Form 1118 Schedule L

Form 1118 Schedule L - Web schedule l (form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years to which they relate, and other information that satisfies the taxpayer’s obligation to notify the irs of foreign tax redeterminations related to prior years. Web instructions for schedule j (form 1118), adjustments to separate limitation income (loss) categories for determining numerators of limitation fractions. Material advisor disclosure statement 1121 06/19/2022 form 1118 (schedule i) reduction of foreign oil and gas taxes 1221 12/21/2021 When to make the election; Web schedule l (form 1118) (december 2021) department of the treasury internal revenue service name of corporation for calendar year 20 foreign tax redeterminations , or other tax year beginning , 20 , and ending attach to form 1118. Web inst 1118 (schedule k) instructions for schedule k (form 1118), foreign tax carryover reconciliation schedule 1218 12/04/2018 inst 1118 (schedule l) instructions for schedule l (form 1118), foreign tax redetermination 1221 01/10/2022 form 1118 (schedule i) reduction of foreign oil and gas taxes 1221 12/21/2021 Web schedule h, part iii. Schedule l (form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years to which they relate, and other information that satisfies the taxpayer’s obligation to notify the irs of foreign tax redeterminations related to prior years. Go to www.irs.gov/form1118 for instructions and the latest information. Instructions for schedule l (form 1118), foreign tax redetermination.

Schedule l (form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years to which they relate, and other information that satisfies the taxpayer’s obligation to notify the irs of foreign tax redeterminations related to prior years. Material advisor disclosure statement 1121 06/19/2022 form 1118 (schedule i) reduction of foreign oil and gas taxes 1221 12/21/2021 Web schedule l (form 1118), foreign tax redeterminations use schedule l (form 1118), (a separate schedule) to report foreign tax redeterminations that occurred in the current taxable year and that relate to prior taxable years. How to complete form 1118; Web schedule h, part iii. Web inst 1118 (schedule l) instructions for schedule l (form 1118), foreign tax redetermination 1221 01/10/2022 form 1118 (schedule l) foreign tax redetermination schedule 1221 11/19/2021 inst 1118 (schedule k) instructions for schedule k (form 1118), foreign tax carryover reconciliation schedule Instructions for schedule k (form 1118), foreign tax carryover reconciliation schedule. Instructions for schedule l (form 1118), foreign tax redetermination. Web instructions for schedule j (form 1118), adjustments to separate limitation income (loss) categories for determining numerators of limitation fractions. Web form 1118 (schedule l) foreign tax redetermination schedule 1222 11/30/2022 form 1118:

Web instructions for schedule j (form 1118), adjustments to separate limitation income (loss) categories for determining numerators of limitation fractions. Web schedule l (form 1118) (december 2021) department of the treasury internal revenue service name of corporation for calendar year 20 foreign tax redeterminations , or other tax year beginning , 20 , and ending attach to form 1118. Instructions for schedule k (form 1118), foreign tax carryover reconciliation schedule. How to complete form 1118; Web form 1118 (schedule l) foreign tax redetermination schedule 1222 11/30/2022 form 1118: Web schedule h, part iii. Go to www.irs.gov/form1118 for instructions and the latest information. Web schedule l (form 1118), foreign tax redeterminations use schedule l (form 1118), (a separate schedule) to report foreign tax redeterminations that occurred in the current taxable year and that relate to prior taxable years. When to make the election; Web schedule l (form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years to which they relate, and other information that satisfies the taxpayer’s obligation to notify the irs of foreign tax redeterminations related to prior years.

