Form 8862 Pdf

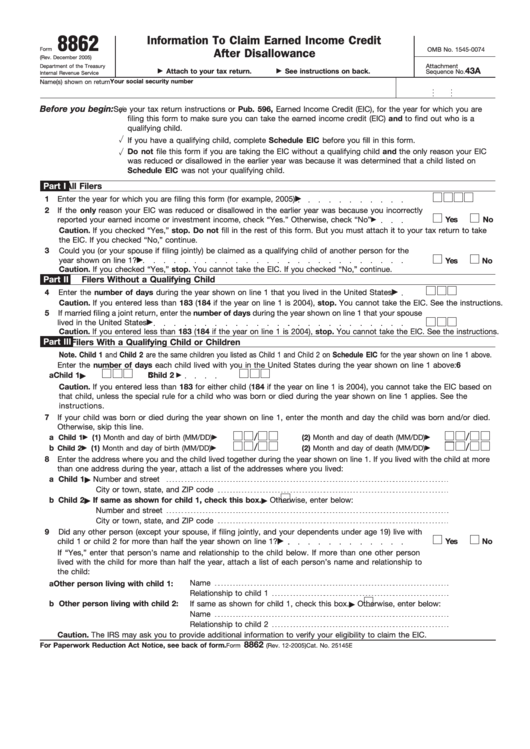

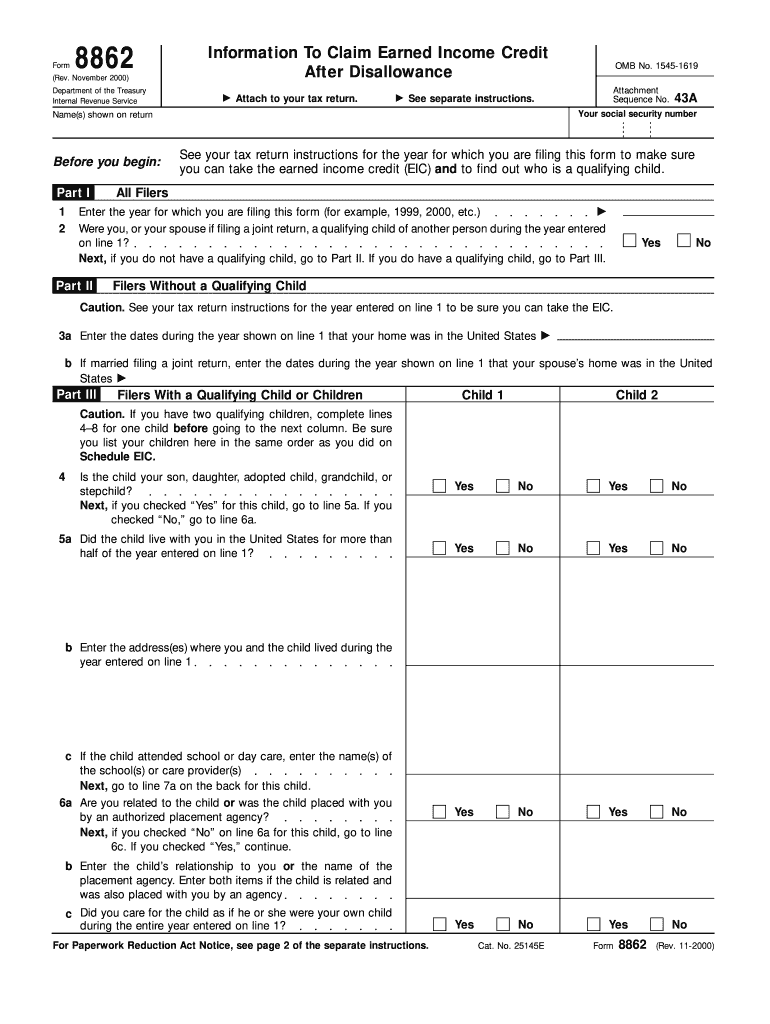

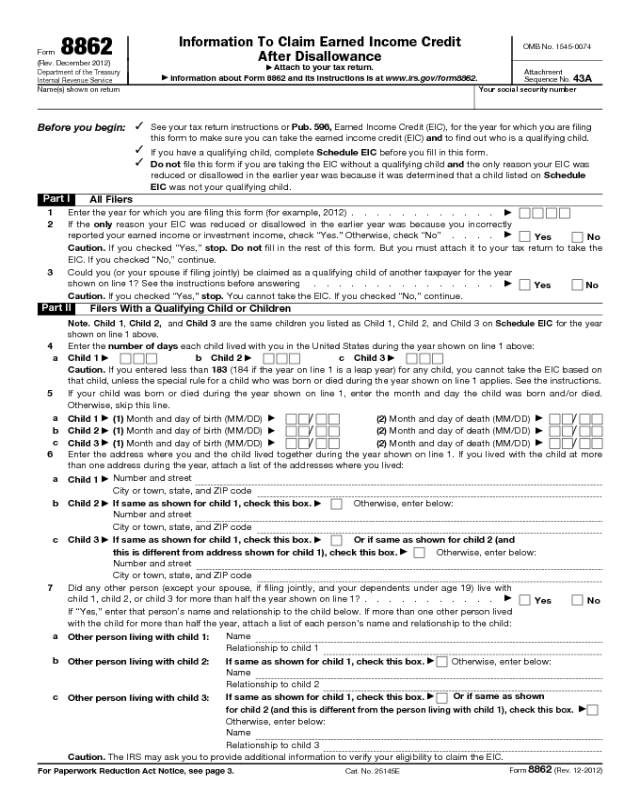

Form 8862 Pdf - Web part i all filers enter the year for which you are filing this form (for example, 2008) if the only reason your eic was reduced or disallowed in the earlier year was because you incorrectlyreported your earned income or investment income, check “yes.” otherwise, check “no”yesnocaution. Information to claim earned income credit after disallowance written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • december 1, 2022 09:08 am overview the earned income credit (eic) is a valuable, refundable tax credit available to low and moderate income taxpayers and. Earned income credit (eic), child tax credit (ctc), refundable child tax credit (rctc), additional child tax credit (actc), credit for other dependents (odc), and american opportunity tax credit (aotc) Are you still seeking a fast and convenient tool to complete irs 8862 at an affordable price? Do not enter the year the credit(s) was disallowed. Web correspond with the line number on form 8862. Download this form print this form Information to claim certain credits after disallowance. December 2012) department of the treasury internal revenue service. Information to claim earned income credit after disallowance.

Information to claim certain credits after disallowance. Information about form 8862 and its instructions is at. Web follow the simple instructions below: Do not enter the year the credit(s) was disallowed. Earned income credit (eic), child tax credit (ctc), refundable child tax credit (rctc), additional child tax credit (actc), credit for other dependents (odc), and american opportunity tax credit (aotc) Download this form print this form Web federal information to claim earned income credit after disallowance form 8862 pdf form content report error it appears you don't have a pdf plugin for this browser. Attach to your tax return. