to transfer out of the selected investment.

Web Securities, When Presented, Are Offered And/Or Distributed By Empower Financial Services, Inc., Member Finra/Sipc.

And when you open an ira with us, we make it easy. Web choose the investments you would like to transfer money from. Web 1 funds rolled over from a pretax retirement account to a roth account are subject to income tax. A direct rollover is a distribution that is made payable to a retirement plan trustee (or ira) for the benefit of (fbo) the participant (or ira account.