Form 5471 Sch R

Form 5471 Sch R - Distributions from a foreign corporation. Web information about form 5471, information return of u.s. Web schedule r of form 5471 is used to report basic information pertaining to distributions from foreign corporations by sections 245a, 959, and 986(c). Web changes to separate schedule e (form 5471). Web the irs form 5471 is an incredibly complicated return. Complete a separate form 5471 and all applicable schedules for each applicable foreign. Web let's look at the schedule q of form 5471. Web the schedule r (form 5471) distributions from a foreign company. Each year an international tax attorney should review direct, indirect, and constructive ownership of the reporting cfc. Web i have linked to the form 5471, schedule p and also indicate the activity number (which just so happens to be the name of the cfc.) sill getting the error.

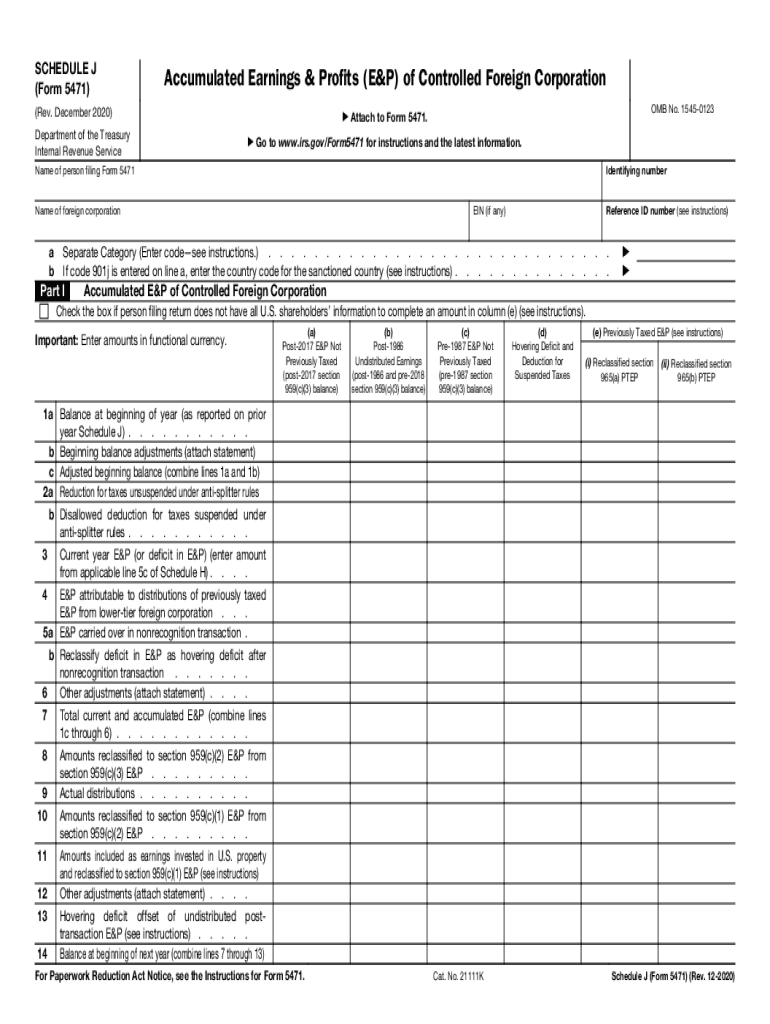

Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how. The term ptep refers to. Web use the links below to find more information on how to produce form 5471. We also have attached rev. Web changes to separate schedule e (form 5471). Web follow these steps to generate and complete form 5471 in the program: Complete a separate form 5471 and all applicable schedules for each applicable foreign. Like cindy said, a u.s. Web the schedule r (form 5471) distributions from a foreign company. Distributions from a foreign corporation.