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc), credit for other dependents (odc) or american opportunity credit (aotc) was reduced or disallowed for any reason other than a math or clerical error. Web part i all filers enter the year for which you are filing this form (for example, 2008) if the only reason your eic was reduced or disallowed in the earlier year was because you incorrectlyreported your earned income or investment income, check “yes.” otherwise, check “no”yesnocaution.

Information to claim certain credits after disallowance. Earned income credit (eic), child tax credit (ctc), refundable child tax credit (rctc), additional child tax credit (actc), credit for other dependents (odc), and american opportunity tax credit (aotc) Web taxpayers complete form 8862 and attach it to their tax return if: Do not enter the year the credit(s) was disallowed. Key takeaways form 8862 is required when the irs has previously disallowed one or more specific tax credits. Web follow the simple instructions below: Are you still seeking a fast and convenient tool to complete irs 8862 at an affordable price? Download this form print this form Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc), credit for other dependents (odc) or american opportunity credit (aotc) was reduced or disallowed for any reason other than a math or clerical error. Enter the year for which you are filing this form to claim the credit(s) (for example, 2022).

Form 8862 Information To Claim Earned Credit After

Are you still seeking a fast and convenient tool to complete irs 8862 at an affordable price? Information to claim earned income credit after disallowance written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • december 1, 2022 09:08 am overview the earned income credit (eic) is a valuable, refundable tax credit available.

37 INFO PRINTABLE TAX FORM 8862 PDF ZIP DOCX PRINTABLE DOWNLOAD * Tax

Information about form 8862 and its instructions is at. Check the box(es) that applies to the credit(s) you are now claiming. Web part i all filers enter the year for which you are filing this form (for example, 2008) if the only reason your eic was reduced or disallowed in the earlier year was because you incorrectlyreported your earned income.

