Form 8812 Instructions

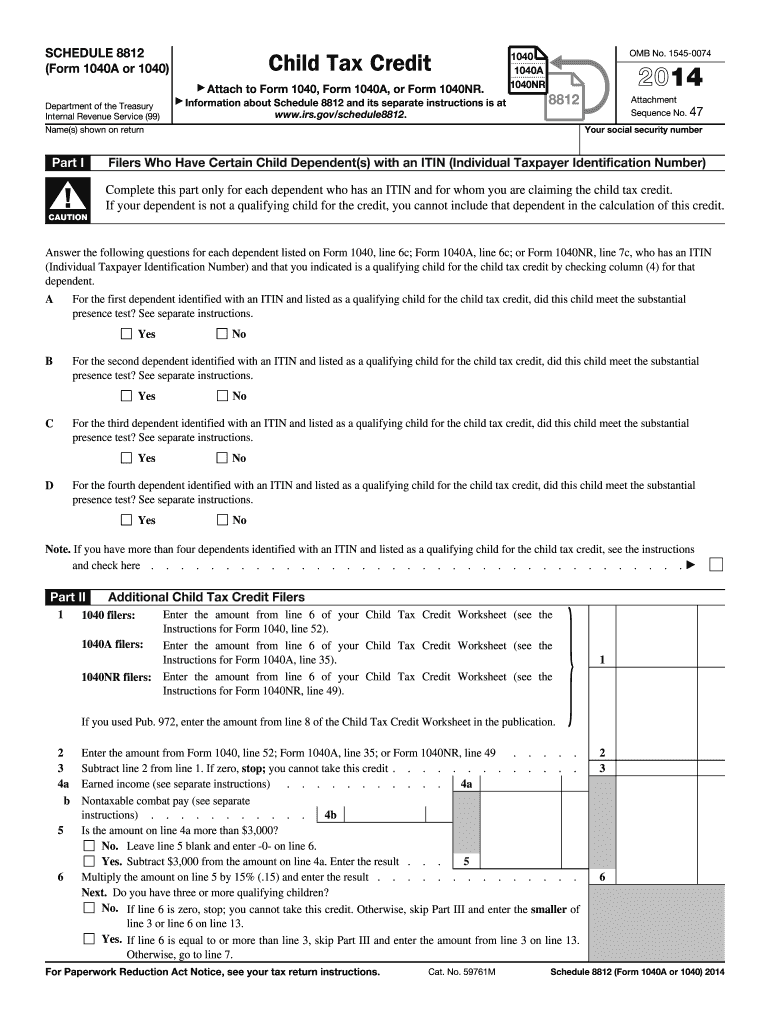

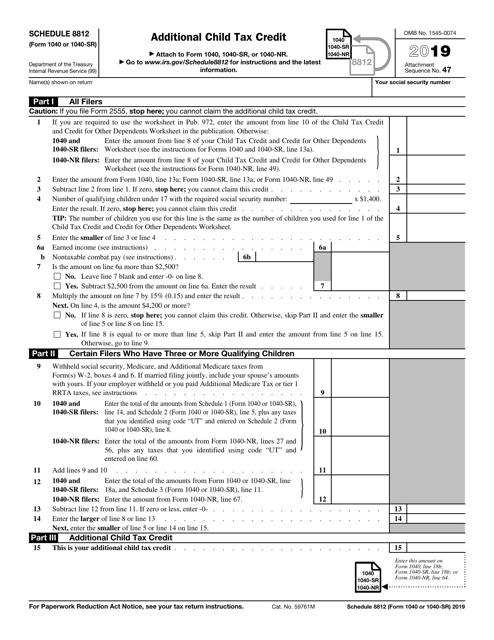

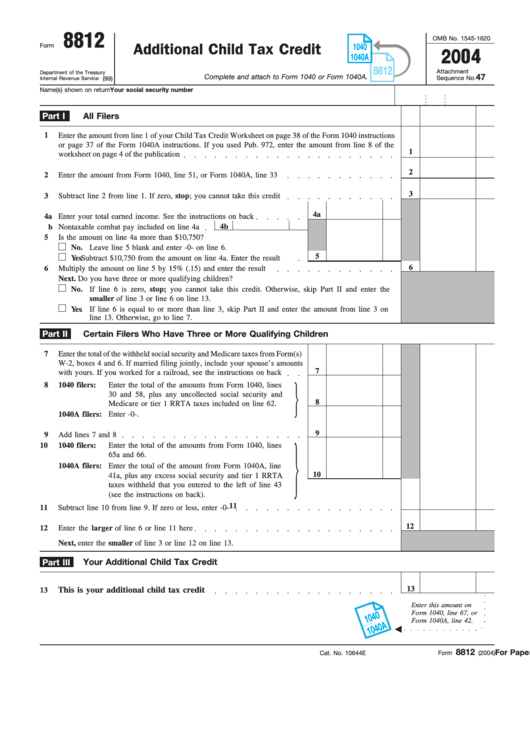

Form 8812 Instructions - Web use part i of schedule 8812 to document that any child for whom an irs individual taxpayer identification number (itin) was entered on form 1040, line 6c; Web 2020 instructions for schedule 8812 (rev. The actc is a refundable credit. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). Go to www.irs.gov/schedule8812 for instructions and the latest information. Web it applies to the child tax credit, refer to the instructions for schedule 8812. You'll use form 8812 to calculate your additional child tax credit. Web how to file form 8812. January 2021)additional child tax credit use schedule 8812 (form 1040) to figure the additional child tax credit (actc). The arpa allows the credit to be fully refundable if taxpayers have a principal place of abode in the united states for more than one half of the taxable year or are bona fide residents of puerto rico for the taxable year.