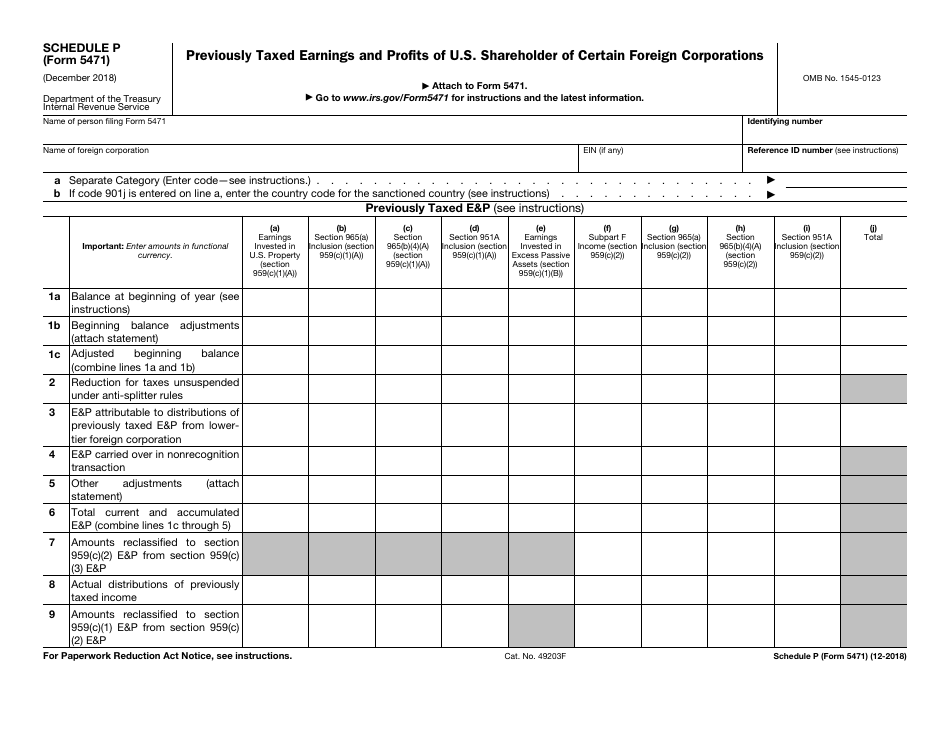

Web use the links below to find more information on how to produce form 5471. Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how. We also have attached rev. To complete 5471 page 3. Complete a separate form 5471 and all applicable schedules for each applicable foreign. Web let's look at the schedule q of form 5471. The term ptep refers to. Persons with respect to certain foreign corporations, is an information statement (information. Web schedule p of form 5471 is used to report ptep of the u.s. Each year an international tax attorney should review direct, indirect, and constructive ownership of the reporting cfc.

A Dive into the New Form 5471 Categories of Filers and the Schedule R

The term ptep refers to. Like cindy said, a u.s. Web follow these steps to generate and complete form 5471 in the program: To complete 5471 page 2 click here. Web i have linked to the form 5471, schedule p and also indicate the activity number (which just so happens to be the name of the cfc.) sill getting the.

IRS Form 5471 Carries Heavy Penalties and Consequences

Web schedule r (form 5471) (december 2020) department of the treasury internal revenue service. Shareholder uses schedule q to report cfc's income, deductions, taxes and assets by cfc income. Web information about form 5471, information return of u.s. Like cindy said, a u.s. Web form 5471, officially called the information return of u.s.

Form 5471, Page 1 YouTube

Web the schedule r (form 5471) distributions from a foreign company. Shareholder of a controlled foreign currency (“cfc”) in the cfc’s functional currency. Web changes to separate schedule e (form 5471). Web schedule r (form 5471) (december 2020) department of the treasury internal revenue service. Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on.

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

To complete 5471 page 3. Web schedule p of form 5471 is used to report ptep of the u.s. Web in 2020, the irs proposed new changes to the information return of u.s. Like cindy said, a u.s. Web form 5471, officially called the information return of u.s.

The Tax Times New Form 5471, Sch Q You Really Need to Understand

E organization or reorganization of foreign corporation stock. Web schedule r (form 5471) (december 2020) department of the treasury internal revenue service. To complete 5471 page 2 click here. Complete a separate form 5471 and all applicable schedules for each applicable foreign. Web information about form 5471, information return of u.s.

IRS Form 5471 Schedule P Download Fillable PDF or Fill Online

Web schedule p of form 5471 is used to report ptep of the u.s. Web changes to separate schedule e (form 5471). Web use the links below to find more information on how to produce form 5471. Complete a separate form 5471 and all applicable schedules for each applicable foreign. To complete 5471 page 3.

form 5471 schedule i1 instructions Fill Online, Printable, Fillable

To complete 5471 page 3. Web i have linked to the form 5471, schedule p and also indicate the activity number (which just so happens to be the name of the cfc.) sill getting the error. To complete 5471 page 1 click here. Complete a separate form 5471 and all applicable schedules for each applicable foreign. We also have attached.

Form 5471 Fill Out and Sign Printable PDF Template signNow

Like cindy said, a u.s. Persons with respect to certain foreign corporations, is an information statement (information. Web information about form 5471, information return of u.s. Schedule r is required when distributions of cash or property are made to the shareholders. Shareholder of a controlled foreign currency (“cfc”) in the cfc’s functional currency.

IRS Form 5471 Reporting for U.S. Shareholders of Foreign Companies

Web form 5471, officially called the information return of u.s. Schedule r is required when distributions of cash or property are made to the shareholders. Web the irs form 5471 is an incredibly complicated return. Web i have linked to the form 5471, schedule p and also indicate the activity number (which just so happens to be the name of.

Web Schedule R (Form 5471) (December 2020) Department Of The Treasury Internal Revenue Service.

Web the irs form 5471 is an incredibly complicated return. To complete 5471 page 2 click here. E organization or reorganization of foreign corporation stock. Web let's look at the schedule q of form 5471.

With Respect To Line A At The Top Of Page 1 Of Schedule E, There Is A New Code “Total” That Is Required For Schedule E And.

Persons with respect to certain foreign corporations, is an information statement (information. Distributions from a foreign corporation. Shareholder uses schedule q to report cfc's income, deductions, taxes and assets by cfc income. Like cindy said, a u.s.

Web In 2020, The Irs Proposed New Changes To The Information Return Of U.s.

Web information about form 5471, information return of u.s. Web schedule r of form 5471 is used to report basic information pertaining to distributions from foreign corporations by sections 245a, 959, and 986(c). Web i have linked to the form 5471, schedule p and also indicate the activity number (which just so happens to be the name of the cfc.) sill getting the error. Web schedule p of form 5471 is used to report ptep of the u.s.

To Complete 5471 Page 3.

Web form 5471 & instructions internal revenue service (irs) form 5471 is required by us person shareholders, directors, and officers of international/foreign corporations who. Schedule r is required when distributions of cash or property are made to the shareholders. Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how. Web follow these steps to generate and complete form 5471 in the program: