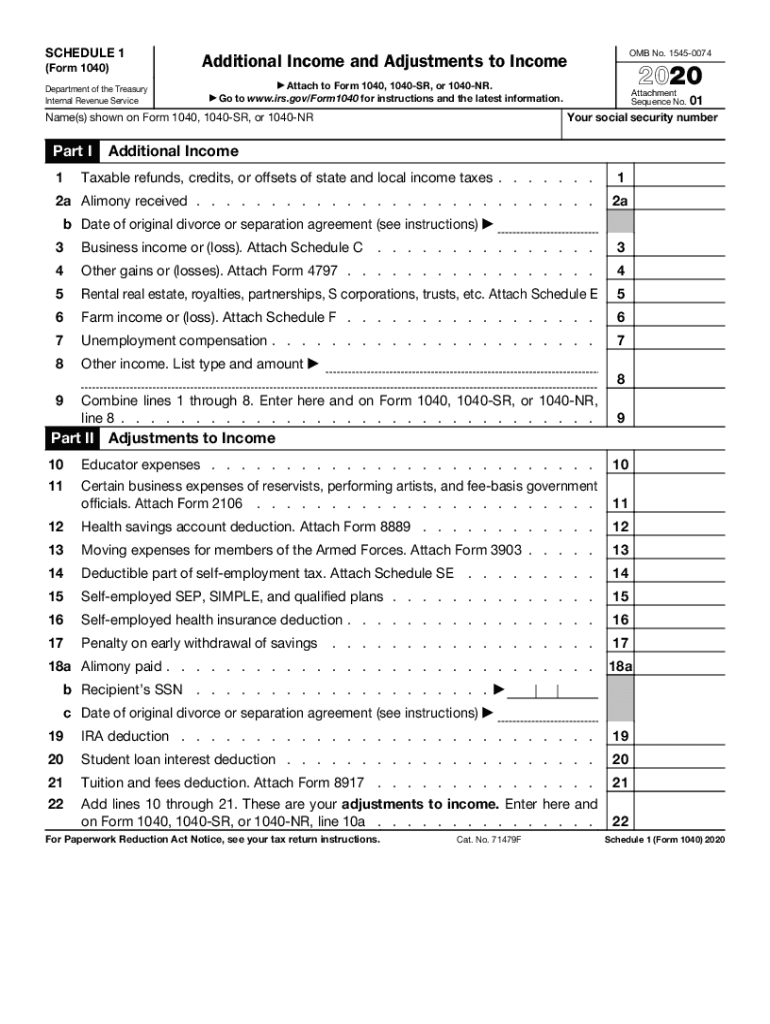

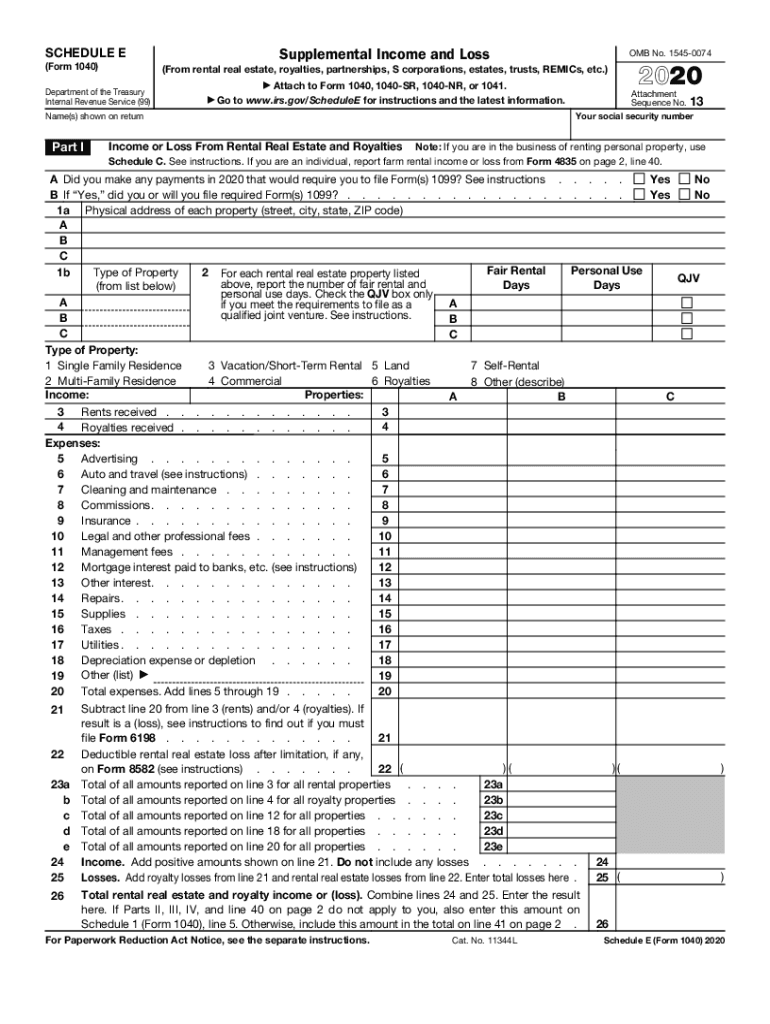

Schedule E Form 2022

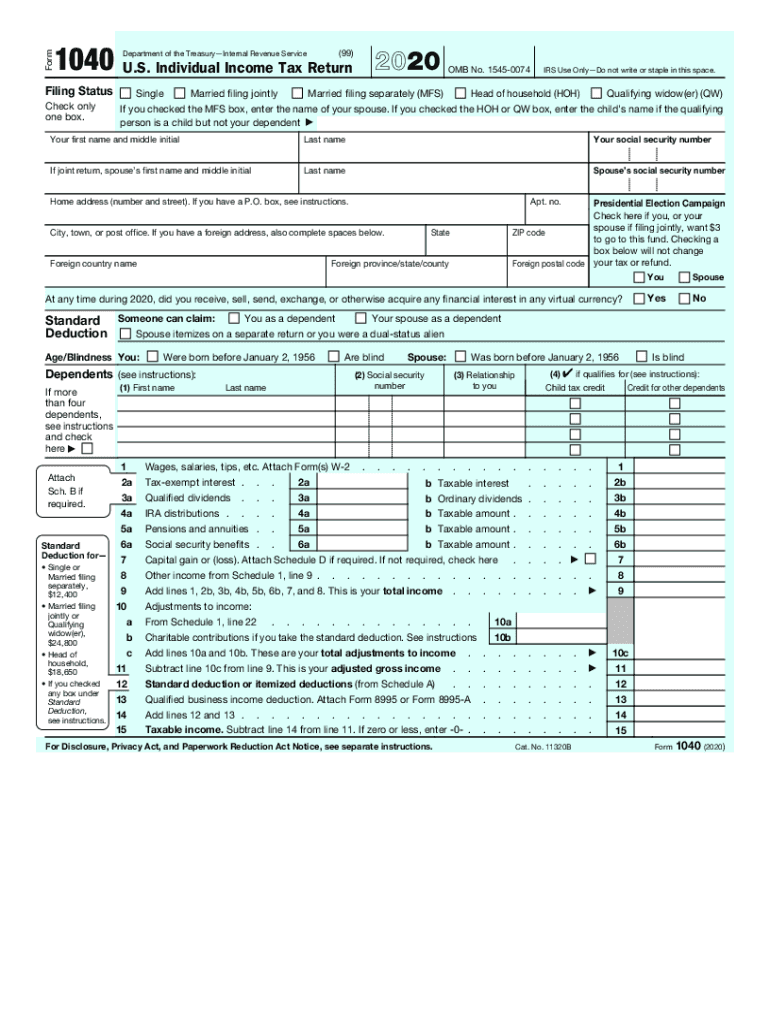

Schedule E Form 2022 - Ad access irs tax forms. 2022 missouri emergency medicine symposium. It is used to report income or loss from rentals, royalties, s corps, partnerships, estates, trusts, and residential interest in. Ad upload, modify or create forms. Web view the 2022 southeast missouri football schedule at fbschedules.com. Web 2022 form efo: Try it for free now! August social security checks are getting disbursed this week for recipients who've. Web information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on how to file. Web schedule e (form 5471) (rev.

Ad access irs tax forms. The redhawks schedule includes opponents, date, time, and tv. Web 2022 schedule e (form 1040) 2021 1040 (schedule e) 2021 schedule e (form 1040) 2020 1040 (schedule e) 2020 schedule e (form 1040) 2019 1040 (schedule e) Web 2022 form efo: Web we’ll take a closer look at the schedule e tax form here and the role it plays in determining your taxable income. It is used to report certain income or losses throughout the tax year. Web schedule e (form 5471) (rev. Published on february 3, 2022. This form is for income earned in tax year 2022, with tax returns due in. Web updated for tax year 2022 • june 2, 2023 08:40 am overview if you earn rental income on a home or building you own, receive royalties or have income reported.

Web updated for tax year 2022 • june 2, 2023 08:40 am overview if you earn rental income on a home or building you own, receive royalties or have income reported. August social security checks are getting disbursed this week for recipients who've. The income of the business for the year is calculated and. The first step of filing itr is to collect all the documents related to the process. This form is for income earned in tax year 2022, with tax returns due in. This is typically done by filling. Schedule e is the official irs. Schedule e is part of form 1040 supplements, all used for the purpose of. It is used to report certain income or losses throughout the tax year. Web understanding schedule e tax forms for supplemental income and loss.

Schedule E Fill Out and Sign Printable PDF Template signNow

2022 missouri emergency medicine symposium. Web use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in remics. Ad access irs tax forms. Web schedule e is used to report income for individual partners in a partnership and for owners of s corporations. Complete, edit or print.

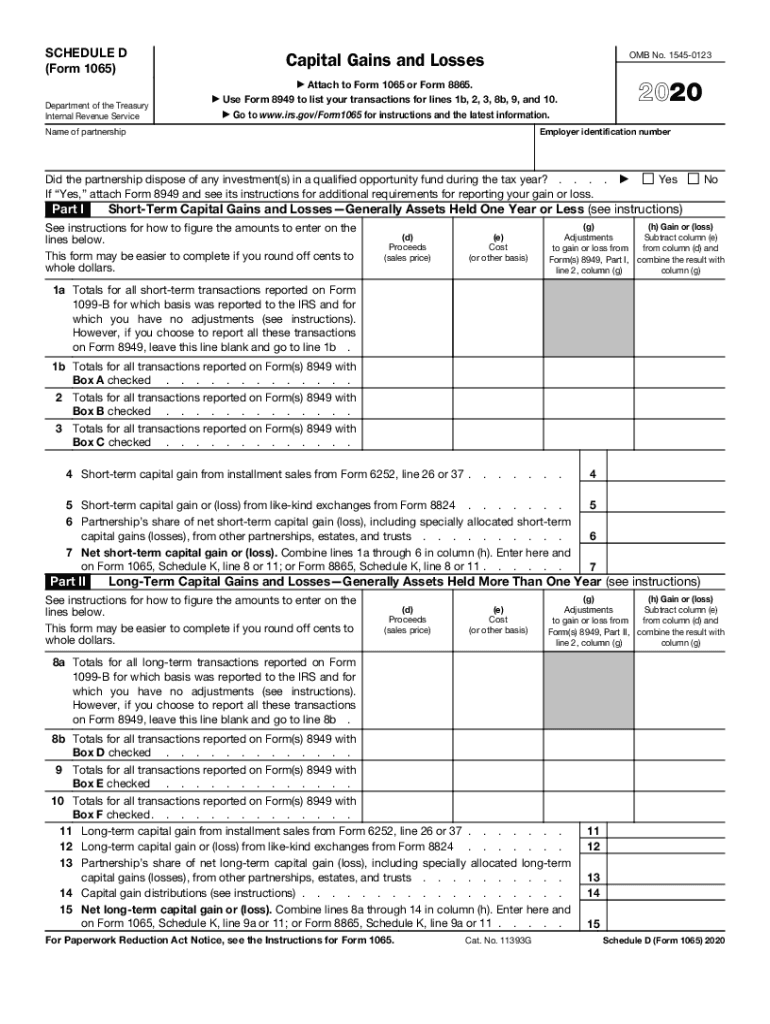

IRS 1065 Schedule D 20202021 Fill out Tax Template Online US

Web schedule e is used to report income for individual partners in a partnership and for owners of s corporations. An individual having salary income should collect. Schedule e is part of form 1040 supplements, all used for the purpose of. Web understanding schedule e tax forms for supplemental income and loss. The first step of filing itr is to.