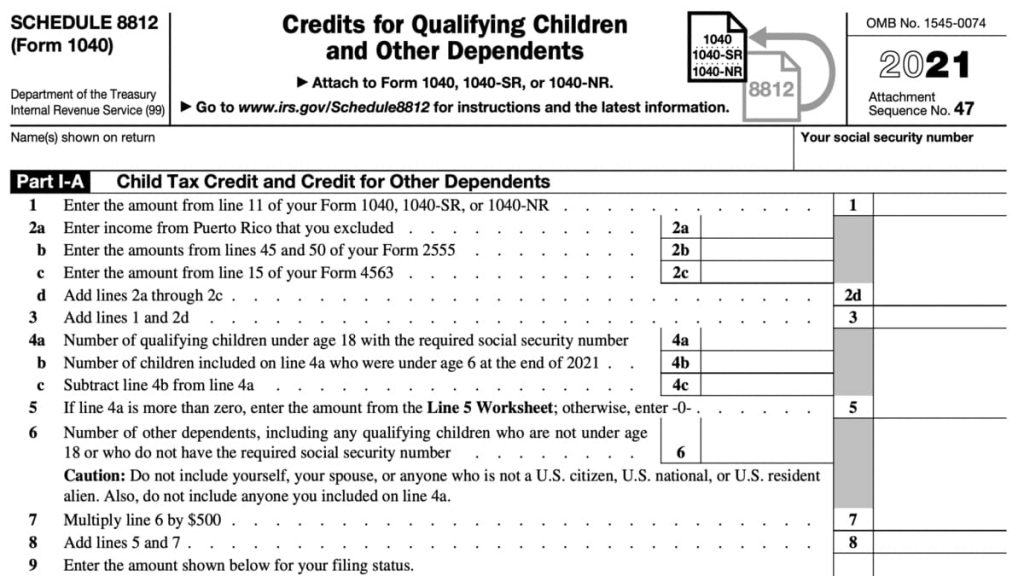

Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). Many changes to the ctc for 2021 implemented by the american rescue plan act of 2021, have expired. Section references are to the internal revenue code unless otherwise noted. And for whom the box in column 4 of that line was also checked, meets the substantial presence test and is not otherwise treated as a. The actc is a refundable credit. See the instructions for form 1040, line 19, or form 1040nr, line 19. Web form 1040 schedule 8812, credits for qualifying children and other dependents, asks that you first complete the child tax credit and credit for other dependents worksheet. The ctc and odc are nonrefundable credits. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax owed if you received excess advance child tax credit payments during 2021. Web use part i of schedule 8812 to document that any child for whom an irs individual taxpayer identification number (itin) was entered on form 1040, line 6c;