Irs Form 8862 Printable Master of Documents

Web taxpayers complete form 8862 and attach it to their tax return if: Web part i all filers enter the year for which you are filing this form (for example, 2008) if the only reason your eic was reduced or disallowed in the earlier year was because you incorrectlyreported your earned income or investment income, check “yes.” otherwise, check “no”yesnocaution..

Irs Form 8862 Printable Master of Documents

Are you still seeking a fast and convenient tool to complete irs 8862 at an affordable price? Web taxpayers complete form 8862 and attach it to their tax return if: Information to claim certain credits after disallowance. Earned income credit (eic), child tax credit (ctc), refundable child tax credit (rctc), additional child tax credit (actc), credit for other dependents (odc),.

Form 8862 Edit, Fill, Sign Online Handypdf

Do not enter the year the credit(s) was disallowed. Are you still seeking a fast and convenient tool to complete irs 8862 at an affordable price? Check the box(es) that applies to the credit(s) you are now claiming. If you checked “yes,” stop. Web form 8862 allows taxpayers to reclaim tax credits that were disallowed on their previous tax returns.

Form 8862 Information to Claim Earned Credit After

Web part i all filers enter the year for which you are filing this form (for example, 2008) if the only reason your eic was reduced or disallowed in the earlier year was because you incorrectlyreported your earned income or investment income, check “yes.” otherwise, check “no”yesnocaution. Web taxpayers complete form 8862 and attach it to their tax return if:.

8862 Form Fill Out and Sign Printable PDF Template signNow

Earned income credit (eic), child tax credit (ctc), refundable child tax credit (rctc), additional child tax credit (actc), credit for other dependents (odc), and american opportunity tax credit (aotc) Key takeaways form 8862 is required when the irs has previously disallowed one or more specific tax credits. Attach to your tax return. Web filing tax form 8862: Information to claim.

How to claim an earned credit by electronically filing IRS Form 8862

Download this form print this form Web part i all filers enter the year for which you are filing this form (for example, 2008) if the only reason your eic was reduced or disallowed in the earlier year was because you incorrectlyreported your earned income or investment income, check “yes.” otherwise, check “no”yesnocaution. Our service provides you with an extensive.

Instructions for IRS Form 8862 Information to Claim Certain Credits

Web form 8862 allows taxpayers to reclaim tax credits that were disallowed on their previous tax returns due to circumstances with the internal revenue service (irs) that have now been resolved. Enter the year for which you are filing this form to claim the credit(s) (for example, 2022). If you checked “yes,” stop. Attach to your tax return. Web filing.

Information To Claim Earned Income Credit After Disallowance Written By A Turbotax Expert • Reviewed By A Turbotax Cpa Updated For Tax Year 2022 • December 1, 2022 09:08 Am Overview The Earned Income Credit (Eic) Is A Valuable, Refundable Tax Credit Available To Low And Moderate Income Taxpayers And.

Enter the year for which you are filing this form to claim the credit(s) (for example, 2022). Web correspond with the line number on form 8862. Are you still seeking a fast and convenient tool to complete irs 8862 at an affordable price? Information to claim certain credits after disallowance.

Web Taxpayers Complete Form 8862 And Attach It To Their Tax Return If:

Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc), credit for other dependents (odc) or american opportunity credit (aotc) was reduced or disallowed for any reason other than a math or clerical error. Check the box(es) that applies to the credit(s) you are now claiming. December 2022) department of the treasury internal revenue service. Download this form print this form

Web Filing Tax Form 8862:

Information about form 8862 and its instructions is at. Earned income credit (eic), child tax credit (ctc), refundable child tax credit (rctc), additional child tax credit (actc), credit for other dependents (odc), and american opportunity tax credit (aotc) December 2012) department of the treasury internal revenue service. Do not enter the year the credit(s) was disallowed.

Key Takeaways Form 8862 Is Required When The Irs Has Previously Disallowed One Or More Specific Tax Credits.

Web federal information to claim earned income credit after disallowance form 8862 pdf form content report error it appears you don't have a pdf plugin for this browser. Attach to your tax return. Web form 8862 allows taxpayers to reclaim tax credits that were disallowed on their previous tax returns due to circumstances with the internal revenue service (irs) that have now been resolved. Web follow the simple instructions below: