Form 3922 Vs 3921

Form 3922 Vs 3921 - Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. Web for iso exercises and applicable espp stock transfers which occurred in calendar year 2020, corporations must file completed forms 3921 and forms 3922 with. It does not need to be entered into. Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates,. Additionally, form 3921 requires reporting. Web with form 3921 for isos, the irs now has the information it needs to confirm your calculation for triggering the alternative minimum tax (amt) when you exercise and hold. Web january 11, 2022 it’s that time of year again. You are required to file a 3922 if: Web form 3921 is used for transfers during the calendar year, while form 3922 is used for transfers during the prior year. Your company transfers the legal title of a share of stock, and the option is exercised under an.

Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section. Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates,. Web form 3921 is different from form 3922. Web for iso exercises and applicable espp stock transfers which occurred in calendar year 2020, corporations must file completed forms 3921 and forms 3922 with. Web when you need to file form 3922. Your company transfers the legal title of a share of stock, and the option is exercised under an. Companies utilize form 3921 to notify the irs that a shareholder has just exercised the. Web with form 3921 for isos, the irs now has the information it needs to confirm your calculation for triggering the alternative minimum tax (amt) when you exercise and hold. You are required to file a 3922 if: For the latest information about developments related to form 3921 and its instructions, such as legislation enacted after they were published, go to.

Web irs sec 6039 form 3921, 3922 compliance as amended by section 403 of the tax relief and health care act of 2006, section 6039 requires corporations to file an information. I feel like i say that phrase a lot—usually when i’m reminding you to renew your naspp membership. Web with form 3921 for isos, the irs now has the information it needs to confirm your calculation for triggering the alternative minimum tax (amt) when you exercise and hold. Web january 11, 2022 it’s that time of year again. Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates,. Web for iso exercises and applicable espp stock transfers which occurred in calendar year 2020, corporations must file completed forms 3921 and forms 3922 with. Your company transfers the legal title of a share of stock, and the option is exercised under an. Additionally, form 3921 requires reporting. Web form 3921 is different from form 3922. Web when you need to file form 3922.