Web use part i of schedule 8812 to document that any child for whom an irs individual taxpayer identification number (itin) was entered on form 1040, line 6c; The arpa allows the credit to be fully refundable if taxpayers have a principal place of abode in the united states for more than one half of the taxable year or are bona fide residents of puerto rico for the taxable year. Web how to file form 8812. You'll need to include the completed schedule with you tax return. And for whom the box in column 4 of that line was also checked, meets the substantial presence test and is not otherwise treated as a. Many changes to the ctc for 2021 implemented by the american rescue plan act of 2021, have expired. Web form 1040 schedule 8812, credits for qualifying children and other dependents, asks that you first complete the child tax credit and credit for other dependents worksheet. The actc is a refundable credit. The 2022 schedule 8812 instructions are published as a separate booklet which you. Or form 1040nr, line 7c;

Download Instructions for IRS Form 1040 Schedule 8812 Additional Child

And for whom the box in column 4 of that line was also checked, meets the substantial presence test and is not otherwise treated as a. The ctc and odc are nonrefundable credits. The actc may give you a refund even if you do not owe any tax. See the instructions for form 1040, line 19, or form 1040nr, line.

Schedule 8812 Instructions Fill Out and Sign Printable PDF Template

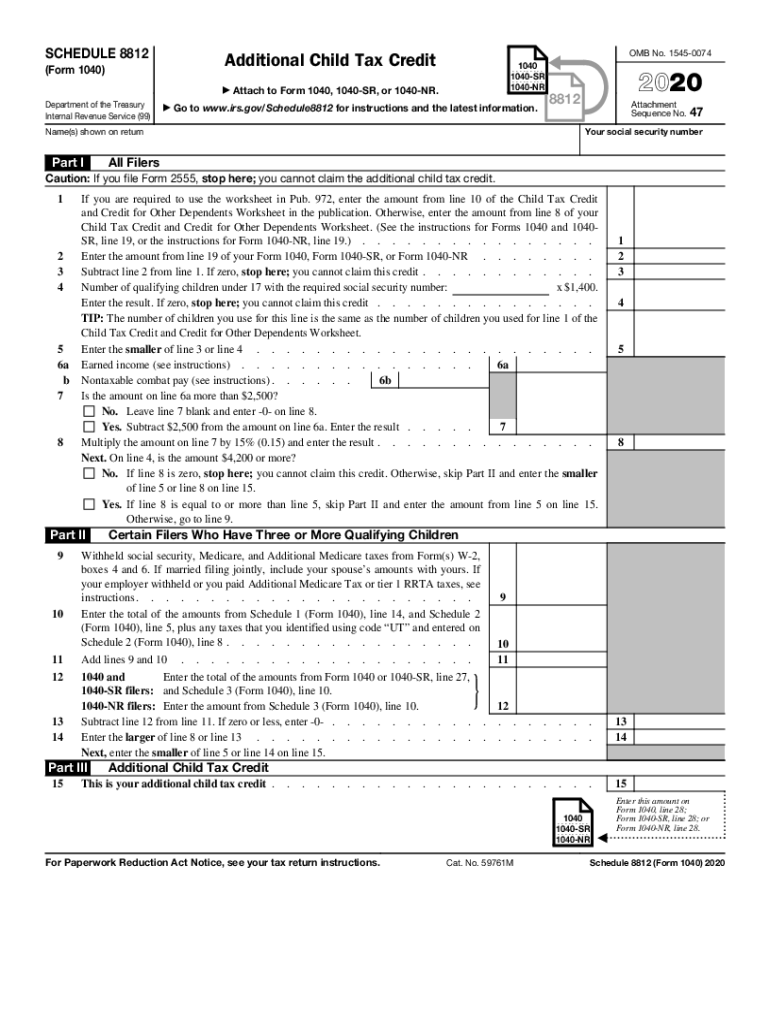

The ctc and odc are nonrefundable credits. The ctc and odc are nonrefundable credits. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). Go to www.irs.gov/schedule8812 for instructions and the latest information. You'll use form 8812 to calculate your additional child tax credit.