Schedule K1 Beneficiary's Share of Deductions, Credits, etc

Web 01 fill and edit template 02 sign it online 03 export or print immediately what is 1040 schedule e? Web information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on how to file. Ad access irs tax forms. Try it for free now! It is used to report income or loss.

Imm 5257 Schedule 1 20202022 Fill and Sign Printable Template Online

Ad access irs tax forms. Web 2022 schedule e (form 1040) 2021 1040 (schedule e) 2021 schedule e (form 1040) 2020 1040 (schedule e) 2020 schedule e (form 1040) 2019 1040 (schedule e) This form is for income earned in tax year 2022, with tax returns due in. Web view the 2022 southeast missouri football schedule at fbschedules.com. This is.

1040 Schedule 1 Fill Out and Sign Printable PDF Template signNow

The first step of filing itr is to collect all the documents related to the process. This is typically done by filling. Web we’ll take a closer look at the schedule e tax form here and the role it plays in determining your taxable income. Web for those that will be completing a schedule e form for the upcoming tax.

How to Efile Form 2290 for 202223 Tax Period

Underpayment of massachusetts estimated income. Ad upload, modify or create forms. The income of the business for the year is calculated and. It is used to report income or loss from rentals, royalties, s corps, partnerships, estates, trusts, and residential interest in. Schedule e is the official irs.

1040 ES Form 2021 1040 Forms

Web schedule e is used to report income for individual partners in a partnership and for owners of s corporations. Complete, edit or print tax forms instantly. Schedule e is the official irs. Web we’ll take a closer look at the schedule e tax form here and the role it plays in determining your taxable income. Web 01 fill and.

Tax Refund Schedule 2022 Irs Calendar September 2022 Calendar

Web schedule e is part of irs form 1040. Ad upload, modify or create forms. Get ready for tax season deadlines by completing any required tax forms today. Web 01 fill and edit template 02 sign it online 03 export or print immediately what is 1040 schedule e? Try it for free now!

CA FTB Schedule CA (540) 20202022 Fill out Tax Template Online US

Web for those that will be completing a schedule e form for the upcoming tax season, let’s review that form and helpful tips and information. Web 01 fill and edit template 02 sign it online 03 export or print immediately what is 1040 schedule e? 2022 missouri emergency medicine symposium. Web view the 2022 southeast missouri football schedule at fbschedules.com..

IRS 1040 20202022 Fill out Tax Template Online US Legal Forms

Web use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in remics. August social security checks are getting disbursed this week for recipients who've. It is used to report income or loss from rentals, royalties, s corps, partnerships, estates, trusts, and residential interest in. Complete, edit.

Underpayment Of Massachusetts Estimated Income.

Web view the 2022 southeast missouri football schedule at fbschedules.com. Web 01 fill and edit template 02 sign it online 03 export or print immediately what is 1040 schedule e? Web updated for tax year 2022 • june 2, 2023 08:40 am overview if you earn rental income on a home or building you own, receive royalties or have income reported. Web 2022 form efo:

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web a schedule e form is related to tax filing, and it is used in conjunction with a 1040 form. Ad upload, modify or create forms. It is used to report income or loss from rentals, royalties, s corps, partnerships, estates, trusts, and residential interest in. August social security checks are getting disbursed this week for recipients who've.

Complete, Edit Or Print Tax Forms Instantly.

The first step of filing itr is to collect all the documents related to the process. Web schedule e (form 5471) (rev. This is typically done by filling. Web documents needed to file itr;

The Income Of The Business For The Year Is Calculated And.

This form is for income earned in tax year 2022, with tax returns due in. Web schedule e is part of irs form 1040. An individual having salary income should collect. 2022 missouri emergency medicine symposium.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)