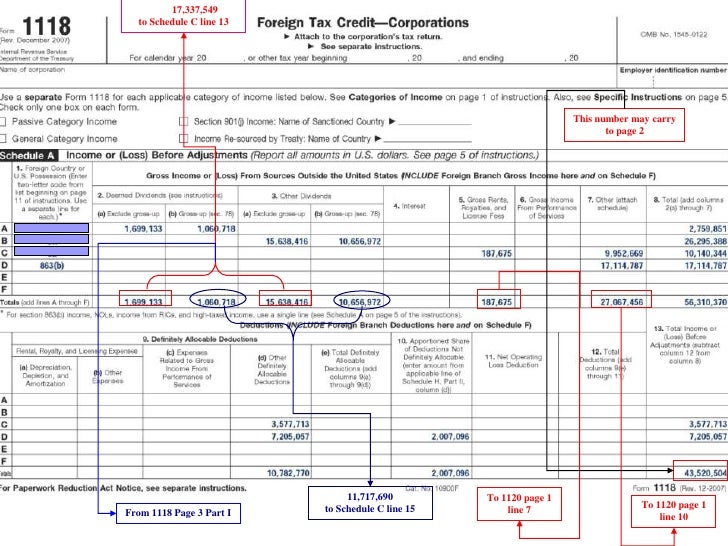

Demystifying the Form 1118 Part 4. Schedule D Foreign Tax Credits

Web instructions for schedule j (form 1118), adjustments to separate limitation income (loss) categories for determining numerators of limitation fractions. Instructions for schedule l (form 1118), foreign tax redetermination. Web schedule h, part iii. When to make the election; Schedule l (form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each separate.

Form 1118 Foreign Tax Credit Corporations (2014) Free Download

Web schedule l (form 1118) (december 2021) department of the treasury internal revenue service name of corporation for calendar year 20 foreign tax redeterminations , or other tax year beginning , 20 , and ending attach to form 1118. Web schedule h, part iii. When to make the election; Instructions for schedule k (form 1118), foreign tax carryover reconciliation schedule..

Forms 1118 And 5471

Instructions for schedule l (form 1118), foreign tax redetermination. Web inst 1118 (schedule k) instructions for schedule k (form 1118), foreign tax carryover reconciliation schedule 1218 12/04/2018 inst 1118 (schedule l) instructions for schedule l (form 1118), foreign tax redetermination 1221 01/10/2022 form 1118 (schedule i) reduction of foreign oil and gas taxes 1221 12/21/2021 Schedule l (form 1118) is.

Form 1118 Foreign Tax Credit Corporations (2014) Free Download

How to complete form 1118; Instructions for schedule l (form 1118), foreign tax redetermination. Web schedule l (form 1118), foreign tax redeterminations use schedule l (form 1118), (a separate schedule) to report foreign tax redeterminations that occurred in the current taxable year and that relate to prior taxable years. Go to www.irs.gov/form1118 for instructions and the latest information. Web inst.

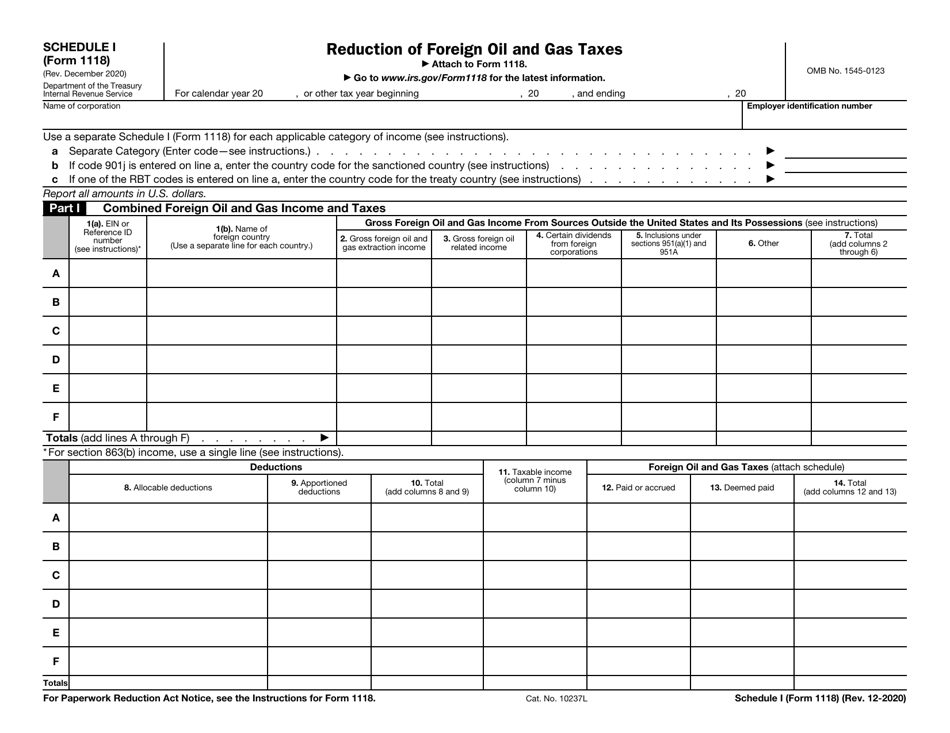

IRS Form 1118 Schedule I Download Fillable PDF or Fill Online Reduction

Web inst 1118 (schedule l) instructions for schedule l (form 1118), foreign tax redetermination 1221 01/10/2022 form 1118 (schedule l) foreign tax redetermination schedule 1221 11/19/2021 inst 1118 (schedule k) instructions for schedule k (form 1118), foreign tax carryover reconciliation schedule Instructions for schedule k (form 1118), foreign tax carryover reconciliation schedule. Web form 1118 (schedule l) foreign tax redetermination.