Form 8812Additional Child Tax Credit

Or form 1040nr, line 7c; Web how to file form 8812. Web 2020 instructions for schedule 8812 (rev. The actc is a refundable credit. The actc is a refundable credit.

Form 8812 Line 5 Worksheet

The actc is a refundable credit. And for whom the box in column 4 of that line was also checked, meets the substantial presence test and is not otherwise treated as a. The actc is a refundable credit. The 2022 schedule 8812 instructions are published as a separate booklet which you. The ctc and odc are nonrefundable credits.

Irs form 8812 instructions Fill out & sign online DocHub

The 2022 schedule 8812 instructions are published as a separate booklet which you. January 2021)additional child tax credit use schedule 8812 (form 1040) to figure the additional child tax credit (actc). Web 2020 instructions for schedule 8812 (rev. Web it applies to the child tax credit, refer to the instructions for schedule 8812. Go to www.irs.gov/schedule8812 for instructions and the.

2023 Schedule 3 2022 Online File PDF Schedules TaxUni

You'll need to include the completed schedule with you tax return. The actc may give you a refund even if you do not owe any tax. You will first need to complete the form using the schedule 8812 instructions and then enter the results on your form 1040. January 2021)additional child tax credit use schedule 8812 (form 1040) to figure.

2014 Form IRS 1040 Schedule 8812 Fill Online, Printable, Fillable

The actc is a refundable credit. The actc may give you a refund even if you do not owe any tax. You will first need to complete the form using the schedule 8812 instructions and then enter the results on your form 1040. Go to www.irs.gov/schedule8812 for instructions and the latest information. Or form 1040nr, line 7c;

IRS Form 1040 (1040SR) Schedule 8812 Download Fillable PDF or Fill

Web how to file form 8812. January 2021)additional child tax credit use schedule 8812 (form 1040) to figure the additional child tax credit (actc). The actc is a refundable credit. The 2022 schedule 8812 instructions are published as a separate booklet which you. Web it applies to the child tax credit, refer to the instructions for schedule 8812.

Tax Payment Report Worksheet Appendix C Worksheet Resume Examples

And for whom the box in column 4 of that line was also checked, meets the substantial presence test and is not otherwise treated as a. January 2021)additional child tax credit use schedule 8812 (form 1040) to figure the additional child tax credit (actc). The actc is a refundable credit. Web 2020 instructions for schedule 8812 (rev. You'll need to.

Fillable Form 8812 Additional Child Tax Credit printable pdf download

See the instructions for form 1040, line 19, or form 1040nr, line 19. You'll use form 8812 to calculate your additional child tax credit. Section references are to the internal revenue code unless otherwise noted. And for whom the box in column 4 of that line was also checked, meets the substantial presence test and is not otherwise treated as.

The Actc May Give You A Refund Even If You Do Not Owe Any Tax.

Or form 1040nr, line 7c; You'll use form 8812 to calculate your additional child tax credit. The 2022 schedule 8812 instructions are published as a separate booklet which you. The actc is a refundable credit.

The Actc Is A Refundable Credit.

Web 2020 instructions for schedule 8812 (rev. The arpa allows the credit to be fully refundable if taxpayers have a principal place of abode in the united states for more than one half of the taxable year or are bona fide residents of puerto rico for the taxable year. The ctc and odc are nonrefundable credits. See the instructions for form 1040, line 19, or form 1040nr, line 19.

The Ctc And Odc Are Nonrefundable Credits.

Web it applies to the child tax credit, refer to the instructions for schedule 8812. You'll need to include the completed schedule with you tax return. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). You will first need to complete the form using the schedule 8812 instructions and then enter the results on your form 1040.

And For Whom The Box In Column 4 Of That Line Was Also Checked, Meets The Substantial Presence Test And Is Not Otherwise Treated As A.

Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax owed if you received excess advance child tax credit payments during 2021. Section references are to the internal revenue code unless otherwise noted. January 2021)additional child tax credit use schedule 8812 (form 1040) to figure the additional child tax credit (actc). Many changes to the ctc for 2021 implemented by the american rescue plan act of 2021, have expired.