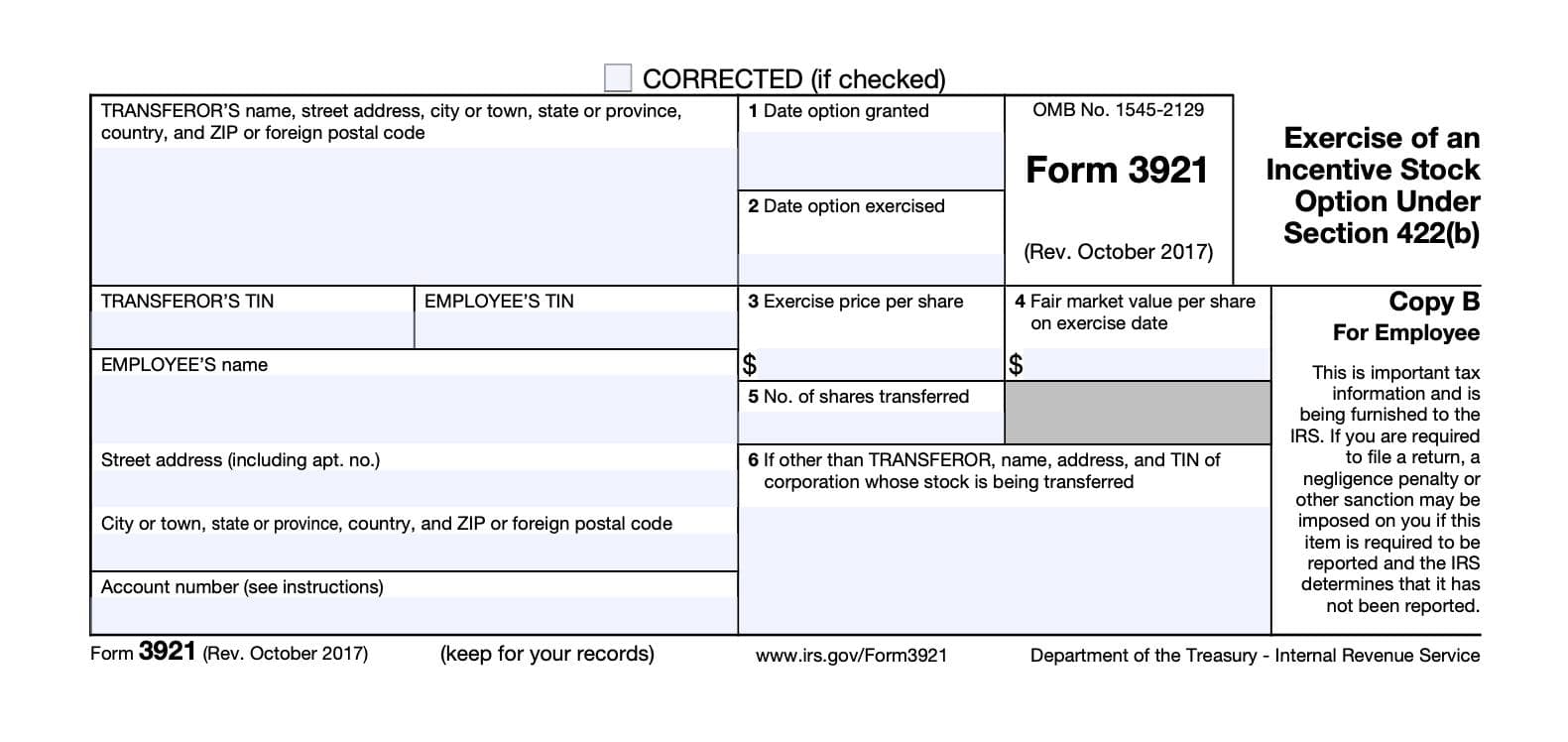

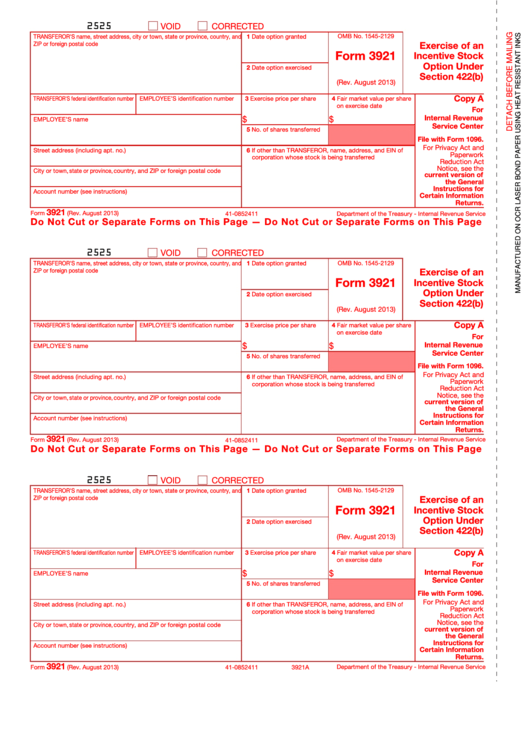

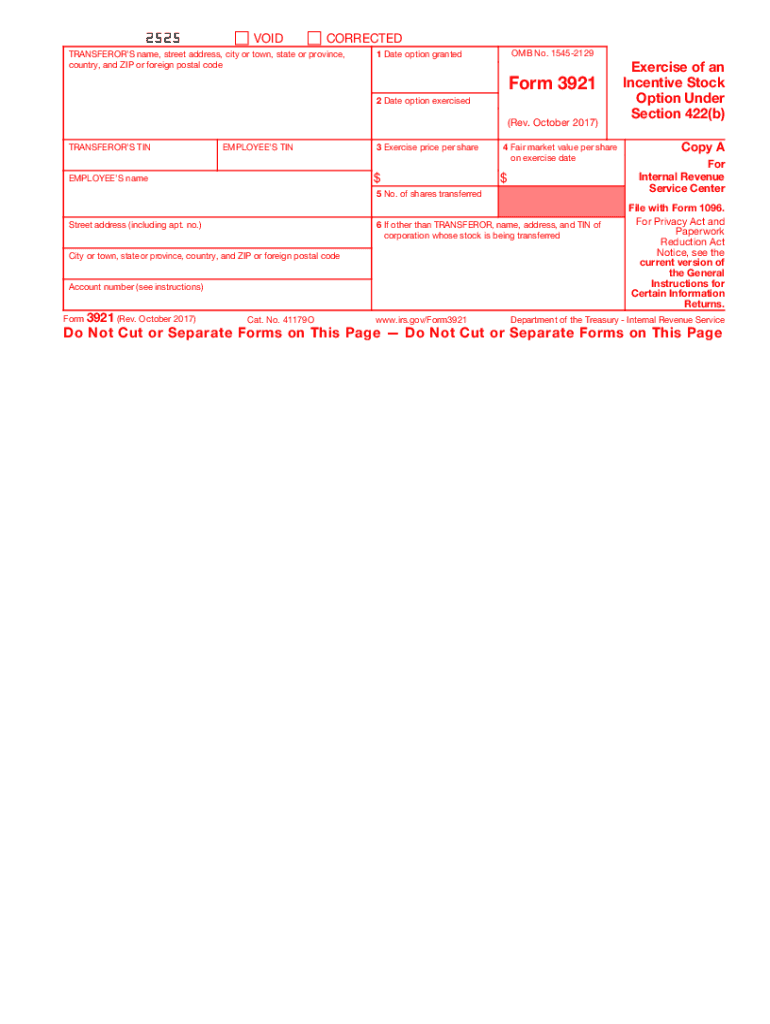

Form 3921 Everything you need to know

Web for iso exercises and applicable espp stock transfers which occurred in calendar year 2020, corporations must file completed forms 3921 and forms 3922 with. Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section. Web when you need to file.