Form 1118 (Schedule J) Adjustments to Separate Limitation

Web inst 1118 (schedule l) instructions for schedule l (form 1118), foreign tax redetermination 1221 01/10/2022 form 1118 (schedule l) foreign tax redetermination schedule 1221 11/19/2021 inst 1118 (schedule k) instructions for schedule k (form 1118), foreign tax carryover reconciliation schedule Web schedule h, part iii. Go to www.irs.gov/form1118 for instructions and the latest information. Instructions for schedule l (form.

Demystifying the Form 1118 Foreign Tax Credit Corporations Part 2

Material advisor disclosure statement 1121 06/19/2022 form 1118 (schedule i) reduction of foreign oil and gas taxes 1221 12/21/2021 When to make the election; Web schedule l (form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years to which they relate, and other information that satisfies the taxpayer’s.

Demystifying the Form 1118 Part 9. Schedule G Reduction of Taxes Paid

Schedule l (form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years to which they relate, and other information that satisfies the taxpayer’s obligation to notify the irs of foreign tax redeterminations related to prior years. Instructions for schedule k (form 1118), foreign tax carryover reconciliation schedule. Go.

Demystifying the Form 1118 Part 6. Schedule F1 Determining the Tax

Web form 1118 (schedule l) foreign tax redetermination schedule 1222 11/30/2022 form 1118: How to complete form 1118; Web schedule l (form 1118), foreign tax redeterminations use schedule l (form 1118), (a separate schedule) to report foreign tax redeterminations that occurred in the current taxable year and that relate to prior taxable years. Instructions for schedule k (form 1118), foreign.

Specific Power Of Attorney Form Pdf

How to complete form 1118; Material advisor disclosure statement 1121 06/19/2022 form 1118 (schedule i) reduction of foreign oil and gas taxes 1221 12/21/2021 Web instructions for schedule j (form 1118), adjustments to separate limitation income (loss) categories for determining numerators of limitation fractions. Web schedule h, part iii. Instructions for schedule l (form 1118), foreign tax redetermination.

Go To Www.irs.gov/Form1118 For Instructions And The Latest Information.

Web schedule l (form 1118), foreign tax redeterminations use schedule l (form 1118), (a separate schedule) to report foreign tax redeterminations that occurred in the current taxable year and that relate to prior taxable years. Web inst 1118 (schedule l) instructions for schedule l (form 1118), foreign tax redetermination 1221 01/10/2022 form 1118 (schedule l) foreign tax redetermination schedule 1221 11/19/2021 inst 1118 (schedule k) instructions for schedule k (form 1118), foreign tax carryover reconciliation schedule When to make the election; Web form 1118 (schedule l) foreign tax redetermination schedule 1222 11/30/2022 form 1118:

Web Schedule H, Part Iii.

Material advisor disclosure statement 1121 06/19/2022 form 1118 (schedule i) reduction of foreign oil and gas taxes 1221 12/21/2021 Web inst 1118 (schedule k) instructions for schedule k (form 1118), foreign tax carryover reconciliation schedule 1218 12/04/2018 inst 1118 (schedule l) instructions for schedule l (form 1118), foreign tax redetermination 1221 01/10/2022 form 1118 (schedule i) reduction of foreign oil and gas taxes 1221 12/21/2021 Web schedule l (form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years to which they relate, and other information that satisfies the taxpayer’s obligation to notify the irs of foreign tax redeterminations related to prior years. Instructions for schedule k (form 1118), foreign tax carryover reconciliation schedule.

Web Schedule L (Form 1118) (December 2021) Department Of The Treasury Internal Revenue Service Name Of Corporation For Calendar Year 20 Foreign Tax Redeterminations , Or Other Tax Year Beginning , 20 , And Ending Attach To Form 1118.

Schedule l (form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years to which they relate, and other information that satisfies the taxpayer’s obligation to notify the irs of foreign tax redeterminations related to prior years. Web instructions for schedule j (form 1118), adjustments to separate limitation income (loss) categories for determining numerators of limitation fractions. How to complete form 1118; Instructions for schedule l (form 1118), foreign tax redetermination.