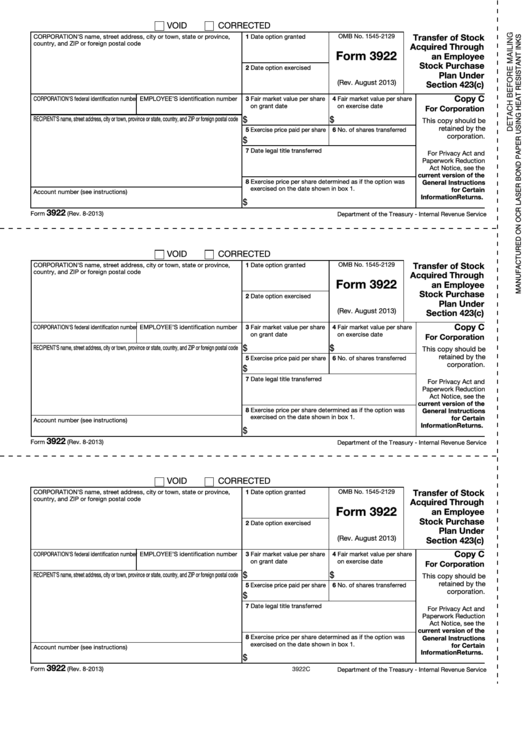

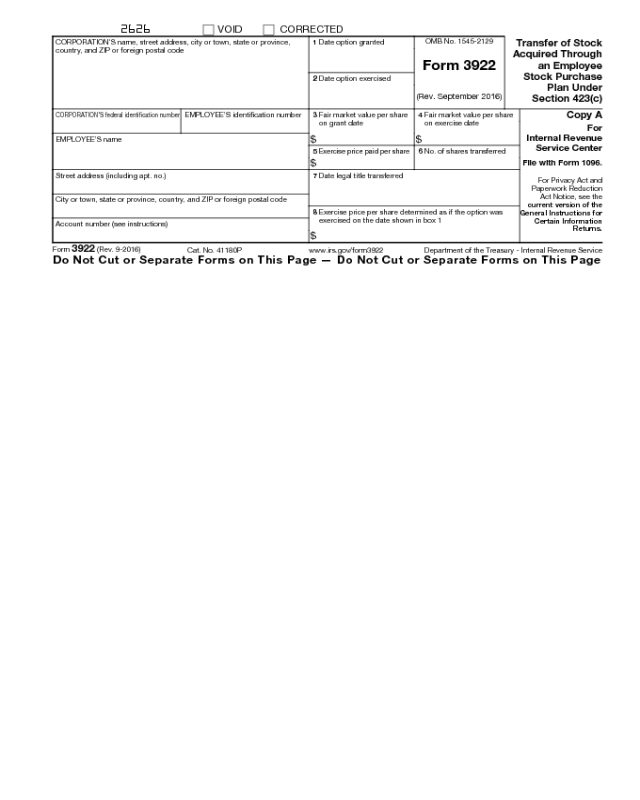

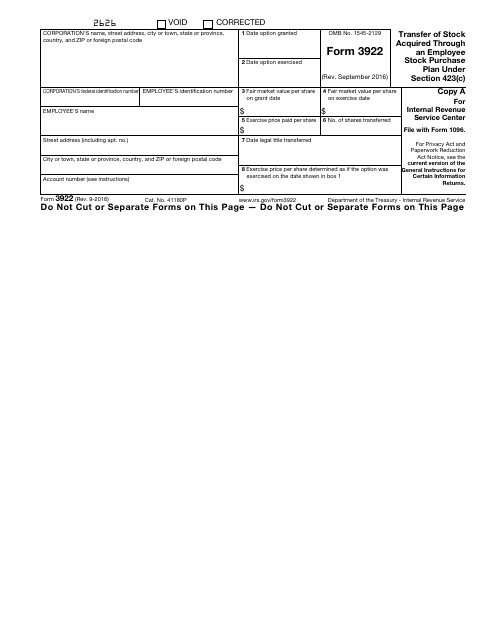

Form 3922 Transfer Of Stock Acquired Through An Employee Stock

Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. Companies utilize form 3921 to notify the irs that a shareholder has just exercised the. Web every corporation which in any calendar year transfers to any person a share of stock pursuant to.

IRS Form 3922 Software 289 eFile 3922 Software

Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. Web form 3921 is used for transfers during the calendar year, while form 3922 is used for transfers during the prior year. Web when you need to file form 3922. For the latest.

Form 3922 Edit, Fill, Sign Online Handypdf

Web when you need to file form 3922. For the latest information about developments related to form 3921 and its instructions, such as legislation enacted after they were published, go to. Additionally, form 3921 requires reporting. Web for iso exercises and applicable espp stock transfers which occurred in calendar year 2020, corporations must file completed forms 3921 and forms 3922.

Form 3921 Exercise Of An Incentive Stock Option Under Section 422b

Your company transfers the legal title of a share of stock, and the option is exercised under an. Web order 3921 and 3922 tax forms for employee stock purchase or exercise of incentive stock options. Web for iso exercises and applicable espp stock transfers which occurred in calendar year 2020, corporations must file completed forms 3921 and forms 3922 with..

20172022 Form IRS 3921 Fill Online, Printable, Fillable, Blank pdfFiller

Companies utilize form 3921 to notify the irs that a shareholder has just exercised the. Web home forms and instructions about form 3921, exercise of an incentive stock option under section 422 (b) about form 3921, exercise of an incentive stock. Web order 3921 and 3922 tax forms for employee stock purchase or exercise of incentive stock options. Web form.

IRS Form 3922

Your company transfers the legal title of a share of stock, and the option is exercised under an. It does not need to be entered into. Web irs sec 6039 form 3921, 3922 compliance as amended by section 403 of the tax relief and health care act of 2006, section 6039 requires corporations to file an information. Web when you.

IRS Form 3922 Download Fillable PDF or Fill Online Transfer of Stock

Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates,. Web january 11, 2022 it’s that time of year again. You are required to file a 3922 if: Web for iso exercises and applicable espp stock transfers which occurred in calendar year 2020, corporations must file completed forms 3921.

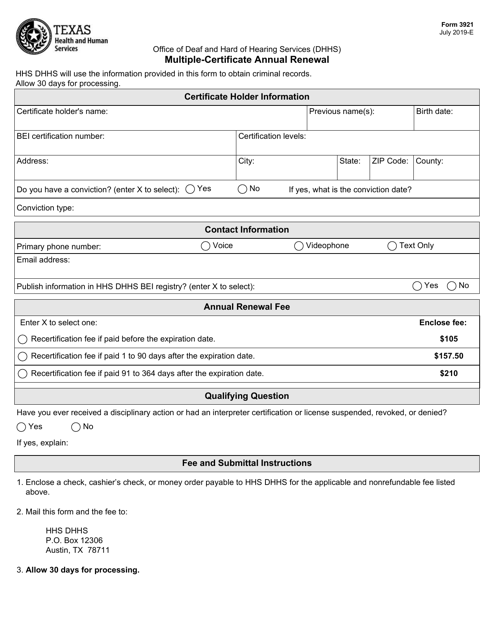

Form 3921 Download Fillable PDF or Fill Online MultipleCertificate

Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. Web for iso exercises and applicable espp stock transfers which occurred in calendar year 2020, corporations must file completed forms 3921 and forms 3922 with. Form 3921 is used by companies to report.

Form 3921 How to Report Transfer of Incentive Stock Options in 2016

Web order 3921 and 3922 tax forms for employee stock purchase or exercise of incentive stock options. Web form 3921 is different from form 3922. Web for iso exercises and applicable espp stock transfers which occurred in calendar year 2020, corporations must file completed forms 3921 and forms 3922 with. Web form 3921 is used for transfers during the calendar.

I Feel Like I Say That Phrase A Lot—Usually When I’m Reminding You To Renew Your Naspp Membership.

Your company transfers the legal title of a share of stock, and the option is exercised under an. For the latest information about developments related to form 3921 and its instructions, such as legislation enacted after they were published, go to. Web order 3921 and 3922 tax forms for employee stock purchase or exercise of incentive stock options. Web home forms and instructions about form 3921, exercise of an incentive stock option under section 422 (b) about form 3921, exercise of an incentive stock.

Web Form 3921 Exercise Of An Incentive Stock Option Under Section 422(B), Is For Informational Purposes Only And Should Be Kept With Your Records.

It does not need to be entered into. Web january 11, 2022 it’s that time of year again. Web when you need to file form 3922. Additionally, form 3921 requires reporting.

Web Your Employer Will Send You Form 3922, Transfer Of Stock Acquired Through An Employee Stock Purchase Plan Under Section 423 (C), If You Purchased Espp Stock.

Form 3921 is used by companies to report that a shareholder has just exercised the iso to the irs. Companies utilize form 3921 to notify the irs that a shareholder has just exercised the. Web form 3921 is different from form 3922. Web for iso exercises and applicable espp stock transfers which occurred in calendar year 2020, corporations must file completed forms 3921 and forms 3922 with.

Web Form 3921 Is Used For Transfers During The Calendar Year, While Form 3922 Is Used For Transfers During The Prior Year.

Web irs sec 6039 form 3921, 3922 compliance as amended by section 403 of the tax relief and health care act of 2006, section 6039 requires corporations to file an information. You are required to file a 3922 if: Web with form 3921 for isos, the irs now has the information it needs to confirm your calculation for triggering the alternative minimum tax (amt) when you exercise and hold. Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates,.